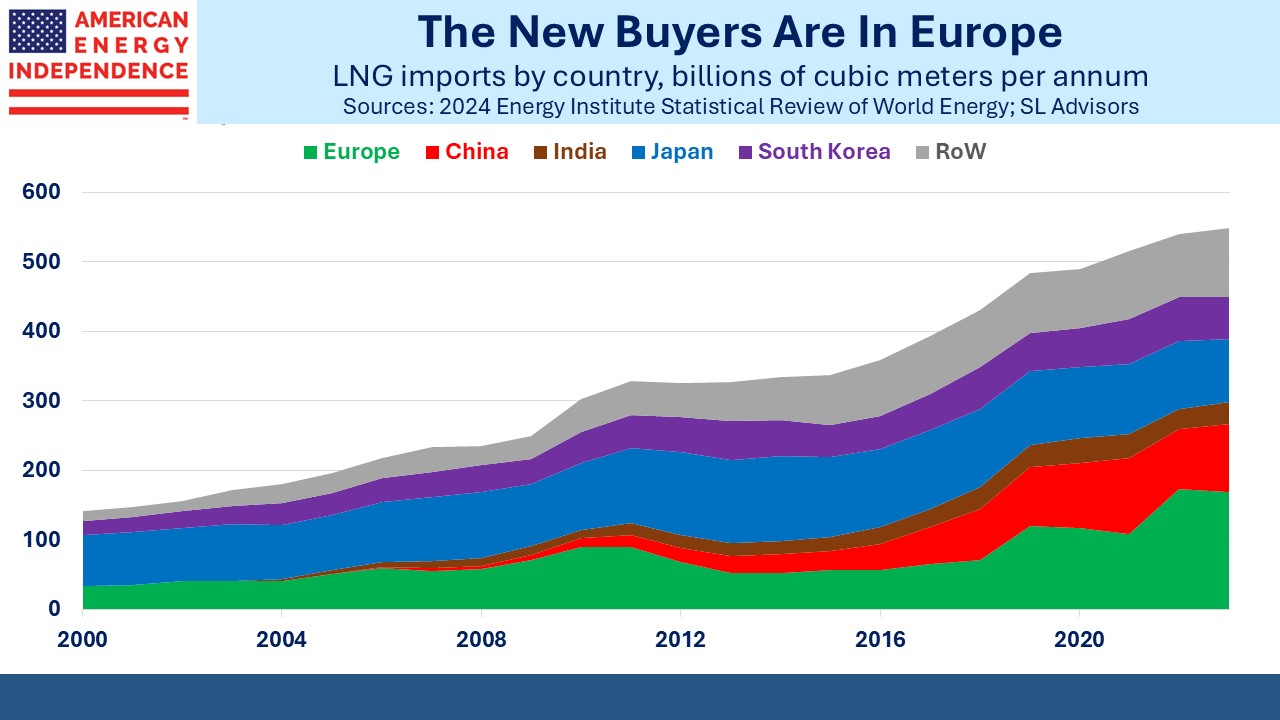

For years the center of gravity for global LNG trade was in Asia. China, India, Japan and South Korea were routinely over 60% of global LNG imports. Asia-Pacific was often over 70%, reaching a high of 75% in 2018. Australia and Qatar were geographically better suited than the US to meet this demand, and our exports were in any case inconsequential until 2017.

Two events of great geopolitical importance followed. The US rapidly grew its LNG exports and is now the world’s #1. Meanwhile Germany’s energy strategy, built on fantasy rather than realpolitik, collapsed. Today Europe is 31% of global LNG trade, a share that has doubled over the past seven years.

Western Europe has adopted policies more oriented to reducing Greenhouse Gas (GHGs) emissions than any other region. Over the past decade, CO2 emissions from fossil fuels declined at a 2.2% annual rate, almost twice the 1.2% rate of the US. Recently they’ve been rather too successful: 2023 was –6.2% versus 2022, but it’s mostly because the high energy prices caused by climate policies have caused GDP growth to slump. The German economy is headed for a second straight year of no expansion in 2025.

Six years ago President Trump famously criticized German leaders for relying on Russian gas imports via the Nordstream pipeline while US troops were stationed in Germany protecting them from Russia. Trump often causes conventional political leaders to squirm with his outspoken attacks, but it’s a pity past presidents hadn’t been so forthright. Germany’s reliance on Russia collapsed spectacularly following the invasion of Ukraine.

Europe relies on renewables for 15% of its primary energy, more than double the rest of the world which is at 7%. It’s an unappealing example to follow given their moribund economies.

In negotiating long term LNG import agreements, European policymakers have clung to the notion that their energy systems will be free of hydrocarbons. So they’ve often balked at the 20+ year deals LNG exporters need to justify their fixed investments in liquefaction terminals.

Meanwhile, incoming President Trump who is our de facto president already, just said,”I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!”

This followed the US Department of Energy’s (DoE) report on the advisability of increased US LNG exports, which it warned would raise domestic prices by 30% over 25 years. It’s a ridiculous forecast, because with natural gas at $3 per Million BTUs versus $12 in Europe and Asia, a $1 increase is inconsequential and a 25 year price forecast is useless. We waited 11 months since the permit pause in January for a weak political document that is the parting gift of Energy Secretary Jennifer Granholm.

There are reports that she sought to ban LNG exports entirely. The only plausible explanation is that she’s taking a stand that will cheer left wing progressives when she runs for public office* again one day. It’s similar to NJ governor Phil Murphy and his pursuit of offshore wind that is widely opposed by the NJ residents who live on the Atlantic coast where the turbines will be situated.

For America, Jennifer Granholm’s retirement can’t come quickly enough.

Some have speculated that opponents of increased US LNG exports could rely on the DoE to persuade the courts to block increased exports. It’s more likely that incoming DoE head Chris Wright will correctly consign the report to the dustbin and focus on what’s in our national interest.

It’s hard to think of a set of circumstances more likely to favor the energy sector at the expense of others. The US is threatening most of our trade partners with tariffs unless they (1) impede illegal immigrants entering from their country, which applies to Canada and Mexico, or (2) buy more American goods, which for the incoming administration means US oil and gas.

According to the US Bureau of Economic Analysis, shipments of crude oil, natural gas liquids, natural gas, fuel oil and other petroleum products were $262BN for the year through October, 15% of all our exports. Pharmaceutical preparations ($90BN) is the next biggest category, followed by civilian aircraft and engines ($80BN).

Europe wants to avoid tariffs and is pursuing green policies that are impeding their economy. At the same time they are reliant on US natural gas, and we have a president who wants them to buy more, which will provide them with reliable, secure energy and maybe even arrest Germany’s industrial decline.

It looks like a good time to be invested in US energy.

*An earlier version of this blog post suggested Jennifer Granholm might decide to run for US president one day. Thank you to a regular and diligent reader who noted that as a Canadian citizen she is ineligible.

—

Originally Posted December 22, 2024 – The Transatlantic Energy Trade

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.