Markets are starting off the week in stride despite news of international trade jabs dominating the weekend. On the one hand, the US is planning to announce 25% duties on steel and aluminum imports from all countries, while on the other, President Trump is seeking to level the global playing field by implementing reciprocal tariffs against nations that maintain levies on the US. But investors are starting to realize that much of the talk is hardly going to come to fruition with the rhetoric increasingly appearing to be a negotiation tactic. The posturing is intended to benefit domestic economic conditions rather than disrupt global commerce momentum, and the outcomes are likely to be much better than feared. For this reason, traders are stepping up to the plate today and scooping up stocks, Treasurys, commodity futures and wagers that benefit from a stronger greenback. Furthermore, there’s a low probability that the headwinds from trade tensions and reduced labor force growth created by restrictive immigration will offset the tailwinds stemming from lighter taxation, milder regulations and measures to incentivize domestic manufacturing.

A Busy Week for Economic Data

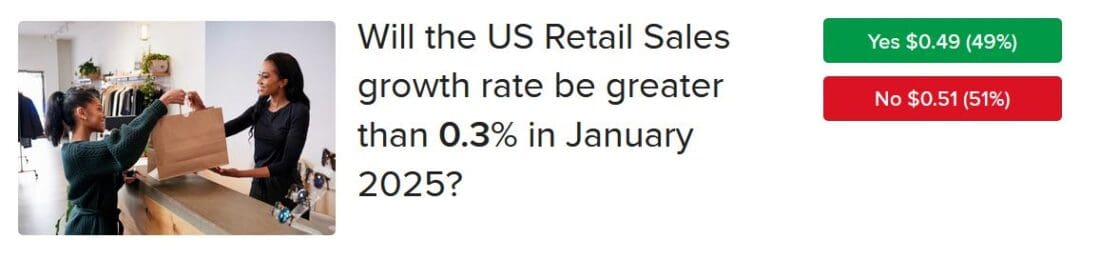

While today’s economic calendar is uneventful, tomorrow features important data concerning the sentiment and behaviors of small and medium-size businesses, which are heavily levered to changes in domestic policy since most of their operations are onshore. The rest of the week brings crucial information on the trajectory and strength of inflation at the wholesale and consumer stages, while Friday will offer an update on the durability of spending across American households, according to retail sales data due before the market opens. Consumption numbers have been robust following the pandemic, and the pressures of elevated prices, heavy financing charges and reduced credit availability have so far been conquered by plentiful employment opportunities, robust wage growth and buoyant capital markets. Incoming publications will give us clues on whether the momentum is continuing or beginning to slowdown; however, we have seen the pot begin to cool off in some former months, only for it to heat up again. Folks, this is a strong consumer and IBKR Forecast Traders are projecting another mighty showing this week. But the solid demand is helping to support price pressures, and our marketplace believes headline and core consumer costs will arrive at annualized rates of 2.9% and 3.1% this Wednesday.

Source: ForecastEx

Markets Kick Off Week with a Rally

Markets are posting strong gains so far today with investors picking up financial instruments across asset classes. Tech stocks are leading the way for equities and the Nasdaq 100 benchmark is gaining the most; it’s up 1.3%. The S&P 500, Dow Jones Industrial and Russell 2000 gauges are progressing more modestly, but are nonetheless advancing by 0.7%. 0.3% and 0.2%. Sectoral breadth is positive with 8 out of 11 segments in the green and led by energy, technology, and consumer discretionary, which are climbing 1.7%, 1.6% and 0.7%. In contrast, financials, healthcare and real estate are representing the laggards with drops of 0.8%, 0.3% and 0.1%. Treasurys are also getting scooped up in bull-steepening fashion, with the 2- and 10-year maturities changing hands at 4.25% and 4.48%, 4 and 2 basis points lighter on the session. The dollar is higher though, as expectations of relative economic outperformance aid the currency, which is appreciating against most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and loonie. Conversely, it is depreciating relative to the Aussie tender. Commodities are also bullish overall, with copper, gold, crude oil and silver up 2.4%, 1.7%, 1.7% and 1.2%, but lumber is bucking the trend; it’s slipping 1.2%. WTI is trading at $72.15 per barrel as oil traders dismiss Trump-tariff concerns and focus on fundamentals instead. Gold reached another fresh all-time high meanwhile and is getting closer to breaking the 3,000 level.

Investors Are Already Tired of Trump Bumps

Despite the new administration being in the White House for only 21 days, investors are already tired of Trump bumps and are choosing to look at the light at the end of the tunnel. Moreover, they’ve learned that much of the confrontational rhetoric may be intended to capture attention and generate fear amongst trade partners so that Washington can get its way. But two important dynamics occurring at the Treasury department are capping bond yields and offering the administration further leverage. First is Secretary Bessent’s intention of keeping issuance levels steady to try and incrementally restore balance in the nation’s fiscal budget. Second is the push toward public efficiency that is seeking to right-size government and limit wasteful spending on Capitol Hill. The two significant developments are contributing to lighter interest rates and offering the President increased wiggle room considering the mild inflationary risks that could be unleashed by a decelerating labor pool and higher goods prices stemming from trade tensions.

International Roundup

China’s Inflation Strengthens

China’s inflation picked up in January, but the underutilization of its manufacturing sector caused wholesale prices to dip. The country’s Consumer Price Index (CPI) accelerated to 0.7% month over month (m/m) and 0.5% year over year (y/y) compared to the 0.8% and 0.4% rates expected by Wall Street. In December, the m/m and y/y readings were flat and up 0.1%. When excluding volatile prices for food and fuel, CPI sped up to 0.6% in January y/y from 0.4% the previous month. Within the broader gauge, costs for the movie and performance tickets group, the airfare classification and the tourism category increased the most y/y, climbing 11.0%, 8.9% and 7.0%. As with other Asian countries, price gains were supported by the Lunar New Year occurring in January rather than last ar’s February celebration. Meanwhile, wholesale prices as depicted by the Producer Price Index dropped 2.3% y/y last month, matching the analyst consensus and December’s result. Manufacturers continue to struggle with the one-two punch of supply chain issues and weak demand.

Australia Building Permits Increase

After sinking 3.4% m/m in November, the volume of building permits issued in Australia climbed 0.7% during the final month of 2024, according to the Australia Bureau of Statistics. The tally met expectations, and its increase was led by approvals for private sector dwellings excluding houses, which jumped 15.2%. Permits for individual houses fell 3%. The headline number, however, sank 1.8% y/y.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC es un Comerciante de Comisiones de Futuros registrado en la CFTC y miembro compensador y afiliado de ForecastEx LLC (“ForecastEx”). ForecastEx es un Mercado de Contratos Designado y una Organización de Compensación de Derivados registrada en la CFTC. Interactive Brokers LLC proporciona acceso a los contratos de pronóstico de ForecastEx para clientes elegibles. Interactive Brokers LLC no hace recomendaciones con respecto a los productos disponibles en su plataforma, incluidos aquellos ofrecidos por ForecastEx.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.