Record TSA travel, a Black Friday spending boom, and monster movie debuts set an upbeat tone ahead of the winter holidays

“Moana 2” gross box office revenue impressed analysts, though industry-wide YTD ticket sales remain down YoY

Drama continues to unfold for the entertainment companies with all-time highs for some stocks and high uncertainty among others

The consumer just kept doing their thing over the Thanksgiving weekend. Retail sales on Turkey Day were record-setting while Black Friday shoppers were out and about with enthusiasm.1 Cyber Monday was also strong along with high volume at silver screens across North America over the holiday weekend.

According to Comscore data, box office sales across the US and Canada summed to $420 million over the five-day stretch.2 It was the highest-ever total, even surpassing pre-pandemic figures when going to the movies was a common thing.

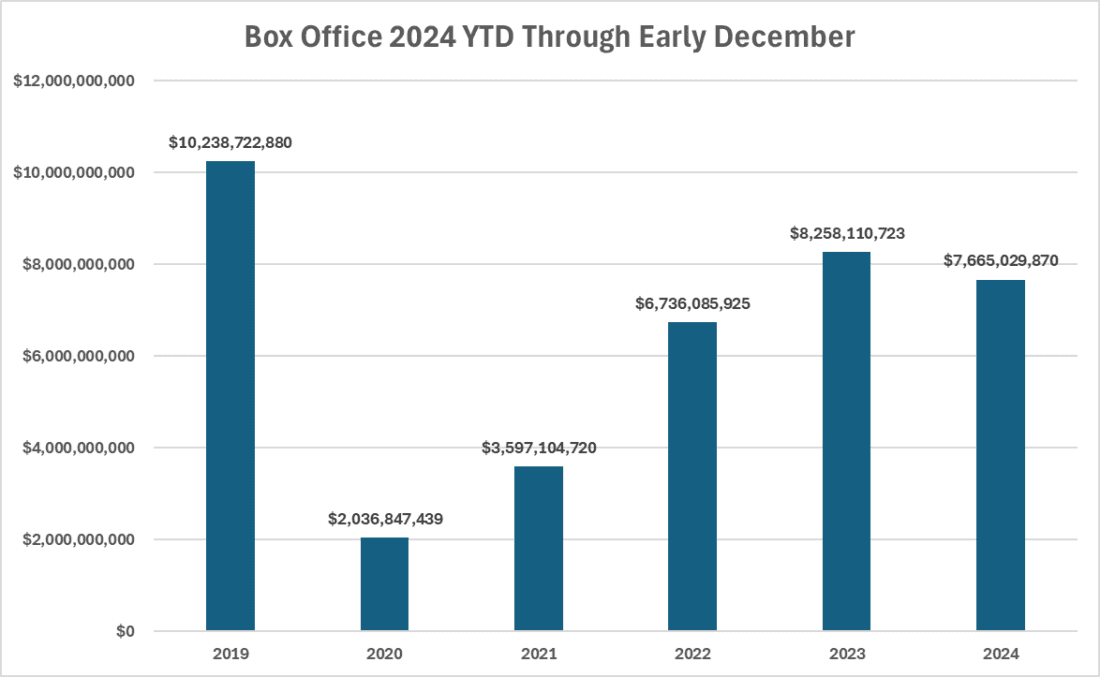

Year to date through December 4, gross box office sales are now $7.665 billion, but that’s down from $8.258 billion YTD through the same day in 2023, according to data from Box Office Mojo by IMDbPro.3 Go back to 2019, and movie-goers had doled out more than $10 billion through early December – and that’s not adjusted for inflation.

This Year Trails 2023’s Box Office Gross Sales Total

Source: Box Office Mojo

Along with tracking the usual corporate event happenings like earnings dates and changes, industry conferences, and dividend announcements, the Wall Street Horizon team pays particular attention to Hollywood trends. OK, it’s not the most serious topic, but we like to have fun with our data coverage too. Some of our team members came back from the holiday with favorable reviews for the biggest Thanksgiving weekend hit, “Moana 2.”

