Don’t trade news. Trade market structure. Let’s use NVDA as an example.

That’s what I wrote to Market Structure EDGE (find it in the Discover section under Research) users Tuesday Jan 7 before the US stock market opened.

Editorial note: Find more EDGE content at IBKR Campus.

Let’s understand “market structure.” It’s the rules and mechanics of the stock market. It’s the way things work.

Most suppose that stocks are driven by demand from investors focused on the opportunities a business offers. But that’s only a small part of the marketplace. Half the volume in the stock market is just machines trading everything, everywhere, all at once, TODAY.

And further, half the volume, nearly, is short – borrowed or created by machines under market-making SEC exemptions to short-selling regulations. EDGE data show Short Volume in S&P 500 stocks is currently 49.2% of volume, a sharp rise from 44.4% Dec 5, 2024.

And from an investment perspective, most dollars directed at stocks aren’t buying differentiated, unique stories. Most of the money is buying the herd, a basket of equities, a PRODUCT in a recipe called “target date funds,” or an exposure to stocks that needs the product to behave predictably.

With me? It cannot simultaneously be true that all the money in the stock market wants stories, while all the money flowing to retirement accounts wants products. The latter is nearly three times greater than the former, which is just 10% of volume.

Take NVDA, and news, now. The company issued four press releases and a blog entry overnight Jan 6. Lots of news! The stock was higher before trading opened.

But it’s not what models needing the HERD are buying. MACHINES read all those things! Machines move prices. But they have a horizon of a day or less. So then retail investors chase the rising prices – and get stuck with losses.

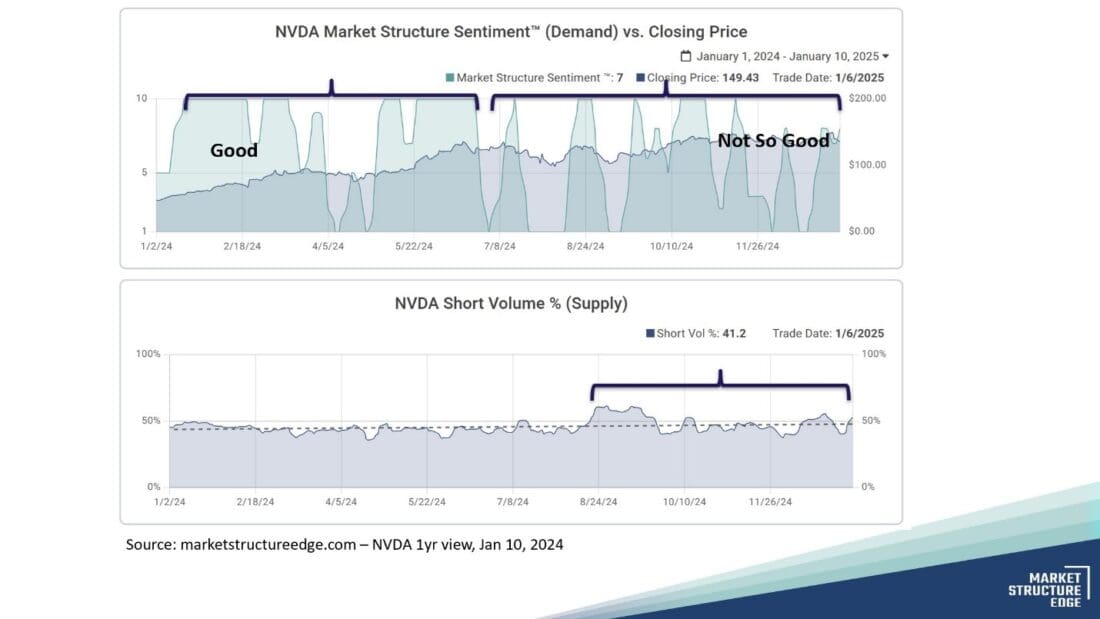

Well, don’t do that. See NVDA below

When Demand, an algorithm metering the COMBINED weight of buying and selling from machines and people and models, and the effects of derivatives like puts or calls is consistently well over 5.0 – and spending lots of time at 10.0 – NVDA rises predictably and should be in both your trading accounts and long-term accounts. That’s MOMENTUM.

When those conditions cease – which has been generally true since July 2024 – NVDA should be in your trading account maybe, but not in your long-term account. It’s not that hard to see once you understand MARKET STRUCTURE. Only when machines and models – 75% of Demand – are buying stocks do they consistently rise.

We don’t know from one day to the next what will happen because it’s difficult to accurately predict what machines will do. But look at the Demand/Supply data. On Jan 7, there were just four stocks in the EDGE Daily Trading Ideas Momentum portfolio at Interactive Brokers (Discover section of Research).

Without MOMENTUM, stocks stop rising. News can fool you because machines can change prices – and suddenly reverse course, leaving you holding the bag (of losses).

As Market Structure EDGE measures the data, Broad Sentiment in US stocks was 4.3 and rising Jan 7. But so was Supply. As of Jan 13, Broad Sentiment has stalled at 5.0, something that happens in negative markets, bear markets.

I’ve been saying since around Christmas that we’re entering a new phase for stocks that may be a lot harder than what we’ve been seeing. I point you again to NVDA. Demand has lost its momentum. The same thing is occurring in the broad market. Be careful here.

PS – Join the live Market Structure EDGE Demo Jan 16 and we’ll help you use market structure for both a short-term and a long-term edge.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Structure EDGE and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Structure EDGE and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.