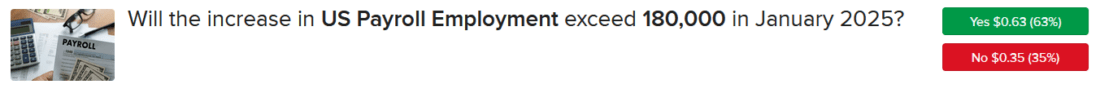

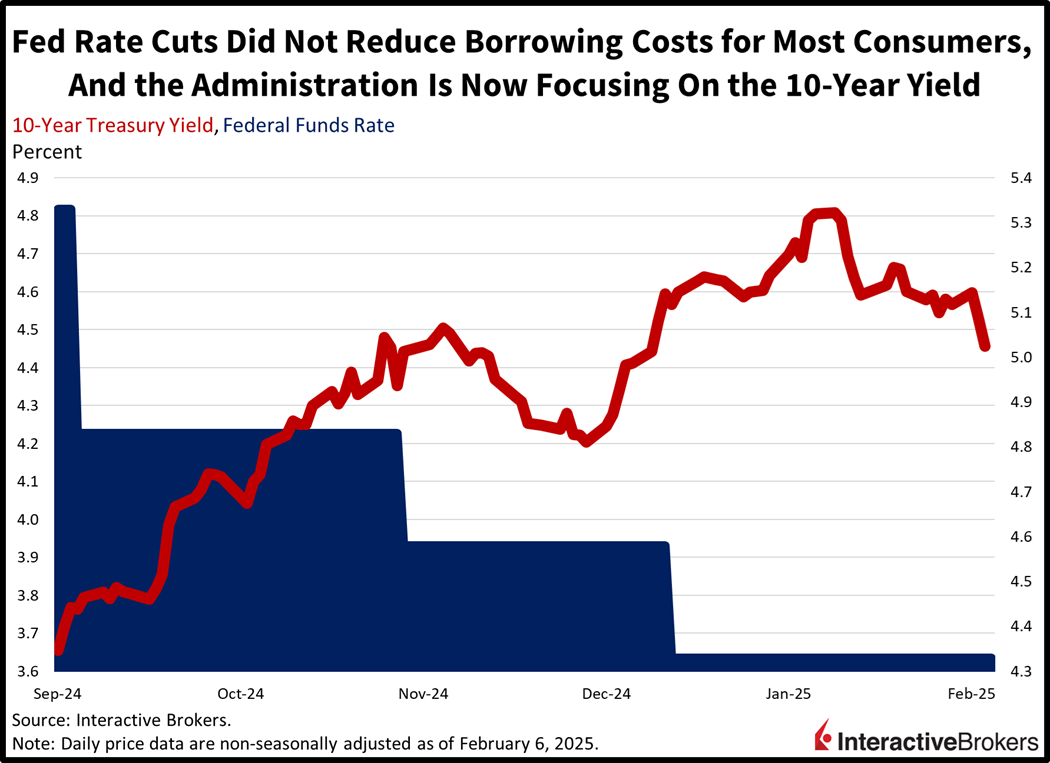

Markets are muted as investors hit the pause button ahead of tomorrow’s pivotal Jobs Friday numbers. Indeed, equities and yields aren’t making any bold moves prior to nonfarm payrolls, which our marketplace projects will arrive near 195,000. But on a quiet day from an economic data perspective, US releases included weekly unemployment claims alongside quarterly productivity statistics, which arrived near expectations. Meanwhile, those figures weren’t enough to incentivize any trading swings, with both stocks and Treasurys hovering near their respective flatlines. Turning to Washington, fiscal chief Scott Bessent communicated that the Trump administration is focusing on lowering interest rates though policy reforms, including limiting fiscal spending, increasing government efficiency and boosting energy production. Furthermore, the cabinet member stated that President Trump will focus on the 10-year maturity level, which impacts American families more directly, rather than asking the Federal Reserve to reduce short-term borrowing costs.

