Market participants are gearing up for a widely expected pause at this afternoon’s Federal Reserve interest rate decision, but investors are going to be laser focused on the outlook from the central bank. Some of the most pressing issues will include how satisfied the committee is with progress on inflation amidst continued labor market strength. Optimism on Wall Street regarding lighter cost trends and stable labor conditions has led to fixed-income watchers pulling forward the potential for another quarter-point reduction to March, with our marketplace indicating 26% odds of a trim in the first quarter. Meanwhile, Chair Powell is likely to field questions related to the new presidential administration, such as how adversarial policies on trade together with confrontational positions on immigration could threaten a reignition of price pressures. Against this backdrop, however, the White House has been increasingly vocal about the need for lower borrowing costs, setting the stage for a familiar feud between monetary policy officials and the executive branch.

Source: ForecastEx

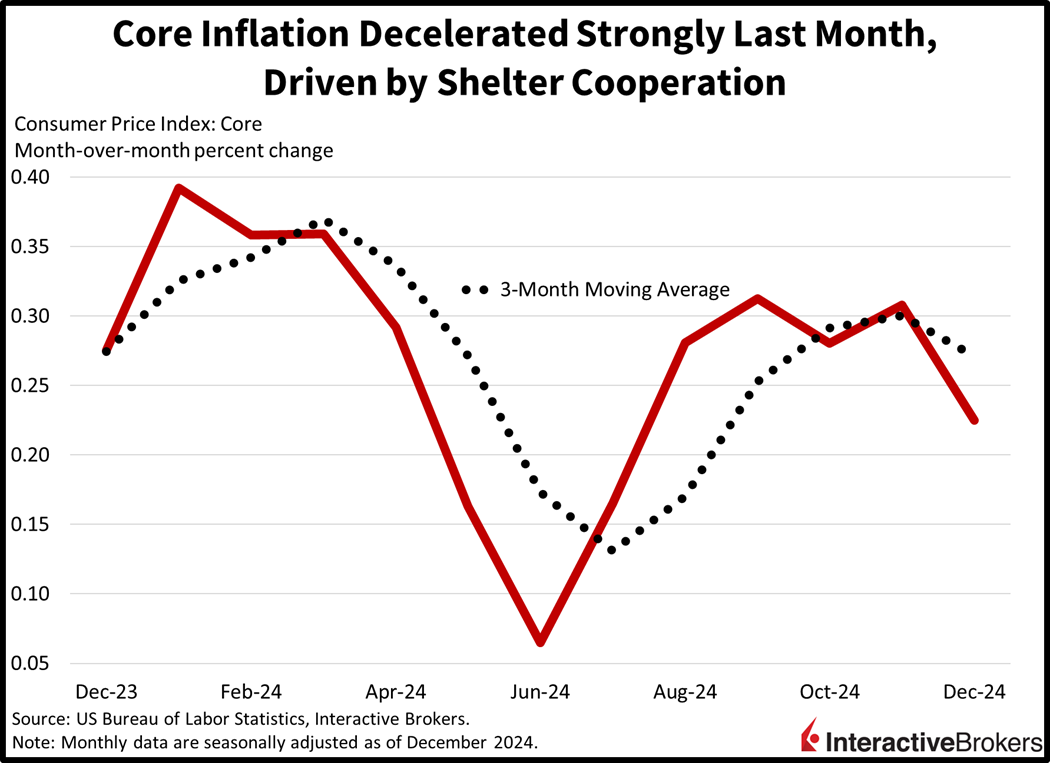

Shelter Prices Have Been Cooperating

Shelter costs declined for the second-consecutive month in December, providing a strong tailwind to the Fed’s inflation battle. And while President Trump’s confrontational stance on immigration risks reigniting wage pressures, it’s also likely to be countered by softening rental demand. Indeed, the downward momentum in housing charges may continue in the coming months against the backdrop of reduced leasing applications. This development can also serve to offset the overall negative impact of the potential for higher goods prices if trade tensions heat up. Nevertheless, the nation has been suffering from a labor shortage for roughly eight years and migrant workers have incrementally served to cushion that blow. Furthermore, compensation trends escalated during Trump 1.0, but shelter costs, goods prices and inflationary trends overall, remained relatively stable.

Gearing Up for Powell & Co.

Clues on the Fed’s balance sheet plans will also be critical this afternoon, with the central bank already trimming its holdings by $2.13 trillion from the peak in April 2022. With the Treasury expected to continue issuing securities to fund the swelling budget deficit, primary dealers are planning on how much government debt they need to absorb. An important question is whether the Fed will turn around and begin adding liquidity to the US Treasury market sometime this year, or will it sit back at a level of assets consistent with ample reserves in the banking system and enable the private sector to achieve price discovery on its own? Moreover, the reverse repo facility is sitting at multi-year lows, pointing to declining excess liquidity on an incremental basis across financials.

Canada Slashes Rates

Ahead of the Fed this afternoon, the Bank of Canada (BoC) this morning reduced its benchmark rate to 3% from 3.25%. But Governor Tiff Macklem pointed to trade risks that would materially test the Canadian economy. The uncertainty led to the BoC pulling forward guidance at this meeting and opening the door for the potential of an extended pause. The institution has reduced borrowing costs by 200 basis points (bps) in roughly nine months and the aggressive accommodation has helped the economy via stronger consumption and housing activity.

Tech Executives Dismiss DeepSeek Threat

In recent earnings reports, tech executives have maintained that the surprising rollout of DeepSeek could increase demand for semiconductors and software. In other sectors, consumers are continuing to drive past coffee shops but are splurging on top-tier wireless phone services. Other quarterly reports point to a strong labor market and the benefits of defense spending. Those are a few points from the following earnings highlights.

