Tech stocks are suffering today on worries that Beijing is becoming increasingly competitive in the high-stakes artificial intelligence race. The concerns were sparked by Chinese AI firm DeepSeek announcing that its open-source model was developed in just two months, costing less than $6 million. On the other hand, some folks believe that there’s no way the advanced technology was built so fast alongside such a modest figure. But equity breadth isn’t bad—it’s actually positive despite the S&P 500 and Nasdaq 100 losing over 2% at the open. Indeed, lighter yields, a softer greenback and buying activity in some of the cyclical and defensive sectors have allowed the Dow Jones and Russell 2000 to hang in there near their respective flatline. Turning to the economic calendar, the Chinese economy continues to tread water while new home sales stateside gain momentum despite 7-handle mortgages hurting affordability. Prospective buyers and sellers alike may have very well given up on waiting for lower interest rates, with last week’s existing home sales data also depicting a buoyant recovery near year-end.

New Home Sales Surge

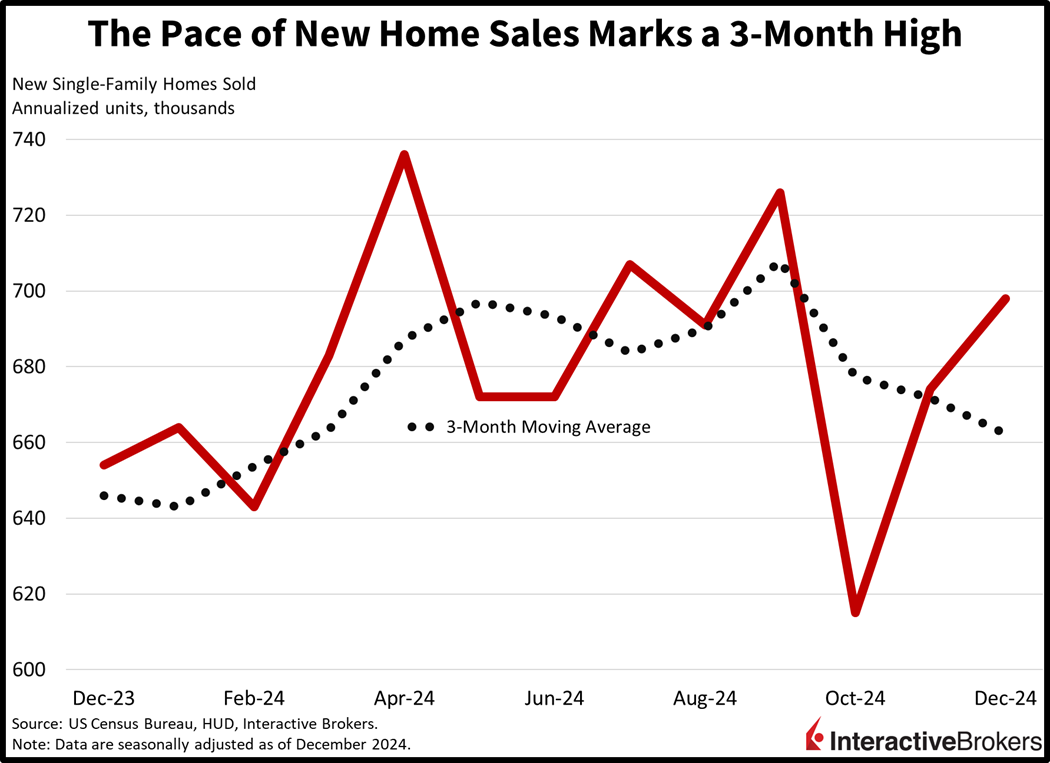

New home sales finished the year with a bang, similar to last Friday’s existing homes transactions data. But while the pace of existing home sales rose to a 10-month high, activity in the new segment wasn’t as robust, marking the loftiest level since September. Overall, however, the data point to a real estate market that has had enough with waiting for lower financing costs as buyers and sellers operate with a “oh well, life goes on” framework. Inventories have been rising and trending higher, having even eclipsed the pre-pandemic level late last year.

December new home sales rose to 698,000 seasonally adjusted annualized units, topping the 670,000 median estimate as well as the 674,000 from the prior month. Staggering month-over-month (m/m) increases of 41.7% and 20.3% in the Northeast and West countered modest declines of 3.3% and 2.1% in the Midwest and South. And transactions weren’t driven by lower prices, as costs rose from $402,500 and $485,000 to $427,000 and $513,600 on a median and average basis m/m. Still, the lower end comprised almost half of the gains, with homes priced below $400,000 representing approximately half of total sales.

