- Secondary equity issuance announcements continue to run below levels from a few years ago

- Uncertainty ahead of the election may have resulted in lower corporate capex and M&A trends, but hope abounds that 2025 could bring about renewed animal spirits

- Buybacks remain the dominant force, though, and 2024 is on track for a record year

Earlier this month, we shed light on the ETF boom. New funds are created each week to meet intense investor demand – so much so that the well of ticker symbols is running dry. As happens often in markets, when there is a push in one niche, there’s a pull in another.

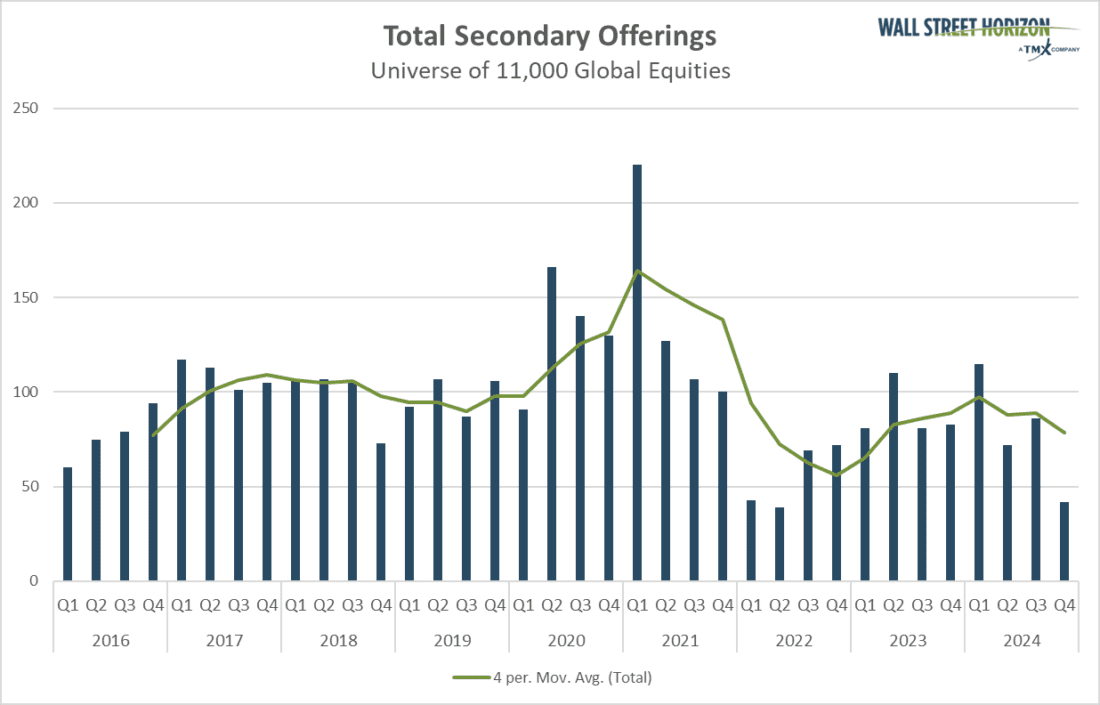

2024 paces to be a somewhat soft year of secondary equity issuance announcements. This year’s total of secondaries appears on track to merely match 2023’s sum and will surely be far below the heydays of 2020 and 2021.

Source: Wall Street Horizon

Election-Year Trepidation: A Global Story

What does an election year mean for investors and portfolio managers? There are a couple of angles. First, it lends credence to the notion that markets were on edge heading into the US election. Also consider that more than 40% of the world’s population was eligible to cast a ballot in various elections in 2024.1 That kind of policy uncertainty among electorates across nations perhaps seeped into C-suites.

Second, the rise of private markets may be capping new firms from hitting the IPO roadshow – less IPO appetite ties into the drive for existing companies to offer new shares. To that end, analysts at Bank of America noted that the net supply of US equities has shrunk by $473 billion thus far in 2024 due to a record year for stock buybacks, weak stock-based compensation, and quiet IPO activity.2

Some Clarity on Capitol Hill

What might it take to bring back animal spirits in the equity issuance space? Well, it’s hard to get around the political story unfolding in Washington, D.C. President-elect Trump and a GOP-controlled congress may seek to ease burdens on companies, and that could come in the form of a friendlier regulatory backdrop.

