A Great Way to Play the Gold Rush

Disseminated on behalf of the issuer

Gold and other resource exploration players know that two of the keys to success are timing and underlying economic trends. A third leg of this stool is to find a company that has true differentiation characteristics, thereby offering major upside potential.

A terrific example of these characteristics is Toogood Gold Corp. (TSXV: TGC; OTCQB: TGGCF).

A Company Snapshot

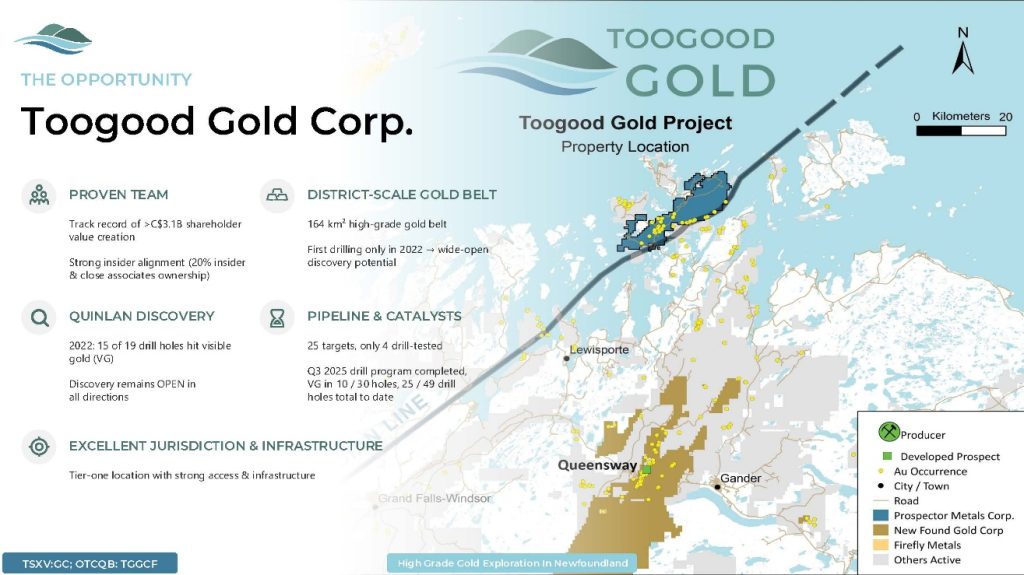

Toogood Gold is a Canadian exploration company focused on the discovery and advancement of high-grade gold deposits in Newfoundland. The Company holds a 100% interest in the district-scale Toogood Gold Project ( 164 km²), strategically located within the highly prospective Exploits Subzone – a structurally complex and underexplored gold district that has yielded recent high-grade discoveries.