- Starbucks (SUBX) faced continuing headwinds during the fourth quarter but still posted revenue and earnings that exceeded Wall Street expectations. The company’s year over year (y/y) decline in earnings per share (EPS) from $0.90 to $0.69 was less than estimates for a quarterly result of $0.67. On the other hand, same-store sales dipped 4% driven by a 6% decrease in traffic. Analysts estimated that traffic would weaken by only 5.5%. The company is upgrading equipment to shorten wait times, scaling back its menu and developing a new algorithm to help employees better manage mobile and in-store orders.

- T-Mobile (TMAUS) posted strong quarterly results shortly after Verizon Communications (VZ) and AT&T (T) reported better-than-anticipated metrics. T-Mobile’s earnings and revenue were better than expected and the company secured 428,000 net new high-speed internet customers and 903,000 net postpaid phone customers, beating expectations for only 402,000 and 858,500. Additionally, its full-year guidance for adding new customers is double what Wall Street anticipated. T-Mobile says most of its growth is occurring with its top-tier offerings that include subscriptions to Netflix and Apple TV.

- ASML (ASML) said net bookings, a popular metric for measuring demand, jumped 169% quarter over quarter and it posted earnings and revenue that surpassed the analyst forecasts. The Dutch provider of semiconductor equipment believes the launch of DeepSeek, a low-cost AI platform in China, is likely to increase demand for semiconductors, says EO Christophe Fouquet. Earlier this week, prices of semiconductor company shares fell dramatically in response to the DeepSeek announcement with investors fearing that platform would curtail demand for computer equipment.

- SAP (SAP) CFO Dominik Asam, while discussing earnings with CNBC, said he believes DeepSeek will increase demand for the company’s software products. During the recent quarter, both top- and bottom-line results beat analysts’ estimates and the company upgraded its full-year operating profit guidance from 10.3 billion euros to 10.6 billion euros. SAP expects revenue growth for its cloud computing products to accelerate.

- Automatic Data Processing (ADP) reported that strong demand from small and medium-size businesses combined with stable employment and low numbers of layoff contributed to the company generating revenue and earnings that surpassed investors’ outlook. The company’s fiscal second-quarter EPS and revenue headed north 10.3% and 8% y/y.

- General Dynamics’ (GD) revenue and EPS grew from $11.67 billion and $3.64 to $13.34 billion and $4.15, with the former exceeding estimates but the latter falling short of expectations. former both metrics better than forecast. While fourth-quarter revenue for the company’s aerospace segment, which includes Gulfstream jets, missed the company’s guidance, defense contracting exceeded General Dynamics’ outlook.

Aussie Inflation Comes in Lighter

Australia’s fourth-quarter Consumer Price Index climbed 0.2% quarter over quarter, matching the pace of the preceding three-month period and lower than the 0.3% forecast by economists. The country’s trimmed CPI, which excludes items with the largest price swings increased by 0.5%, lower than the forecasted rate of 0.6%. The headline annual rate dropped from 2.8% y/y to 2.4% while the trimmed benchmark moved from 3.6% y/y to 3.3%. Both results were lower than expected. On a y/y basis, electricity and automotive fuel price declines were among the most significant contributors to the lower inflation.

Japan Confidence Falls Further

Japan’s Consumer Confidence Index in January dropped from 36.2 in December to 35.2. Both consumers’ views of overall livelihood and willingness to buy durable goods weakened. Additionally, employment and income growth results also fell.

Markets Meander Before Powell Presentation

Asset prices are tilted marginally to the downside as strategists and economists alike await big news from the Fed this afternoon. Equities and bonds are trading lower, while the greenback is higher and commodities are mixed. For stocks, the Nasdaq 100 and S&P 500 benchmarks are down 0.4% each while the Dow Jones Industrial and Russell 2000 indices are near their respective flatlines. Sector breadth is strongly positive, however, with 8 of the 11 major segments trading north and led by communication services, consumer staples and utilities; they’re all up 0.5%. The laggards, meanwhile, are represented by technology, real estate and health care; those components are losing 1.1%, 0.5% and 0.2% on the session. Treasurys are down modestly, with the 2- and 10- year maturities trading at 4.21% and 4.54%, 2 and 1 bp heavier. Loftier borrowing costs are leading to a US dollar bid, with its index up 6 bps as the greenback appreciates relative to most of its major counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders. At the same time, it is depreciating against the yen. Commodities are mixed as gains of 1.4%, 1.3% and 1% across silver, copper and lumber are offset by losses of 1.1% and 0.5% in crude oil and gold. WTI crude is trading at $73.05 per barrel as stateside inventories jumped well in excess of expectations, according to this morning’s Energy Information Administration report.

Powell Will Emphasize Fed Independence

Fed Chair Jerome Powell is likely to strike a cautious tone on the central bank’s outlook considering that President Trump’s policies are clouding the path for monetary policy. I’m expecting him to repeat that the institution is independent of political pressures and is going to make decisions meeting by meeting against the backdrop of incoming data. While projections aren’t due this meeting, they’ll get updated at the March gathering. I’m expecting to hear that forecasts of the neutral rate continue moving higher. My estimate is currently at 3.75% for the neutral rate considering that this economy has consistently posted terrific activity and employment figures despite fed funds carrying handles of 4 and 5. Furthermore, the long end of the curve has been yelling that the US central bank doesn’t have much more room to cut, because inflation, growth and term premiums would flare up as a result. Finally, the 40-year rally in bonds ended with COVID-19, and the next four decades will provide monetary and fiscal authorities with challenges that are much different than the last.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.