Investors are being served a one-two punch on this Jobs Friday as a weaker-than-expected nonfarm payrolls report was shortly followed by another miss on UMich consumer sentiment. The employment print was mixed and open to interpretation, however, as strong wage pressures, declining unemployment and favorable revisions to the past two months were met with narrow roster expansions from a sector perspective amidst the shortest hourly work week since the pandemic. Indeed, paycheck growth climbed to a 19-month high while the hourly work week was the briefest in roughly fifteen years when excluding Covid. Meanwhile, stocks were focusing on the positives and doing fine until 10:00 AM ET hit and the latter publication reflected the heaviest inflation expectations in over a year amidst households communicating mounting anxiety about current conditions and the future. The intraday print sparked a bearish reversal in equities while yields further extended their climb from earlier.

Payrolls Fall Short of Expectations

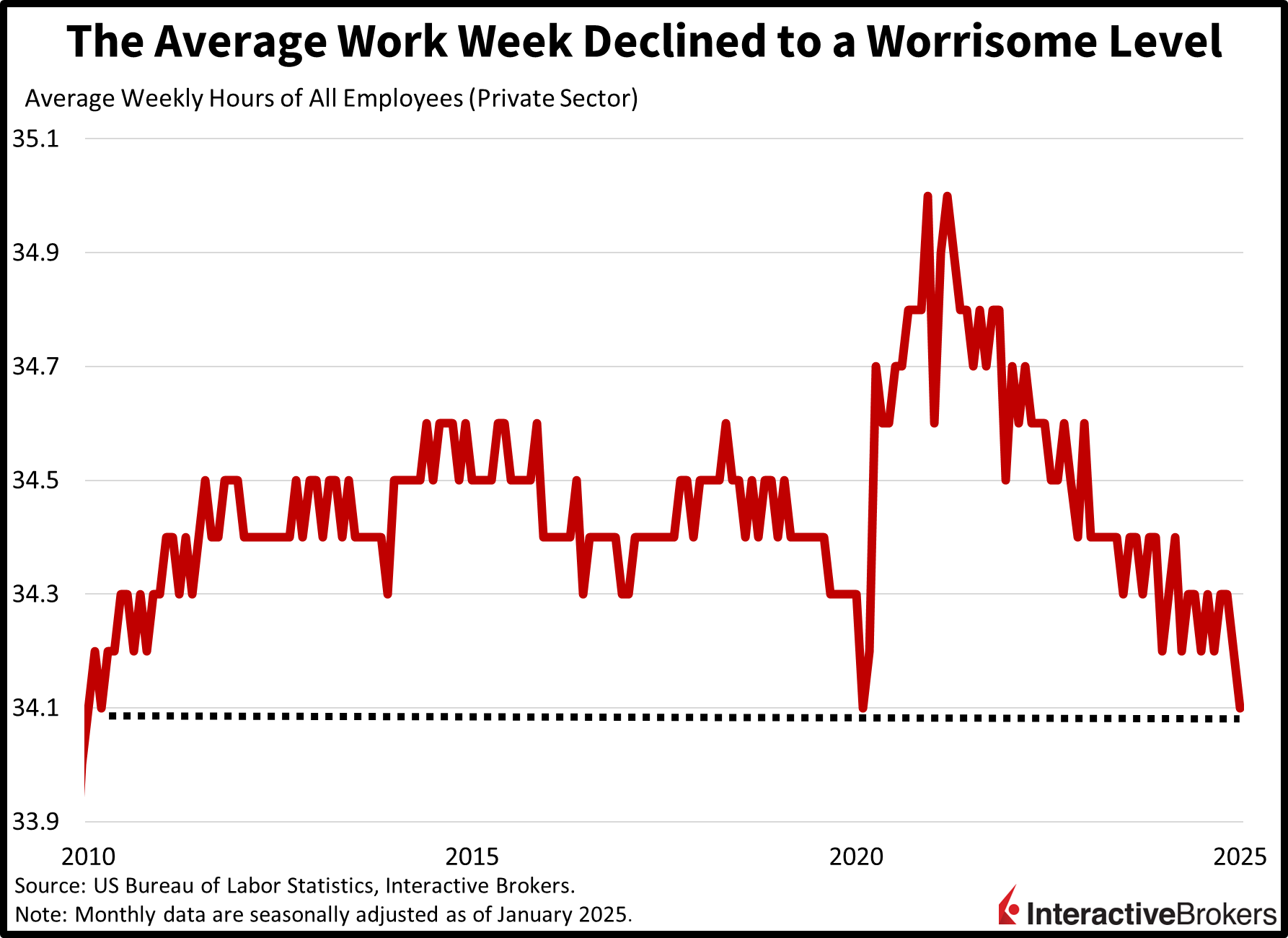

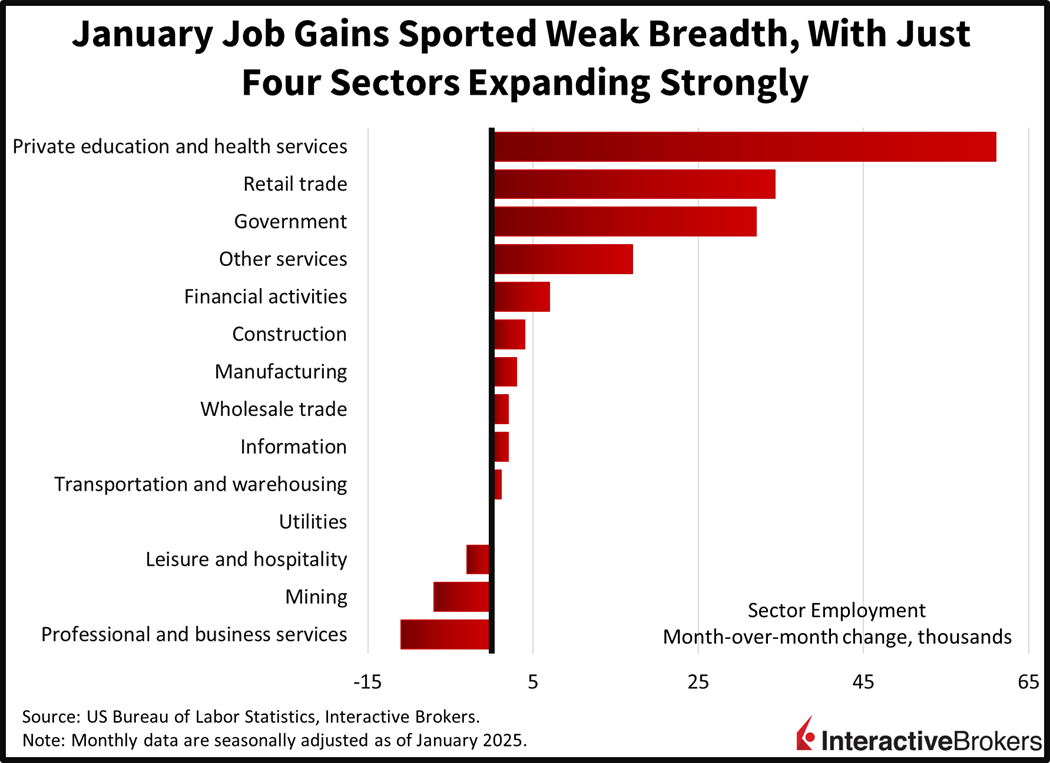

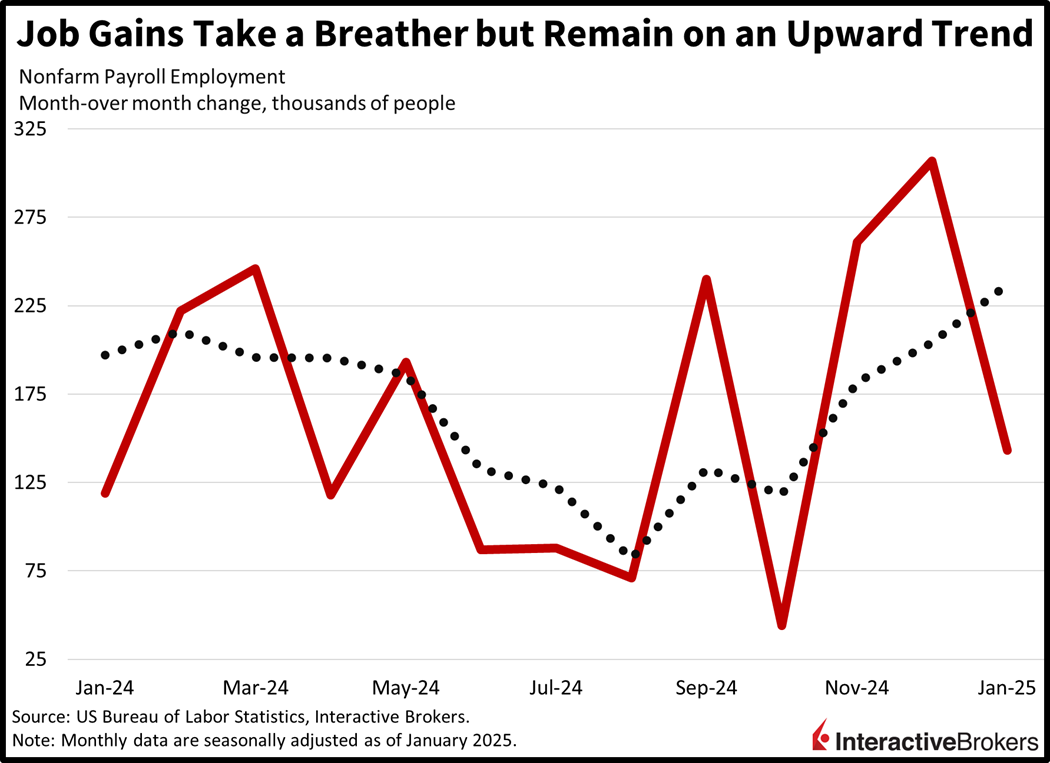

The US economy added 143,000 jobs last month, according to the Bureau of Labor Statistics. The result arrived beneath projections calling for 170,000 as well as the upwardly revised 307,000 from December. Job gains were incredibly concentrated and featured a non-cyclical tilt, as private education/health services and government expanded by a combined 93,000. And other than the 34,300, 17,000 and 7,000 net gains in retail trade, other services and financial activities, the remaining industries were quite anemic. Emblematic of the lethargy were construction, manufacturing, information, wholesale trade, transportation and warehousing, and utilities, which offered headcount growth between 100 and 4,000 each. And 3 of the major 14 industries ended up trimming payrolls, as professional/business services, mining and leisure/hospitality reduced their workforces by 11,000, 7,000 and 3,000. Furthermore, the average hours in a work week declined to 34.1, which is the lowest since June 2010 when excluding the pandemic. The measure is a critical indicator because firms tend to reduce staff schedules prior to enacting layoffs.

