Editor’s Note: The markets experienced a sharp selloff this morning, triggered by a Chinese AI lab releasing a new and free large language model called DeepSeek R1. This LLM appears to be just as good – if not better – than ChatGPT, which OpenAI created. This has caused AI stocks to sell-off, led by NVIDIA Corp. (NVDA).

Now, we know many of you may be worried about what this means for AI stocks… and your portfolio. So, Eric and his team will cover this story in tomorrow’s Fry’s Investment Report weekly update (subscription required) and, later this week, here in Smart Money. If any immediate action needs to be taken in any of our services, Eric will let you know.

Do you remember 1990?

That was the year when Driving Miss Daisy won Best Picture at the Academy Awards, and when Tom Cruise and Nicole Kidman tied the knot.

But 1990 was also the year that Japanese businessman, and golf enthusiast, Minoru Isutani spent $841 million to buy California’s iconic Pebble Beach Resorts.

This high-profile transaction marked the peak of the Japanese economic “miracle” that dominated the world of finance throughout the 1980s. By the end of that decade, two-thirds of the world’s 50 largest companies were Japanese.

“Japan Inc.” was a marvel without equal.

Japan’s awe-inspiring might throughout that period was not merely an economic phenomenon. It was a seismic sociological event that inspired a mythology of Japanese economic superiority. But just as the new mythology was becoming irrefutable gospel, it faltered and became a relic of financial history.

Japan’s “Lost Decades” followed.

Within nine months of hitting its all-time high in 1989, Japan’s Nikkei 225 index had tumbled nearly 50%… and it continued sliding lower for two decades. Finally, in 2009 the Nikkei hit its ultimate post-bubble low. At that point, the once-mighty Nikkei had collapsed nearly 80%.

But from that low-water mark, Japanese stocks started a long road back to respectability and relevance. Finally, last February, the Nikkei surpassed its ancient all-time high of 38,957.

The Nikkei’s resurgence over the last couple of years could be signaling a new era of superior economic growth. Already, the Japanese economy has regained a solid financial footing.

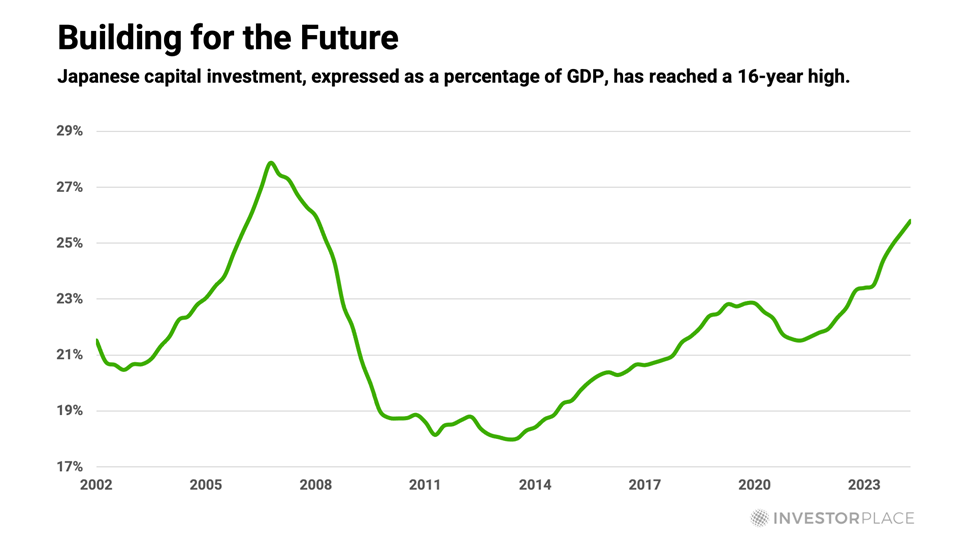

Japanese businesses are also opening their wallets and spending. Capital investment rose 8.1% last year and is trending sharply higher. Expressed as a percentage of GDP, capital investment has climbed to 26%, which is the highest level in 16 years.

Japanese stocks are beginning to reflect these positive trends, but their valuations remain subdued, relative to both their own history and to U.S. stocks. At 15 times earnings, the MSCI Japan Index is trading nearly 20% below its 30-year median level… and 43% below the current valuation of the S&P 500.

But these depressed valuations may not persist for long. Three powerful factors could combine to boost Japanese share prices sharply higher…

- Japanese companies have become more devoted to returning capital to shareholders.

- The Japanese government is incentivizing individual investors to buy stocks in their retirement accounts.

- Mergers and acquisitions are on the rise, with a growing number of Japanese companies are using their large cash reserves to acquire other companies.

As positive economic trends build upon one another, Japanese economic growth should accelerate, which would light a fire under Japanese stocks. Even modest economic improvement could produce outsized stock market gains.

To capitalize on the nascent opportunity Japanese stocks are offering, I recommend using a “broadbrush” approach. Specifically, I recommend a $12.9 billion ETF devoted to Japanese stocks.

Already, shares of this ETF are up nearly 5% since I recently recommended it to my Fry’s Investment Report subscribers, due to the news that the Bank of Japan will raise rates to their highest levels in 17 years. All else equal, higher interest rates raise the value of Japan’s currency, making its stocks more attractive.

Importantly, this trade offers a compelling diversification from U.S. stocks. Assuming the Japanese economy continues its current growth trajectory, this play could produce solid double-digit gains for several years – even if the U.S. stock market falters somewhat.

To learn more about this recommendation, join me at Fry’s Investment Report today.

As a member, you will also receive all of my latest research and recommendations. My team and I are actively researching and vetting additional prospects to introduce to our portfolio.

Now, let’s look at what we covered here at Smart Money this past week…

Smart Money Roundup

The Most Profitable 100 Days of Your Life Are About to Begin

Last Monday, Donald Trump took the oath of office and began his second term as President of the United States. We are now in an unprecedented period of change, especially over the next 100 days. As one of the most accomplished traders of our time, my colleague Jeff Clark has spent the past 40 years successfully using chaos and volatility to his advantage. And for the first time ever, Jeff is pulling back the curtain to reveal a trading strategy tailored to harness the chaos and opportunities Trump’s first 100 days are sure to bring.

Trump’s Second Inauguration Marks a New Era for AI – Here’s How to Profit

Donald Trump’s pro-innovation mentality signals a fundamental shift in how the U.S. will approach AI development and regulation. This will impact what technological developments and opportunities will arise. So, I’ll share what Trump’s deregulation stance means for the industry… and how you can position yourself to profit from AI’s next phase – artificial general intelligence, or AGI.

The Best Stock to Buy for Trump’s Stargate Project (and the Best Way to Play It)

Last Tuesday, President Trump announced a joint venture – called Stargate Project – that will fund American AI infrastructure development over the next four years to the tune of $500 billion. One company in particular stands to benefit. Let’s take a look what this company is all about… and where I expect it to go. I’ll also offer up an idea on how to play it… a strategy that can turn small gains into triple-digit ones, with little risk.

The Two Best Ways to Trade “Drill, Baby, Drill”

I’ve found two ways to take advantage of the natural gas opportunity we’re seeing. The first is a stock. The second is that simple twist in your investment strategy that can turn 2X winners into 5X winners – and beyond. Click here to read on.

The Simple Reason Why Stocks Are Soaring Right Now

Before President Donald Trump returned to the White House, he was persistently vocal about tariffs. Having yet to see any action, suspense is building. So, my InvestorPlace colleague Luke Lango is sharing his perspective on why tariffs have yet to be front and center, and what Wall Street is anticipating. Continue reading here.

Regards,

Eric Fry

Editor, Smart Money