Sirius XM Holdings (SIRI -0.77%) had a rough 2024. The company’s share price collapsed by more than 50%, wiping out roughly $8 billion in value. But it appears as if the correction has attracted some well-known investors. Warren Buffett’s holding company, for instance, now owns $2.4 billion in shares, adding to its position as recently as December.

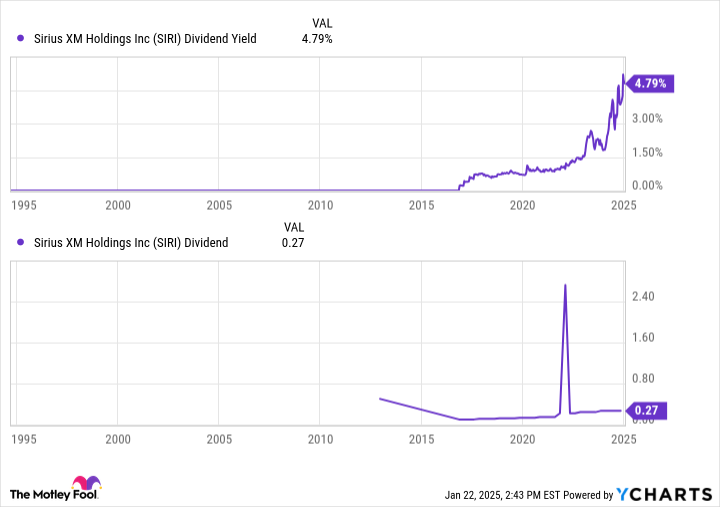

Sirius XM’s share price weakness has pushed its dividend yield up to historic highs. Might this be why Buffett is adding to his position? How much exactly will the company pay out in dividends this year?

Sirius XM is now a serious dividend stock

For most of its history, Sirius XM did not issue a dividend. This makes sense when you remember the company’s history. In the late 1990s and early 2000s, Sirius XM was spending heavily to build out its distribution infrastructure, as well as marketing aggressively to new potential customers. From 2005 through 2010, meanwhile, the business struggled mightily. Many analysts were predicting that the company would soon go bankrupt. Instead, Sirius and XM — the two largest domestic satellite radio providers — merged in a deal that would see the combined company’s financial prospects soar.

For a decade straight beginning in 2015, Sirius XM consistently posted positive profits and free cash flow. Despite a down year in 2024, the business still generated more than $900 million in free cash flow. The company used this excess cash in part to fund a $0.27 quarterly dividend, which cost approximately $360 million annually.

SIRI Dividend Yield data by YCharts.

Due to Sirius XM’s collapsing share price, the stable dividend payout has forced the stock’s dividend yield to soar. Right now, a $1,000 investment would generate nearly $48 in annual dividends. The company did post a surprise loss last quarter, but its free-cash-flow position remains solid. The company has also spent hundreds of millions of dollars recently on share buybacks. Pausing that program could free up even more cash to keep the nearly 5% dividend yield stable.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.