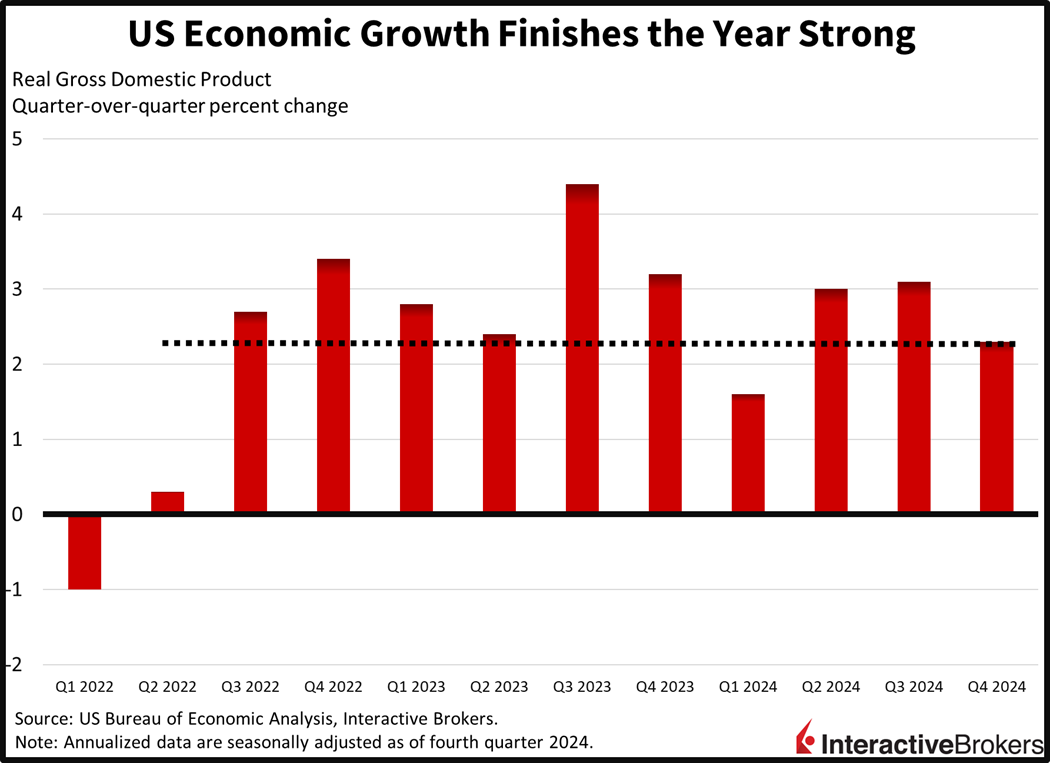

US economic growth finished 2024 strong as remarkable consumer spending, stabilizing residential investments and robust government outlays countered sluggish capital expenditures and a sizeable inventory draw. Furthermore, household consumption accelerated to its fastest pace in almost two years, as buoyant capital markets, subdued unemployment and heavier paychecks offset the restrictive impacts of lofty prices and elevated interest rates. The progress comes on the heels of yesterday’s hawkish pause from the Federal Reserve, with Chair Powell citing labor market strength and somewhat elevated inflation as reasons to wait and see. Moreover, a separate report on unemployment claims depicted tighter conditions from a week ago, further supporting bullish market activity. Investors are indeed responding to the positive data stateside, with traders scooping up equities, fixed-income instruments and commodity futures while neglecting volatility protection and the greenback.

