Clorox (CLX -0.86%) is down 10.1% year to date at the time of this writing, with most of that drop occurring last week when the company reported second-quarter fiscal 2025 results. The maker of bleach, Kingsford charcoal, Hidden Valley Ranch, Burt’s Bees, and more has been on a roller coaster in recent years, but the end of its turnaround is finally in sight.

With a 3.3% dividend yield and 40 consecutive years of dividend raises, Clorox stands out as a solid passive income opportunity, but only if the underlying business fundamentals improve. Here’s why the sell-off in Clorox stock is a buying opportunity for long-term investors.

Image source: Getty Images.

Getting back on track

Over the last five years, Clorox’s earnings have been all over the place for external and internal reasons. The COVID-19 pandemic led to a surge in demand for household cleaning and hygiene products, initially benefiting Clorox. But then the company overestimated demand trends, leaving it especially vulnerable to supply chain and inflationary pressures.

In August 2021, during the pandemic, Clorox announced a five-year plan to replace its enterprise resource planning (ERP) system, transition to a cloud-based platform, and invest in other digital technologies. The goal was to modernize Clorox’s internal operations — from supply chain to finance and data management — to improve efficiency. The total cost is now expected to be $560 million to $580 million.

In Q4 fiscal 2023, Clorox took a noncash impairment charge of $445 million in its Vitamins, Minerals, and Supplements business as it aimed to streamline its portfolio to focus on its core brands. Then, in fiscal 2024, it took a one-time noncash pension settlement charge of $171 million. Clorox also suffered a costly cyberattack that mostly affected its fiscal 2023 and fiscal 2024 results. And in March 2024, the company announced the divestment of its Argentina, Uruguay, and Paraguay operations.

Needless to say, Clorox has not had a “normal” year since before the pandemic. A better way to gauge the company’s performance is its adjusted earnings, which reflect the core business’s performance by removing one-time charges or the added cost of the ERP investment.

Clorox is investing in long-term growth

Clorox has been focusing on margin improvement rather than revenue growth. The most recently reported quarter, Q2 fiscal 2025, marked the ninth consecutive quarter of gross margin expansion. For the full fiscal year, Clorox is guiding for organic sales growth of 3% to 5% — excluding the impact of the ERP transition. The company expects full fiscal year gross margins to expand 125 to 150 basis points.

Clorox upped its adjusted earnings per share guidance for the fiscal year to a new range of $6.95 to $7.35, a year-over-year increase of 16% at the midpoint. Clorox would have a 20.4 adjusted price-to-earnings ratio based on fiscal 2025 projected results (period ending June 30) and a share price of $145.95 at the time of this writing.

Despite focusing on profitability, advertising and sales are key elements of Clorox’s strategy. In other words, it isn’t implementing sweeping cost cuts just to squeeze every percentage point out of margins. Rather, it believes in spending money to make money by doubling down on its strongest, most profitable brands. For fiscal 2025, Clorox forecasts selling and administrative expenses to be 15% to 16% of net sales and advertising and sales promotions to be 11% to 11.5%.

Clorox’s aggressive sales, general, and administrative (SG&A) spending is noteworthy because it impacts operating margins, not gross margins. So, Clorox may be expanding gross margins, but it ultimately needs to show it can also sustain strong operating margins. The ERP investments are an effort to improve efficiency and, in turn, operating margins. But it remains to be seen whether the spending was worth it.

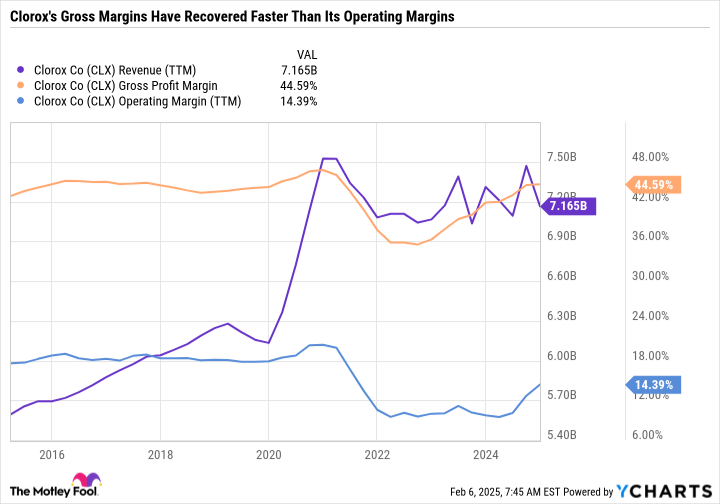

As you can see in the following chart, Clorox’s revenue has flatlined since its pandemic-induced boost, and gross margins have recovered. However, operating margins are still down a few percentage points from pre-pandemic levels.

CLX Revenue (TTM) data by YCharts. TTM = trailing 12 months.

A few percentage points difference in operating margins can turn a good company into a great company. Or, in the case of Clorox, each percentage point change in operating margin equates to a $70 million or so swing in operating income. So, while Clorox’s turnaround is progressing well, it still needs to show that its divestitures, long-term investments, and SG&A expenses are paying off.

Clorox is a buy if you like where the business is headed

Buying Clorox now is a bet on management making the right decision by restructuring the business through internal processes and how it allocates advertising dollars around these core brands. By investing in top brands, Clorox is prioritizing gross margin expansion over revenue growth, which could help it take market share in core categories if the advertising is effective.

The 3.3% dividend yield also provides a compelling reason to own the stock, especially since the turnaround will hopefully be nearing completion within the next year or two.