- Q4 S&P 500® EPS growth expected to come in at 12.7%, the highest growth rate in three years

- Large cap outlier earnings dates this week include: LUV, KMB, PPG, CI, CB, OTIS

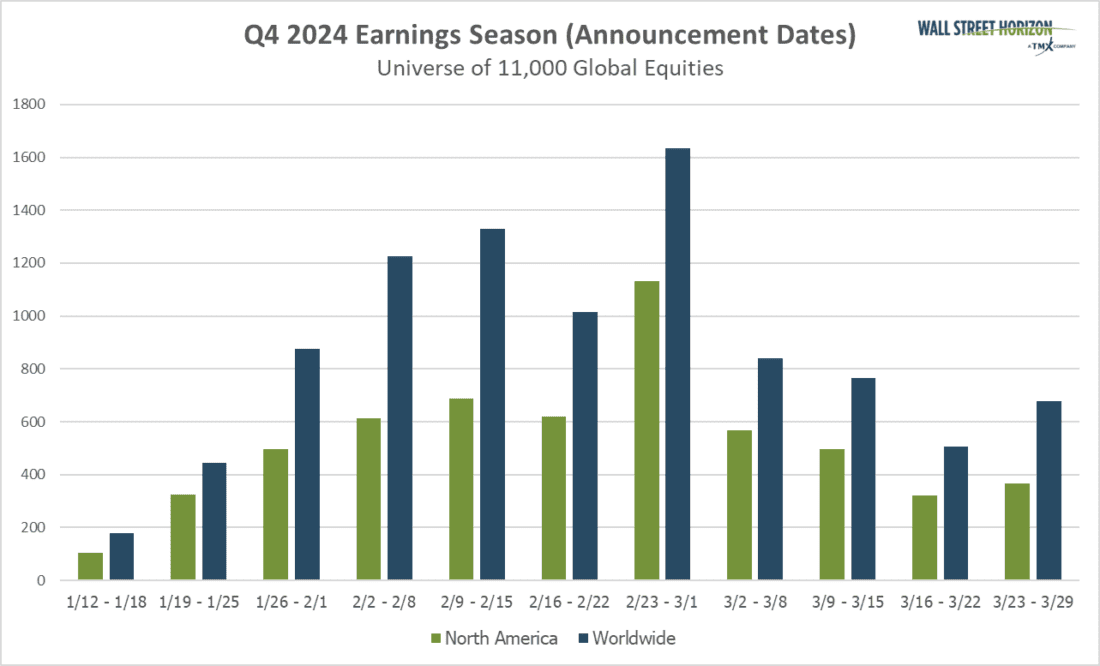

- Peak weeks for the Q4 season run from February 3 – 28

The Q4 earnings season continued on a positive note after big banks and other financials struck a bullish tone in the first two weeks of reporting. Of the S&P 500 companies that have reported at this point, 80% have beaten analyst expectations and by an average of 7.3%, pushing expected growth for the index to 12.7%.1 The percentage of companies beating on revenues is lower at 62% and they are only beating by an average of 0.7%, lower than the historical average.2 While it looks like companies have gotten very good at managing margins, investors are likely hoping for earnings that are supported by strong underlying revenues.

Mag 7 Take the Stage

Highly anticipated reports from the Magnificent 7 will be in focus over the next couple of weeks. Tesla, Microsoft and Meta are slated to report Wednesday, January 29 after-the-bell, followed by Apple on Thursday, January 30. The following week, Google is confirmed to report Tuesday, February 4, and Amazon on Thursday, February 6. And as usual, Nvidia will close things out when they report on February 26.

After putting up profit growth north of 35% from Q1 – Q3 2024, Q4 is expected to show a marked slowdown for these seven names. Even so, the blended EPS growth expectation of 21.7% for Q4 is nothing to sneeze at. In fact, if you remove these seven companies, S&P 500 growth for the quarter drops to 9.7%.3

Just as Mag 7 growth looks to begin to slow, other sectors are coming back to life after a lackluster 2023 – 2024. The S&P 500 minus Mag 7 goes from a current expectation of sub-10% EPS growth in Q4 to an anticipated increase of nearly 15% in the back half of 2025.4 Lagging sectors such as Industrials and Materials are expected to pick up in the latter half of the year, partially due to easier YoY comps.

