1/ New Highs are On the Rise

2/ Laggards Play Catch Up

3/ Betting Big on Biotech

4/ Retail’s Ready to Move

5/ Retail’s Ready to Move

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

New Highs are On the Rise

The bulls were on parade this week after a decisive election result, and an additional interest rate cut helped drive investors further out on the risk curve.

Courtesy of Optuma

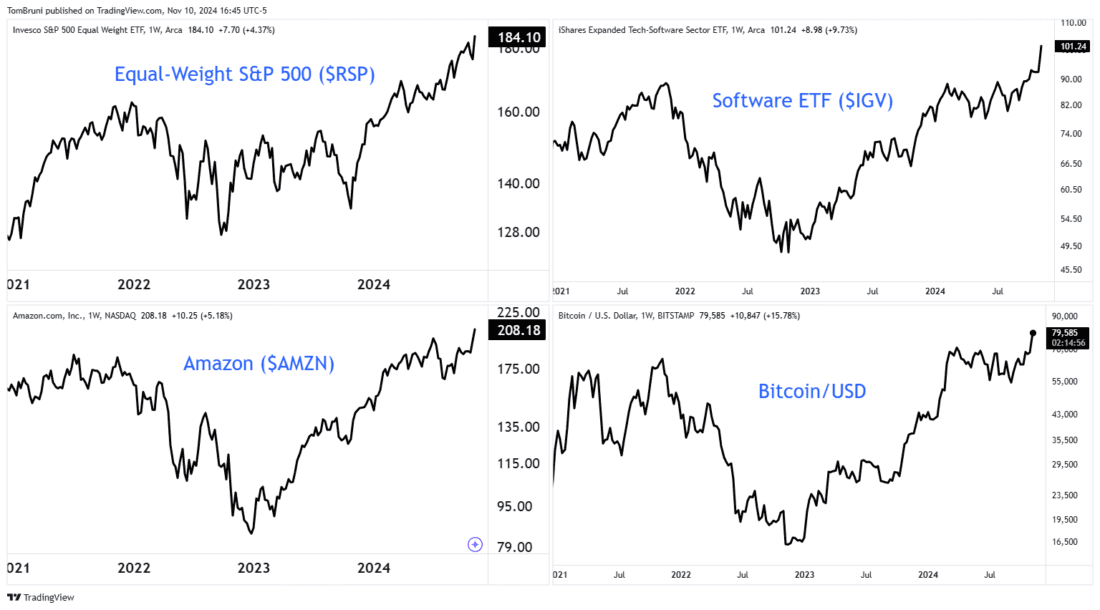

Strength in risk assets remains broad-based. At the index level, the equal-weight S&P 500 is making new all-time highs alongside the market-cap-weighted indexes to confirm the recent breadth thrusts.

The technology sector’s rally continues to broaden out, with the software ($IGV), cybersecurity ($HACK), and other sub-sector ETFs breaking out to new all-time highs. Magnificent Seven performance is also broadening beyond Nvidia, with Amazon joining the party after upbeat earnings and Jeff Bezos’ selling spree ending. And finally, crypto is going $BONK-ers as Bitcoin hits a new all-time high after seven months of consolidation.

As technical analysts, a rise in new highs is a positive sign for the bull market in the long term, even if some price moves are a bit extended in the near term.

