To the best of my knowledge, none of the many Eagles fans in my college friends group text attempted to overturn a car or climb a light pole in Center City Philadelphia, but they were justifiably giddy last night and this morning. The question is: should investors share, or curb, their enthusiasm?

As someone who roots for a hapless team, based about 90 miles to the northeast, wearing a similar green jersey to the Eagles but with none of the recent winning pedigree (the Jets, ugh), and a daily column to write, I thought it would be an opportune time to see if there might be some market implications from last night’s result To put it mildly, the “Super Bowl Indicator” stinks. There was once a very high spurious correlation between the Super Bowl winner’s conference and the performance of the market over the ensuing 12 months; lately that has been flatly untrue.

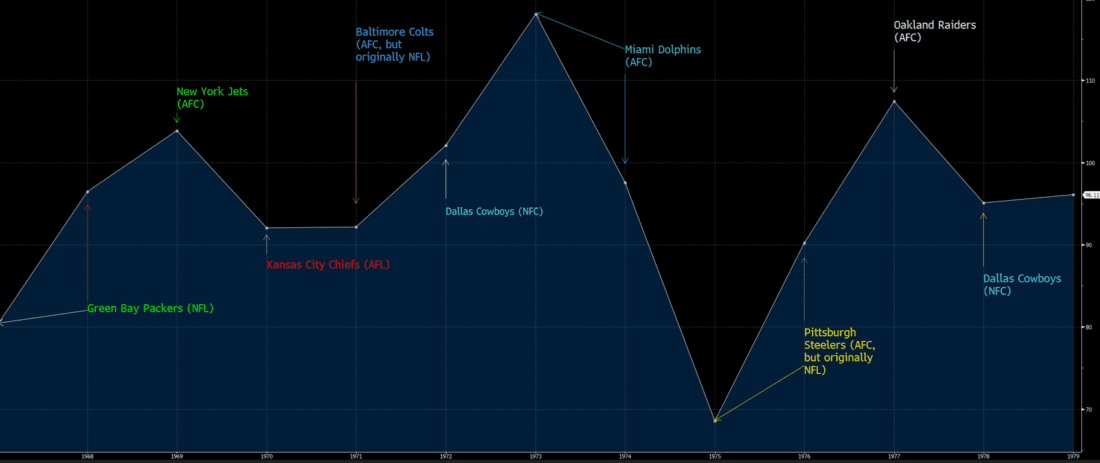

The theory stated that if a team originally from the NFL or NFC won, then the market would trade higher; if a team originally from the AFL or AFC won, then it would trade lower. When the correlation was first discovered in 1978, the Super Bowl was relatively new (the first was played in 1967), and markets were choppy during that period. The chart below shows its success:

Super Bowl Indicator, 1967-1978

Winning Team in Text vs, Yearly S&P 500 (line)

Sources: Bloomberg, Interactive Brokers

Since then, however, the “Super Bowl Indicator” has given more than its share of false readings. For investors, there is a beneficial reason – during the 12 years covered by the original theory, we had 7 up years, 4 down years, and one essentially flat year (SPX rose by 0.1% in 1970). Since then, in the ensuing 46 years, the S&P 500 has registered gains in 36 of them. I’m quite sure that investors would prefer a solidly rising market over one that responds to the whims of a football game. And during the last 10 years, 7 of which have resulted in higher markets, 7 of them have seen AFC wins (3 each by the New England Patriots (ugh) and Kansas City Chiefs, and one by the Denver Broncos). More interestingly of the three down years in the past 10, two of them had NFC winners (2018 Los Angeles Rams and 2022 Philadelphia Eagles), and the time that the NFC won during an up year (2021 Tampa Bay Buccaneers), the quarterback was the same as the AFC’s one winner in a down year, the 2015 Patriots, led by Tom Brady (ugh).

Yet there is an important omen in here. In 2018, the prior Eagles victory year, SPX closed -6.24% lower. That year got off to a rip roaring start, but suffered from “Volmageddon” just a few days after the Eagles victory. The market then recovered, but swooned in the fourth quarter of that year. Other Philadelphia victories have occurred during checkered market years. The Philadelphia Phillies last won the World Series in October 2008, which was the height of the Global Financial Crisis. Do we look at that as a positive or negative, since markets did turn around in 2009? The Phillies’ prior victory was similarly tricky, occurring in October 1980, a +25.77%% year for SPX, but just ahead of Paul Volcker’s crackdown on inflation that preceded a -9.73% down year. The Philadelphia Flyers’ two Stanley Cup wins came in 1974, the second year of an awful bear market that saw SPX close -29.72%, and 1975, when SPX recovered 31.55%. That said, when the Philadelphia 76’ers won NBA titles in 1967 and 1983, both years were solidly higher.

There are a few takeaways here:

- First, I am by no means a Philadelphia hater (spare me your comments). I spent wonderful years getting my degrees there – including the 1983 76’er championship led by Julius Erving (Dr. J), my all-time favorite player – and as noted above, have lifelong friends from that area.

- Second, don’t invest based upon what spurious sports indicators may or may not portend.

- Third, and by far the most important, long-term equity investing has been a wonderful thing! With 36 of the last 46 years bringing positive results, that is quite a track record. Of course, past performance is no guarantee of future results, and we can debate whether the current valuations of the market support future gains of the prior magnitude, but generations of investors have done quite well – regardless of whichever team happened to win a big game.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.