Market players are shedding risk assets in response to this morning’s big increase in the Consumer Price Index, which significantly exceeded expectations and sparked fears that it may cause the Fed to delay its first rate cut. Today’s report of lower-than-expected initial and continuing unemployment claims, furthermore, has failed to offset price pressure concerns, with data depicting robust labor market conditions that are likely to support inflation in the coming weeks. Investors are now looking ahead to the next potentially big market moving catalyst—this afternoon’s auction of $21 billion in 30-year U.S. Treasury bonds. Sufficient demand may help reverse selling pressure while a quiet auction room with few participants may exacerbate today’s risk-off sentiment.

Inflation Makes a Comeback

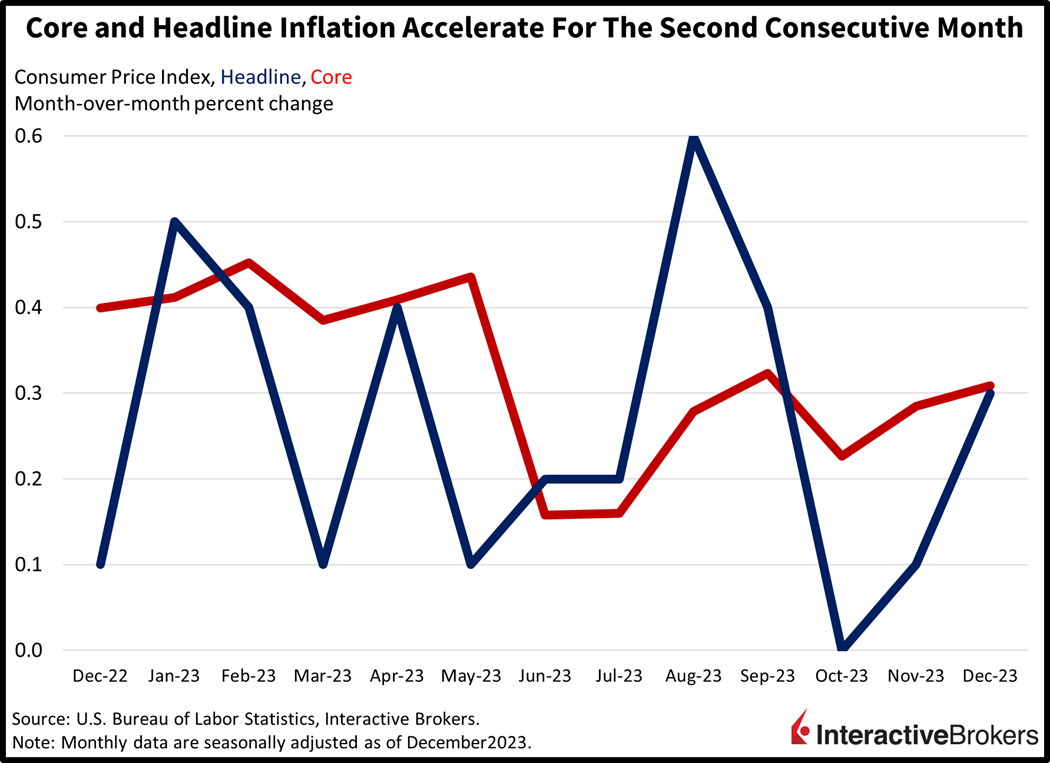

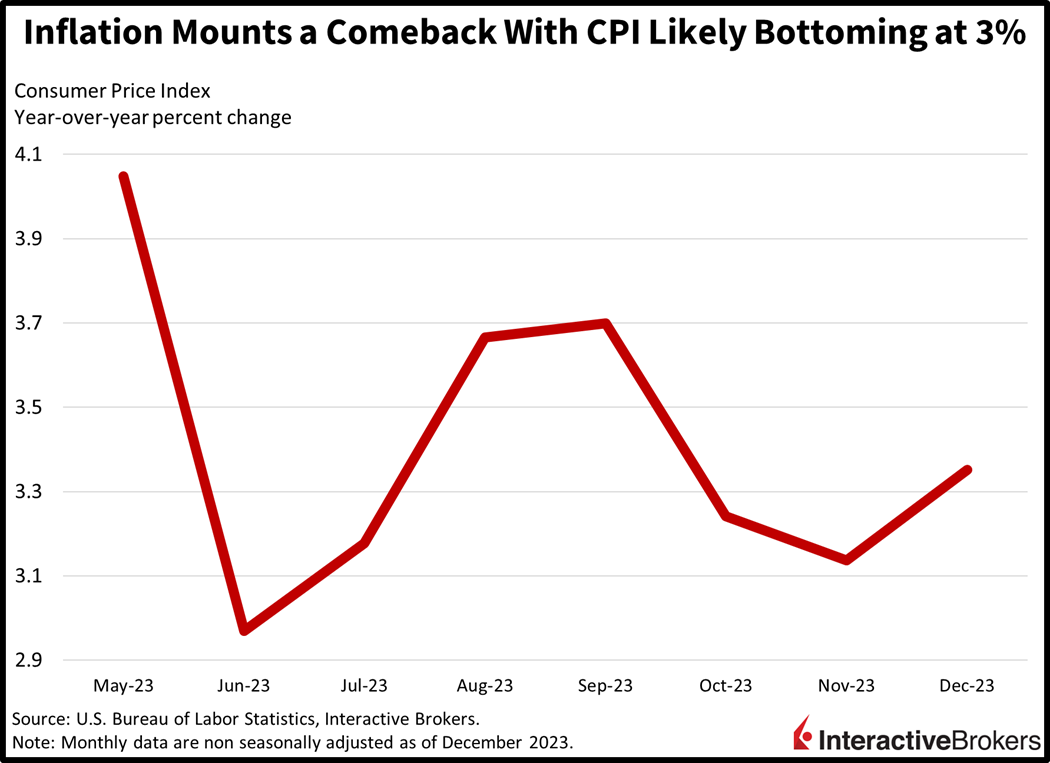

Consumer prices accelerated at the fastest pace since September last month, rising 3.4% year over year (y/y) and 0.3% month over month (m/m), according to the US Bureau of Labor