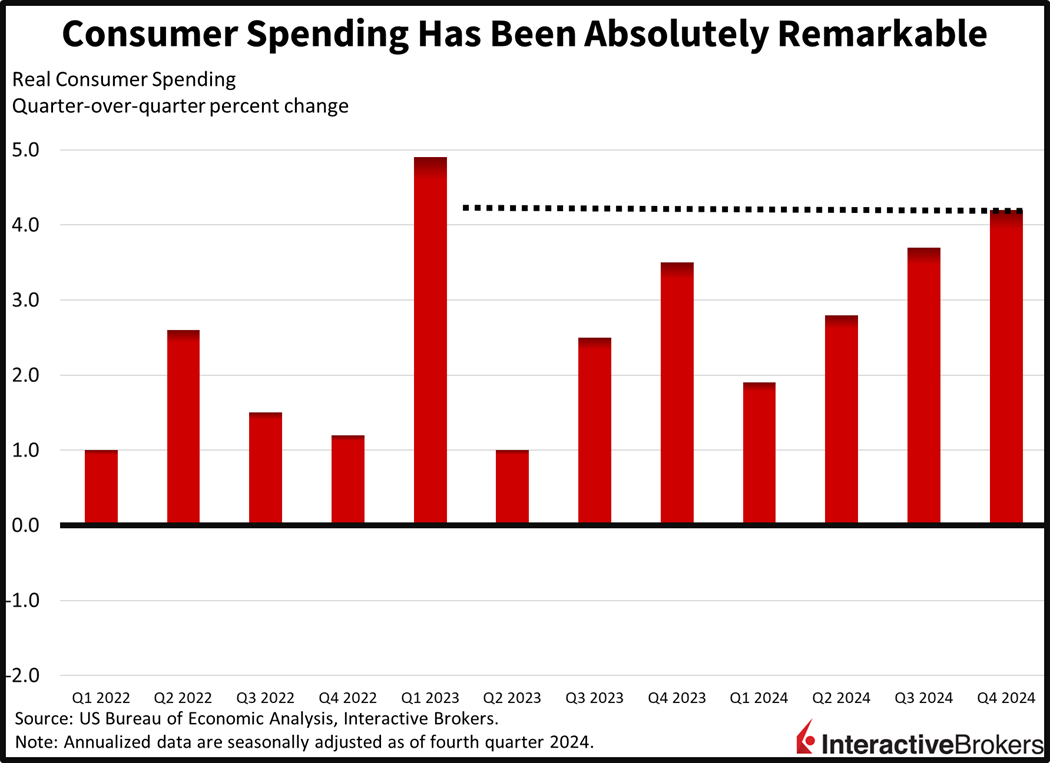

Consumer Spending Marks 7-Quarter High

The US economy grew at an annualized rate of 2.3% in the fourth quarter of 2024, decelerating from the previous period’s 3.1% and missing projections calling for 2.6%. The volatile airline category drove the headline miss, as the Boeing strike weighed on business investment, which dropped 2.2% during the period. It is the first contraction since the third quarter of 2021, over three years ago. Conversely, consumer spending accelerated to a rate of 4.2%, its fastest pace since the first quarter of 2023, with purchases picking up in the durable goods and services segments while decelerating slightly in nondurables. Meanwhile, government spending boosted the headline by 0.4% while net exports contributed at a more modest degree of less than 0.1%. A reduction in private inventories, however, was a 0.9% drag on the top number.

A Hawkish Pause

The Federal Reserve took a break from rate cutting yesterday following three consecutive reductions at meetings in September, November and December. The central bank cited solid labor market conditions, a stabilizing unemployment rate and somewhat elevated inflation as reasons to stay on hold. Additionally, the monetary policy authority said it will continue to reduce its balance sheet at its current pace, which disappointed folks that were looking for an end to the institution’s quantitative tightening. Overall, the FOMC looks happy with rates where they are and economists are likely to increase their estimates of where neutral is closer to 3.25% or 3.5%. Meanwhile, my estimate of r* is currently at 3.75% considering that this economy has consistently posted terrific activity and employment figures despite Fed Funds carrying handles of 4 and 5. Furthermore, the long end of the curve has been yelling that the US central bank doesn’t have much more room to cut, because inflation, growth and term premiums would flare up as a result.

