By Todd Stankiewicz CMT, CFP, ChFC

1/ January is NOT a Barometer

2/ The Dow Breaks Down

3/ Let the Prices Lead

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

January is NOT a Barometer

The S&P 500 finished January up 2.78% on a total return basis, and right on cue, the financial media is buzzing about the January Barometer, the idea that the stock market’s performance in January sets the tone for the rest of the year.

It’s a neat story, but is there any real substance behind it?

At first glance, the concept seems logical: a strong start signals momentum, while a weak start suggests trouble ahead. But history tells a different story. Since 1950, there have been 30 negative Januarys, yet only 13 of those years ended in the red.

That’s hardly a strong predictive track record.

Some of the market’s best years followed terrible starts. In 2009 the S&P 500 dropped 11.25% in January but ended the year up 26.46%.

Some of the worst years also had strong starts. In 2001 the index gained 6.45% in January, but still finished the year down 11.89%.

In other words, a strong or weak January doesn’t guarantee anything about the months ahead.

Rather than chasing seasonal market myths, investors should focus on data, signals, and fundamentals. Short-term trends can be noisy, and trying to predict the market’s direction based on a single month’s performance is a losing game.

A positive January is great, but it doesn’t tell us anything about how 2025 will unfold. Markets don’t follow simple rules, and neither should your investment strategy. Instead of reacting to headlines, focus on what actually matters – the data.

2/

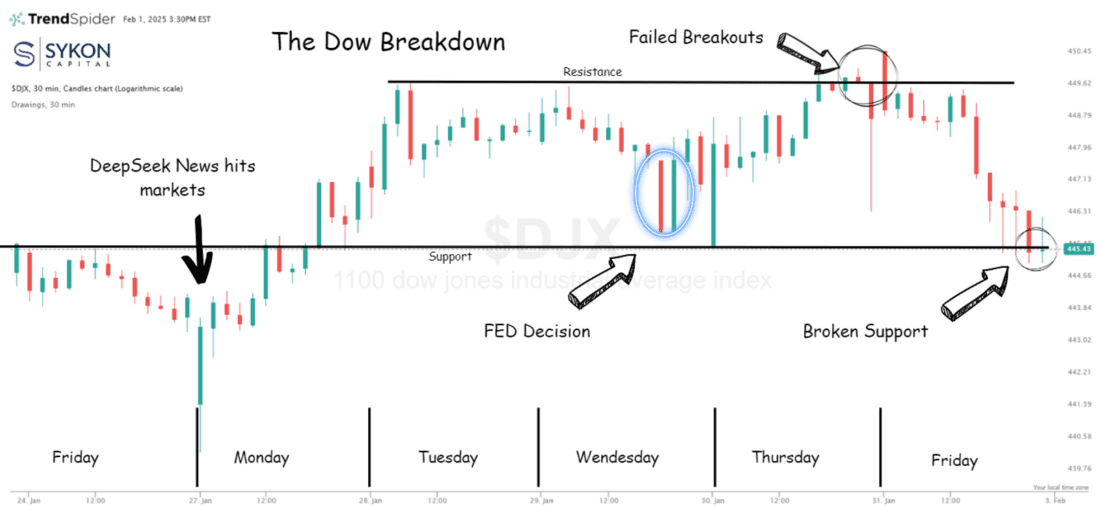

The Dow Breaks Down

Last Friday, I pointed out signs of strength in the Dow. The index appeared poised for a breakout, but news of potential tariffs quickly overshadowed an otherwise in-line inflation report. Instead of pushing higher, the Dow reversed course, breaking below a key support level.

This breakdown resulted in a bearish engulfing candle on the daily chart, a well-known reversal pattern that signals a potential shift in momentum.

The first few days of this week will be critical. The Dow is now back in its prior trading range, and the next move could set the tone for the weeks ahead.

- A swift recovery could signal that the breakout attempt was just delayed.

- Further downside would confirm that sellers are taking control, increasing the riskof a deeper decline.

Price action will tell the story. Momentum is shifting, now it’s a question of which direction takes hold.

3/

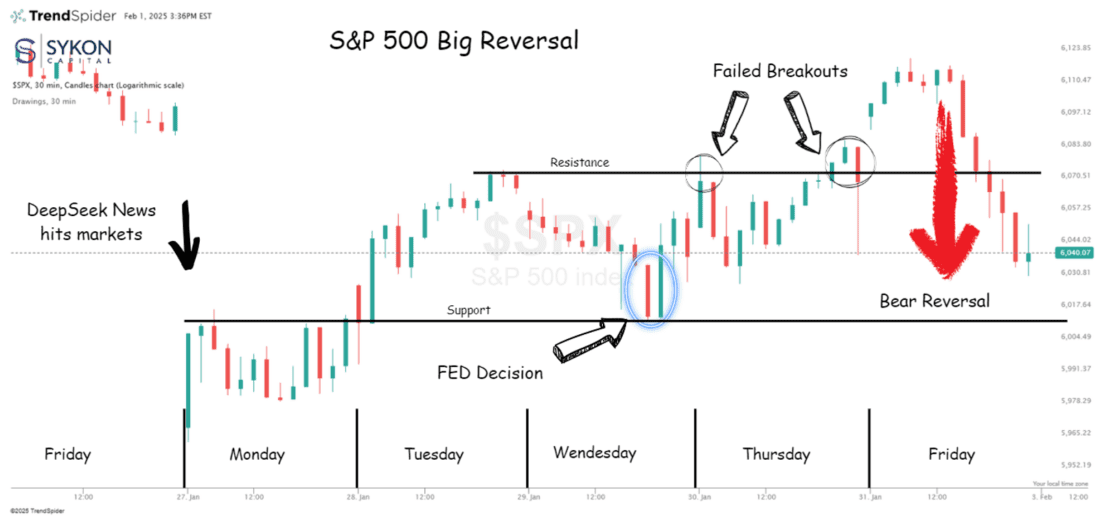

Big S&P 500 Reversal

The S&P 500 made a strong attempt to break out of its trading range last week, rebounding after a major gap down on Monday following the DeepSeek news. However, much like the Dow, the index reversed sharply, falling back into its prior range.

This failed breakout also meant the S&P 500 couldn’t close the gap from Monday’s open, and instead, it formed a bearish engulfing candle on the daily chart.

This week, all eyes should be on the lower support level. A decisive break below could trigger a deeper pullback, putting further downside in play.

For traders and investors, the takeaway is clear: Know your levels, stay disciplined, and manage risk accordingly.

Momentum is shifting, now it’s about watching where it leads next.

Disclaimer: Advisory Services offered through Sykon Capital, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.

—

Originally posted 3rd February 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.