Source: ForecastEx

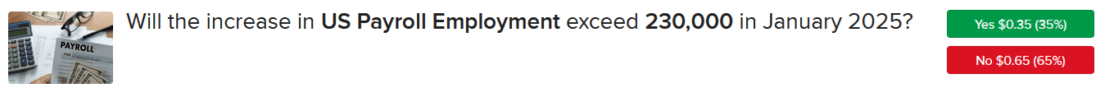

Labor Market Remains Stable

Unemployment claims rose slightly in the past two weeks but remained well-anchored and range-bound, signaling stable labor conditions. Initial filings rose to 219,000 for the week ended February 1, exceeding expectations of 213,000 as well as the 208,000 from the prior 7-day period. Continuing claims for the seven-day interval ended January 25 also climbed, coming in at 1.886 million, above projections of 1.870 million and the 1.850 million from the previous span. Four-week moving average trends ticked north on both fronts, from 212,750 and 1.870 million to 216,750 and 1.872 million week over week.

Productivity Improvement Slows

Productivity gains among workers decelerated to end the year but remained strong, rising at a 1.2% annualized rate in the fourth quarter. The figure, which reflects worker output per hour, arrived below the 1.4% median estimate and the third quarter’s 2.3%. Unit labor costs, defined as the ratio of hourly compensation to labor productivity, rose 3%, as a 4.2% increase in wages was partially offset by the 1.2% productivity number. Unit labor costs did miss the anticipated 3.4%, however, but advanced from the third quarter’s 0.5% climb.

A Sleepy Day on Wall Street

Markets are quite uneventful today with stocks, bonds and the greenback moving around narrowly. In equities, major domestic benchmarks are being led by the S&P 500 and Nasdaq 100 indices, which are both up 0.1%, while the Dow Jones Industrial and Russell 2000 are 0.1% lower. Sectoral participation is split with gains of 0.7%, 0.3% and 0.2% from financials, consumer staples and consumer discretionary being countered by losses of 1.3%, 0.5% and 0.3% across the energy, utilities and real estate segments. In fixed income, the 2- and 10-year Treasury maturities are changing hands at 4.21% and 4.44%, 2 basis points (bps) heavier on each. Pricier borrowing costs are pushing up the dollar modestly, with its index 19 bps higher as the greenback appreciates relative to all of its major counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders. The US currency is depreciating against the yen, however. Commodity action is mixed as lumber, crude oil and copper rise 1.1%, 0.3% and 0.3% but gold and silver drop 0.5% and 0.4%. WTI is paring some of yesterday’s losses, which were triggered by a surprise inventory build stateside as well as a softer demand outlook stemming from potential trade conflicts and geopolitical tensions.

