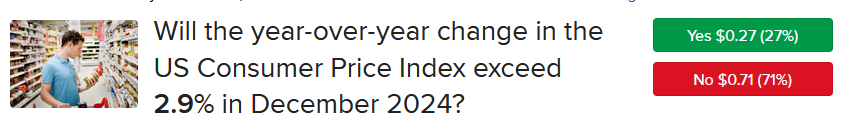

The path towards non-inflationary growth widened this morning as a weaker-than-expected PPI coincided with reports that the incoming Trump administration will implement tariffs incrementally instead of all at once. The tactic is designed to foster acquiescence among trade partners while limiting the potential for a reacceleration in goods price pressures. Meanwhile, small business optimism leaped to more than a six-year high on the back of stronger economic growth expectations and upbeat sentiment regarding incoming policies from Washington. Markets were reacting positively to the news but have since reversed in consideration of annualized price pressures either exceeding or approaching 3-handles across several distinct gauges. Meanwhile, Fed easing expectations remain distant, with IBKR ForecastTraders increasingly envisioning a year with zero cuts while assigning a 27% chance of a 3% CPI tomorrow morning.

Source: ForecastEx

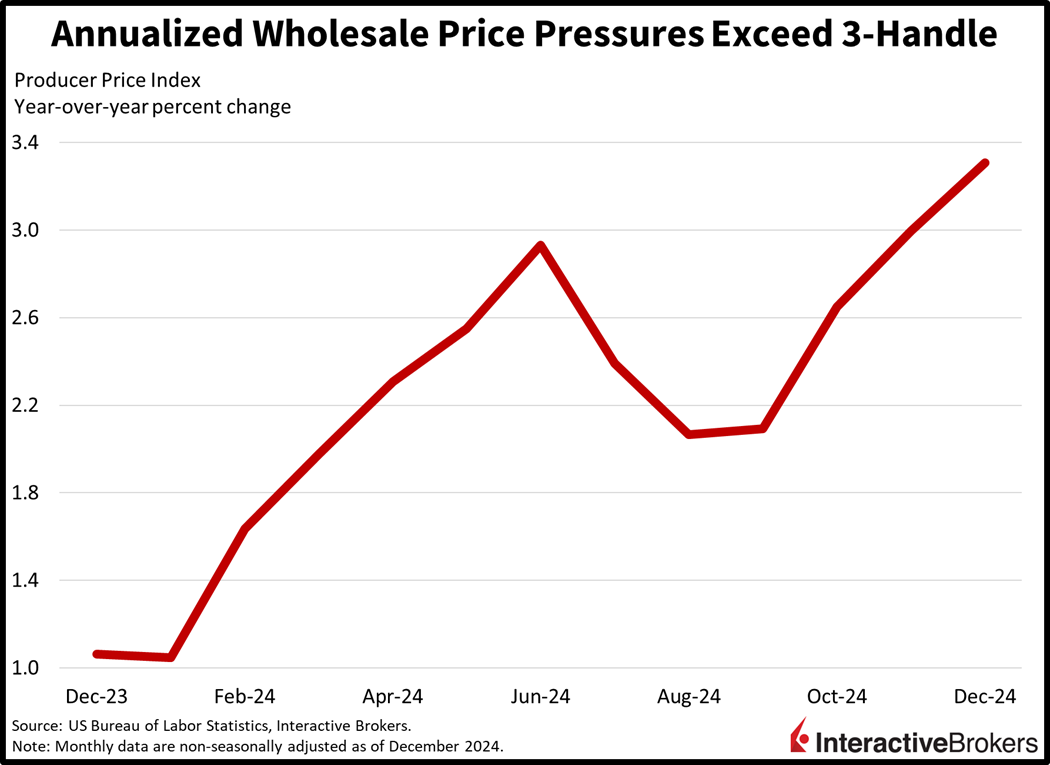

Wholesale Inflation Exceeds 3%

Wholesale prices decelerated last month as certain services and foods countered a significant increase in energy costs. December’s Producer Price Index (PPI) rose just 0.2% month over month (m/m), softer than the 0.3% projected as well as the 0.4% from November. The segment of the gauge that excludes food, energy and trade due to their volatile characteristics climbed just 0.1% m/m, beneath the 0.3% median estimate but unchanged from the prior period. Despite figures arriving below projections, the headline PPI increased from 3% year over year (y/y) in November to 3.3% in December and is adding to evidence that the progress on inflation has stalled and may be reversing.

Last month’s PPI gains were driven by sharp increases in energy and transportation and warehousing services. The categories saw charges jump 3.5% and 2.2% m/m, but other services, trade services and foods experienced monthly deflation of 0.2%, 0.1% and 0.1%. Additionally, goods that were unrelated to energy or food experienced a flat month overall.

