Key News

Asian equities were largely higher except for Japan, China, and Hong Kong. It was a fairly quiet night as the “Two Sessions” important policy meetings in China roll on.

February Export/Import data beat expectations. Exports increased by +7.1% year-to-date (YTD) versus last year versus an expected increase of only +1.9%. Meanwhile, imports increased +3.5% versus an expected +2%. This is a promising sign for the global economy!

JD.com gained +6% in Hong Kong after reporting great results yesterday. Hong Kong and Mainland China slipped in afternoon trading as several macroeconomic headlines weighed on investor sentiment.

Health care was the worst-performing sector in both Hong Kong and Mainland China, falling -5.83% and -2.81% in each market, respectively, as a US Senate advanced a bill that would bar Chinese biotech companies from doing business with health care providers that accept medicaid and medicare. However, as discussed below, it has a LONG way to go before coming law. Meanwhile, concerns about EU tariffs on Chinese electric vehicles (EVs) weighed on the ecosystem in both Hong Kong and Mainland China. Foreign Minister Wang Yi’s press conference noted the increase in US government actions against China despite progress made at APEC. The market lacked a catalyst to overcome the negative headlines that weighed on sentiment.

After the Hong Kong close, Bilibili and Full Truck Alliance reported their Q4 financial results, discussed below. The National Team likely intervened in the afternoon as two of their favorite ETFs saw spikes in volume during the afternoon dip, indicating the continued effort to stabilize the market. Mainland investors bought the dip in Hong Kong via Southbound Stock Connect, as Tencent posting its third net buying day via Southbound Stock Connect, though, yes, it was a small amount. Tencent has seen net selling year to date.

The US Senate Homeland Security Committee passed a bill that would bar WuXi Biologics, WuXi AppTec, and other Chinese biotech companies from doing business with US government-funded healthcare providers to prevent the companies from sending US citizens’ DNA data to the Chinese government. That’s not a typo! The bill has a long way to go before it is law, as the House and Senate would have to pass it, and then the President has to sign it into law. The Wuxi companies are domiciled in the Cayman Islands and have facilities pretty much everywhere (the US, Ireland, Germany, etc.).

Despite this, WuXi Biologics (2269 HK) fell -21.47% and WuXi AppTec (2359 HK) fell -20.56% overnight due to their high US revenue exposure. WuXi AppTec’s seven largest shareholders include six US asset managers, according to the latest SEC 13F data. Those six US asset managers’ shareholders lost $231 million today based on their ownership of 154 million shares! Since January 24th, those six US asset managers’ shareholders have lost $693 million on the US Congress’ actions! Many US asset managers own the shares, and I don’t have time to calculate them. WuXi AppTech has denied the allegations against it while employing thousands of Americans in its US facilities. It hasn’t sued, which it should, in my opinion.

One must wonder how much of Apple’s recent China market share loss is a consequence of US restrictions on Huawei, which forced the company to innovate and become a formidable opponent. Today’s Wall Street Journal has an article on China’s push for technology independence. Gee, I wonder why? The article briefly acknowledges that the actions result from recent US policies restricting their technology purchases and the US government’s spying on China, as revealed by Edward Snowden.

Bilbili Earnings Highlights

Bilibili (BILI US, 9626 HK) calls itself “an iconic brand and a leading video community for young generations in China.” The company allows users, particularly those who enjoy video games, to make videos, watch others play video games, and participate in online group videos. The company released Q4 financial results after the Hong Kong close/US market open. % changes are year-over-year.

- Revenue increased +3% to RMB 6.3B from RMB 6.142B in Q4 2022 versus expectations RMB 6.322B

- Adjusted net loss declined -58% to RMB 555.8mm versus expectations loss RMB 632mm

- Adjusted EPS loss RMB 1.34 from a loss of RMB -3.31 in Q4 2022 versus expectations loss RMB 1.43

- Average daily users increased +8% to 100.1mm

Full Truck Alliance Earnings Highlights

Full Truck Alliance (YMM US), a “leading digital freight platform,” i.e., the Uber of truckers in China, released Q4 financial results after the Hong Kong close/US market open. % changes are year over year.

