SMCI plummets after delaying a key filing … how did Nvidia’s earnings come in? … Berkshire Hathaway tops $1 trillion … how many years of “suck” can you handle?

Today, AI market-darling Super Micro Computer (SMCI) blew up as fears of fraud intensified.

As I write Wednesday afternoon, the stock is down 25% after the company delayed filing its annual report with the Securities and Exchange Commission.

Ordinarily, such a delay might raise some eyebrows, but it wouldn’t lead to such a violent market reaction. The difference this time is that the announcement comes just one day after short-seller Hindenburg Research published a scathing attack on SMCI.

Here’s Quartz with more:

[Hindenburg Research accused] Super Micro Computer of accounting red flags and questionable business dealings, including potential sanctions evasion from exports to Russian and Chinese firms…

It found “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues,” according to a report released Tuesday.

And this comes directly from Hindenburg’s report:

All told, we believe Super Micro is a serial recidivist.

It benefitted as an early mover but still faces significant accounting, governance and compliance issues and offers an inferior product and service now being eroded away by more credible competition.

This isn’t the first time Super Micro has run into trouble with the SEC

In 2018, the Nasdaq briefly delisted SMCI after the company failed to file required financial statements.

Regulators eventually charged SMCI with “widespread accounting violations” that included improperly reporting revenue. The penalty was a $17.5 million fine.

Hindenburg’s report cites that violation, then claims that SMCI’s businesses practices haven’t gone straight-and-narrow since.

Back to the report:

Even after the SEC settlement, pressure to meet quotas pushed salespeople to stuff the channel with distributors using ‘partial shipments’ or by shipping defective products around quarter-end, per our interviews with former employees and customers.

Returning to SMCI’s announcement that it’s delaying its 10-K filing for fiscal year 2024, management said additional time is needed “to complete assessment of its internal controls over financial reporting.”

Now, while the optics here aren’t good, we don’t know if this delay is a red flag or not.

This morning, in his Flash Alert podcast, legendary investor Louis Navellier noted “it’s possible that [SMCI’s] CFO wants to make sure that he doesn’t give Hindenburg any credibility.” He then reminded his listeners that SMCI still has still has over 100% percent sales growth.

We’ll keep an eye on this and will report back as new details emerge.

Meanwhile, the far more important report that should be out by the time you’re reading this comes from Nvidia

Nvidia (NVDA) reports Q2 earnings today after the closing bell. Due to our publishing deadline, I don’t know how the numbers have come in, but I do know history suggests fireworks.

Looking at NVDA’s price action in the wake of earnings over the last 12 quarters, we find that the chipmaker has moved an average of about 8%.

Now, as you read this, you’re in a fun position to compare “what was predicted” with “what has happened.”

On that note, yesterday, Louis suggested that for this quarter’s earnings announcement, investors would be zeroing in less on NVDA’s trailing earnings, and more so on its forward-looking guidance.

From Louis:

Nvidia’s earnings are going to be more about the guidance than anything else.

It’s all going to be about how many of the Blackwell chips are they going to sell. They got a $10 billion order from Google, huge orders from Meta, Microsoft, the server farms, meaning Super Micro, etc…

Guidance right now is more important than results.

So, how did guidance come in?

If NVDA points toward robust demand leading to higher earnings forecasts, we’re likely to get a big “up” day in the market tomorrow.

But if NVDA disappoints, the market won’t take it well. After all, Nvidia has become the most important stock in the world for AI… and AI has become the most important investment trend in the world for Wall Street.

At least for tomorrow, odds are that “as Nvidia goes, so goes the market.”

Switching gears, a big “congratulations” goes to Warren Buffett and Berkshire Hathaway investors

Earlier today, Berkshire became the first non-tech company to reach at $1 trillion market cap.

It joins Apple, Nvidia, Microsoft, Alphabet, Amazon and Meta in this elite club.

Now, to be fair, while Berkshire isn’t a tech company, we might consider it “tech adjacent” thanks to its overweight position in Apple.

As of December, Apple made up 50% of Berkshire’s holdings. And even though Buffett sold a huge chunk of Apple this year, it’s still his largest holding, comprising roughly 30% of his portfolio. Beyond Apple, Buffett’s other tech holdings include Amazon and Verisign.

His largest holdings outside of Apple are Bank of America, American Express, and Coca-Cola.

