Markets rallied hard in pre-market trading following robust earnings from Amazon and Meta, but fortunes turned abruptly when markets opened. This morning’s blockbuster jobs report featuring the strongest employment growth in 12 months alongside the fastest wage growth in 22 months sent yields towards the heavens while bringing stocks near the flatline. Indeed, market players are reconsidering if the Federal Reserve will be able to cut rates in May given this level of labor market strength. However, a familiar bifurcation with the job report occurred this morning with the less popular household survey reflecting a weaker labor market than the establishment version.

Job Additions Post a Double Beat

Employers added a whopping 353,000 jobs in January, according to the US Bureau of Labor Statistics. Jobs grew at the fastest rate since January of last year and absolutely shattered projections calling for 180,000, effectively achieving a double beat. Gains were broad-based, with almost every sector adding jobs except for mining, which lost 6,000. The following categories led job gains and posted the noted number of additions:

- Private education and health services, 112,000

- Professional and business services, 74,000

- Retail trade, 45,200

- Government, 36,000

- Manufacturing, 23,000

The construction, wholesale trade, transportation and warehousing, utilities, financial activities, leisure and hospitality and other services sectors hired at slower rates. The previous report covering December achieved a strong upward revision, with an upgrade to 333,000 from 216,000. The labor market remained tight, with the unemployment rate sticking at 3.7%, despite estimates of 3.8%.

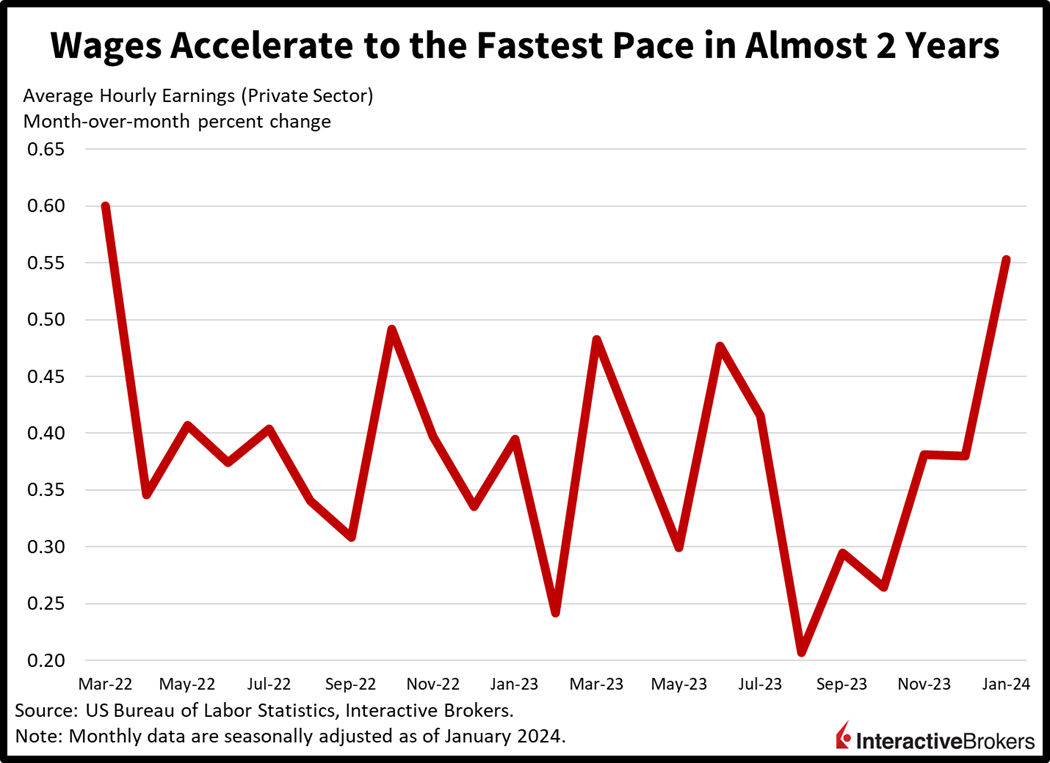

Paychecks Get Bigger

Compensation also posted a double beat—wage growth accelerated at its fastest pace since March 2022 and surpassed the analyst expectation. Average hourly earnings rose a sharp 0.6% month over month (m/m), even as paycheck gains were expected to slow to 0.3% from 0.4% in December. On a year-over-year (y/y) basis, wages grew 4.5%, beating the forecast of 4.1% and accelerating from the previous month’s 4.4%.

Employers Reduce Workers’ Hours

Some weakness existed, with the average hourly work week dropping to 34.1 as employers cut hours to maintain margins. It’s the lowest since the pandemic trough and prior to the COVID period, we have to go back to 2010 to see a figure as low. Additionally, the less reliable household survey depicted a lower employment level, a decline in the labor force, an increase in discouraged workers and an uptick in part-time work, pointing to job losses and reduced participation.

Big Tech Earnings Season Ends with A Bang

Amazon, Apple and Facebook parent Meta solidly exceeded expectations for their respective quarters with all three companies reporting various tailwinds. Apple, however, said it experienced a large decline in sales in China, causing its shares to decline significantly.