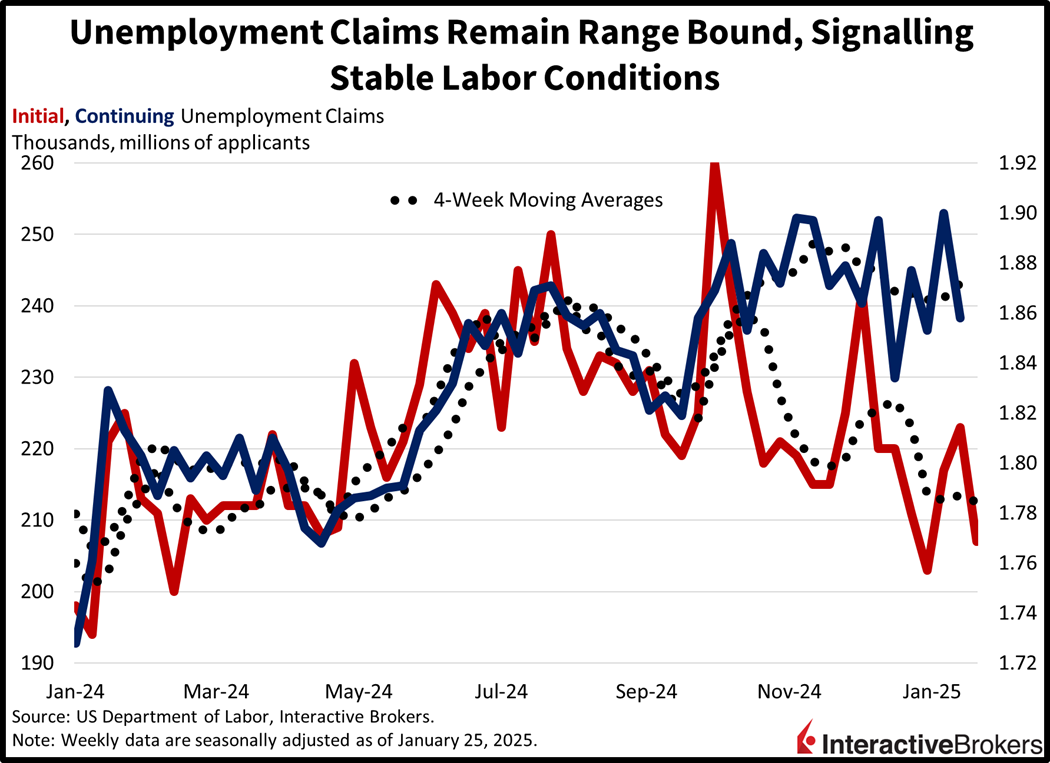

Unemployment Claims Drop

The number of physical trips and website clicks to unemployment offices declined during the last two weeks, according to this morning’s weekly report from the US Department of Labor. Initial jobless claims fell to 207,000 for the week ended January 25, beneath the 220,000 projection as well as the 223,000 from the prior period. Continuing claims also reflected a drop, but are reported for the week before, which ended on January 18. That figure came in at 1.858 million, below the 1.890 million median estimate and the 1.900 million from the previous seven-day span. Four-week moving averages were bifurcated, however, with those numbers shifting from 213,500 and 1.866 million to 212,500 and 1.872 million.

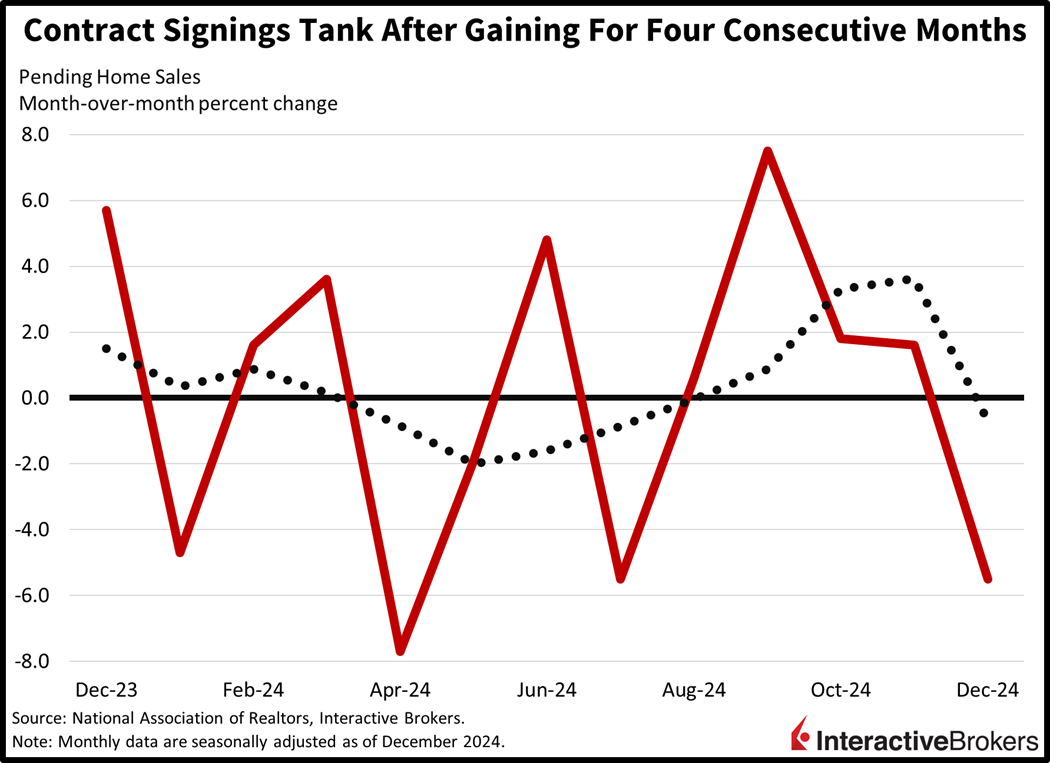

Home Sale Contract Volumes Weaken

The recent recovery in real-estate transactions may be short-lived, as elevated mortgage rates and record high prices weigh on affordability and sales. After increasing for four consecutive months, contract signings slid 5.5% month over month (m/m) in December, below anticipations of an unchanged figure and November’s 1.6% gain. All regions contributed to the weakness, with pending home sales declining 10.3%, 8.1%, 4.9% and 2.7% m/m across the West, Northeast, Midwest and South. Contract signings are considered a leading indicator to closed transactions, as paperwork is typically addressed by prospective sellers and buyers roughly 30 days before financing is finalized and keys are exchanged.

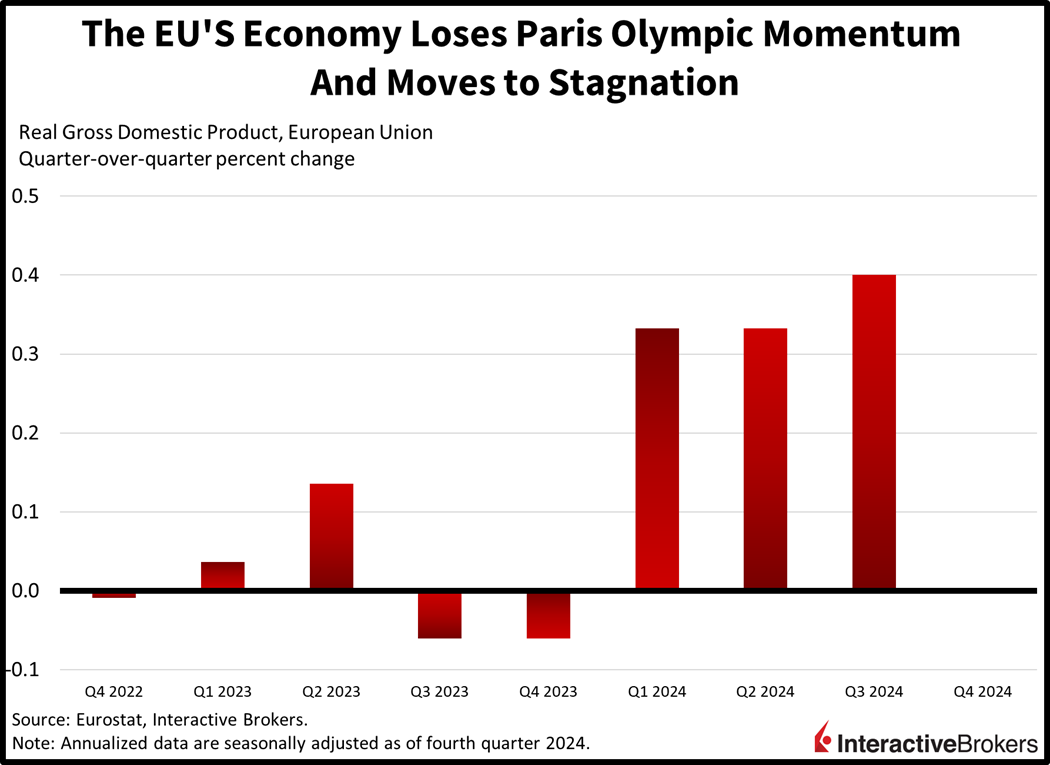

European Economy Stagnates

But economic fortunes aren’t as rosy across the Atlantic in the EU, with this morning’s GDP print reporting stagnation to end 2024 as consumer and business confidence dwindle on the back of political uncertainties in the continent’s two largest economies as well as trade risks stemming from the US and China. Weak prospects going forward enabled the ECB to lower its key benchmark rate by another quarter-point today and central bank watchers are expecting 3 to 4 more for the rest of the year.

Aussie Trade Prices Climb

In Aussie land, import and export prices rose 0.2% and 3.6% quarter over quarter to end last year, recovering from declines of 1.4% and 4.3% in the third quarter. On an annualized basis, export and import charges fell 8.6% and 1.9% year over year (y/y). Deflationary developments related to coal and scrap metal on the export front and petroleum on imports led to the overall drop. A spike in gold prices offset some of the lower charges in both the export and import categories, however.

