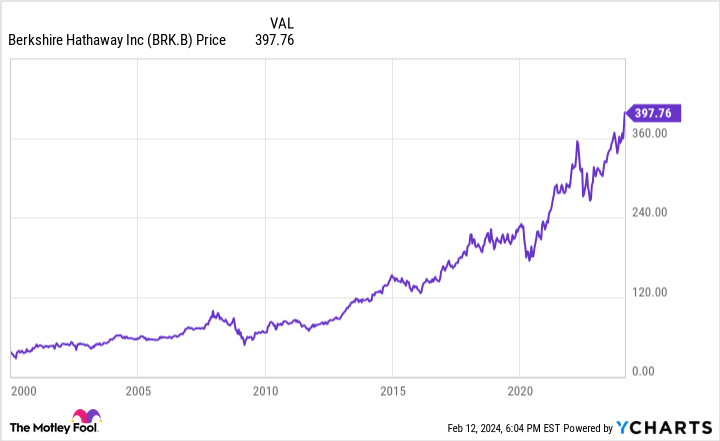

Good things come to those who wait. Long-term shareholders of Berkshire Hathaway (BRK.A 0.51%) (BRK.B 0.63%) personally know that to be true. In 1980, if you had invested just $100 into the stock, you would have more than $200,000 today.

For many, this has been the only stock they ever needed. If you’re looking to put $100 to work today, there are several reasons why Berkshire Hathaway should be a top pick.

Little has changed

The good news for investors looking at Berkshire stock today is that the business is pretty much the same as it was 10, 20, or even 30 years ago. What made the company so successful in the past is still true today. Of course, the company is much bigger and more complex than it used to be, but all of the core pieces remain in place.

In a nutshell, Berkshire is an investment conglomerate that has a portfolio of hundreds of companies. For some businesses, it is merely a minority shareholder, but it owns many outright.

Put together, Berkshire has exposure to nearly every facet of the economy. It owns stakes in technology companies like Apple and Amazon, and financial stocks like American Express and Bank of America. And it wholly owns the Burlington Northern Santa Fe railroad company.

By owning shares of Berkshire, you instantly get diversification across dozens of industries and countries, including many blue chip stocks.

Someone needs to choose where Berkshire allocates its capital, and that person is Warren Buffett, arguably the best investor of all time. He is 93 and has had a succession plan in place since 2006. Berkshire’s portfolio companies, meanwhile, nearly all operate autonomously, reducing the risk related to a Buffett departure.

The most clever aspect of Berkshire’s business is not that it’s run by a famous investor or that it provides broad exposure to blue chip stocks, but that its funding base is not vulnerable to financial markets.

Its core business is insurance, perhaps surprisingly. It owns dozens of such companies that operate globally. Insurance is a steady business regardless of the economy, and every time a policy is taken out, Berkshire gets to keep the cash until it needs to be paid out.

The term for this “free” cash is the float. By investing the float from its insurance companies, Berkshire always has ample capital to invest in new businesses. That’s a big advantage during a bear market when valuations are cheap but deployable cash is scarce.

Investing $100 is a big deal

Stocks like Berkshire prove how investing even $100 can generate long-term wealth. There is only one thing investors need to practice: patience.

Berkshire’s epic rise wasn’t always even. During the financial crisis, shares shed around 40% of their value. Since 2000, the stock has experienced double-digit losses on many occasions. The trick to success wasn’t to trade around these events; it was simply to buy and hold.

Practicing patience requires a long holding period. Turning $100 into $200,000 by investing in Berkshire stock took more than 40 years. Repeating this type of success requires a lifetime of patience, making it suitable only for younger investors or investors intending to leave their wealth to future generations.

Will Berkshire turn $100 into $200,000 yet again? To be sure, it will be harder for it to achieve such growth. The company today is worth around $860 billion. Doubling or tripling in size will be increasingly difficult, but the ride is a long way from over.

As more recent investments in Apple and Amazon show, Berkshire can still generate market-beating returns even when relegated to picking among trillion-dollar businesses. Plus, Buffett can always repurchase Berkshire’s own shares, something he has done over the years. Eventually, he might even opt to pay a dividend, which he has thus far resisted.

If you want instant diversification and a portfolio managed by an expert investor with a terrific long-term track record with many options for growth still on the table, consider stashing $100 in Berkshire stock. Just make sure to stay patient through the decades. And given the company’s huge size, expect returns to be lower than the past.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.