Thanks to an FOMC meeting and key earning reports after the close, today promises to be a consequential day for markets. As we noted yesterday, the market reactions to the Fed, Meta Platforms (META), Microsoft (MSFT), Tesla (TSLA) and others are more likely to hinge upon the guidance that they offer more than the current results themselves. Overall, we see some risk aversion, though it is indeed relatively modest in most cases.

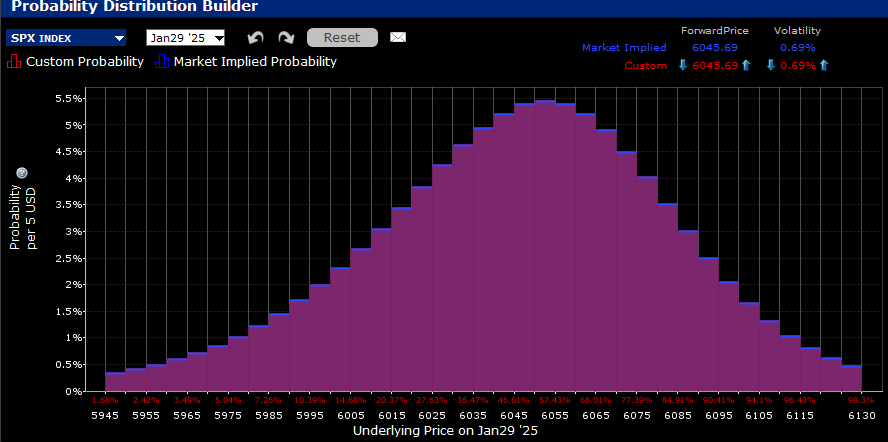

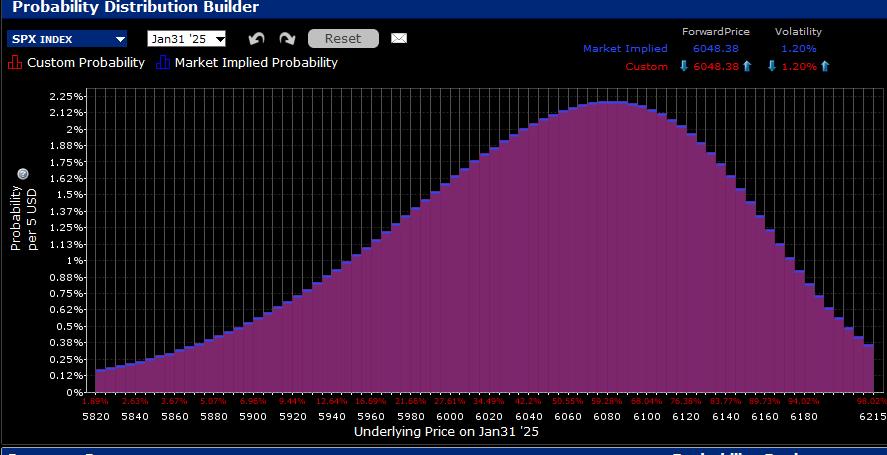

Starting with the FOMC, the IBKR Probability Lab shows a fairly symmetric range of probabilities for the S&P 500 (SPX) centered at-the-money for options expiring today, though Friday’s expiration shows a definite (and now somewhat customary) upside bias. The message seems to be, “today might be a push, but the rally resumes on Friday.”