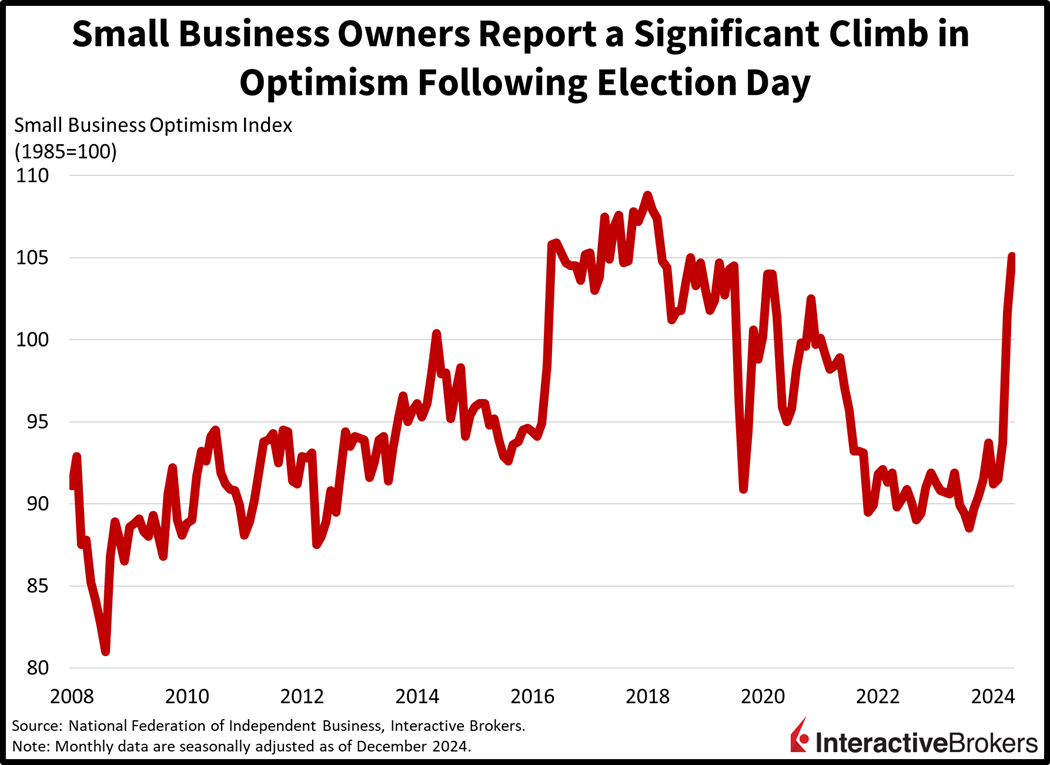

Small Business Optimism Climbs

The National Federation of Independent Business (NFIB) reported a significant jump in small business optimism. The sentiment index increased to 105.1 last month, its highest reading since October of 2018. Owners reported improved outlooks regarding economic growth, business expansion, sales volumes, capital expenditure projects and raising employee compensation. Still, price pressures and labor quality are the top two issues dominating small enterprise concerns. Furthermore, there’s risk that those challenges worsen next year as adversarial trade postures and mass deportations have the potential to support loftier goods costs and accelerating pay-check growth.

Aussie Consumer Sentiment Slips

Elevated interest rates, anemic economic growth and weakening currency trends have dampened consumer confidence in Australia with the Westpac Banking Corp. sentiment gauge falling 0.7% to 92.1, substantially below the 100 pessimism and optimism threshold. The plunge follows a weakening property market and the country’s economy barely expanding in the second and third quarters of 2024. Consumers lowered their views of their current finances relative to a year ago by 7.8% to only 77.7. Additionally, the Westpac-Melbourne Institute Unemployment Expectations Index strengthened 2.8%, reaching 127.2, implying that consumers expect joblessness to increase in the next 12 months. On a positive note, the subindex asking if it’s the right time to buy a major household item grew 1.8% to 90.8 and the right time to buy a dwelling gauge advanced 10% to 89.9.

