By Todd Stankiewicz CMT, CFP, ChFC

1/ Keep it Simple with Stocks

2/ Valuations are Off the Chart

3/ Diversification is NOT Dead

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Keep it Simple with Stocks

The news loves to hype up every little move in the stock market, creating drama where it doesn’t always belong. But sometimes, you just need to take a step back and look at the bigger picture. Over the past 30 years, the S&P 500’s quarterly chart has only broken below the middle Bollinger Band twice; once during the dot-com bubble burst and again during the Financial Crisis.

Interestingly, during the pandemic and again in the 2022 sell-off, the S&P 500 tested the middle band but never broke through it. Each time, it bounced back quickly. This highlights an important takeaway: investors may want to tolerate some volatility in the index as long as it stays in an uptrend above the middle Bollinger Band. Sometimes, staying focused on the long-term trend is the best way to cut through the noise.

2/

Valuations are Off the Chart

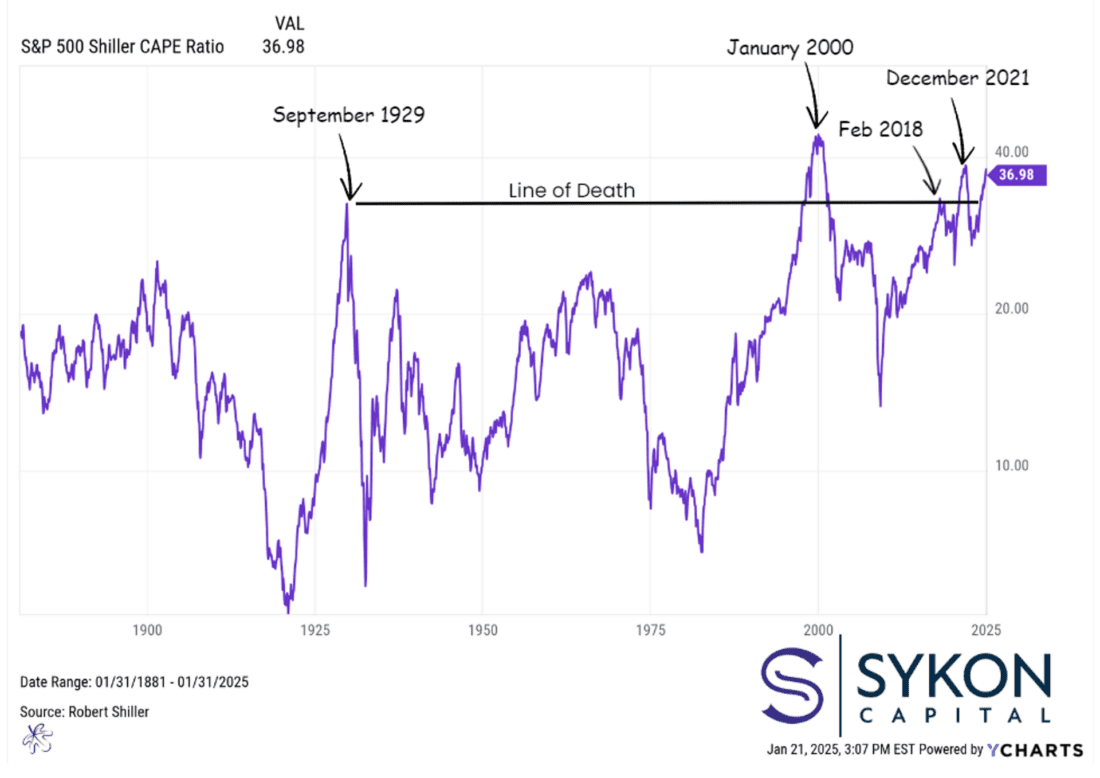

While the trend might be your friend for now, valuations tell a different story. The Shiller CAPE Ratio is sitting just shy of 37, similar to levels we saw in January 2000 and December 2021. Historically, elevated price-to-earnings ratios have been linked to poor risk-reward trade-offs over the long term.

Looking back, history has taught us a few painful lessons. In 1929, 2000, and 2021, lofty valuations preceded some rough patches in the equity markets. After September 1929, the Dow Jones Industrial Average dropped 33.7% in 1930 and another 52.67% in 1931. During the dot-com bubble, the S&P 500 experienced losses in 2000, 2001, and 2002. And more recently, following the December 2021 reading, the index fell 18.11% in 2022.

While it’s true that this time may be different, a little caution until valuations become more reasonable could be a prudent approach.

3/

Diversification is NOT Dead

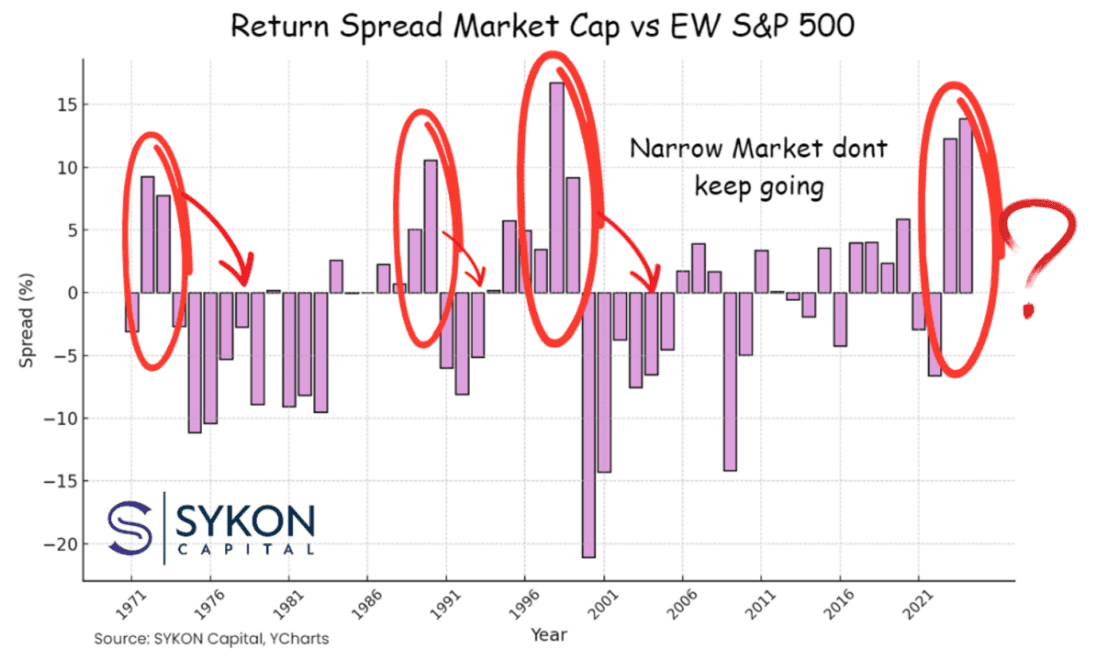

The excitement around artificial intelligence and the Magnificent 7 has driven one of the largest performance spreads between the market-cap-weighted S&P 500 and the equal-weighted index in the past 50 years. This lopsided performance has been fueled by heavy concentration in a handful of tech giants, leaving the rest of the market behind.

Historically, these types of performance gaps are short-lived. When a small group of stocks drives the majority of market returns, it often signals an unsustainable trend. Over time, markets tend to revert to favoring broader diversification, where gains are distributed across a wider array of sectors and companies.

For investors, this presents an important opportunity to pause and rethink strategy. Chasing the returns of a concentrated group of stocks may feel enticing in the short term, but it also carries risks. The more concentrated the market becomes, the more fragile it is to sudden shifts in sentiment or unforeseen events.

Instead of falling into the “set it and forget it” mentality, consider taking a contrarian perspective. A diversified equity portfolio not only helps spread risk, but also positions you to benefit when the market rotation inevitably takes place. As we move into 2025, focusing on diversification and rebalancing your portfolio may be the smarter long-term play.

Remember, the goal isn’t just about riding the hottest trend, it’s about creating a portfolio that’s resilient and adaptable in different market environments.

Disclaimer: Advisory Services offered through Sykon Capital, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.

—

Originally posted 27th January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.