IBKR Probability Lab for SPX Options Expiring January 29, 2025

Source Interactive Brokers

IBKR Probability Lab for SPX Options Expiring January 31, 2025

Source Interactive Brokers

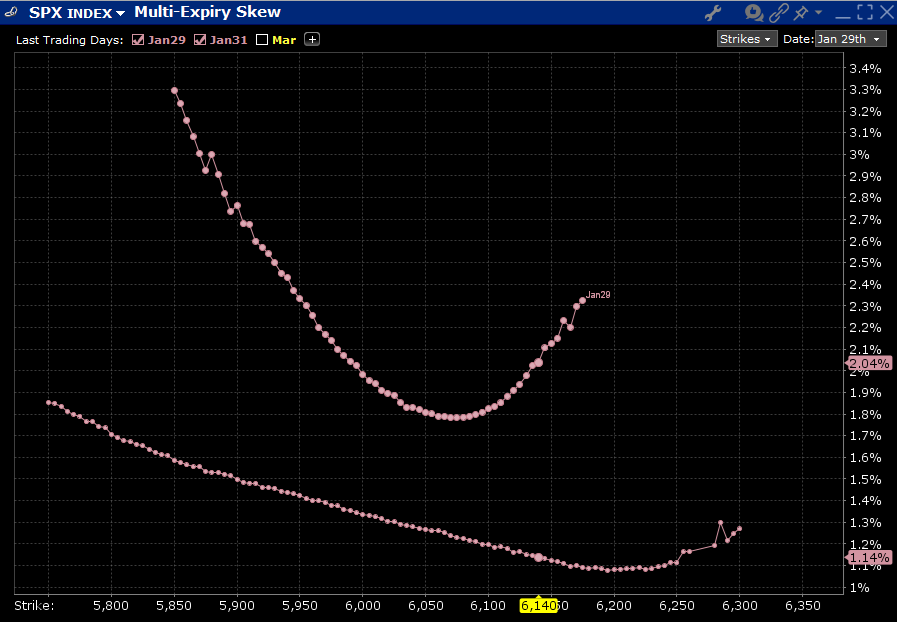

Meanwhile, befitting the probability curves above, we see a fairly steep, relatively symmetrical skew for SPX options expiring today, with a roughly 2% move priced into implied volatilities, but a flatter skew and a much higher inflection point for options expiring Friday.

Skews for SPX Options Expiring January 29th (top), January 31st (bottom)

Source Interactive Brokers

Traders in options expiring today seem to remember the big move after the last FOMC, since 2% is well above the average FOMC day move. That said, the three-day options are relatively unperturbed compared to recent history:

Source Interactive Brokers

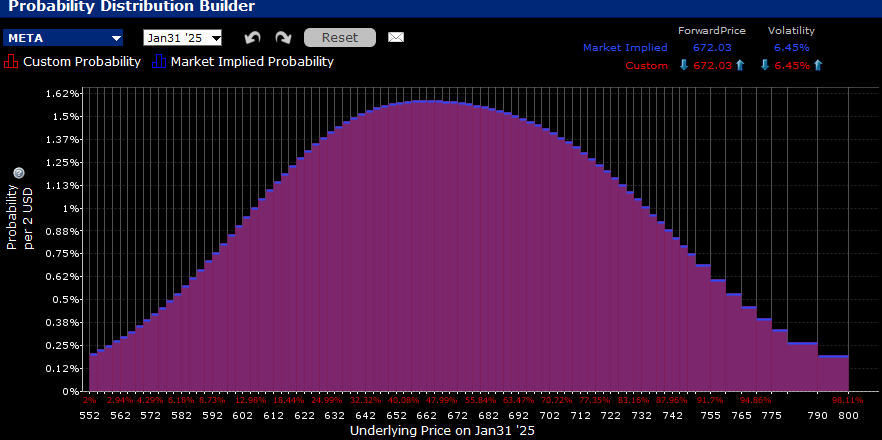

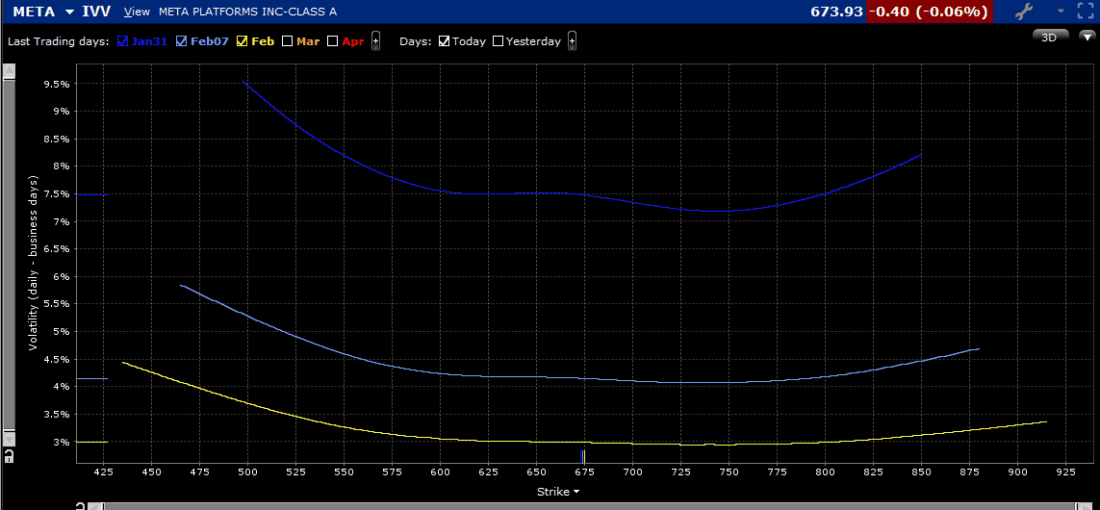

Moving onto META, we see a bit of a probability plateau, though the peak is slightly below the current price:

IBKR Probability Lab for META Options Expiring January 31, 2025

Source Interactive Brokers

Interestingly, skews for META options expiring this Friday, next Friday and on the next monthly expiration are almost identical in both shape and levels to those from just before the company’s last earnings report. It’s quite uncanny. The nearest term options sport an implied volatility of 7.5% (measured in daily terms), which is quite close to META’s 7.99% average post-earnings move using the past six quarters’ data (-4.09%, +4.82%, -10.56%, +20.32%, -3.73%, +4.4%):

Skews for META Options Expiring January 31st (top), February 7th (middle), February 21st (bottom)

Source Interactive Brokers

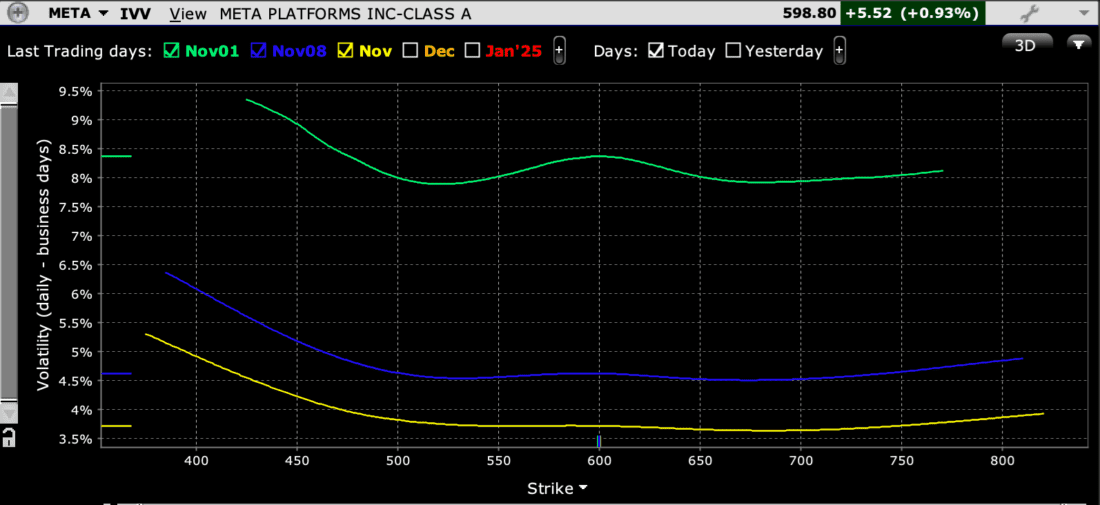

Skews for META Options Expiring November 1, 2024 (green), November 8th (blue), November 15th (yellow)