The Disney (DIS) film took in $221 million in domestic ticket revenue from Wednesday through Sunday of the holiday period, good enough to make it the biggest domestic sales Thanksgiving blockbuster of all time. “Wicked” and “Gladiator II” continued to attract the public, with sales of $117.5 million and $44 million, respectively.4

High-Profile Showtimes in Store

While escaping to the big screen is almost therapeutic in today’s world of being connected 24/7 to work, it’s also big business. Last year’s Hollywood writers’ strike and disappointing box office sales (outside of a few big hits) before late November were significant headwinds even with an aggressive consumer. Optimism now builds for a star-studded end to 2024.

On the docket for the balance of December are “The Lord of the Rings: The War of the Rohirrim,” “Mufasa: The Lion King,” “The Count of Monte-Cristo,” and “Sonic the Hedgehog 3.”

Next Year’s Coming Attractions

Some of the most anticipated blockbusters of 2025 include “Mission: Impossible – The Final Reckoning”, “Avatar: Fire and Ash”, “Jurassic World: Rebirth”, and “Knives Out 3.” A rising trend is that it’s all about the kids these days. “Barbie,” released in tandem with “Oppenheimer” in the summer of 2023 was followed by “Taylor Swift: The Eras Tour” that autumn. Next year, expect your daughters and sons to beg you to take them to see “Snow White,” “Elio,” and “How to Train Your Dragon.”

So, there’s something for everyone with a slew of horror films on tap and plenty of nostalgia vibes to be had with both family-friendly and edgier remakes and sequels.

And the Oscar Goes To…

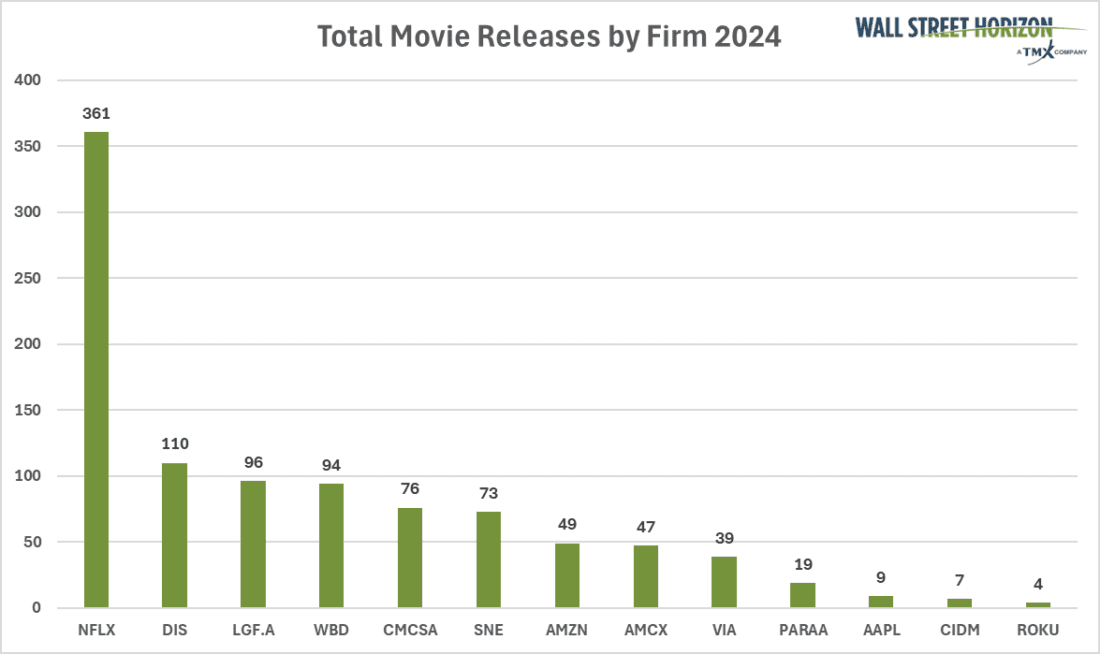

Digging into the data, Netflix (NFLX) remains a dominant player in the movie business. The $386 billion market cap Communications Services sector company has been on a roll since the middle of 2022. After falling below $200 per share from a peak above $700 in late 2021, NFLX hit all-time highs this month, now up more than 100% in 2024.

