One of the biggest investment themes in 2023 was artificial intelligence (AI). Each of the “Magnificent Seven” stocks is playing a role in AI, and they helped fuel the Nasdaq Composite over 40% last year. This momentum seems to have carried over into 2024. The S&P 500 recently hit a new all-time high, and investors are probably wondering where they can find some value.

Among mega-cap tech enterprises, one in particular sticks out. E-commerce and cloud computing specialist Amazon (AMZN 0.87%) has a lot of exciting catalysts that I think are overlooked, relative to cohorts such as Microsoft, Alphabet, and Nvidia.

Let’s look at why scooping up shares in Amazon stock right now could be a lucrative opportunity.

Amazon’s secret profit machine

Amazon might be best-known for its online e-commerce store. However, the company has many other operations that make meaningful contributions to the overall business. Perhaps the most important of these other ventures is the company’s cloud business, Amazon Web Services (AWS).

Although AWS has dominated the cloud computing industry for many years — fending off stiff competition from Microsoft, Alphabet, and Oracle — the last couple of years have not come without challenges. The macroeconomy has been subject to several rounds of interest rate hikes from the Federal Reserve as it looks to combat inflation.

As such, businesses of all sizes have been operating under tighter budgets and more stringent cost controls. This dynamic affected the technology landscape in particular, as demand for expensive software platforms started to wane. Unsurprisingly, growth in AWS started to decline and significantly affected Amazon’s overall cash flow.

Despite a turbulent economy, the back half of 2023 carried some positive momentum. Inflation has been cooling for several months now, and the rising interest in AI applications injected some much-needed life into AWS in particular. In fact, between the second and third quarter of 2023, Amazon tripled its free cash flow. Although e-commerce accounts for the majority of the company’s revenue, it’s AWS that contributes the most in operating profits. Through the first nine months of 2023, AWS generated more than 70% of Amazon’s total operating income.

Although results for the fourth quarter have not yet been released, I am optimistic that AWS will clock in another stellar performance. Amazon’s progress on the AI front, albeit quiet, should not be discounted among the competition.

Image source: Getty Images.

The bedrock of AI

When it comes to the biggest technology companies, it seems that the AI chatter largely centers around Nvidia, Microsoft, and Alphabet. Following its multi-billion-dollar investment in OpenAI — the developer of ChatGPT — a year ago, Microsoft has been on a relentless mission to integrate the technology across its Windows operating system. Additionally, billionaire hedge fund manager Bill Ackman has repeatedly spoken about his conviction in Alphabet and the company’s AI vision.

But Amazon, for its part, has made some savvy moves of its own. In September, the company announced that it was investing $4 billion in a rival to OpenAI, called Anthropic. As part of the deal, Anthropic will be using Amazon as its primary cloud provider and will train future generative AI models on the AWS cloud.

Furthermore, the partnership with Anthropic ultimately serves as a lead generation funnel for Amazon’s newest cloud development, called Bedrock. Bedrock is a managed services platform that provides developers with a host of large language models (LLMs) and generative AI applications, all housed under one umbrella.

Given the newness of the Anthropic relationship, long-term investors should be encouraged by the prospects the start-up can bring to AWS as it looks to return to accelerated growth.

Should you invest in Amazon stock?

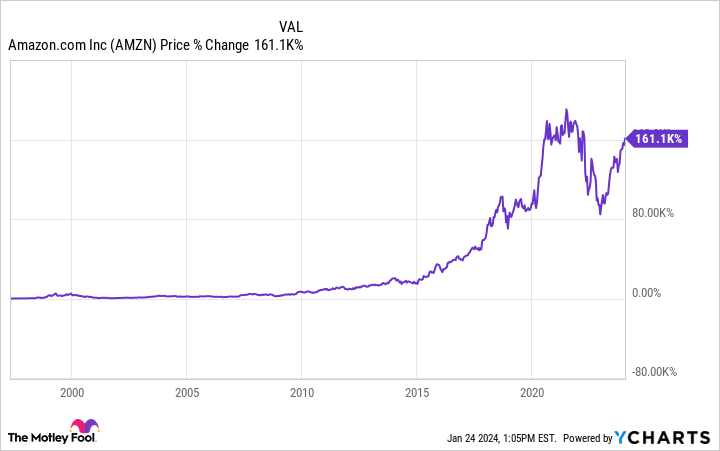

Amazon is truly one of the most interesting case studies in recent corporate history. The company began as an online bookseller, eventually evolving into an e-commerce pioneer offering all sorts of different products. Over the years, the company expanded beyond online shopping and now has advanced businesses across cloud infrastructure, media and entertainment, advertising, logistics, and more. And as Amazon built this platform, the stock price generally rose. The chart below illustrates that since its initial public offering (IPO), Amazon stock is up over 160,000%.

One of the most important concepts demonstrated by this chart is the power of holding strong conviction positions for long periods of time.

According to the company’s leadership, “90% of the global IT spend still resides on premises. If you believe, like we do, that equation is going to flip, there’s a lot more there for us.” This dynamic underscores the greenfield opportunities Amazon has ahead as it relates to the intersection of cloud computing and generative AI. So even though AWS is a nearly $100 billion run-rate revenue business, I think it’s just getting started.

As of this writing, Amazon stock trades at a price-to-sales (P/S) ratio of 2.9 — well below its long-term average of 4.2. The chart above, and the themes explored in this article, support a long-term bull thesis for Amazon. The company has clearly demonstrated its ability to innovate while creating new and profitable business segments.

Given the demand fueling AI and its expanding proliferation, I see Amazon as very well-positioned to dominate among tech leaders in the long run. Now looks like a fantastic opportunity to scoop up shares at an attractive valuation.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool has a disclosure policy.