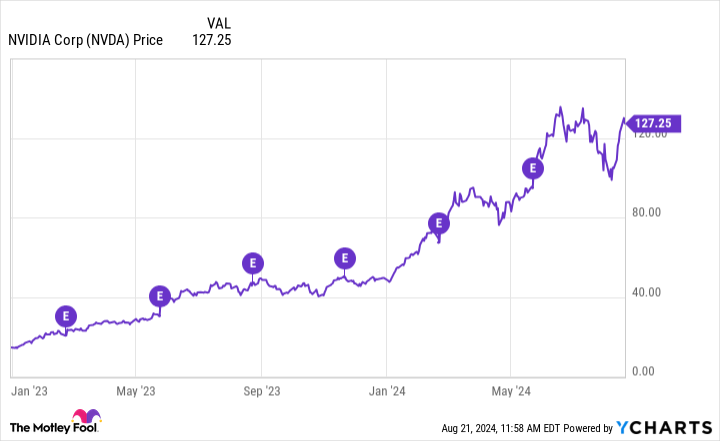

Nvidia’s stock has tended to pop after its quarterly earnings are announced.

Nvidia (NVDA 0.98%) has been one of the hottest artificial intelligence (AI) stocks on the market, and for good reason. It has put up incredible growth numbers quarter after quarter lately, and each time, the stock has popped following those reports. With Nvidia’s second-quarter FY 2025 results being announced on Aug. 28 after the markets close, investors may want to consider buying Nvidia stock before that date.

However, these results may differ from some of its previous announcements, as year-over-year comparisons are becoming more difficult.

The growth won’t be as strong as in previous quarters

Nvidia’s rise is tied to its primary product: graphics processing units (GPUs). GPUs were developed by Nvidia back in the ’90s as devices that could process gaming graphics more efficiently than a CPU. While GPUs excelled in this field, other uses were quickly developed for them.

Because a GPU can process multiple calculations in parallel, it is useful for calculation-intensive tasks like engineering simulations, drug discovery, and AI model training. The latter has caused its business to explode, and we’ll get a checkup on demand next week when the company releases its most recent quarterly results.

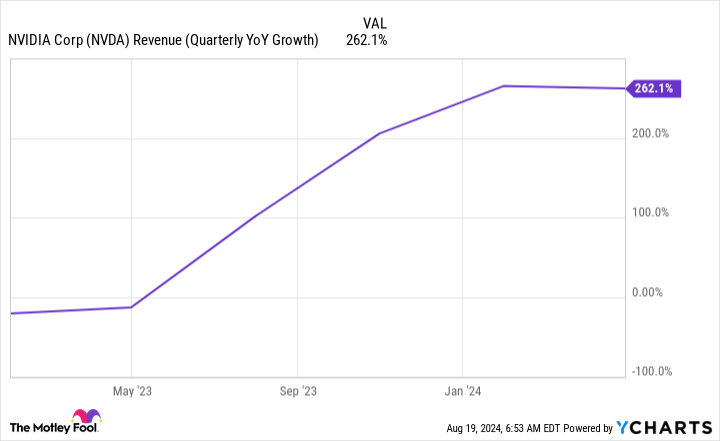

For Q2, management told investors to expect $28 billion in revenue. Compared to last year’s Q2 sales of $13.5 billion, that represents 107% year over year growth. That would be an impressive jump, but would represent a growth rate slowdown compared to previous quarters.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

This slowdown is occurring because we are overlapping the period when AI demand really started to take off. Still, I wouldn’t consider a doubling of revenue a disappointment. Additionally, don’t be surprised if Nvidia beats that target. It has consistently outperformed its guidance over the past year, and Wall Street analysts are starting to catch on to this trend. From an average of 40 analysts, they collectively think Nviida’s Q2 revenue will be $28.5 billion.

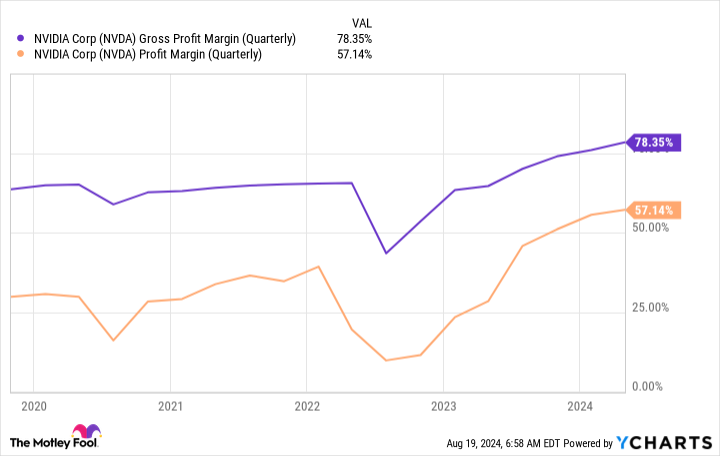

While year-over-year revenue growth is an important stat, there are others that I think are more important to consider, with margin at the top of that list.

Nvidia’s margin will be important to examine

Nvidia’s revenue growth has been nothing short of incredible, but its margin expansion has been even more impressive. With a gross margin near 80% and a profit margin approaching 60%, Nvidia has become one of the most profitable companies ever to trade on the public markets.

NVDA Gross Profit Margin (Quarterly) data by YCharts

When the Q2 report comes out, I’ll be looking to see if the company has maintained or expanded these elevated levels. If investors see weakness in these margins, it’s a sign that Nvidia is facing increased competition and needed to adjust the price of its GPUs to stay competitive in the market.

I don’t expect a margin drop, but if one does occur, don’t be surprised if the stock gets slammed immediately after the release of information.

Is the stock a buy now?

With Nvidia expected to report another strong quarter, many investors may wonder if they should invest now, before the report. Investors should first consider that investing success hardly ever comes from trying to time the market and jump in and out at just the right time.

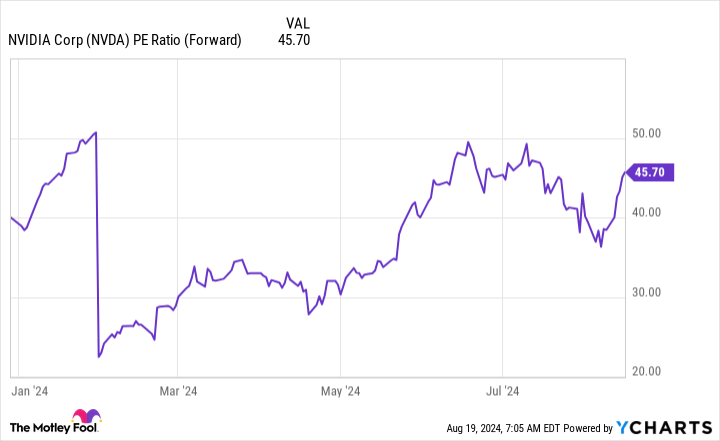

They should also consider how expensive the stock is, trading at nearly 46 times forward earnings estimates.

NVDA PE Ratio (Forward) data by YCharts

The stock has a lot of growth baked into it, and Nvidia will need to report a strong Q2 and give impressive Q3 guidance to justify the optimism.

For many investors (including myself), the price is too high. But for others, it may still represent a buying opportunity. At this valuation, Nvidia needs to report another year or two of flawless quarters; otherwise, it could be knocked from its perch. If you believe it can do that, Nvidia’s stock could still be interesting here. But with its history of reporting strong earnings, and being rewarded by investors for doing so, if you’re ready to be a buyer, you might want to buy before Aug. 28.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.