Although we are loath to make predictions, conditions appear to be favorable for fixed income in the coming year, and we think investors should consider adjusting their allocations accordingly.

2024 was a very good year for most U.S. investors. Reading the tea leaves for what 2025 and beyond may bring is tricky at best given how far some markets have rallied. While no two cycles are identical, there are similarities with past cycles that we can learn from and apply to our current positioning. We believe that sector allocation and risk mitigation will be very important themes going forward.

The world is fraught with uncertainty both geopolitically and economically, with wide divergences between regions. This has as much to do with governance frameworks, such as overregulation in Europe, as with overinvestment, such as real estate and infrastructure overbuilding in China. Structural impediments are very difficult to reverse, and large capital misallocations are expensive to fix. America is in a unique position as arguably one of the strongest economies in the world, and there is hope that a reduction of the regulatory burden by the incoming administration will help that continue. The $64 trillion question is whether we stay stronger than most economies or weaken. Nobody knows at this point, but markets generally seem to be upbeat.

The New York Times had an interesting article on December 22nd titled “Reading Wall Street’s Irrelevant Market Predictions.” It compared year-ahead forecasts starting in December 2000 and found that the average prediction for equity market returns was for a gain of 8.8%, while never forecasting a down year. The average variance between these predictions and actual results was 14.2%. To quote, “being wrong by that much means that these forecasts weren’t merely inaccurate. They were completely out of bounds.” We agree. The article excuses the inaccuracies by pointing out that the “predictions are simply the results of their models.” No one knows how or when the current markets will reverse, but the old adage “an ounce of prevention is worth a pound of cure” is apt. Needless to say, we will not be making any year-ahead forecasts for market performance.

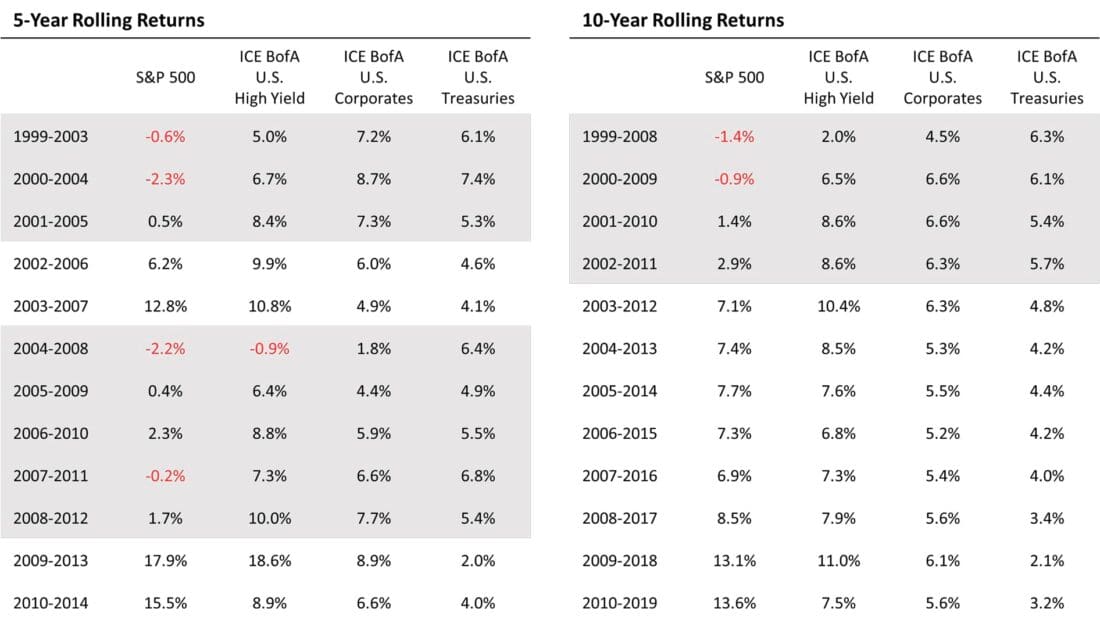

Equity markets have been making new highs throughout 2024, and valuations have not been this lofty since the dot-com bubble peak in early 2000. Market leadership back then was also very narrow, as it is today. The poster child for the internet age in 2000 was Cisco, which reached a valuation peak it has yet to surpass 25 years later, despite the company having grown revenues and earnings over that period. We do not know what the future holds for a company like Nvidia, which seems to be the current analog for the AI era. Taking a step back and looking at longer-term returns for a few broad asset categories following the 1999 peak may be a surprise to some and could be informative to future portfolio allocations. Below are five- and ten-year rolling returns starting in the year 2000 for the S&P 500, high yield corporate bonds, investment grade corporate bonds, and U.S. Treasuries:

Source: RIMES. The above tables show the annualized returns for the 5- and 10-year periods for each index during the date range specified.

As you can see, equities did not outperform any of the three major fixed income categories for subsequent rolling five- and ten- year periods roughly following the 2000 peak, as depicted by the highlighted rows in the tables (or for the 15-year period beginning in 1999, not shown). Moreover, an investment in the S&P 500 at the beginning of each year for the six years starting in 1999 underperformed the high yield index for each of the subsequent ten years. And finally, the cumulative returns for the S&P 500 starting from 1999 did not exceed that of high yield until year-end 2020, a 22-year lag (also not shown).

While active management can enhance returns, the fact that passive equities lagged fixed income and especially high yield bonds so persistently is eye-opening. The past five years have been outstanding for equity investors, as had the prior five years leading to the early 2000 peak. Whether events unfold in a similar fashion in coming years is not known, but it may pay to be alert to changes in leadership. Stay tuned.

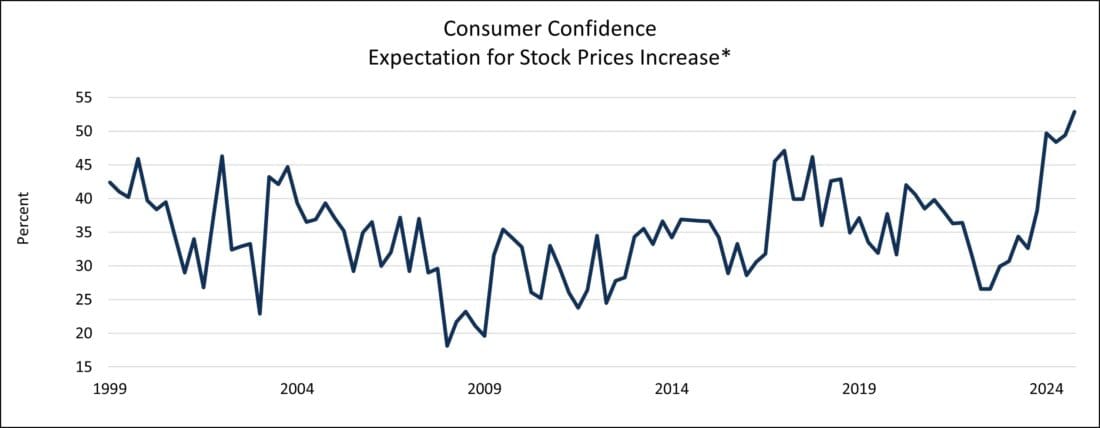

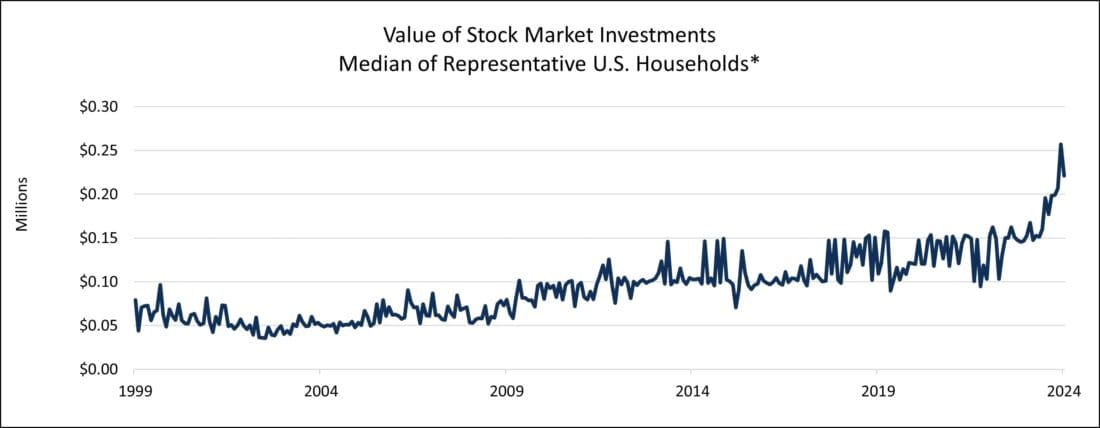

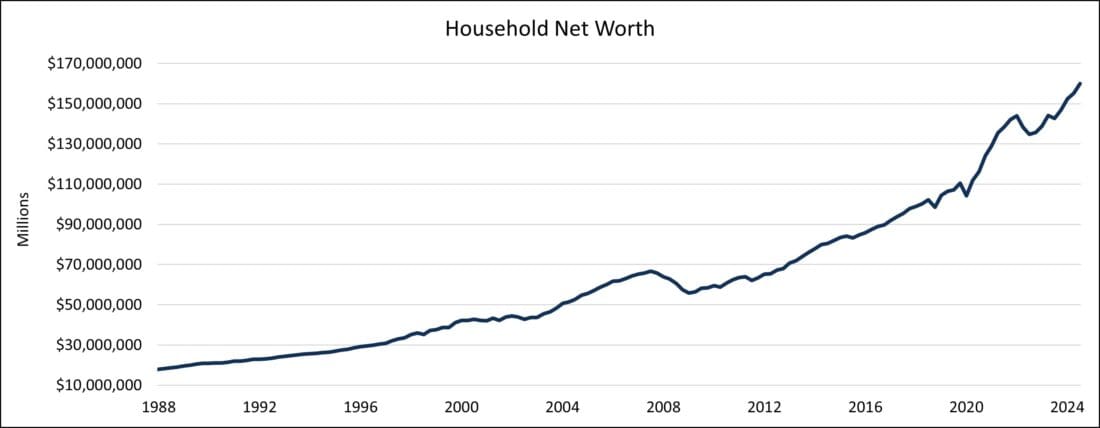

The U.S. economy is still healthy and the labor market, while a touch softer recently, is nowhere near weak enough to warrant recession fears. Inflation, while having ebbed from peak levels, remains stubbornly above the Fed’s Edenic 2% target. Consumer confidence signals euphoria, likely driven by robust equity markets, which in turn translate into consumer wealth, as illustrated in the three charts below:

Source: Bloomberg. *Conference Board Survey. Random sample of approximately 3,000 U.S. households.

Source: Bloomberg. * University of Michigan. Three-month moving average.

Source: FRED

Speculation is that some of this unbridled optimism may be due to political affiliation, but the longer-term charts seem to tell a more nuanced story. We have a still healthy economy combined with rising consumer wellbeing and record optimism about future stock returns. Heightened investor optimism is palpable, and if we have learned anything from our investing experience, at a minimum this should be taken as a flashing yellow light.

The Fed has continued to cut rates despite grumblings from the bond market that cuts were not yet needed. As evidence, we can see that except for the very short end of the yield curve, the reaction to Fed cuts has generally been negative. The yield on the 10-year Treasury since the Fed began easing on September 18th has risen from 3.70% to 4.57% on December 31st, almost 90 basis points, while the yield on the 2-year Treasury has risen from 3.62% to 4.24%, over 60 basis points. Clearly, the bond market is at odds with the Fed regarding the durability of future economic growth and inflation. But maybe the Fed is coming around. Following its December meeting, the Fed released predictions for interest rates, in the form of its famous, or should we say infamous, Dot Plots. What they show is that the Fed governors now predict a median terminal rate for year-end 2025 at 3.88% versus their prior estimate of 3.38%. This means that we will likely only have two cuts in the fed funds rate this year versus the four they were predicting previously. While we have shown in the past that these predictions are not very reliable, they do reflect a change in sentiment at the Fed and the markets have taken note. The steepening of the yield curve is finally happening. We believe that this is due to the realization that we will likely have a slower glide path for inflation to reach the Fed’s 2% target, combined with a still healthy economic backdrop.

In sum, the U.S. equity markets are at all-time highs, commensurate with richer valuations, in turn driving consumer confidence to record highs too. Additionally, interest rates beyond the one-year tenor continue to rise, while much of the developed world is in or near recession levels and cutting rates. There is much handwringing on trade and tariffs, which could cause inflation to stay elevated at a minimum and possibly rise at worst. We also point out that there is currently a historically high valuation differential between small and large cap equities, so if the economy begins to slow, finding stocks with true growth potential will be very desirable. Traditionally these have been found in newer, fast growing smaller companies. Given that the mega cap stocks, which have led the S&P 500 index, have fabulous businesses with almost insurmountable competitive advantages, we may not have a repeat of the post dot-com era bust, but as yields rise on long-term Treasuries the hurdle rate for returns versus a risk-free rate also rises. This may translate into tepid equity returns for a period of time. As we showed above, following the last peak in 2000, fixed income did considerably better than equities, and perhaps that should be considered when making portfolio allocations for long-term investments.

As many of you know, we continue to position defensively while not sacrificing much yield (or returns), given the inverted yield curve we enjoyed for most of 2024. In addition to favoring very near maturities during the inverted yield curve era, we have recently been gradually moving from cash-like instruments into slightly longer- but still shorter-term bonds, as yields continue to rise for tenors one year and out. We have also been finding short-dated convertible bonds in financially strong companies with very competitive yields. We are still waiting for a deeper correction before we materially increase our duration in order to lock in much higher yields than we are seeing today.

Thank you for your continued confidence in our management.

—

Originally Posted January 14, 2025 – First Quarter Strategic Income Outlook

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Osterweis Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Osterweis Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.