The move to tack on an ad-supported tier has worked well. Over the past 12 months, it has generated $16.51 of FCF per share, even after the remarkable YTD rally.5

Most Motion Pictures? Netflix.

Source: Wall Street Horizon

Disney’s Struggles Persist, But Recent Trends Are Encouraging

Disney, on the other hand, has continued to show signs of struggle over the past three years. We’ve profiled its management shake-ups in the past, and struggles have been in the foreground regarding its long-term strategy. Recent trends are encouraging, however, for the $212 billion market cap Movies industry company. Shares rallied 40% from their August lows to the December peak; DIS rose more than 6% after it reported its fiscal Q4 results in mid-November.

Investors were probably relieved considering strong numbers from its entertainment segment – which includes traditional TV, direct-to-consumer streaming, and films. Moreover, the management team put out upbeat guidance for its FY 2025. A high-single-digit adjusted earnings growth rate is now seen.6 As shown in the chart above, while Disney can’t match the torrid pace of Netflix releases, the California-based company leads among the remaining movie producers thus far in 2024.

Cheers for the Mega Caps

Apple (AAPL) and Amazon (AMZN) are stars of the show, together bringing 58 films to the public. Both stocks have also been on the rise, hitting all-time highs as the holiday season progresses. While those are feel-good stories from a stockholder’s perspective, things might be feeling less positive for Comcast (CMCSA).

Shares are down more than 30% from their high in Q3 2021. The legacy media stalwart now intends to spin off its cable networks amid consumers continuing to cancel their cable bundles. Networks such as CNBC, MSNBC, Golf Channel, and USA could be divested before long.7

The Event Trailer: Key Happenings This Month

Looking ahead, several of the aforementioned stocks could be in play this week. The UBS Global Media, Telecoms Communications, Technology (TMT) Conference 2024 began Monday, and Netflix, Disney, Comcast, and Roku (ROKU) are each slated to present at the gathering.

Then, on Friday this week, Warner Bros Discovery’s (WBD) “The Lord of the Rings: The War of the Rohirrim” hits theaters. Disney’s “Mufasa: The Lion King” is released on Friday, December 20 (also at IMAX locations).

The Bottom Line

As has become tradition, our annual holiday-themed look at the movie scene awards Netflix as the film-count winner. Shares have followed the bulls’ script, up almost 90% in 2024. Disney scored a winner with “Moana 2” over Thanksgiving, and it hopes for another strong showing from “Mufasa: The Lion King.” Plenty of corporate event action may offer more thrilling moments in the weeks and months ahead.

—

Originally Posted December 10, 2024 – A Blockbuster Thanksgiving at the Box Office: Grab Your Popcorn for Upcoming Movie Release Data

1 Consumers spend record $6.1 billion online during Thanksgiving day, CNBC, Courtney Reagen, November 29, 2024, https://www.cnbc.com

2 ‘Moana 2’ Lifts Box Office to Thanksgiving Record With $221 Million Haul, The Wall Street Journal, Robbie Whelan, December 1, 2024, https://www.wsj.com

3 Domestic Yearly Box Office, Box Office Mojo, December 4, 2024, https://www.boxofficemojo.com

4 ‘Moana 2’ Lifts Box Office to Thanksgiving Record With $221 Million Haul, The Wall Street Journal, Robbie Whelan, December 1, 2024, https://www.wsj.com

5 Netflix Inc, Seeking Alpha, December 4, 2024, https://seekingalpha.com

6 Disney stock surges on streaming growth, guidance, CNBC, Lillian Rizzo, November 14, 2024, https://www.cnbc.com

7 Comcast to spin off cable networks as subscribers flee the bundle, CNBC, Lillian Rizzo, Alex Sherman, November 19, 2024, https://www.cnbc.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.