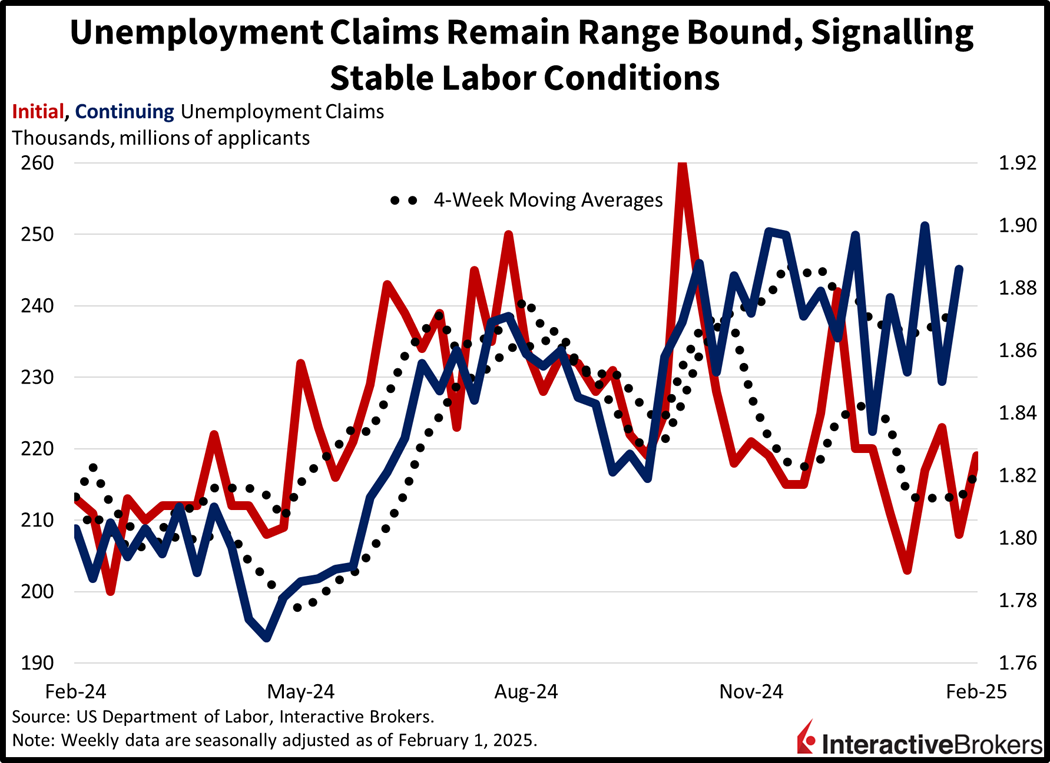

Focusing on the 10-Year is Right Approach

While the yield curve has historically shifted alongside the Federal Reserve’s interest rate moves, this time was certainly distinct. The US central bank began an easing cycle last year with a super-sized 50-bp reduction, but the long-end of the yield curve didn’t cooperate. Folks in rate sensitive sectors were shocked that the borrowing costs they viewed on their computer screens rose despite the FOMC lowering its key benchmark. This kind of confusion is what the Trump administration is looking to avoid while US Treasury Secretary Bessent is taking the focus off of the central bank. Furthermore, consumers are much more affected by interest expenses over multiple years, rather than the overnight bank lending rate, which is what the Fed controls. An additional benefit of focusing on the entire curve and specifically the 10-year yield is the avoidance of a confrontation between the White House and monetary policy officials, the kinds of quarrels we witnessed during Trump 1.0 when the President demanded that the central bank reduce rates. By taking a wider view on the cost of capital, the US reestablishes a valuable precedent of monetary policy independence which doesn’t consider political influence in its decisions.

International Roundup

Europe Retailing Slows and BOE Cuts Rates

Eurozone consumers curtailed their spending in December relative to the preceding month by 0.2% but on a y/y basis, outlays jumped 1.9%. The m/m decline was twice the rate that analysts predicted while the y/y result met forecasts. In November, outlays were unchanged m/m but climbed 1.6% y/y.

On a m/m basis, eurozone households spent 0.7% less on food, drinks and tobacco, but the non-foods excluding automotive fuels category and the automotive fuel in specialized stores group experienced increases of 0.3% and 0.2%. For y/y results, the overall increase was led by cashier activity in the non-food products excluding automotive fuel category and automotive fuel in specialized stores group growing 3.1% and 1.2%.

Dissenting BOE Members: Larger Rate Cut Required

As expected, the Bank of England (BOE) trimmed its key rate from 4.75% to 4.5%, its lowest rate since June 2023. Among the bank’s nine voting members, two opposed the measure, explaining that they believe a 50-basis-point cut is needed. The BOE also downgraded its already anemic 2025 growth estimate for gross domestic product from 1.5% to 0.75% and warned that the expansion could be lower if tariff pressure mounts.

China’s Woes Dampen Australia’s Exporting

Weakening demand from China and a surge in imports caused Australia’s December trade surplus to fall from A$6.56 billion to A$5.09 billion m/m. Analysts thought the trade surplus would increase to A$6.79 billion. The country experienced a dip in demand for metals, machinery, and port products. In November, imports climbed only 1.7% but the metric accelerated to 5.9% in the final month of 2024 with an increase of textiles, clothing and footwear and capital goods entering the country. Australia’s future exporting volumes will be influenced by the results of China’s monetary and fiscal stimulus as the country’s economic growth has weakened considerably.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.