2/

Laggards Play Catch Up

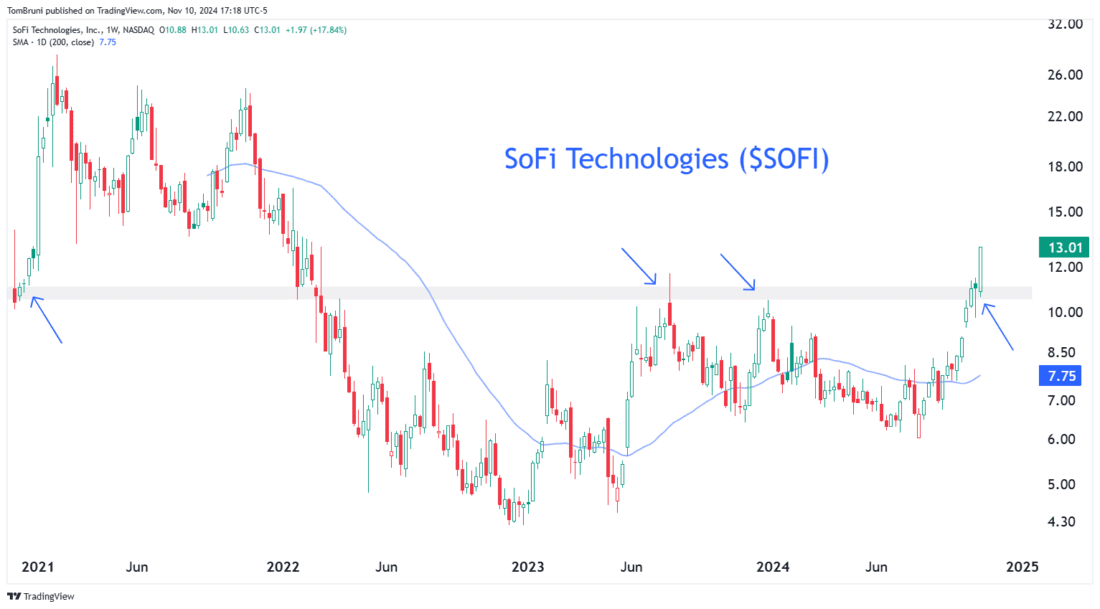

While the new all-time highs list is getting all the attention, many popular stocks are also making multi-year highs as investors bet on them playing catch up.

SoFi Technologies is a great example of this in action, with the company’s fundamentals gaining momentum and helping push prices above long-term resistance. Recently, the stock cleared the $10-$11 resistance level where it came public. Meanwhile, other beaten-down stocks like Upstart rose sharply this week as investors look for the next Carvana-like move.

Courtesy of Optuma

As for retail investors and traders on Stocktwits, there’s been a major uptick in activity and overall bullishness surrounding these stocks for much of the last year. And these recent breakouts have turned that sentiment into overdrive.

3/

Betting Big on Biotech

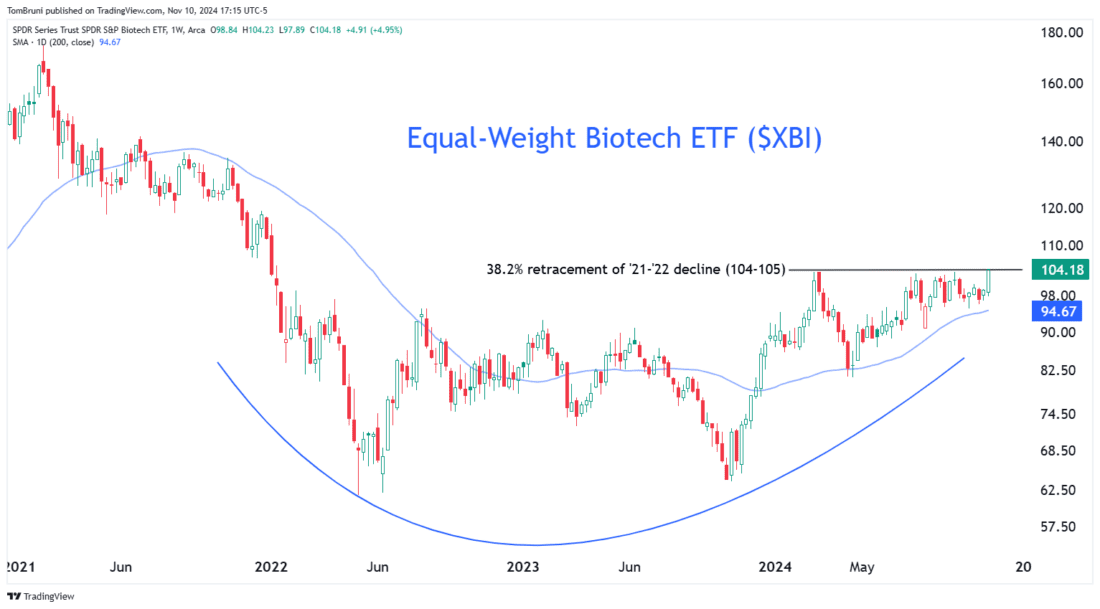

Speaking of catch-up plays in the market, one of the areas retail investors and traders are focused on is the biotech industry. The equal-weight biotech ETF ($XBI) has been firtling with a breakout from a 3-year base for much of 2024, and bulls are betting on new highs coming soon.

Courtesy of Optuma

Notably, retail investors and traders on Stocktwits are showing ‘extremely bullish’ sentiment toward this sector amid a sharp increase in message activity. If this breakout is successful, this industry group will be a major focus area for retail headed into year-end and 2025.