Statistics. Headline prices beat projections for 3.2% y/y and 0.2%, while bumping up from November’s 3.1% and 0.1% rates. Similarly, core prices, which exclude food and energy, also accelerated at their quickest m/m rate since September, albeit not as sharply. Core prices increased 3.9% y/y and 0.3% m/m, compared to anticipation of 3.8% and 0.3% and the previous month’s 4% and 0.3%. The m/m pickup in core prices amounted to just 2.5 basis points (bps) and appears unchanged due to rounding.

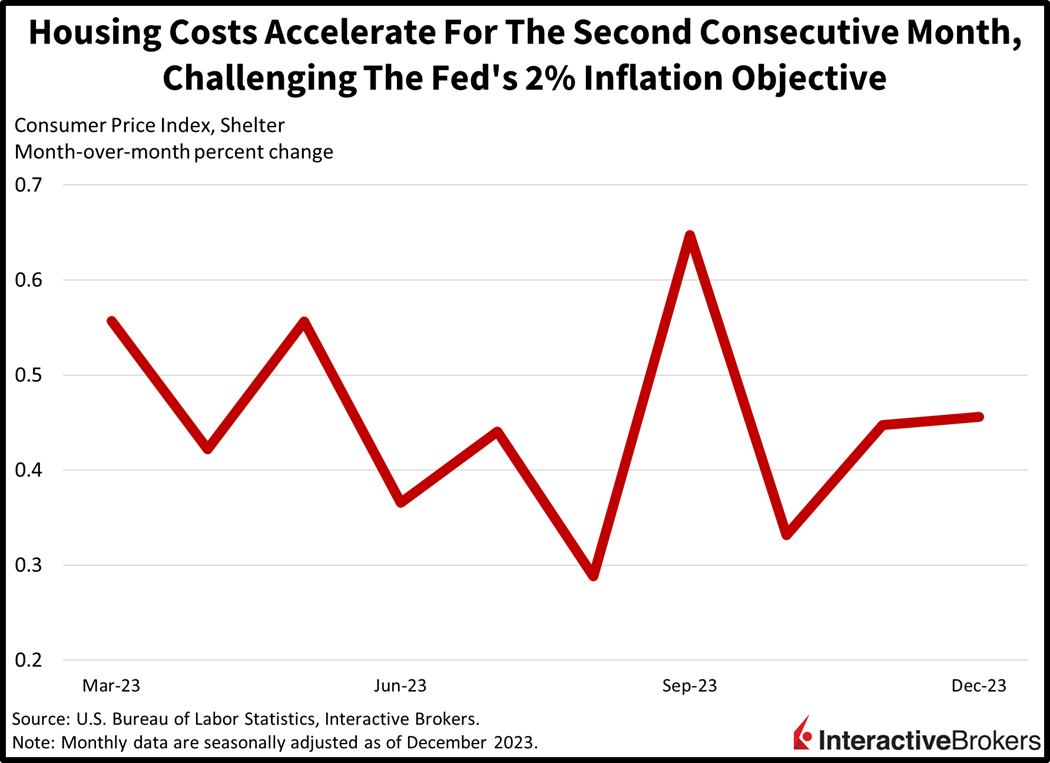

December price pressures were led by energy services (heating and electric), which climbed 0.9%, and medical care services, which rose 0.7%. Used automobiles and shelter gained 0.5% and 0.5%, respectively. All other major categories notched gains of 0.3% or less except for medical care commodities, which experienced a 0.1% m/m decline. Food at dining establishments, new automobiles, gasoline, apparel, food at the market and transportation services saw prices increase 0.3%, 0.3%, 0.2%, 0.1%, 0.1% and 0.1% m/m, respectively.