Of course, much more goes into equity-issuance decisions for medium and large-sized firms than just what’s happening politically. The overall cost of capital weighs highly, and changes in the interest-rate market matter too. But if there’s the perception that less red tape will stand in the way of companies, then maybe we will see more aggressive equity offerings in the quarters to come. We’ll just have to wait and see how all that plays out.

Will the Real Economy Please Stand Up?

Aside from possible regulatory changes, a company’s decision to conduct a secondary equity sale is often driven by growth opportunities. For the last handful of quarters, it seems that much of the focus has been on the AI hyperscalers gobbling up semiconductor chips.

That aggressive capex trend has been countered with prudence from areas away from tech. If parts of the so-called “real economy,” such as those tied to manufacturing and even cyclical parts of the services sector, see expansion opportunities, then that could result in an increased number of secondary offering announcements in the year ahead.

Strike While the Iron’s Hot

For US companies, the ensuing quarters might be an ideal time to consider secondary offerings. The S&P 500® has rallied more than 60% in the past 25 months, and while earnings growth has been solid over the past year, it’s actually been multiple expansion that has explained most of the index increase. All else being equal, when valuations turn lofty, it’s generally viewed as a better time for secondary offerings.

Credit Spreads Point to Corporate Health

While the regulatory framework could turn more conducive to equity issuance next year and as growth optimism ticks up, a potential roadblock to a wave of new secondaries in 2025 may be the fact that certain corporate balance sheets are in healthy shape. After all, why seek to raise capital if there’s plenty of liquidity on hand and cash flow from operations runs high?

Look no further than how tight borrowing spreads are for both investment-grade and speculative companies – both IG and HY credit spreads have tightened.3 Not only does it suggest that companies may not need to tap new equity liquidity, but it also underscores that the bond market could be an opportunity for CFOs to access. Debt is usually a cheaper financing source than equity, even with higher interest rates today versus a few years ago.

Looking to M&A and Buybacks for Clues

Something we’ll keep a close watch on next year is how M&A trends evolve. Like with IPOs, we have seen slim pickings on the deal front. Often, when a rush of mergers and buyouts comes about, capital must be raised to complete reorganizations. Dealmakers appear to be upbeat about M&A trends next year, and if that sanguine outlook plays out, then we might see more aggressive equity-sale announcements sooner rather than later.4

Finally, buybacks remain appealing in today’s market, particularly for S&P 500 companies. 2024 paces to be a record year, with Goldman Sachs noting that notional buyback authorizations have surged 21% YTD through mid-October.5 A stock-repurchase boom has undoubtedly helped reduce total share counts, which boosts EPS. Barring a renaissance in capex outside the AI orbit, higher M&A volumes, and perhaps a pickup in IPOs, it’s hard to envision secondaries supplanting buybacks any time soon.

The Bottom Line

We have observed a modest increase in the number of secondary equity offering announcements in the last 18 months following a weak 2022, but the speculative fervor of late 2020 and early 2021 is a distant memory. Outside of AI investments, corporate capex has been unimpressive lately, but there’s hope that 2025 will bring about a wave of new investment. A friendlier regulatory backdrop could also spur M&A, which might also result in a higher equity supply. For now, though, buybacks appear to be the action of choice for many well-capitalized blue-chip companies.

—

Originally Posted November 20, 2024 – Another Soft Year for Secondaries: Changes on the Way in 2025?

1 More than 4 billion people are eligible to vote in an election in 2024. Is this democracy’s biggest test?, The Conversation, Nicholas Reece, January 14, 2024, https://theconversation.com

2 BofA Global Research, BofA Securities, November 14, 2024, https://business.bofa.com

3 Corporate bond spreads tighten slightly after Trump victory, Reuters, Matt Tracy, November 6, 2024, https://www.reuters.com

4 After 3 slow years, dealmakers expect to see plenty of action in 2025, Chicago Business, Mark Weinraub, October 15, 2024, https://www.chicagobusiness.com

5 Buyback authorizations have surged 21% YTD, Goldman Sachs Global Investment Research, November 14, 2024, https://www.goldmansachs.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.