4/

Retail’s Ready to Move

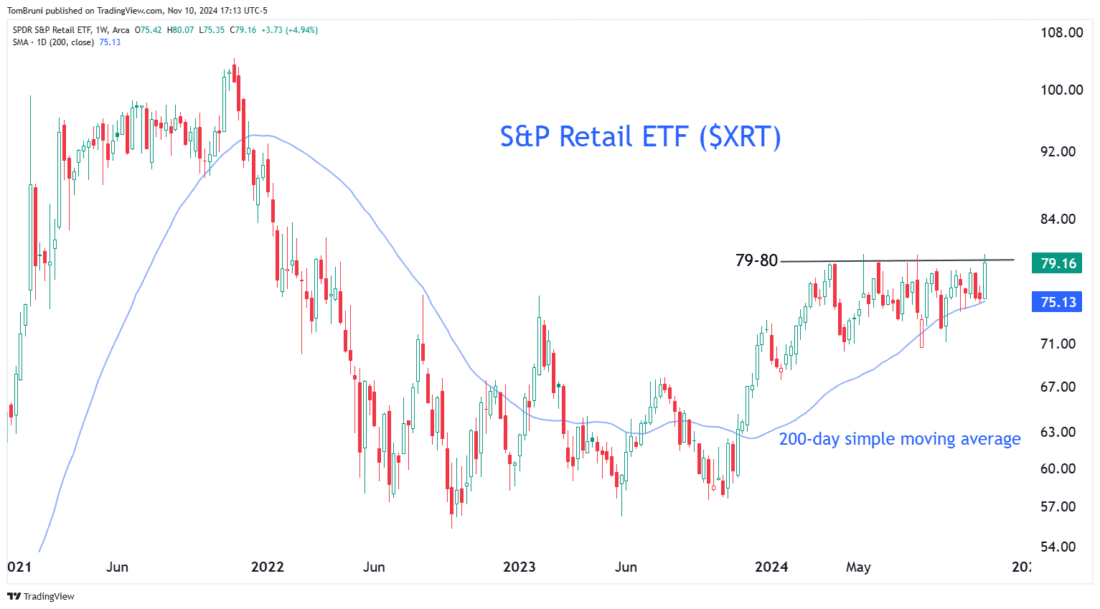

Another area retail investors and traders on Stocktwits are looking to play catch up is the retail sector ETF ($XRT).

Like biotech, it’s spent much of the last seven months consolidating in a tight range and is now test resistance again. A close above the 79-80 region would confirm a breakout, with a rising 200-day moving average providing some support underneath.

Courtesy of Optuma

5/

Crypto Goes $BONK-ers

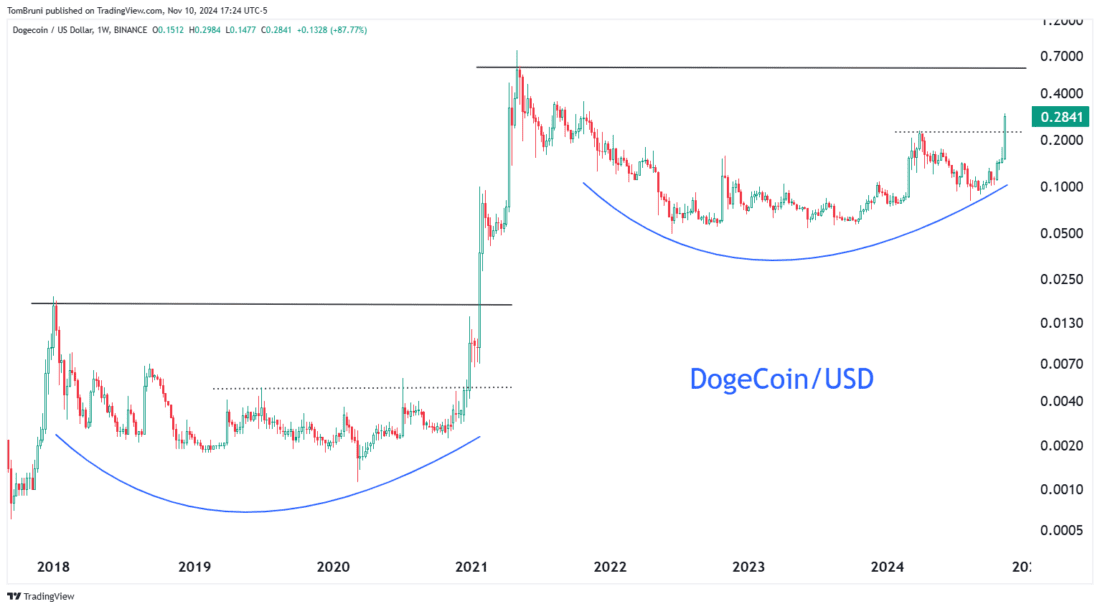

Finally, since it’s a bull market in risk assets, we have to talk about the craziness occurring in crypto. While Bitcoin reaches new all-time highs, some altcoins (and meme coins) are experiencing massive moves of their own.

Below is a long-term weekly chart of DogeCoin showing what happened last time this asset completed a multi-year base like it is currently. At the very least, many expect this recent run to drive prices back to their 2021 highs, which would still be roughly 200% from current levels.

Courtesy of Optuma

As for the Stocktwits community, our trending and most active tickers list on the site has been dominated by altcoins like BONK coin. Believe in the comeback or not, retail investors and traders have significant risk appetite right now, and it’s very clear where their attention is focused in crypto.

—-

Originally posted 11th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.