As noted above, expectations remain high for the Magnificent 7 this earnings season. We’ve seen what happens to big tech stocks when results don’t impress. For the Q3 2024 earnings season, despite beating expectations on the top and bottom-line, Meta, Microsoft and Apple, saw their stocks fall when other quarterly metrics or soft guidance disappointed investors.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.5

This week we get results from a number of large companies on major indexes that have pushed their Q4 2024 earnings dates outside of their historical norms. Six companies within the S&P 500 confirmed outlier earnings dates for this week, three which are later than usual and therefore have negative DateBreaks Factors*. Those names are Kimberly-Clark Corp (KMB), Southwest Airlines (LUV), and PPG Industries (PPG). The three names with positive DateBreak Factors are Otis Worldwide (OTIS), Cigna Group (CI) and Chubb Limited (CB).

Southwest Airlines

Company Confirmed Report Date: Thursday, January 30, BMO

Projected Report Date (based on historical data): Thursday, January 23, BMO

DateBreaks Factor: -2*

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Southwest Airlines is set to report their Q4 2024 results on Thursday, January 30, a week later than expected. While they are still adhering to their Thursday reporting trend, they have pushed their report into the 5th week of the year (WOY), after reporting in the 4th WOY for the last two years. This will be the latest LUV has reported for Q4 in ten years.

A variety of factors could be at play in this later reporting date. Despite operational challenges in 2022 (there is literally a Wikipedia page dedicated to this failure, entitled “2022 Southwest Airlines scheduling crisis”) that lead to several cancellations and unhappy customers, Southwest looks to have improved their services. Just last week they were named the second best airline in the US by the Wall Street Journal, after Delta.6

A shake up in IR or CFO leadership can often lead to outlier dates. Earlier this year Southwest announced their long-time CFO, Tammy Romo, will be retiring on April 1 after being with the company nearly 25 years.7 A successor has not yet been announced, but this will be the last quarterly report with Romo at the helm.

Airline results have generally been mixed this season. First out the gate this season was Delta, kicking things off by handily beating sell-side estimates on the top and bottom-line, and with CEO Ed Bastian telling CNBC that 2020 is expected to be the “best financial year in our history.”8 On the other hand, last week you had American Airlines giving lower than expected guidance for Q1 2025. EPS for that company would now show a loss of 20 – 40 cents, vs. the $0.04 expected by sell side analysts.9 On Thursday we’ll see what side Southwest joins.

Q4 Earnings Wave

With the Q4 season getting started a little later this year, the peak weeks are expected to fall between February 3 – 28, with each week expected to see over 1,200 reports. Currently, February 27 is predicted to be the most active day with 872 companies anticipated to report. Thus far, only 53% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

—

Originally Posted January 27, 2025 – Can the Magnificent 7 Maintain an Upbeat Earnings Season

1 Earnings Insight, FactSet, John Butters, January 24, 2025, https://advantage.factset.com

2 Earnings Insight, FactSet, John Butters, January 24, 2025, https://advantage.factset.com

3 Earnings Insight, FactSet, John Butters, January 17, 2025, https://advantage.factset.com

4 Earnings Insight, FactSet, John Butters, January 24, 2025, https://advantage.factset.com

5 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

6 The Best and Worst Airlines of 2024, Wall Street Journal, By Dawn Gilbertson and Allison Pohle, January 21, 2025, https://www.wsj.com

7 Southwest Announces Leadership Changes, January 9, 2025, https://www.southwestairlinesinvestorrelations.com

8 Delta outlook tops estimates as CEO expects 2025 to be airline’s ‘best financial year in our history’, CNBC, Leslie Josephs, January 10, 2025, https://www.cnbc.com

9 American Airlines Fourth Quarter and Full-Year 2024 Financial Results, January 23, 2025, https://americanairlines.gcs-web.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.