If you own Berkshire, congrats, you’re up 28% on the year compared with the S&P’s 17% climb.

But if you’ve been a long-time owner of Berkshire Hathaway stock, you’re aware of a secret that most investors don’t know…

Buffett’s long-term average return clocks in at an eye-watering 19.8% from 1965 to the present, compared with 9.9% for the S&P 500.

But hidden beneath this fantastic, glossy number is a reality that most investors don’t realize, and fewer still could handle…

In any given year, Buffett underperforms the market…by a lot.

My friend Meb Faber, co-founder and CIO of Cambria Investments, ran a fun piece a few years ago highlighting this reality.

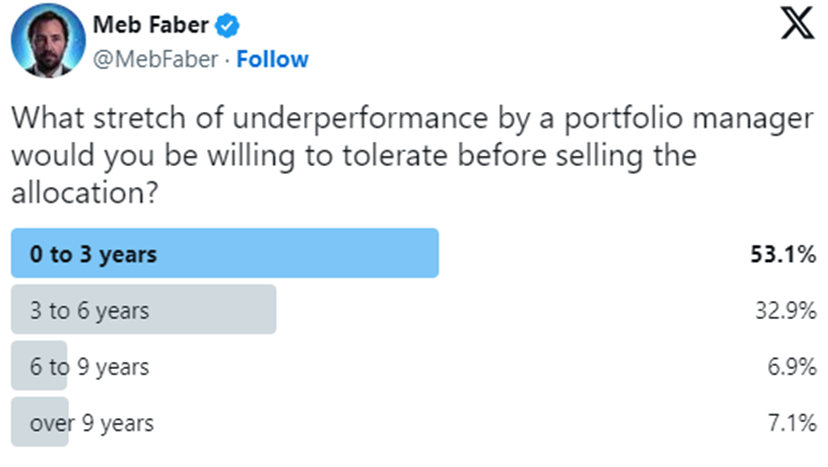

He started by pointing toward how impatient investors are in wanting to see big returns fast. He asked his Twitter (now X) followers what stretch of underperformance by a portfolio manager they’d be willing to tolerate before selling the allocation.

The majority answer?

0 – 3 years.

Now, with that in mind, let’s jump to Meb as he redirects toward Buffett:

Many portfolio managers can go years, or even longer underperforming their benchmark and still be viable allocations.

Let me give you an example everyone can relate to.

An investor who put $10,000 into Berkshire Hathaway in 1965 would now have $200,000,000.

That’s Two. Hundred. Million. Dollars.

But most could never have endured the roller coaster to get there. It’s easy to fantasize about the $200,000,000 finish line…but think about suffering through one of Berkshire’s multiple 50% drawdowns…

Right now, revisit some past chapter of your life – say, saving for that down payment, or opening your kid’s enormous college tuition bill, or needing a new roof after finally getting that leak checked. You go to check your finances for the first time in a while, only to realize you’re down 50% because Berkshire has been tanking.

Would you have held, having no idea whether the losses would continue coming or not? Yet knowing that the down payment, or tuition, or roof had to be paid?

Meb goes on to note that as of his article in 2020, Berkshire had underperformed the S&P in 11 of the 17 prior years. And if you looked at that entire 17-year stretch, the S&P had beaten Buffett.

Would you stay with Buffett through this period?

Or would you be tempted to conclude that the old man had lost his edge?

To Meb’s point, think about watching your Buffett position underperform for, say, 15 years while your neighbor’s “hot stock” portfolio ripped higher.

On a related note, it was Buffett’s business partner, Charlie Munger, who once quipped, “I’ve heard Warren say a half a dozen times, ‘It’s not greed that drives the world, but envy.”

Now, despite this underperformance, Buffett has dominated over a longer period.

Back to Meb:

Yet had you invested in Berkshire at the turn of the century, [as of 2020] his picks would have outperformed the S&P 500 by three percentage points PER YEAR. (Top 10 stock holdings, equal weighted and rebalanced quarterly, via AlphaClone.)

In fact, his performance would have beaten over 94% of all mutual funds during that period.

That’s what it takes to outperform over time. Long ass periods of suck. (Technical phrase.)

This is a good reminder that if you’re holding what you believe is a great company that will remain a leader for the decades to come, sticking with it despite years of “suck” is likely the right call.

Circling back to the top of this Digest, it’ll be interesting to see exactly how bad the “suck” is for Super Micro over the coming days.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg