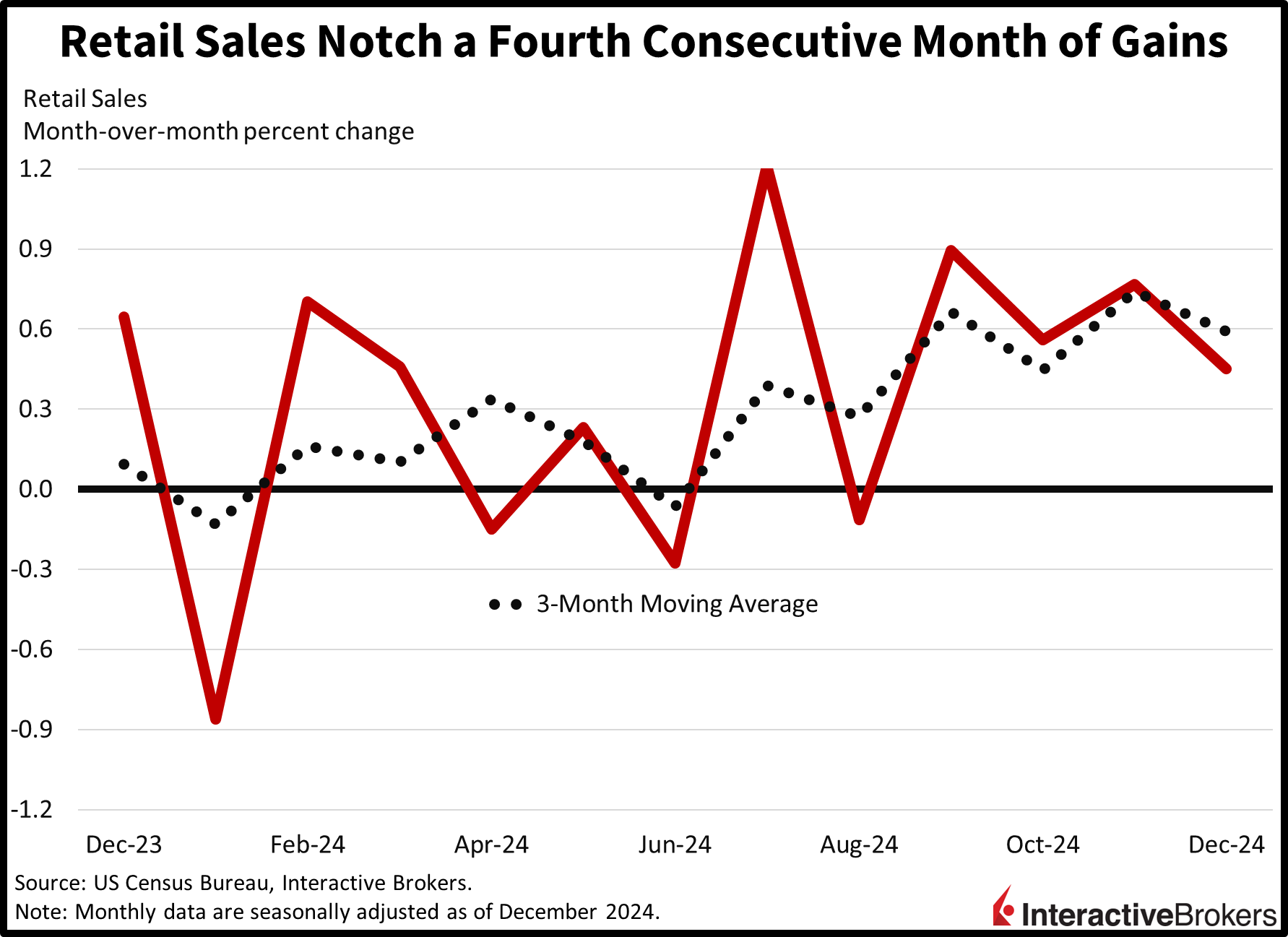

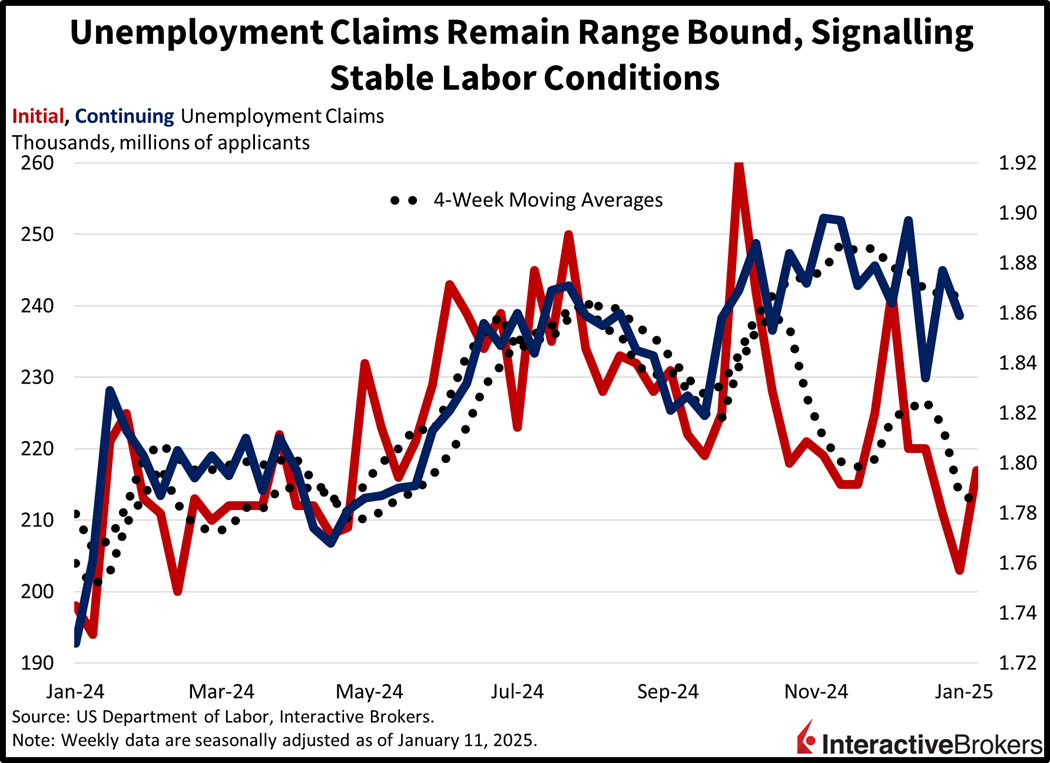

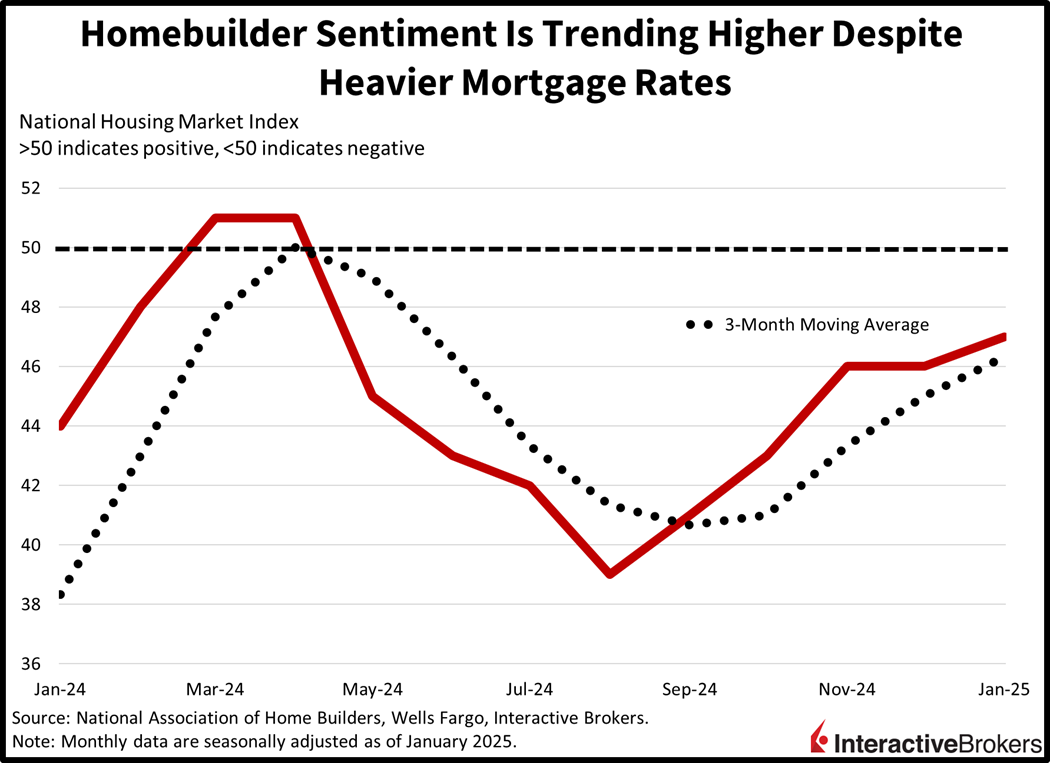

Investors are hitting the pause button following yesterday’s momentous rally as economic data this morning reflected continued consumer spending strength amidst solid labor conditions. Despite retail sales posting a miss, the transaction figures alongside stable unemployment claims provided interest rates with a lift. But IBKR Forecast Traders have responded to this week’s favorable wholesale and core consumer inflation data by pulling forward a potential rate cut by the Fed to sometime this summer. Meanwhile, stocks have struggled to find buyers this year when the S&P 500 nears its mighty 6,000 level, as bear-steepening action across the yield curve gives folks the chills. But despite the heavier borrowing costs recently, stateside homebuilders reported a modest improvement in sentiment this month, a result of stronger economic growth projections offering some light toward the end of the real estate tunnel.

Consumers Dine Out Less

Consumers took a break from dining out last month, according to this morning’s retail sales report from the US Census Bureau, but that didn’t prevent the print from posting broad-based gains in 10 out of 13 major categories. Overall transaction dollars grew 0.4% month over month (m/m), below the 0.6% expectation and November’s 0.8%. The growth rate excluding gasoline and automobiles was lighter at 0.3%, as robust purchasing alongside loftier prices for the two categories weighed on that number, which was projected to be 0.4%. Still, it marked an improvement from 0.2% during the previous period. Furthermore, the control group, which omits some of the more volatile aspects like cars, fuel and building materials and is used in the GDP calculation, rose 0.7%, exceeding the anticipated 0.4% rate, which would’ve matched the prior interval. Categories that contributed to overall spending growth and the amount of their increases were as follows:

- Miscellaneous retailers, 4.3%

- Sporting goods destinations, 2.6%

- Furniture showrooms, 2.3%

- Gasoline stations, 1.5%

- Clothing shops, 1.5%

Contributing at more modest degrees were food markets, automobile dealerships, electronics stores, general merchandise sellers, and ecommerce coming in at 0.8%, 0.7%, 0.4%, 0.3% and 0.2%.

Hampering the progress, however, were building material suppliers, dining and drinking establishments and health and personal care retailers, which declined 2%, 0.3% and 0.2%.

Wildfires Affect LA Labor Market

Labor markets remain well-anchored as indicated by this morning’s unemployment claims data release, but the tragic wildfires in Los Angeles County have contributed to a jump in the state’s figures. Initial claims in the state rose to 54,587 for the week ended January 11, marking a two-year high. Additionally, seasonality played a role, because numbers tend to increase sharply in the beginning of the year. Turning to the nation overall, initial claims increased to 217,000, exceeding the 210,000 median estimate and the 203,000 from the week prior. Continuing claims, in comparison, declined to 1.859 million during the week ended January 4, arriving beneath the 1.870 million estimate and the 1.867 million from the previous seven-day interval. Encouragingly, four-week moving averages cooperated on both fronts, dropping from 213,500 and 1.868 million to 212,750 and 1.867 million.

Homebuilders’ Sentiment Gains Slightly

Homebuilder sentiment improved slightly this month despite the outlook for sales deteriorating modestly. The NAHB/Wells Fargo Housing Market Index increased one point to 47 in January, well ahead of expectations calling for a drop to 45. While prospects for single-family sales in the six months dipped from 66 to 60, current sales conditions and the traffic of prospective buyer segments strengthened to 51 and 33 from 48 and 31. From a regional perspective, the Northeast and West drove gains, increasing from 57 and 39 to 67 and 42, but weakness in the Midwest and South hampered progress. The two lagging regions saw their figures decline from 48 and 49 to 44 and 47.

US Export Prices Climb

In other stateside economic news, import and export prices increased 0.1% and 0.3% m/m last month, in-line with estimates on the former but hotter by a tenth of a percent on the latter. For comparison, November’s figures came in at 0.1% and 0%. Turning to the Philadelphia area’s manufacturing sector, the Philly Fed’s manufacturing gauge rose sharply to 44.3 this month from -10.9 and exceeded the expected -5. Results were boosted by new orders, business conditions, capital expenditures, hiring and prices.

AI and Money Centers Shine

Taiwan Semiconductor Manufacturing Company’s (TSMC) fourth-quarter revenue and earnings grew 38% and 57%, respectively, year over year (y/y), exceeding analyst expectations. Wendell Huang, chief financial officer and vice president at TSMC, says the company experienced strong demand for producing artificial intelligence chips. Shares of TSMC were up approximately 3.75% this morning.