Corporate America Posts Mixed Results

Tesla (TSLA) and Caterpillar (CAT) provided mediocre quarterly presentations while technology shops continued to tout the growth of artificial intelligence despite it producing mixed results. Those are a few observations from the following earnings highlights:

- Tesla dished out disappointing earnings and revenue results that fell below Wall Street expectations. Its overall revenue climbed only 2% y/y with the 113% growth of its energy segment, which includes solar energy and batteries, failing to offset an 8% decline in transactions for automobiles. Reported auto revenue of $21.56 billion, furthermore, included $692 million in subsidies provided as regulatory credits. In the final quarter of 2024, Tesla’s net income fell from $2.27 per share to $0.66. Tesla’s earnings release material included a note that “Affordability remains top of mind for customers.”

- Caterpillar posted earnings and revenue that surpassed estimates with strong demand for construction products; however, it said sales this year will be marginally lower than 2024. While the company expects current construction levels to continue throughout 2025 year, it believes demand for its products within the sector will ease with distributors having high levels of inventory. On a positive note, sales for energy and transportation projects are expected to increase.

- Microsoft (MSFT) grew its revenue 12% y/y and its earnings per share from $2.93 to $3.23. Both metrics exceeded analysts’ estimates, but its Intelligent Cloud sales fell below forecasts despite jumping 19%. On a positive note, CEO Satya Nadella said daily users of Microsoft’s Copilot AI assistant double from the third quarter. The company’s outlook for the growth of its Azure cloud offering, however, missed analysts’ expectations.

- Meta (META) posted a surprisingly strong 21% revenue jump, welcome news to investors who have been scrutinizing the company’s plans to spend up to $65 billion this year on developing AI. Earnings also beat estimates, but the company’s guidance for 2025 operating expenses was worse than investors anticipated. Additionally, the top range of its first quarter revenue guidance only met analyst expectations, but it believes AI will help drive a boost in advertising revenue during the full year.

- United Postal Service (UPS) shares dropped 15% this morning after it reported EPS of $2.01, which missed the analyst consensus estimate of $2.51 per share. Additionally, the company guided for $89 billion in full-year revenue while Wall Street expected $95 billion. UPS is struggling with declining shipping volumes following peak demand during the Covid-19 pandemic. Additionally, many customers have opted for lower cost delivery options. UPS also announced plans to cut delivery of Amazon.com packages by 50%, citing the lower profitability of providing services for the ecommerce giant.

Tech Lags as Markets Advance

Markets are tilted to the bullish side, but AI uncertainty is weighing on tech shares amidst some significant earnings reports. The Russell 2000 and Dow Jones Industrials are leading the equity benchmarks and gaining 1.1% and 0.2% while the S&P 500 is unchanged and the Nasdaq 100 is lower by 0.3%. Sector breadth is positive with 9 of the 11 major segments trading north and driven by real estate, utilities, and financials which are up 1.8%, 1.6% and 0.9%. Technology and communication services are representing the laggards, though, those components are losing 0.7% and 0.5% on the session. Treasurys are catching modest bids though as the 2- and 10-year maturities change hands at 4.21% and 4.52%, a basis point (bp) lighter across both durations. The dollar is taking its cue from softer borrowing costs and a weaker than expected US GDP report; its index is down 16 bps as the greenback depreciates against most of its major counterparts including the euro, pound sterling, yen, and Aussie and Canadian tenders. The US currency is appreciating marginally relative to the franc and yuan, however. Commodity futures are getting scooped up with silver, gold, copper, crude oil and lumber higher by 2.2%, 1.2%, 1.1%, 0.4% and 0.1%. WTI crude is trading at $73.27 per barrel as supply concerns stemming from Trump tariff threats offset rising stateside inventories.

Economic Growth to Accelerate

While the past two years have delivered impressive economic growth figures, we are likely to witness an acceleration in 2025. The new administration’s plans of milder regulations, lighter taxation and a manufacturing onshoring push are likely to continue boosting business sentiment and send figures higher. Meanwhile, deficit spending is almost certainly going to persist, as the White House is unlikely to accept the consequences of budget balancing, which would include weaker activity that would hurt profitability. We saw the dynamic occur in 2017 following President Trump’s first arrival at the White House, when real GDP growth ramped from 2% in the first quarter to 4.6% by year-end. The tailwinds of fiscal stimulus and structural improvements are likely to deliver a similar kind of acceleration this time around as well.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.