Source Interactive Brokers

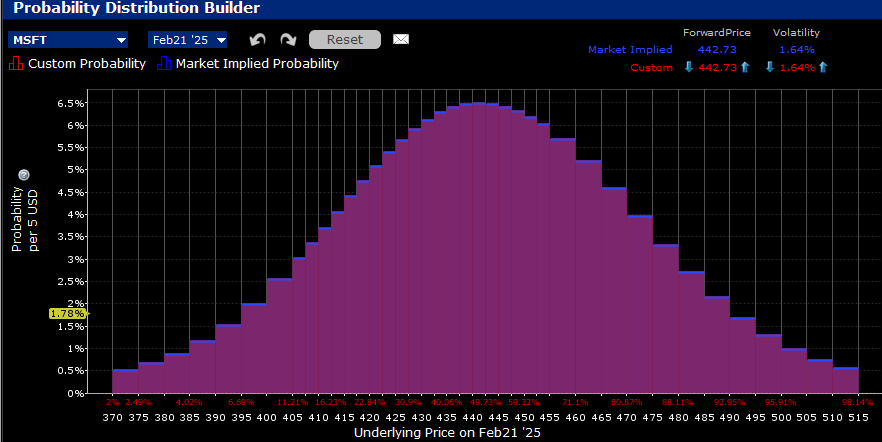

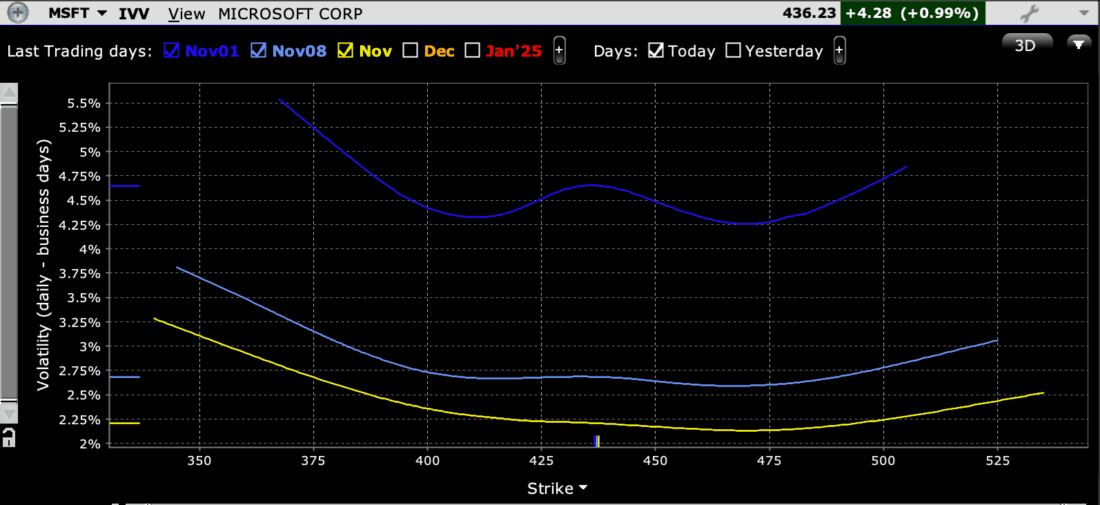

Regarding MSFT, we see a symmetrical probability distribution centered upon at-money options:

IBKR Probability Lab for MSFT Options Expiring January 31, 2025

Source Interactive Brokers

As with META, the shape and the levels of the skew curves are almost identical to those seen last quarter. One key difference, of course, is that META is up about 10% since its prior report while MSFT is essentially unchanged. The 4.6% daily implied volatility is somewhat robust compared to an average post-earnings move of 3.08% after its last six reports (-6.05%, -1.08%, +1.82%, -2.69%, +3.07%). Perhaps traders are putting more weight on the last 6% move than the prior smaller moves.

