Blue chip stocks rarely go on sale. When they do, it pays to do your research. High-quality businesses trading at deep discounts are the ultimate buy-and-hold opportunities.

For decades, 3M (MMM 0.57%) was the epitome of a blue chip stock. Shareholder returns consistently beat the market, and the company’s diversified, recession-resistant business model insulated the stock during times of turmoil. With that in mind, the last few years have been exceptional, and not in a good way. Shares have lost around 65% of their value since 2018, pushing the valuation down to multidecade lows.

Has 3M stock become the ultimate buy-and-hold opportunity?

More than meets the eye

The best buy-and-hold stocks have business models that consistently make money in nearly any environment, typically over long stretches of time. This consistency is the reason you can invest for the long term with minimal worry. In that regard, 3M is still very much the ideal buy-and-hold stock.

In a nutshell, the company is an industrial materials company with a portfolio of thousands of specialized products that serve a wide array of end markets all over the world. You may use some of the company’s consumer products yourself, things like personal respirators, heat-resistant tubing, and safety goggles, though it also owns respected brands like Scotch tape, Post-it Notes, and Scotch-Brite cleaning products. The majority of 3M’s sales, however, target larger buyers, with products like automotive adhesives, surgical tools, and optical films.

It’s almost impossible to summarize all of 3M’s products, but know this: The company owns thousands of patents and spends nearly $2 billion annually for research and development, ensuring its products are differentiated and command high margins. 3M’s ability to innovate and charge premium prices is easily verifiable. For decades, research and development spending has continued to rise, and returns on equity have remained exceptionally high, averaging above 30%.

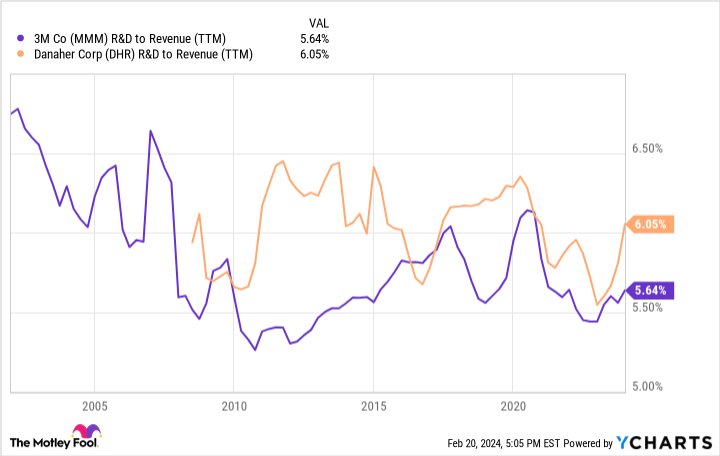

Over decades, 3M built a blue-chip portfolio of high-margin products capable of generating high returns on equity, but that doesn’t mean the business is impervious to competition. While the company still spends billions every year in research and development, its spending as a percentage of revenue has declined from previous decades. Competitors like Danaher have consistently outspent 3M in recent years when it comes to reinvesting in new product development.

MMM R&D to Revenue (TTM) data by YCharts

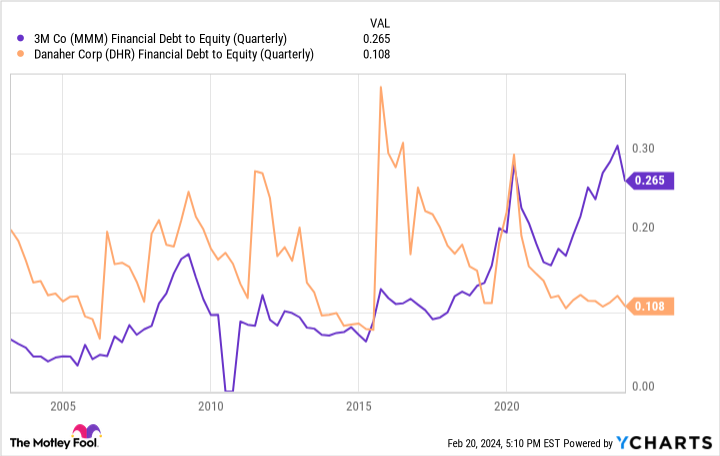

Additionally, 3M’s high returns on equity have partially been driven by mounting debt levels. Comparing the company to Danaher reveals yet another divergence in strategy. While Danaher traditionally used more debt than 3M, the trend has reversed in recent years, with 3M’s debt to equity levels rising to 40-year highs .

To be sure, 3M still has an incredible portfolio of valuable products, including thousands of patents. But the numbers suggest that management has been underinvesting in research and development for years, and mounting debt levels give the company less room for error.

MMM Financial Debt to Equity (Quarterly) data by YCharts

Several multi-billion dollar errors

The problem plaguing 3M today is simple in nature, but the ultimate effects are still unknown. All we know is that the company settled a lawsuit last summer for around $10.3 billion. The lawsuit charged 3M with contaminating public water supplies with PFAS, a chemical used in many of its products, including firefighting foams and consumer products. Notably, 3M began to phase out many PFAS substances in early 2020 and will stop producing all PFAS products over the next 12 to 24 months.

The primary challenge following the settlement is whether 3M will face further fines or litigation related to its PFAS use. This is where the near-term direction of the stock becomes incredibly murky. It could take years to fully quantify 3M’s liabilities. From a cash-flow perspective, however, the company is in little danger. 3M generates between $1 billion to $2 billion in free cash flow every 90 days. Its dividend, which currently yields above 6%, could also be slashed to conserve cash for potential legal setbacks.

Importantly, the 3M’s PFAS settlement is only one of several multi-billion dollar settlements the company has recently agreed to. Last August, 3M agreed to settle litigation related to its sale of defective ear protection to the U.S. military . As past of the settlement, the company agreed to pay around $6 billion. In combination with the PFAS case, 3M is on the hook for more than $16 billion in legal settlements, roughly 30% of the company’s current market cap.

How will 3M satisfy these obligations? In November, management revealed plans to spin off its healthcare business, Solventum, which generated $8.4 billion in sales in 2022. . It also recently agreed to pay off part of its legal settlement by selling $1 billion in stock in lieu of cash. There will likely be more capital-raising efforts to come, including a potential cut in the dividend, which is costing the company more than $800 million per quarter . Don’t expect any sizable share repurchases, either, something the company has consistently done in years past.

With two sizable settlements now on the books, some of the financial damage has been quantified, but we can’t be sure the damage won’t continue to proliferate, especially when it comes to PFAS litigation. Even if its legal woes are behind it, what are investors left with? 3M faces severe challenges over the coming quarters and years. Free cash flow remains high enough to deal with many problems, including high debt levels, but the company is in its weakest position to do the thing that made it so historically successful: invest heavily in research and development.

There is still value to 3M stock, but any investment today requires a very long time horizon. Management will need to allocate cash flow wisely not only to deleverage the company, but strengthen a product portfolio that has been relatively neglected for more than a decade.