Joblessness Falls, Pay Climbs

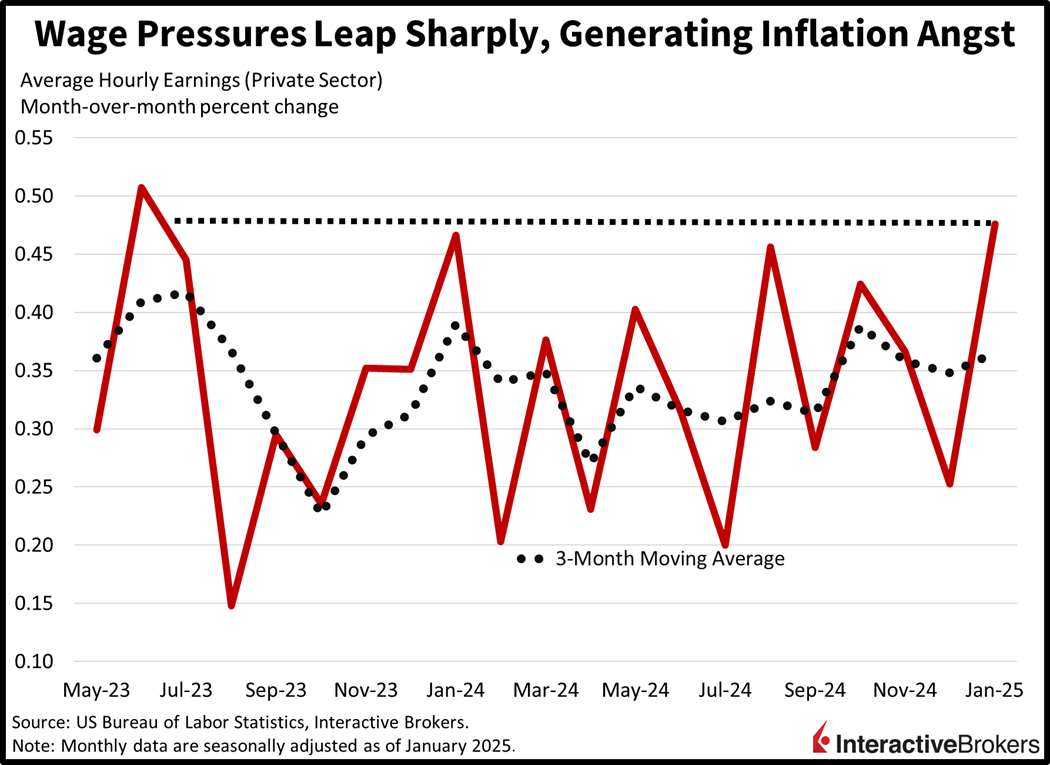

Turning to the positive aspects of the print, joblessness retreated while paychecks climbed at the fastest clip since June 2023. The unemployment rate sank to 4%, driven by a sharp increase in the labor force. The 4% figure arrived beneath expectations of an unchanged 4.1% rate from the prior month. Average hourly earnings (AHE) posted a staggering 0.5% month-over-month advance, trouncing projections anticipating an unchanged 0.3%. On a year over year (y/y) basis, AHE increased 4.1%, above the median estimate of 3.8% while matching December’s level.

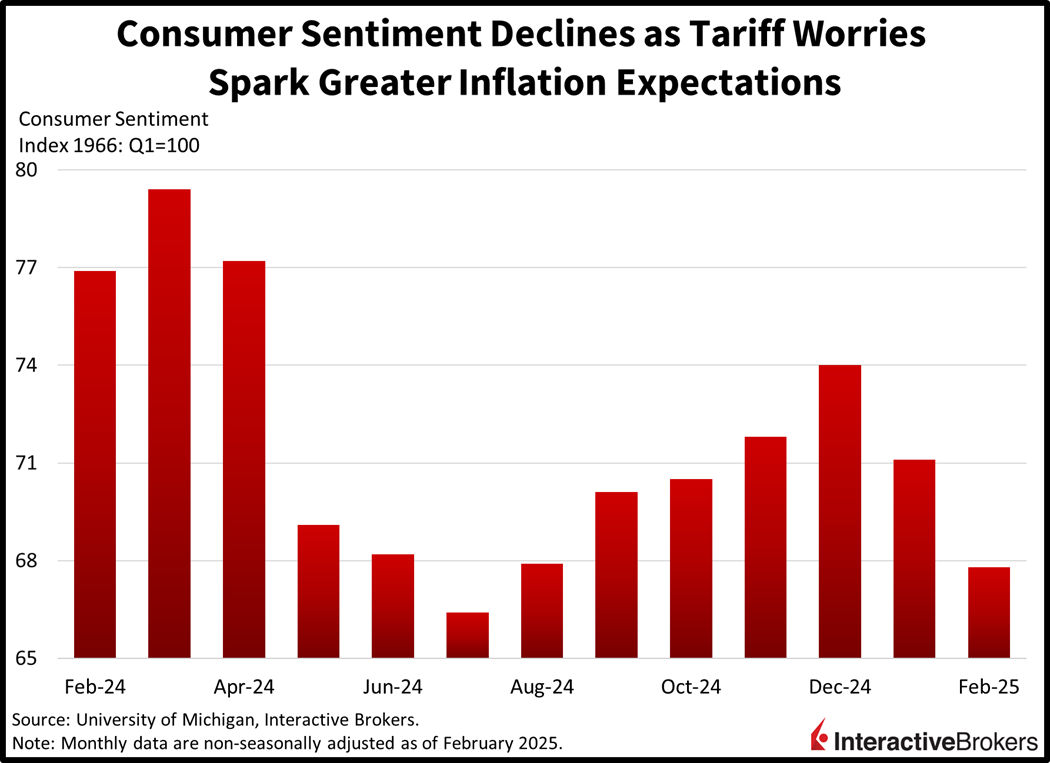

Consumer Sentiment Falls Again

Households are continuing to experience a decline in optimism with the University of Michigan’s (UMich) Consumer Sentiment Index dropping for a second-consecutive month. The 67.8 headline figure missed the 71.3 forecast and arrived below January’s 71.1. It was pulled lower by each of the two sub-indices, with gauges of current conditions and consumer expectations declining from 74 and 69.3 to 68.7 and 67.3. Inflation expectations ticked north across the 1- and 5-year time horizons, reaching 4.3% and 3.3% from 3.3% and 3.2% in the previous period. Folks expressed pessimism over potential durable goods transactions against the backdrop of a negative outlook on tariffs.

Markets Drop on Jobs and Sentiment News

Markets are taking losses as stocks and bonds alike trim some of their recent gains, but investors are scooping up the greenback, commodity futures and volatility protection. All major US equity benchmarks are in the red with the Russell 2000, Nasdaq 100, S&P 500 and Dow Jones Industrial indices down 0.7%, 0.5%, 0.3% and 0.3%. Sector breadth is split with the laggards represented by consumer discretionary, materials and real estate, which are losing 1%, 0.6% and 0.3% on the session. The gainers, meanwhile, are led by energy, communication services and industrials; they’re up 0.4%, 0.2% and 0.1%. Nervousness about inflation and wage pressures are weighing on fixed-income instruments with the 2- and 10-year Treasury maturities changing hands at 4.28% and 4.50%, 6 basis points (bps) heavier across both durations. The greenback is benefiting from pricier borrowing costs and its index is up 28 bps as the US currency appreciates relative to all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Turning to commodities, they’re green across the board: copper, lumber, crude oil, gold and silver are gaining 3%, 0.9%, 0.6%, 0.5% and 0.2%.

Keeping Policy Changes in Perspective

Today’s data are quite noisy but before we get nervous about tariffs and the potential for goods reinflation, it’s important to note that the administration has achieved trade acquiescence thus far and the economy is still strong, sporting low unemployment and robust consumer spending. As far as wage pressures, they haven’t cooperated throughout our journey of disinflation, which began in 2022, and there’s no reason to believe they will turn south any time soon. President Trump’s border policy is likely to weigh on labor force growth and lead to greater bargaining power for domestic workers, supporting services inflation. Finally, we’ve had an employee shortage in the States for about seven years and although the gap has been narrowing, it may very well begin to widen in the coming months as immigration restrictions drive job vacancies north.

International Roundup

Canada Posts Another Strong Jobs Report

Canada added 76,000 workers to its payrolls last month, a moderation from the 90,900 additions in December but well above the 25,000 consensus expectation. Gains were driven by 35,000 individuals securing full-time employment. It was the third-consecutive monthly gain. Manufacturing, with 33,000 additions, led, followed by the professional, scientific and technical services group and construction, which added 33,000 and 19,000 workers. The unemployment rate fell from 6.75 to 6.6%. Analysts expected it to climb to 6.8%.

UK Home Prices Set New Record

UK house prices climbed 0.7% m/m and 3% y/y in January, according to the Halifax House Price Index. The gains pushed the average property price to 299,138 British pounds, which set a new record, and the m /m result surpassed estimates for a 0.2% increase. The recent price gains may be driven by first-time buyers rushing to close on homes before a new tax on real estate purchases starts next month. January’s score followed a 0.2% decline in December.

Japan Cash Register Transactions Climb

Japanese households increased their spending 2.7% y/y in real terms during the final month of 2024, substantially surpassing Wall Street’s expectation for a modest 0.2% increase. The strong report, which focuses on residence with two or more persons, comes as Japan Prime Minister Shigeru Ishiba meets with President Trump. The meeting is expected to focus on trade and efforts to counter the growing influence of China and North Korea. Regarding spending, the housing category and transportation and communication segment led the upward surge with gains of 15.8% and 6.5%. Conversely, the fuel, light and water group declined 2.4% followed by the 1.4% decline of furniture and household utensils. In other developments, the country’s Cabinet Office reported that the leading and coincident indicators climbed 1.4% and 1.1%, providing additional evidence that the country’s economy is strengthening. The leading indicator reading of 108.9 exceeded the estimate for 108.1. Improvements in exports to the US, Europe and Asia supported the rise in the coincident index, which is a measurement of current conditions.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.