In another tailwind for inflation, the resilient and tight labor market appears to be holding up with unemployment claims during the week ended January 6 hitting the lowest level in three months. Initial claims for unemployment insurance dropped to 202,000, down by 1,000 from the preceding week’s revised results while missing expectations of 210,000. Perhaps more significantly, the four-week moving average was 207,750, a decline of 250 from the previous week’s 208,000. The four-week average is used to smooth out results in weekly claims, which can be volatile.

In another indicator of a tight labor market, continuing unemployment claims for the week ended December 30 also fell, dropping by 34,000 to 1.834 million while the four-week average of 1.862 million dropped by 8,000 from the previous week’s revised average. The Street was expecting a much higher number closer to 1.871 million.

The tight labor market is supporting gains in real hourly earnings, which increased 0.2% from November to December, the third consecutive month of increases. While this is favorable news for households that are struggling with increased living costs and higher interest rates, it is another setback in the Fed’s inflation battle. Higher real wages can cause consumers to spend more, driving up prices for goods and services. Additionally, businesses may seek to preserve their earnings by increasing the prices to offset higher labor costs. It appears that labor, price pressures in services, loosening financial conditions and geopolitics point to a CPI trough of 3% this year.

Volatility Picks Up Ahead of Earnings

Markets are getting pulverized today as it appears yesterday’s strength was a bull trap. All major U.S. equity indices are being slammed on higher yields, geopolitical problems and concerns about inflation. The small-cap Russell 2000 is leading the decline, dropping 1.7%, while the Nasdaq Composite, S&P 500, and Dow Jones Industrial indices are down 0.8%, 0.8% and 0.6%. Sectoral breadth is awful, with all sectors lower minus energy, which is up 0.4% due to rising oil prices, a result of heightening geopolitical tensions. Meanwhile, utilities, real estate and communication services are the biggest laggards on the session, with the sectors down 2.6%, 1.1% and 1%. We’re seeing some bear-steepening along the yield curve ahead this afternoon’s pivotal 30-year auction, with short-end yields nearly unchanged while long-end yields move higher. The 2-year Treasury is trading at 4.35% while the 10-year trades at 4.05%. The former is trading 1 bp lower while the latter is 2 bps higher. Currency markets are on edge as they think about a Fed that may not cut until May or June. The US Dollar Index is up 29 bps to 102.65 as the greenback gains against the euro, pound sterling, franc, yen and Aussie and Canadian dollars. The US currency is down relative to the yuan though.

Geopolitical Tensions Rise

This morning’s seizure of a tanker carrying Iraqi crude by Iran illustrates heightening geopolitical tensions in the Middle East. This action is framed as a response to the United States’ previous confiscation of the same vessel and its oil, underlining the ongoing friction between Iran and the US. Additionally, the incident, which involved the Marshall Islands-flagged St Nikolas, has become a focal point in a diplomatic standoff regarding the Israel-Palestine conflict and symbolizes the complex dynamics in the Middle East.

This incident has occurred as Yemen’s Iran-backed Houthi militias have been attacking ships in Red Sea shipping routes, further complicating the geopolitical chessboard as regional powers assert their influence and pursue their interests. This targeting of shipping routes adds an additional layer of concern to an already volatile situation, impacting maritime security.

Many logistics companies have decided to avoid the Red Sea and instead ship oil and other products around the Southern tip of Africa, a more costly route. The St Nikolas incident, meanwhile, is driving up oil prices, which can impact consumers worldwide, as increased energy prices can drive up prices for various goods and services. A report yesterday depicting rising energy inventories stateside didn’t help to offset much of the geopolitical concerns, with WTI crude oil up 3.3%, or $2.36, to $73.61 per barrel on the news.

January 2022 Deja vu?

As we look forward to earnings season, which begins tomorrow with the banks, investors will be focusing on how corporations have been navigating a tough economic landscape. While economic conditions in the states are strong at the moment, revenues and earnings are a global phenomenon for large-cap U.S. companies. With Europe and China significantly weaker than the U.S., market players will be focusing on how much cost-cutting is required to maintain profits. If companies can grow the top and bottom lines in tandem, the Street will reward them. But if companies struggle to grow earnings, even as they cut expenses, the Street will punish them. Overall, this earnings season reminds me of January 2022, when indices were near all-time highs and expectations were in the nosebleeds. The result was that the macroenvironment didn’t allow firms to exceed those lofty projections, a scenario I believe we’re revisiting. In the meantime, many investors are distracted by the fresh news on Bitcoin.

Join Me at The MoneyShow

I look forward to discussing the Federal Reserve’s challenging journey across the monetary bridge—or process of taming inflation while keeping growth positive—when I speak at the MoneyShow Virtual Expo. I will discuss economic and financial market conditions and place an emphasis on consumer spending, labor markets, equities, fixed-income, commodity trends, and monetary and fiscal policies. I will also cover the real estate, banking and manufacturing sectors. Please click below to receive a free pass to the online event, which is scheduled for 11:50 a.m. EST on Thursday, January 18. Register For Free Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.