China’s Industrial Profits and PMIs Falter

China’s industrial profits and overall activity weakened in January with Purchasing Managers’ Indices (PMI) for manufacturing and non-manufacturing sectors dropping from 50.1 and 52.2 to 49.1 and 50.2 m/m. Economists anticipated that the manufacturing component would have matched December’s figure, keeping the sector above the contraction and expansion threshold of 50. The declines drove the overall PMI from 52.2 to 50.1, significantly below the forecast of 52. Despite the disappointing results, a PMI component asking businesses about their outlooks for production and operations activity increased to 55.3, pointing to confidence that conditions will strengthen after the Jan. 29 Lunar New Year. Also in January, industrial profits descended 3.3% year over year (y/y)compared to the 4.7% dip in the final month of 2024.

Singapore’s Hiring Spree Moderates

Singapore’s economy continued to add workers in the fourth quarter and its unemployment rate remained unchanged at 1.9%. The country’s payrolls expanded by 8,700, considerably lower than the third-quarter increase of 22,300. Nevertheless, the result was still higher than in the year-ago period. When releasing the data, Singapore’s Ministry of Manpower said it anticipates softening labor conditions due to geopolitical uncertainty and market volatility. Some people are fearful that potential US tariffs on the country’s products may weaken hiring.

Hong Kong’s Asian Imports Soar

Hong Kong’s trade imbalance declined considerably in December m/m and y/y. At HK$34.5 billion it was down from November’s gap of HK$43.4 billion and the year-ago shortfall of HK$59.9 billion. Exports to Vietnam advanced 49.9% y/y followed by the 33.8% gain from the Philippines. Despite China’s economic woes, the country’s imports from Hong Kong climbed 14.9%. Countries with significant declines in Hong Kong imports included the United Kingdom and the Netherlands with contractions of 28.1% and 23.6%, respectively.

Japan’s Outlook Revised Upward

Japan’s final Leading Economic Index for November was tweaked higher from its previous flash reading but dropped m/m from 109.1 to 107.5 compared to the analyst forecast of 107, which was also the preliminary estimate. In a related matter, Japan’s Coincident Index result of 115.4 weakened m/m from 116.8. The final result was updated from the 115.3 flash estimate.

Nvidia Surrenders Top Slot as Equities Weaken

The equity market is down overall as the Chinese AI developments dominate headlines and cause Nvidia to fall off from being the most valuable company in the world; it’s down a whopping 14%. The semiconductor juggernaut’s weakness is pushing the Nasdaq 100 and S&P 500 benchmarks much lower, with the gauges losing 2.7% and 1.7% in volatile trading. But the Dow Jones Industrial and Russell 2000 indices are only lower by 0.1% and 0.5%, as investors search for things to buy amidst lower overall prices. Sector breadth was positive but has now moved to a split, with 6 out of 11 sectors higher and led by healthcare, consumer staples and communication services, which are gaining 1.5%, 1.5% and 0.6%. But technology, utilities and industrials are down sharply and trimming 4.4%, 4.3% and 1.7%. Meanwhile, Treasurys are catching bids with the 2- and 10-year maturities changing hands at 4.22% and 4.54%, 4 and 7 basis points (bps) lighter on the session as inflationary fears were reduced by Bogota’s acquiescence to President Trump on the immigration front. Currency traders are sensing that Trump’s transactional attitude toward foreign policy will lead to less tariffs than feared and they are essentially sending the Dollar Index south by 20 bps. The greenback is depreciating relative to the yen, franc and euro but is appreciating against the pound sterling, yuan and Aussie and Canadian tenders. Commodities are down across the board as Trump tariff worries ease. Crude oil, copper, lumber, gold and silver are losing 1.7%, 1.3%, 1.2%, 1% and 0.8%. WTI crude is trading at $73.26 per barrel as supply fears are sidelined following Bogota’s agreement with Washington.

One-Trick Pony

This bull market’s accelerant from 2023 has been the boom in artificial intelligence. But one of the major risks to the rally is the overreliance on one specific theme rather than broad outperformance by the entire market. The concentration of upside gains has generated vulnerabilities, because if anything goes wrong with AI, then painful selling ensues. Progress stemming from wide and diverse areas of the equity universe are the most sturdy and desirable, since problems in one area can be countered by advancement in another. Those kinds of results take time and are driven by strong economic growth and ensuing corporate earnings. But two consecutive annual returns of around 25% aren’t sustainable with a one-trick pony.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.