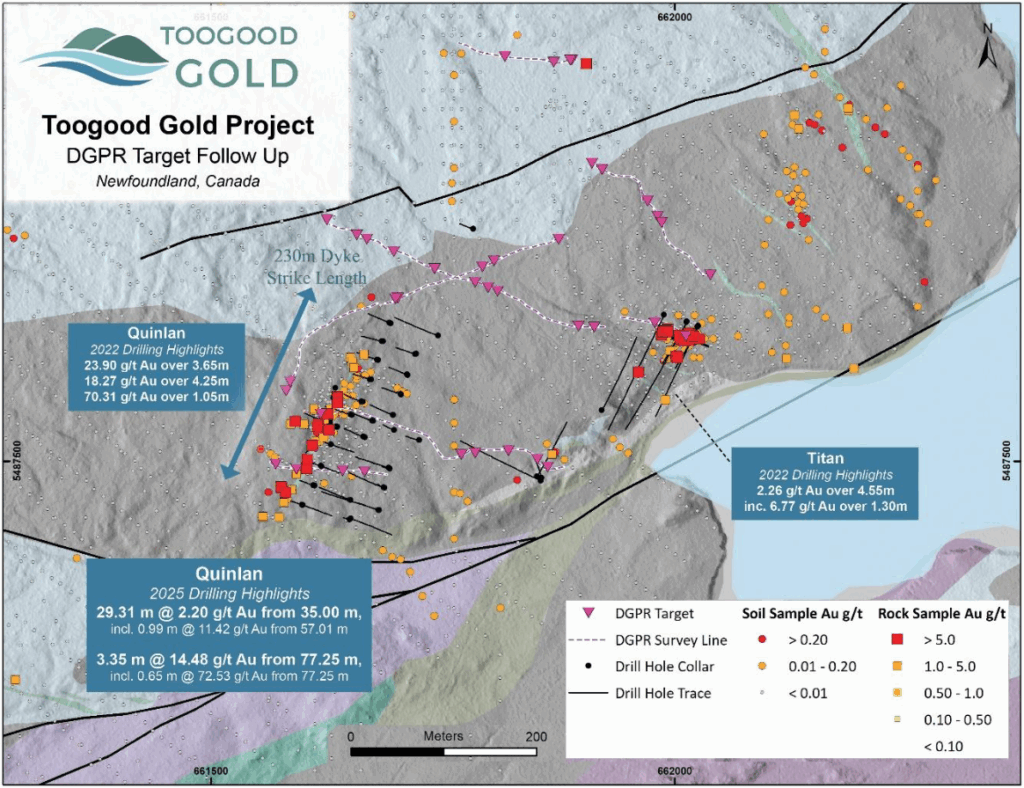

The Project’s inaugural drill program in 2022 delivered a new, at-surface high-grade gold discovery, with visible gold encountered in 15 of 19 holes and mineralization remaining open in all directions. Follow-up drilling in 2025 continued to expand this system, intersecting visible gold in 10 of 30 holes and further confirming open-ended mineralization along strike and at depth.

The Toogood Gold Project benefits from exceptional infrastructure, including paved highway access, power lines, fresh water, and proximity to deep water ports, positioning the Project for efficient, low-cost exploration and development.

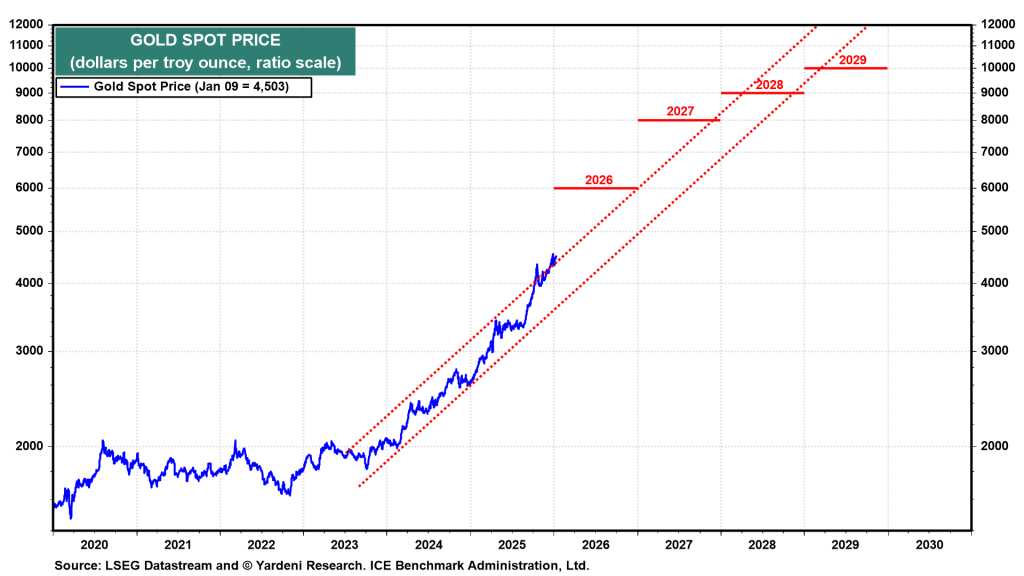

Gold Forecasted to Leap Higher

Just last week, a new forecast by global investment behemoth HSBC suggests that gold could enjoy at least a 10% pop in the first half of 2026, due in part to current, global geopolitical risks. Longtime strategist and economist Ed Yardeni of Yardeni Research projects gold could reach the $6,000 mark by year-end 2026, a 33.3% jump from its $4500.90 close as of Friday.

Looking down the road, Yardeni predicts that gold could reach the $10,000 market between 2029-2030! That is more than double recent prices! He believes that this extended rise could lead gold’s role as a primary hedge by central banks and institutional investors.

In any case, gold appears a great place to be, and Toogood Gold offers a strategic way to play this trend.

What Makes Toogood Gold Unique?

For starters, Toogood Gold is advancing its fully permitted, high-grade gold project in a Tier 1 Canadian mining jurisdiction which is an established gold belt in Eastern Canada hosting large-scale gold discoveries. The region boasts 25 historical and new prospects with occurrences of coarse (1+ cm) and fine visible gold. In fact, it represents over 28 km of a highly prospective, fertile Au belt and the geological terrain hosts multiple significant gold discoveries. Toogood Gold’s project sits 50km north of Queensway Project (New Found Gold) and 200km northeast of Calibre’s Valentine Lake Gold Mine (~7.8 Moz Au).

This is not your typical crowded field of projects. Toogood Gold’s project is in Newfoundland where there are more strategic advantages than meets the eye!

Newfoundland:

- Home to producing mines, there are more than fifteen commodities produced or mined, taking advantage of the mineral rich deposits.

- Mining is one of the region’s largest industries with 8,000 employed in mining and exploration and outstanding infrastructure.

