Shares of online learning platform operator Udemy (UDMY -22.34%) sank on Thursday after the company reported its results for 2023’s fourth quarter. Most of the numbers looked pretty good, but management’s cautious outlook and gentle warning regarding operating expenses seem to have spooked the market. As of 1:15 p.m. ET, Udemy stock was down 23%.

Good numbers overshadowed by fears

In 2023, Udemy’s revenue rose 16% to $729 million, boosted by higher-than-expected Q4 revenue of $190 million. And for the first time, it posted positive full-year adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $7.8 million, which was another pleasant surprise.

However, Udemy CFO Sarah Blanchard didn’t boost investor confidence when she said, “From a macro perspective, the current environment remains volatile.” That statement might have cast a shadow over the company’s guidance.

For 2024, Udemy expects to generate revenue of $795 million to $810 million, which would equate to growth of 9% to 11%. That’s not an overly exciting growth rate. And if the macroeconomic situation is “volatile,” as suggested by Blanchard, perhaps investors fear Udemy may fail to clear even that low bar.

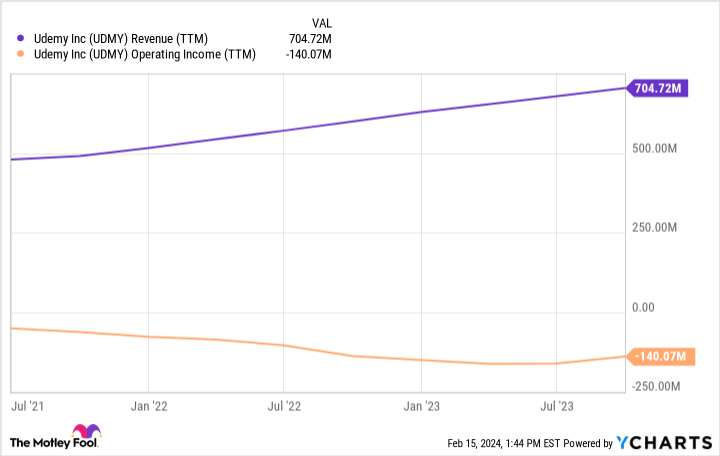

Moreover, Udemy says it expects a higher level of operating expenses in 2024. That’s not particularly encouraging, considering that it booked an operating loss of $122 million in 2023.

UDMY Revenue (TTM) data by YCharts. Chart does not reflect Q4 2023 results.

Is this an opportunity for investors?

I believe the top-line guidance numbers will be easier to hit than investors realize. Udemy is a marketplace where learners can browse courses to acquire skills without pursuing formal degrees or certifications. However, the company is increasingly bundling its best courses and offering them to enterprises as a subscription service.

In Q4, Udemy grew its enterprise customer count by 13%, and Udemy Business revenue accounted for 61% of total revenue. The company is retaining these enterprise customers, which means it’s retaining most of its revenue since it’s coming from subscriptions.

Over the long term, I still see upside potential for Udemy. However, whether the stock is a buy today or not depends on whether one believes that management can one day rein in its expenses and turn better profits.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.