- Revenue increased +25.3% to RMB 2.408B from RMB 1.922.5B versus expectations of RMB 2.408B

- Adjusted net income increased +64.4% to RMB 733B from RMB 195.7B versus expectations of RMB 636mm

- Adjusted EPS RMB 0.69 from RMB 0.42Q1 revenue forecast between RMB 2.11B and RMB 2.16B, representing a YoY growth rate of 23.9% to 27.1%.

- The company had repurchased 30.7mm ADRs at a cost of $200mm. The board approved a repurchase program of $500mm.

The Hang Seng and Hang Seng Tech indexes fell -1.27% and -1.56%, respectively, on volume that decreased -4.27% from yesterday, which is 99% of the 1-year average. 153 stocks advanced, while 316 declined. Main Board short turnover declined -3.83% from yesterday, 87% of the 1-year average, as 15% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large caps “outperformed”/fell less than the growth factor and small caps. The top sectors were materials +2.5%, industrials +0.79%, and energy +0.74%, while healthcare -5.84%, real estate -2.49% and discretionary -1.76%. The top sub-sectors were materials, energy, and capital goods, while pharmaceutical/biotech, auto, and media were the worst. Southbound Stock Connect volumes were moderate as Mainland investors bought $575mm of Hong Kong stocks and ETFs, with CNOOC a large net buy, Bank of China and WuXi Biologics moderate net buys while PetroChina, Meituan, and China Mobile small net sells.

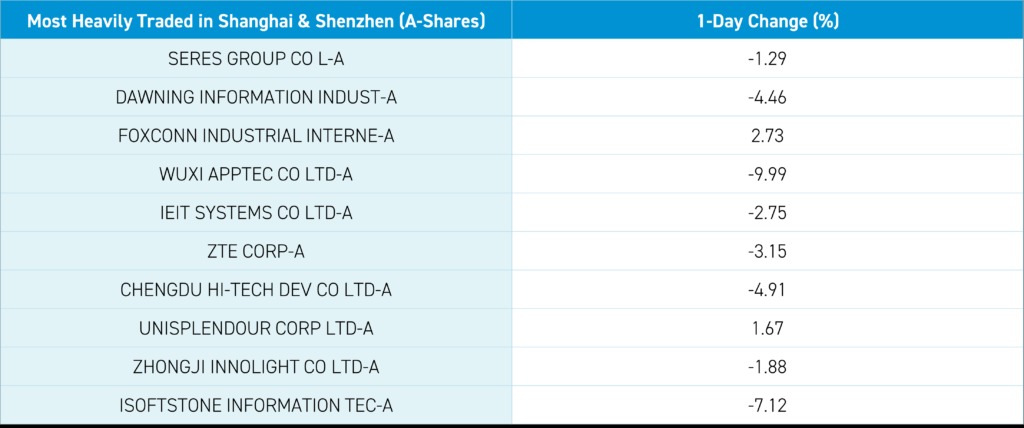

Shanghai, Shenzhen, and STAR Board fell -0.41%, -1.2%, and -2.18% on volume +5.08% from yesterday, which is 113% of the 1-year average. 1489 stocks advanced while 3,386 declined. The value factor and large caps outperformed the growth factor and small caps. The top sectors were energy +1.45%, materials +1.1%, and utilities +0.64%, while healthcare -2.84%, communication -2.34%, and tech -2.09% were the worst. The top sub-sectors were precious metals, steel, and oil/gas, while computer hardware, pharmaceutical, and software. Northbound Stock Connect volumes were moderate/high as foreign investors sold -$297mm of Mainland stocks, with Kweichow Moutai, Cypc, and ZTE were small net buys while CATL, WuXi AppTec, and Sokon were small net sells. CNY was flat versus the US dollar. Treasury bonds fell while copper and steel gained.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.19 yesterday

- CNY per EUR 7.84 versus 7.82 yesterday

- Yield on 10-Year Government Bond 2.27% versus 2.26% yesterday

- Yield on 10-Year China Development Bank Bond 2.38% versus 2.36% yesterday

- Copper Price +0.54%

- Steel Price +0.19%

—

Originally Posted March 7, 2024 – Bilibili & Full Truck Alliance Beat Expectations, WuXi Hit By Potential US Policy

Author Positions as of 3/7/24 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.