- Yet, Newfoundland represents one of the youngest and under-explored gold rushes on the planet! It just oozes upside. In 2024, it ranked eighth globally for investment attractiveness by the Fraser Institute.

Attractive Project:

- The project has good size. It has district-scale at 164 square kilometers and a high-grade gold belt.

- It represents follow-up exploration at the historic Quinlan high grade gold discovery.

- High-grade gold and visible gold confirmed from the initial 2025 drilling.

The fact that it was first drilled in 2022 is a major plus. It reflects the under-explored nature of the project. Moreover, Quinlan is open in all directions which has a hidden value for the Company and investors. Toogood Gold recently acquired its Golden Nugget property which adds 12 km of underexplored fertile gold trend. Importantly, historic rock samples represent an average grade ~7 g/t Au.

We would be remiss if we did not highlight the experienced and successful management team. The Company’s leadership team has an enviable track record of CAD $3.1B in value creation for shareholders. This is a rare feat for an early-stage firm and should provide investors with confidence.

Recent News Leads to Near-Term Catalysts

Toogood Gold has published as series of press releases of late, including one in early January 2026, the first of what we believe could be a series of catalytic and milestone events this year.

In December 2025, the Company released results and interpretations from the high-resolution Deep Ground Penetrating Radar (“DGPR”) survey at the Company’s 100%-owned Toogood Gold Project located in Newfoundland.

High-resolution DGPR survey completed over the high-grade gold Quinlan discovery to map the gold-hosting felsic dyke at depth and under cover. DGPR results clearly imaged the felsic dyke at depth, with interpretations suggesting the mineralized structure extends >300m beyond previous drilling.

“Quinlan” is a flagship target within Toogood Gold’s 164km Toogood Gold Project, with historic and recent drilling delivering multiple high-grade gold intercepts and visible gold in 25/49 holes to date. Mineralization remains open along strike and at depth. The results support continuity of a broader gold system at Quinlan rather than a single, isolated zone.

Step-out drill hole 25TG033 validated the interpretation, intersecting the felsic dyke over 100m along strike from previous drilling (assays pending).

Importantly, the DGPR technique is scalable across the entire Project, where over fifty additional felsic dykes have been identified, enabling the Company to benefit from cost-effective and rapid target evaluation.

On January 6, 2026, the Company announced the completion of its Phase 2 fieldwork program at its 100%-owned Toogood Gold Project, located on New World Island in the mining-friendly jurisdiction of Newfoundland, Canada.

- Prospecting, rock and soil sampling, and geological and structural mapping were completed at the newly acquired Golden Nugget Property targeting an 8.5-kilometer-long high-grade outcrop trend with a subset of 148 historical rock samples that grade ≥1 g/t Au and average ~7 g/t Au.

- The continuation of regional soil sampling within the underexplored northeastern block and infill sampling of anomalies returned from Phase 1 soil sampling

- Phase 2 fieldwork was completed in four weeks, and all assays remain pending.

Management noted that Phase 2 marks the next step in systematically expanding the discovery footprint across the Toogood district. The combination of regional high-grade historical outcrop sampling at Golden Nugget, new geophysical targets at Quinlan, and extensive underexplored ground to the northeast translates multiple near-term catalysts as Toogood Gold continues building momentum.

A Hidden Advantage: AI-Assisted Mineral Discovery Platform

Toogood Gold engaged VRIFY for a 12-month contract. Their AI modelling platform is trained to discover specific mineral systems (i.e. epithermal gold, orogenic gold).

At its core, VRIFY utilizes advanced algorithms to identify complex correlations across vast datasets. This approach enables it to quickly formulate insights that can lead to discovery, while reducing bias and human error along with maximizing value of existing data and new data from 2025 exploration. VRIFY boasts a track record of success and discovery (e.g. Southern Cross Gold, Sunday Creek Project, Australia) and could provide the Company with an overlooked competitive advantage.

Risks

Key risks include those that are specific to resource exploration and mining companies. These include delays in exploration and testing, on the path to the mining stage. Funding for the Company’ s current flagship products could become an issue, as is not uncommon in the industry. However, given the favorable nature of the space, and management’s track record, we believe that this is not a significant risk occurrence. Finally, Toogood Gold does carry capital markets risk, as a publicly traded company. These could include sharp swings in share price movement or liquidity, from time to time.

Worth a Closer Look…

With a plethora of competitive advantages and favorable positioning, we believe that at the least, Toogood Gold is worth a closer look, and even a deep dive. Leading investment pundits see major upside potential exists in gold prices and that can trickle down to exploration and mining companies as well.

Disclaimer: Please make sure to completely read and understand our disclaimer at https://www.wallstreetpr.com/disclaimer.html

About akchirpy

Contributor at WallStreetPR.