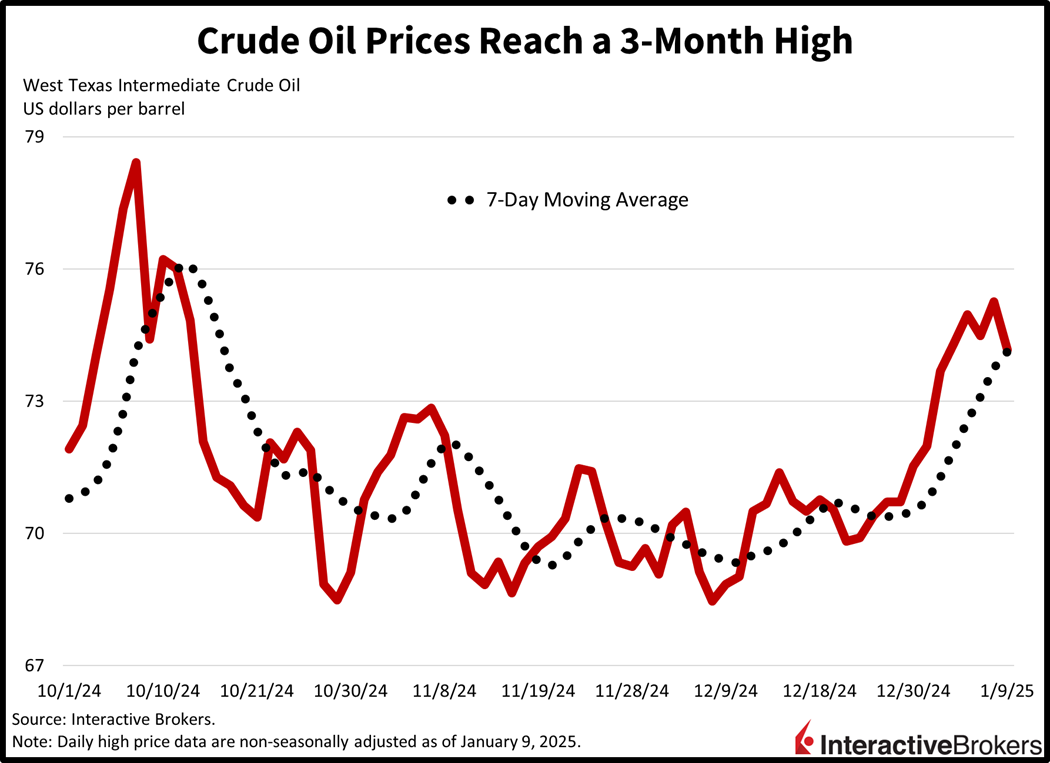

Weaker-than-expected consumption figures from Aussie land and the European Union combined with worries about Chinese deflation are contributing to a stronger US dollar. But the firmer greenback isn’t weighing on the commodity landscape or energy markets specifically for that matter, as cold weather conditions and heavy travel activities ahead of the Lunar New Year Holiday support the demand picture for crude oil. The critical liquid has been on somewhat of a tear as of late, jumping to a three-month high and exceeding $75 per barrel in yesterday’s morning trading. Folks did apply selling pressure to push its price back below $75, however, following a report depicting sharp increases in gasoline and distillate supplies stateside. In other news, wildfires in Los Angeles county are devastating communities and have already claimed five lives.

LA County Suffers Massive Economic Losses

Los Angeles is suffering from the worst wildfires in history with economic losses exceeding $55 billion. Rising temperatures and ferocious winds coinciding with a lack of rainfall and frequent droughts as a result have raised the risk profile of the region. Roughly 2,000 structures including residences and businesses have been destroyed, while 130,000 people are under evacuation warnings and at least five people have died.

Labor Deal Eases Supply Chain Angst

In trade and labor news, the US landscape has incrementally benefitted this morning from a deal between dock workers and port employers. The tentative agreement covers six years but isn’t publicly available yet since both sides still need to ratify the terms. The progress is welcome as a strike was likely to occur on January 15, when the current package expires, absent a compromise.

China’s Economic Malaise Persists

China racked up its fourth month of anemic Consumer Price Index (CPI) data with the benchmark depicting December year-over-year (y/y) inflation of only 0.1%, which matched forecasts, while the Producer Price Index retreated 2.3%. The month marked the second-consecutive year of declining factory gate prices and illustrated how the country’s fiscal and monetary stimulus programs have yet to significantly stoke domestic demand for goods and services. Officials in Beijing have already committed to try and rev up its economy as it struggles with a declining real estate industry, a price-war among electric vehicle providers, excess manufacturing capacity and softening manufacturing orders. It’s also bracing for additional trade tariffs proposed by President Trump.

Exports Drive Australia Trade Surplus

Australia produced a trade balance surplus of A$7.08 billion in November as cold weather in Asia and stimulus in China supported demand for commodities. Additionally, Australia’s weaker currency and higher commodity prices provided additional support to the country’s trade balance. The surplus surpassed the analyst estimate of A$5.75 billion and October’s positive trade balance of A$5.67 billion seen in the prior month. On a month-over-month (m/m) basis, exports of rural goods, which consists of agriculture products, grew 18.1%. Within this category, the sub-group of other rural, which includes cotton, butter, cheese and powdered milk, jumped 34.6%. Exports of non-rural products, a category with ores, coal mineral fuels, machinery and other manufactured items grew 2.1%. While overall imports increased 1.7%, consumption goods fell 0.5%. The decline was offset by a 3.3% increase in capital goods.

Black Friday shopping and discounting helped Australia’s retail sales head north by 0.8% in November but failed to push the metric above the forecasted gain of 1.0%. The result, however, was still stronger than the 0.5% and 0.4% gains in October and September. Sales also climbed 3% compared to the eleventh month of 2023. Gains relative to October were fairly widespread as follows:

- Department stores, 1.8%

- Clothing, footwear and personal accessories, 1.6%

- Cafes and restaurants, 1.5%

- Household goods, 0.6%

- Food retail, 0.5%

- Other retailing (pharmaceutical, cosmetics, toiletries, print publications and recreational goods), 0.3%

Europe Produces Weak Retail Results

Eurozone retail sales grew at a disappointing 0.1% m/m rate in November, falling below the analyst expectation for expansion of 0.4% but reversing from October’s 0.3% decline. On a y/y basis, activity at cash registers climbed 1.2% among the eurozone, which is also called the euro area and is comprised of 20 countries that use the euro. The modest m/m increase was driven by automotive fuel in specialized stores gaining 0.8% and food, drink and tobacco expanding 0.1%. Gains were partially offset by non-food products not including fuel dropping 0.6%.

Commodities and Treasurys Rally

US stocks are closed today in memory of the late President Jimmy Carter, but Treasurys, the greenback and commodities are all gaining. The 2- and 10-year maturities are trading at 4.26% and 4.67%, 2 and 3 basis points (bps) lighter across both durations. The Dollar Index is up 19 bps as the US currency appreciates versus almost all of its counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders, but it is depreciating relative to the yen. Commodities are tilted to the upside with crude oil, copper, lumber, silver and gold higher by 1.3%, 0.7%, 0.6%, 0.2% and 0.1%.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.