The big news today is once again coming from the bond market – Treasury Secretary Bessent stated late yesterday that he wanted to focus on 10-year rates rather than the short end of the yield curve. This explains why yesterday’s refunding announcement did not shift Treasury borrowing to longer maturities, as many had expected. It is tough to expect lower long rates while simultaneously increasing supply.

Interestingly, Treasury rates are higher across the curve. It is understandable why the short end is under a bit of pressure, with yields about 2bp higher. The Secretary’s comments said that there will be less of a focus on lowering short rates, partly because he assured us that the President will not be pressing the Federal Reserve to lower rates. Overall, the market should like that the Fed should be able to operate independently, but the combination of continued supply of short-term paper with an unhurried Fed is not helpful to those rates in the near-term. The long end is also about 3bp higher, but that could simply be another sign that bond traders tend to overshoot – with yesterday’s 9bp drop perhaps being a bit too exuberant.

Meanwhile, all sorts of traders can now focus on tomorrow morning’s employment report. The consensus estimate for January Nonfarm Payrolls is 173,000, though ForecastEx shows a 60% chance that the number will be above 180k. The Unemployment Rate is expected by economists to remain unchanged at 4.1%, while ForecastEx traders have a 57% preference for a higher number.

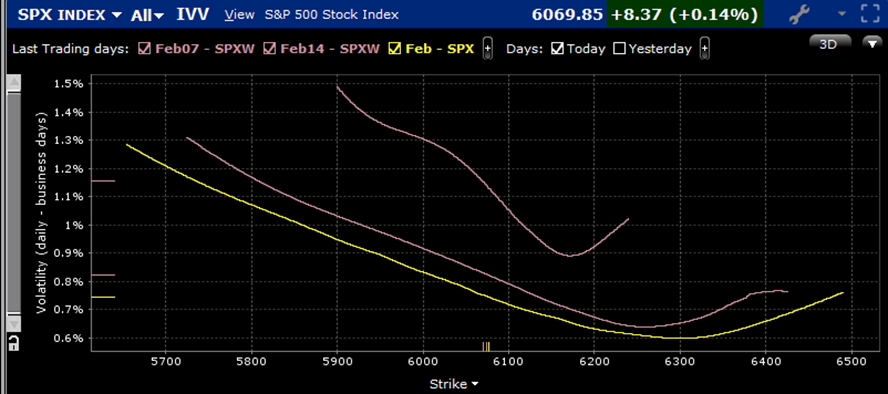

Options markets are relatively sanguine ahead of the report, though. S&P 500 (SPX) options expiring tomorrow show a peak probability in the 6105-6110 range, about ½% above the current index level.

IBKR Probability Lab for SPX Options Expiring February 7th, 2025

Source: Interactive Brokers

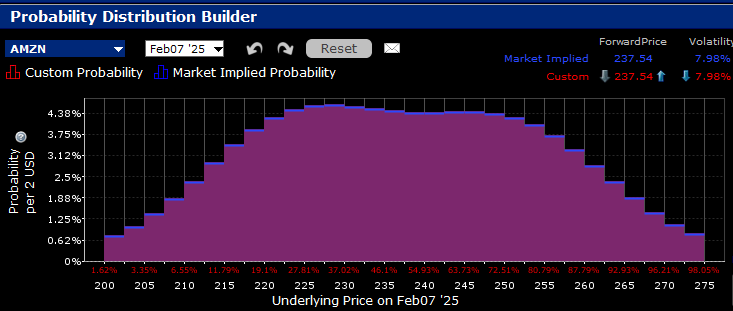

That said, we see a relatively steep skew for options expiring tomorrow, along with a relatively elevated 1.15% daily implied volatility:

Skews for SPX Options Expiring February 7th (top), 14th (middle) 21st (AM, bottom)

Source: Interactive Brokers

At the same time, traders are far mor unsure about the post-earnings prospects for Amazon (AMZN), who reports after today’s close. Although the peak is in the $227.5-$230 range, somewhat below the current price, the market assigns relatively equal probabilities to outcomes anywhere between $225 and $250:

IBKR Probability Lab for AMZN Options Expiring February 7th, 2025

Source: Interactive Brokers

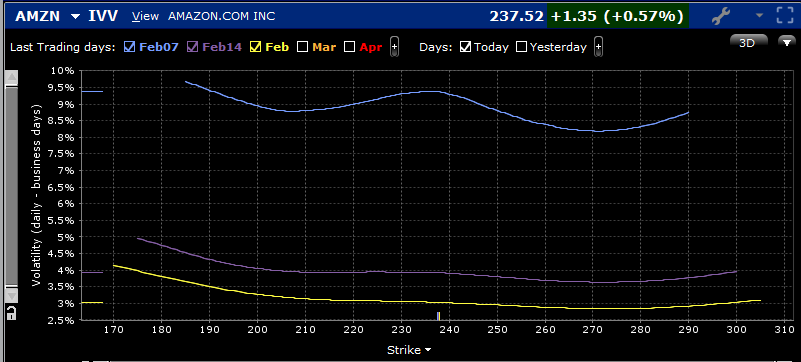

As we might expect from the probability graph above, we see an extraordinarily flat skew in options expiring tomorrow. Perhaps after the recent cloud-computing induced stumbles in Microsoft (MSFT) and Alphabet (GOOGL, GOOG), traders are roughly equally split between concerns about too much competition in that sector versus optimism that AMZN is gaining share at their expense. However, the at-money volatility of just under 9.5% is elevated when compared to the 6.71% average of the past 6 post-earnings moves (+6.19%, -8.78%, +2.29, +7.87%, +6.83%, +8.27%)

Skews for AMZN Options Expiring February 7th (top), 14th (middle) 21st (bottom)

Source: Interactive Brokers

Overall, both stock and markets seem disinclined to do too much today. With potentially market moving events lurking on the horizon, that seems quite sensible.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.