Skews for MSFT Options Expiring January 31st (top), February 7th (middle), February 21st (bottom)

Source Interactive Brokers

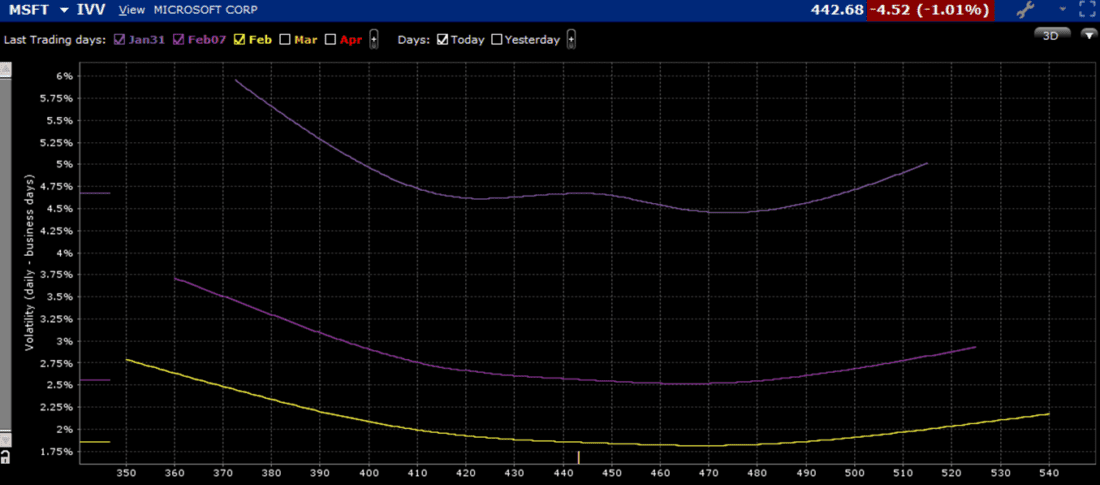

Skews for MSFT Options Expiring November 1, 2024 (dark blue), November 8th (light blue), November 15th (yellow)

Source Interactive Brokers

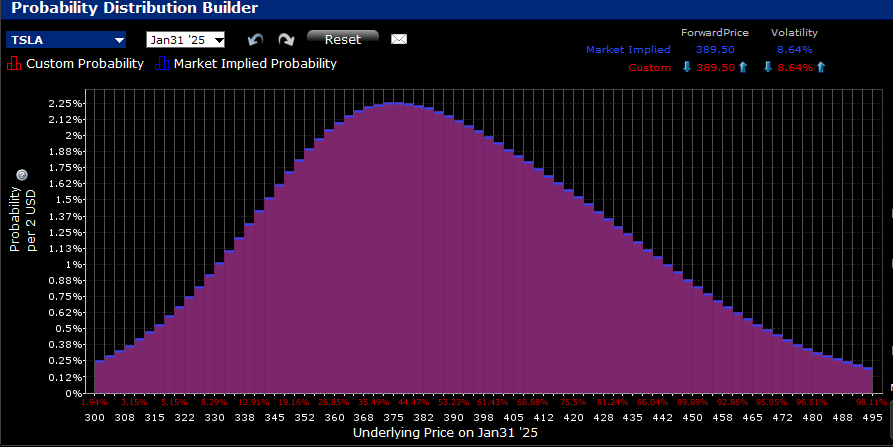

Finally, with TSLA we see some outright risk aversion, with the probability curve shifted to the downside and a peak about -4% below the current stock price:

IBKR Probability Lab for TSLA Options Expiring January 31, 2025

Source Interactive Brokers

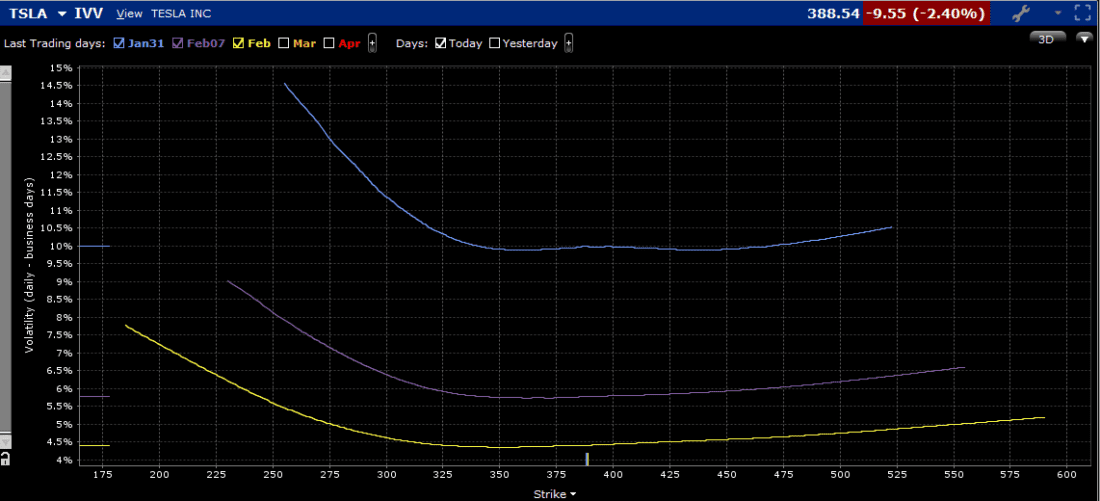

While skews are relatively flat from about $340 upward but very steep below that level. Implied volatilities across the curve are significantly higher than they were prior to TSLA’s last earnings report. But bear in mind that the stock is roughly 80% (not a typo) in that three-month span. It has been under some pressure recently, though, with yesterday’s 0.24% rise breaking a streak of five prior down days in a row. No wonder why more volatility is being priced in right now, especially TSLA has moved an average of 12.91 after its last six earnings reports (+21.92%, -12.33%, +12.06%, -12.13%, -9.3%, -9.74%)

Skews for TSLA Options Expiring January 31st (top), February 7th (middle), February 21st (bottom)

Source Interactive Brokers

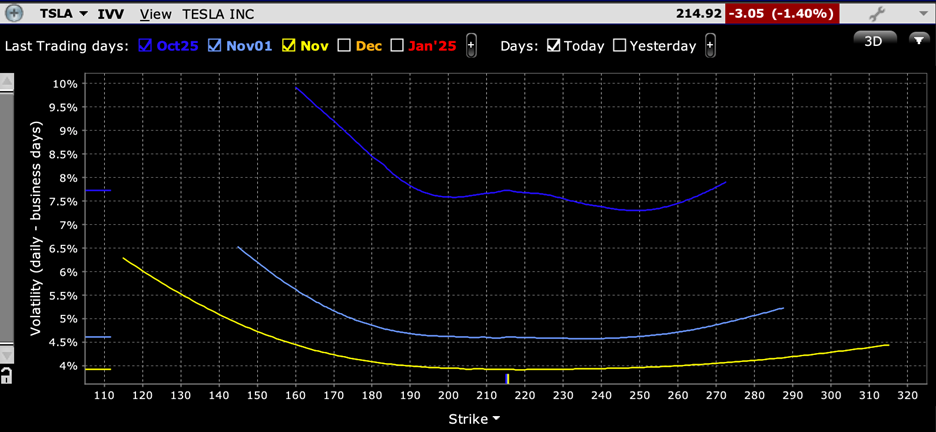

Skews for TSLA Options Expiring October 25, 2025 (dark blue), November 1st (light blue), and November 15th (yellow)

Source Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. “Characteristics and Risks of Standardized Options”

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.