NFLX Earnings Stock Reaction: Market Expectations vs Actual

Investors and traders often look to earnings announcements as key events that can cause significant stock price movements. One intriguing way the market signals its expectations for a stock’s post-earnings price reaction is through the pricing of options, particularly straddles.

With Netflix’s (NFLX) stock recently soaring 10.7% post-earnings, two interesting questions arise:

1. What did the market expect for Jan 23 earnings?

2. Does the market tend to underestimate or overestimate NFLX’s earnings moves?

To help answer this question we will compare historical implied moves against NFLX actual moves.

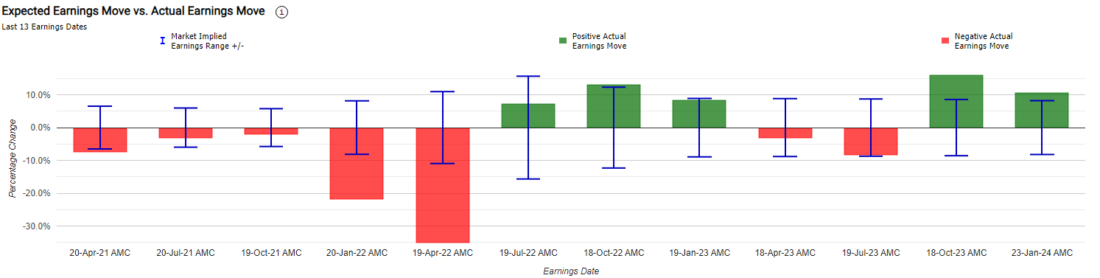

A Historical Visualization: NFLX Implied Earnings Moves vs Actual

When interpreting the chart provided above, note the following: the up/down brackets represent the historical expected moves based on option prices. The green bars extending upwards indicate actual up moves, while red bars descending show actual down moves.

If a colored bar exceeds the bracket, it indicates that the actual move was larger than what the market priced in before the announcement.

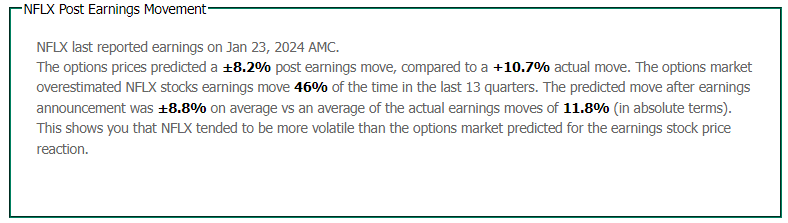

Market Chameleon Provided A Summary Of The Data

source: Market Chameleon

History Shows The Market Tended To Underprice NFLX Earnings Moves

Our analysis reveals that the market underpriced NFLX’s moves 54% of the time. Historically, the market implied a move of +/- 8.8%, while the actual average move was around 11.9%. This differential of approximately 3% is substantial in options trading.

Latest Earnings: History Was On Your Side

The most recent pre-earnings straddle for NFLX implied an 8.2% move. The stock surged by 10.7%. Traders who leveraged these historical patterns found themselves at an advantage.

Conclusion

Analyzing historical data can offer valuable insights into potential market behaviors. In the case of NFLX, earnings moves have historically been dramatic, averaging a significant 11.9% change. It appears that traders have frequently underestimated the actual moves. Utilizing these historical benchmarks can be a crucial strategy for planning potential trading approaches, especially when considering recent earnings releases.

—

Originally Posted January 24, 2024 – Do Options Traders Tend to Underestimate NFLX Earnings Moves? A Market Chameleon Analysis

NOTE: Stock and option trading involves risk that may not be suitable for all investors. Examples contained within this report are simulated And may have limitations. Average returns and occurrences are calculated from snapshots of market mid-point prices And were Not actually executed, so they do not reflect actual trades, fees, or execution costs. This report is for informational purposes only, and is not intended to be a recommendation to buy or sell any security. Neither Market Chameleon nor any other party makes warranties regarding results from its usage. Past performance does not guarantee future results. Please consult a financial advisor before executing any trades. You can read more about option risks and characteristics at theocc.com.

The information is provided for informational purposes only and should not be construed as investment advice. All stock price information is provided and transmitted as received from independent third-party data sources. The Information should only be used as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments and trading strategies. The Company does not guarantee the accuracy, completeness or timeliness of the Information.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