Meta shares soared more than 17% in pre-market trading after the company said its results benefited from businesses increasing their online advertising and said it was launching its first dividend program, which will pay $0.50 per share. The company’s revenue climbed 25% y/y to $40.1 billion and surpassed the analyst consensus expectation of $39.18 billion. After a year of cost cutting, Meta’s expenses declined 8% y/y, which in combination with strong revenues caused its net income of $14 billion, or $5.33 per share, to triple from $4.65 billion, or $1.76 per share, y/y. The earnings beat the analyst expectation of $4.96 per share.

Meta’s advertising revenue grew 23% from $31.25 billion to $38.71 billion and exceeded the analyst expectation of $37.8 billion. Meta’s largest increases in advertising came from ecommerce, entertainment and gaming businesses. For example, online retailers Temu and Shein, which trace their origins to China, have been increasing their advertising and last year, Chinese companies were responsible for 10% of ad revenues. Artificial intelligence has also helped boost ad sales. Additionally, Facebook’s metaverse revenues climbed above $1 billion, trimming the quarterly loss from the service to $4.65 billion. Meta anticipates current-quarter sales to range from $34.5 billion to $37 billion. Analysts expected guidance of $33.8 billion.

Amazon’s share price jumped more than 8% in extended trading after the company said net income surged to $10.6 billion, or $1.00 per share, from $278 million, or $0.03 per share, in the year-ago quarter. The net income blew past the analyst expectation of $0.80 a share. Amazon’s significant cost cutting in 2022 and 2023, including firing 27,000 employees, and its strong quarterly revenue of $170 billion, which climbed 14% y/y, drove the earnings growth. The revenue beat the analyst expectation of $166.2 billion. Amazon said it generated strong holiday ecommerce sales, and separately, its advertising revenue climbed 27% y/y to $14.7 billion. The company’s Amazon Web Services cloud revenue increased 13% y/y to $24.2 billion, which met analysts’ forecast. CFO Brian Olsavsky said orders for the cloud service have been increasing, in part due to Amazon enhancing the product with artificial intelligence (AI), including chatbots. In a statement, CEO Andy Jassy said AI is still a small part of Amazon’s business but in the coming years it could generate billions of dollars in revenue. The company expects current-quarter revenue to range from $138 billion to $143.5 billion, or potentially increasing between 8% and 13% y/y. Analysts anticipated revenue guidance of $142.1 billion.

Apple also beat expectations, but declining sales in China and the company’s guidance made it the ugly duckling of the day, with its share price dropping more than 4%. For its fiscal first quarter ended December 30, revenue climbed 2% y/y to $119.58 billion, its first increase in four consecutive quarters. Additionally, revenue beat the $117.91 billion analyst expectation. Apple’s net income of $33.92 billion climbed 13% y/y while its earnings per share of $2.18 climbed 16% and beat the analyst consensus forecast of $2.10. For the quarter, iPhone and Mac sales exceeded expectations while iPad sales fell 25% and missed analysts’ estimates. Apple’s services, which include streaming entertainment and Apple Pay, grew 11% y/y but also missed the analyst forecast. China was a weak spot with revenue declining 13%, but Apple CEO Tim Cook said after accounting for fluctuations in currency exchange rates, the decline was only in the “mid-single digits.” Apple CFO Luca Maestri said revenue for the current quarter would be comparable to the year-ago quarter after adjusted for a large bump in iPhone sales resulting from the pandemic.

Cyclical Stocks Suffer While Tech Rallies

Stock indices are mixed today as investors rely on technology earnings for bullish motivation while cyclical shares are getting battered. The Nasdaq Composite and S&P 500 indices are up 0.8% and 0.3% while the cyclically tilted Russell 2000 and Dow Jones Industrial benchmarks are down 1.5% and 0.4%. Sectoral breadth is deeply negative with 8 out of 11 sectors lower. Real estate, utilities and materials are leading the way lower; they’re down 2.7%, 2.1% and 1.3%. The communication services, consumer discretionary and technology are the only sectors higher today, as Amazon and Meta earnings boost the segments. The sectors are up 3.4%, 0.3% and 0.2%. Bond yields are spiking with the 2- and 10-year Treasury maturities trading at 4.38% and 4.03%, 15 and 17 basis points (bps) higher on the session. The dollar is getting a boost from lighter Fed easing projections and propped up inflation expectations. The greenback’s index is up 75 bps to 103.84 as the US currency gains against the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Oil prices are dropping and may record their worst week since November. As of early this morning, the price of WTI Crude was down 2.30% to $72.21 a barrel, while Brent Crude was down 1.89% to $77.28 a barrel. Oil market softness set in after a spokesperson for Qatar’s Ministry of Foreign Affairs said there is good news regarding discussions that could result in a ceasefire in the Israel-Hamas conflict.

The Monetary Bridge Extends

Just days after Fed Reserve Chairman Powell said the central bank needs additional data depicting a durable decline in inflation before it eases monetary policy, this morning featured a double dish of data showing that policymakers may have a riskier and longer than expected bridge to cross before declaring victory in fighting price increases. After Powell all but ruled out a March rate cut, investors set their sights on the central bank turning dovish in May, but today’s tight labor market data and news that businesses are aggressively increasing their advertising optimism—a clear sign of —point to an economy that is strong enough to drive additional price pressures. It may be time for investors to assess if monetary easing won’t happen until June, a development that could cause additional challenges for corporate earnings and make it harder to justify current nose-bleed valuations with the S&P 500 Index trading at a price-to-earnings ratio of 20 and the risk premium in the basement.

Visit Traders’ Academy to Learn More About Payrolls and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.