Among money centers, Morgan Stanley (MS) said its revenue climbed 26% and profits more than doubled y/y, with equity trading climbing 51%, although the comparison was influenced by regulatory charges in the last quarter of 2023 hurting earnings. Both metrics in the recent quarter exceeded analyst estimates. Revenues advanced in large part due to clients increasing equity transactions shortly before and after the presidential election. Morgan Stanley’s prime brokerage business also increased. In other areas, fixed-income operations, investment banking and wealth management revenues climbed 35%, 25% and 13%, respectively. Morgan Stanley competitor Bank of America (BAC) also posted earnings and revenue that surpassed Wall Street estimates. Fourth-quarter revenue and profit more than doubled from the final quarter of 2023 when the company paid a significant Federal Deposit Insurance Corp. special assessment associated with the regional bank failures. In the same quarter, it also faced the headwind of a charge connected to interest rate swap accounting. In the recent quarter, the bank’s 15% y/y revenue increase was driven by a 44% climb in fees from investment banking.

In other earnings news, UnitedHealth Group (UNH), which struggled with a cyber attack last year and rising medical costs, posted fourth-quarter revenue that missed analyst forecasts, causing its shares to drop almost 5% prior to the open of markets. The ratio of the amount of insurance premiums spent on medical costs exceeded expectations with expenses associated with government supported Medicare plans for the elderly continuing to grow. On a positive note, earnings were stronger than forecasted.

UK GDP Turns Positive

The United Kingdom’s weakening economy reversed course last in November, growing an estimated 0.1% and 1.0% m/m and y/y, but the results fell below forecasts of 0.2% and 1.3%. The barely positive growth follows m/m declines of 0.1% in both September and October. From a longer term perspective, GDP is estimated to be flat for the three months to November compared with the three months leading to August. Services grew 0.1% m/m in November while industrial production dipped 0.4% following a 0.6% contraction in October. On a positive note, construction output grew 0.4%, reversing a 0.3% decline in October and matching the analyst consensus expectation. Also in November, the UK’s trade imbalance narrowed slightly but was still worse than estimates. Its negative trade balance of $19.31 billion improved slightly from the negative $19.33 billion in October but exceeded the anticipated imbalance of $18 billion. During the month, imports dropped 0.6% and exports headed north by 0.8%.

Japan’s Wholesale Inflation Matches November

Japan’s Producer Price Index (PPI) climbed 0.3% m/m and 3.8% y/y last month. Both metrics were unchanged from November. The y/y figure matched the analyst forecast but the m/m number was below the 0.4% forecast. On a m/m basis, the electric power, gas and water group and the agriculture, forestry and fishery products category increased 0.20% and 0.10%, respectively, while petroleum and coal products gained 0.8%. The nonferrous metals group was the most significant category for price weakness with a decline of 0.04% followed by transportation equipment, which sank 0.02%.

Australia Job Market Picks Up

An increase in part-time jobs contributed to Australia adding 56,300 workers to payrolls in December following a downwardly revised addition of 28,200 in the preceding 30-day period. Analysts expected a December increase of only 15,000. The country’s total number of full-time workers, conversely, declined by 23,700 after increasing by 49,500 in November. An uptick in individuals deciding to seek work led to the country’s unemployment rate moving from 3.9% to 4.0%. In a related matter, consumers surveyed in December reported a mean expectation for inflation of 4.0% during the next 12 months, down from 4.2% in November. They also expect total pay to grow 1.5% during the same period.

A Bumpy Road Ahead

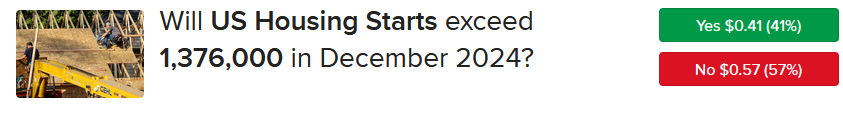

Today’s US economic data generally points to continued expansion ahead, as persistent consumer spending coincides with firm labor demand and robust capital markets. Tomorrow, however, we’ll receive new information concerning construction activity last month and the extent that heavy mortgage rates are weighing on the sector. I’ll also update you on new data from China, with folks increasingly attentive to the impacts of aggressive stimulus packages, cratering domestic yields, the stronger greenback and the nation’s manufacturing condition and prospects. Finally, inauguration day is this Monday and market participants are bracing for Trump bumps as we shift from a predictable political environment to more of an erratic landscape.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.