1/ Opinions vs. the Market

2/ S&P500

3/ Trend “Predictors”

4/ Stocks, Stocks, and Stocks

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Opinions vs. the Market

Is the market topping? Is a recession right around the corner? What about the upcoming inauguration – that’ll probably cause the next leg down, won’t it?

Political opinions have no place in investment decisions. Same goes for any other “opinion,” for that matter.

The market doesn’t care what you think about:

- Historical market valuations

- Inflation

- Interest rates

- The Fed, or

- Market concentration in mega-caps and tech

The market… doesn’t… care.

Instead, what we need to do as portfolio managers is to allow the market to tell us what to do, not the other way around.

So, let’s take an objective look at what’s going on right now, starting with my “Inverse Traffic Light” chart of the S&P500, and see if chicken little even has a dog in this hunt.

- The stock market still remains in the “Green Zone,” which currently sits above the two summer highs – as well as below the two fall lows – and this is perhaps in spite of the fear mongering financial news that’s being thrown in your face on a daily basis.

- The bottom of the “Caution Zone” for the stock market still resides at the spring 2024 lows, which took place after a multi-week correction to the tune of just over -10%.

- …and this is still where the “Danger Zone” sits, just south of 5,000 on the S&P500.

2/

S&P500

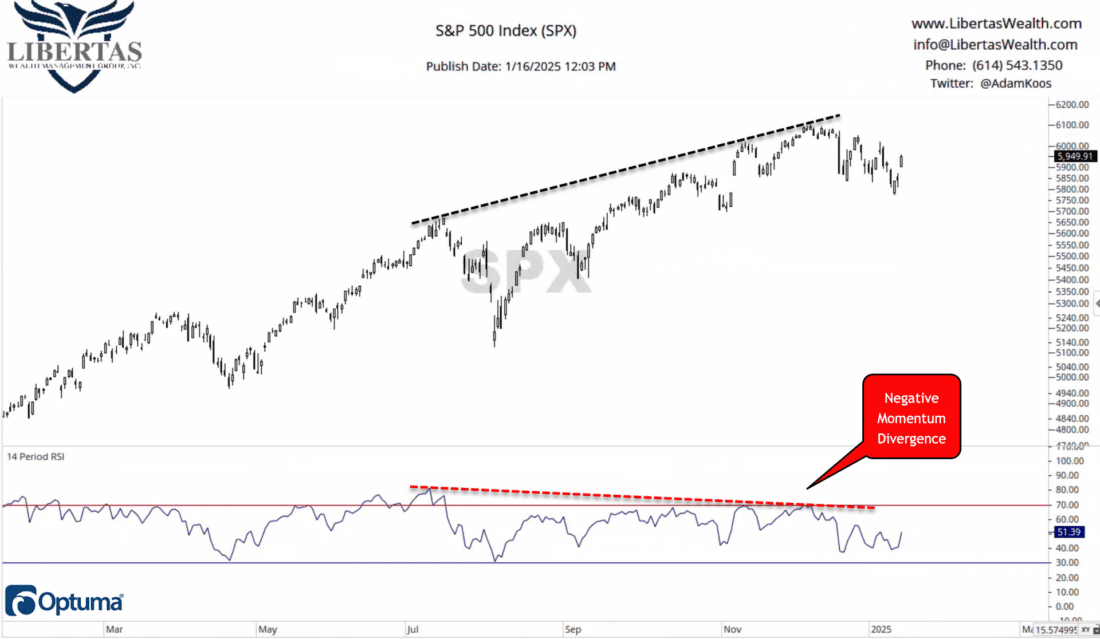

For the nay-sayers out there, yes… there are still some breadth issues that exist when looking at things form an intermarket analysis standpoint.

Furthermore, if we’re just keeping it simple and focusing on the S&P500, there is a negative momentum divergence going back to summer of 2024 that is still valid; and the market would need a nice, sustained, multi-day (if not multi-week) rally in the short-term to negate what I’m seeing in RSI (in the lower-pane).

