Shares of FuboTV (FUBO -2.23%) skyrocketed last month after the sports-focused streaming service agreed to a merger with Disney’s Hulu + Live TV.

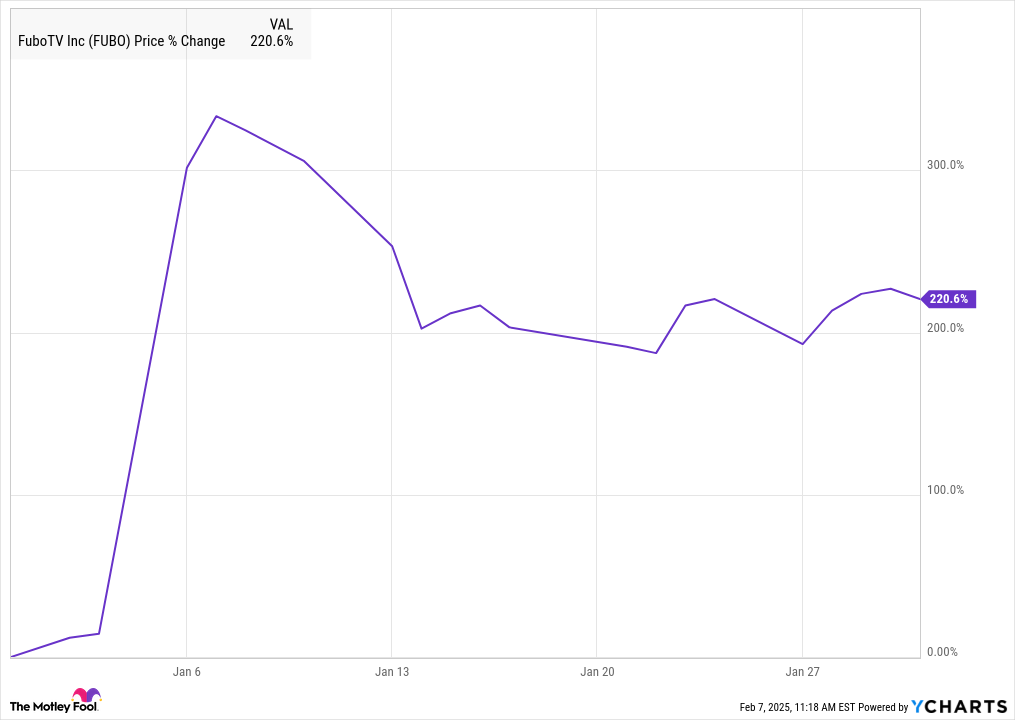

The valuation implied in the merger agreement led the stock to more than triple on Jan. 6 when the news was announced. Fubo shares pulled back after that as investors reassessed the deal, but the stock still finished the month up 221%, according to data from S&P Global Market Intelligence.

As you can see from the chart below, investors enjoyed a monster one-day gain from the stock before it cooled off a bit.

What the Hulu deal means for Fubo

The deal between the two media companies represented a surprising denouement after Fubo and Disney had been engaged in a legal tussle over Venu, the sports streaming joint venture that has since been abandoned.

According to the terms of the merger, Fubo and Hulu + Live TV will combine, with Disney owning 70% of the company. Fubo will remain publicly traded, and the company will now represent both Fubo and Hulu + Live TV. The stock soared 220% on the news because the company now represents an entity that is roughly that much more valuable than it was before, according to the terms, now that Fubo the service represents just about 30% of total subscribers.

The logic behind the deal doesn’t seem fully clear since the two services will continue to be offered separately. And Disney plans to take its flagship ESPN network to streaming in the fall, likely competing with Fubo.

Still, the deal represents a clear win for Fubo because the company had been struggling to stay afloat in an increasingly challenging streaming environment.

Fubo continues to grow, with a 21% increase in the third quarter, but its subscriber base is small at just 1.61 million subscribers in North America. It’s also unprofitable, reporting a loss of $27.6 million on the basis of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

Image source: Getty Images.

Is Fubo a buy?

It’s clear why Fubo stock soared. The company essentially absorbed a larger streaming service, but the jump is a reflection of financial engineering, not the strength of the combined company, which still needs to pass regulatory muster to be approved.

Given that, investors shouldn’t mistake the pop in the stock for the market’s belief that the new company has a bright future. Rather than continuing to hold Fubo as the regulatory drama plays out, investors may be better off cashing in their winnings and investing them elsewhere.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends fuboTV. The Motley Fool has a disclosure policy.