Green To Red Morning

Markets were gaining cautiously as investors awaited the PPI’s favored cousin, which arrives 24 hours later at 8:30 am ET tomorrow. But as IBKR ForecastTraders and market participants patiently prepare for the Consumer Price Index (CPI), 3 of the 4 major domestic stock benchmarks have turned from green to red on the session. The scorecard features the Russell 2000 still up 0.3%, but the Dow Jones Industrial, Nasdaq 100 and S&P 500 are now lower by 0.2%, 0.3% and 0.4%. Sector breadth is still positive though with industrials, utilities and materials leading the charge; they’re climbing 0.6%, 0.5% and 0.4%. Just 4 of the 11 segments are lower and the laggards are represented by healthcare, communication services, consumer staples and technology which are losing 1.6%, 0.6%, 0.4% and 0.3%. Treasurys are catching modest bids and aren’t rejoicing just yet with the 2- and 10-year maturities down just 1 basis point (bp) while changing hands at 4.38% and 4.78%. The greenback is down slightly as it depreciates versus the euro, franc, yuan and Aussie and Canadian tenders. The US currency is appreciating against the pound sterling and yen; however, with the former’s underperformance being driven by fiscal concerns and a lack of liquidity in the Gilt market. Commodities are mixed with silver, copper and gold travelling north by 1.1%, 0.5% and 0.3%, while lumber and crude oil journey south by 1.4% and 1%. WTI crude is trading at $77.90 per barrel as oil bulls take a break from the critical commodity’s recent rally, which was driven by Washington tightening the screws on Moscow.

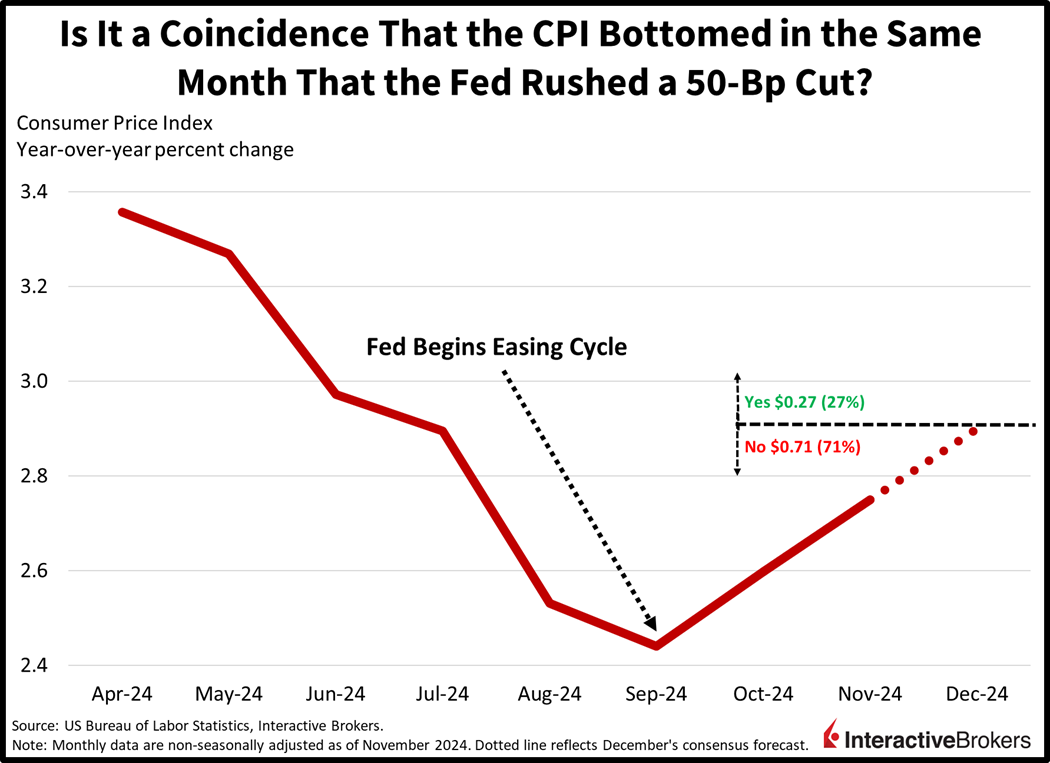

Was September a Coincidence?

Tomorrow’s CPI is expected to reflect an inflationary uptick back towards a 3-handle, with IBKR Forecast Traders granting 27% odds of a beat of Wall Street’s 2.9% y/y consensus. Interestingly enough, an upside surprise would blunt much of the progress attained in 2022 and 2023, as a 3% number would mark a 60-bp acceleration from this year’s 2.4% low achieved last September, which happens to be the same month that the Federal Reserve jumped the gun and reduced its benchmark rate by a super-sized 50 bps. The central bank was in a rush that month, only to become increasingly patient in December. Is it a coincidence that the same September that the Fed enacted a policy mistake may end up being the lightest CPI reading we see for the foreseeable future? I don’t think so. This illustrates how monetary policy errors are costly and directly linked to higher charges at the register as well as greater volatility in markets.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.