3/

Trend “Predictors”

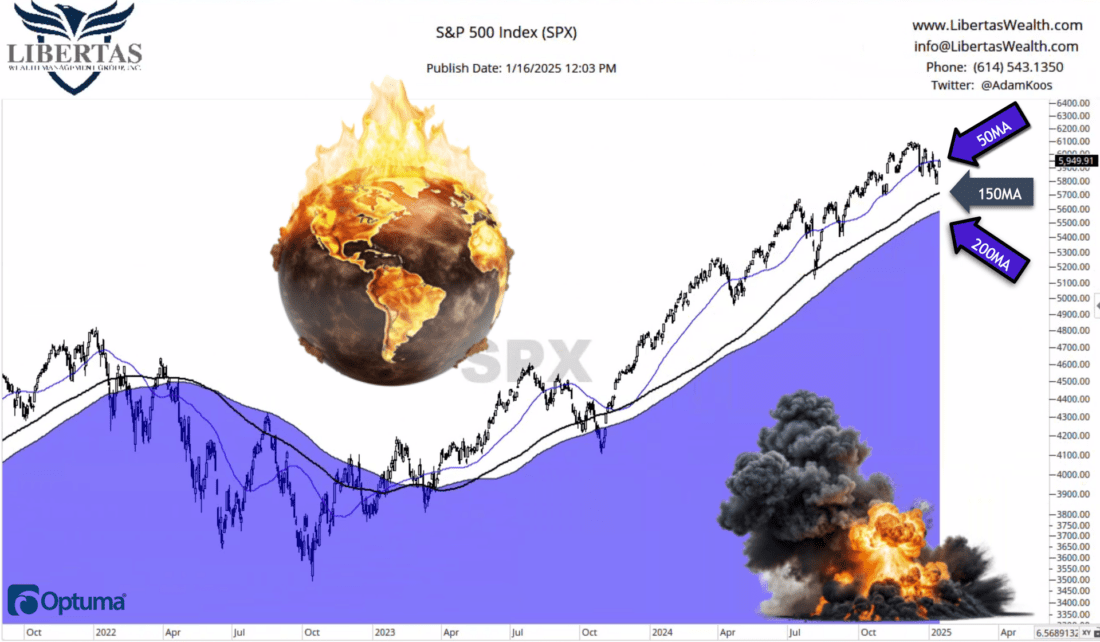

That all being said, look at the chart below…

The SPX is trading above rising 150 and 200-day moving averages, and it’s only barely bumping its head underneath the 50MA. Anyone who says this is a major market top is a “trend predictor,” not a trend follower, and their “analysis” (if you can even call it that) would be no better in Vegas than it is in the markets.

Again, keeping it simple, look back to 2021-22 and notice how the market fell “below water” (i.e., below the 200MA) followed by two failed attempts to come up for air. What we’re seeing in the market right now doesn’t even remotely resemble early-2022.

4/

Stocks, Stocks, and Stocks

Last, but not least, here’s another simple look at the major asset classes and a longer-term ranking system. The S&P500 is unequivocally the #1 runner, followed by international stocks, then small caps and finally, commodities.

Said another way, “stocks, stocks, and stocks” are in the #1, 2, and 3 slots from a relative strength standpoint. How in the world could this be a bad thing?!

An early mentor of mine once told me that “As soon as you ‘think,’ ‘like,’ ‘hope,’ you’ve already lost.” You can’t say things like:

- I really “like” this stock,

- I “think” the market is going to head lower from here, or

- I “hope” this stock comes back – I’ll sell it when it gets back to <this price>.

Instead, you have to invest your money based on the current prevailing market landscape/climate and trends. Sure, you can add relative strength, volume, and momentum to your analysis. That’s totally fine – we do, but I digress.

As the age-old saying in technical analysis goes, “The trend is your friend, ‘till the end, when it bends.”

—–

Originally posted on 17th January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.