1/ Looking Opportunities for Alpha Generation Through Quadrant Crossovers

2/ Multi-month Breakout in CI

3/ ORCL Staring at a Meaningful Upmove

4/ Promising Setup in ACGL

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

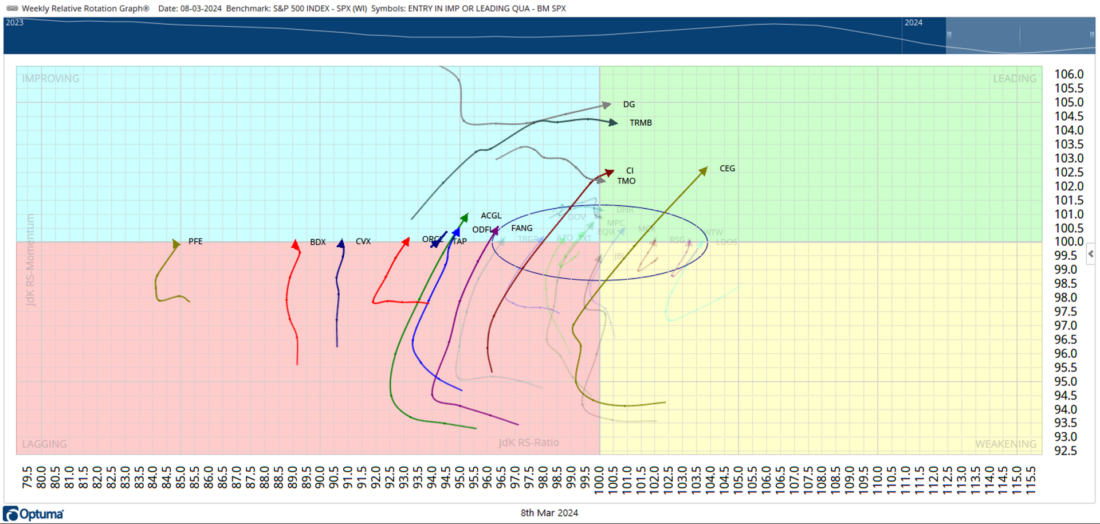

1/ Looking Opportunities for Alpha Generation Through Quadrant Crossovers

RRG Quadrant crossovers provide an important insight when one is looking for the presence of Relative Strength. It helps us find those stocks where when coupled with good chart setups, one can find alpha-generating opportunities. In the above chart, we scan for Quadrant Crossovers. To find incremental alpha, we have further filtered the scan results by 1.0 standard deviation. As a rule of thumb, the larger the distance of the stock from the center, the greater the alpha it is likely to generate. Out of these many candidates, we pick up three stocks that show a good technical setup on the charts. With just one day to go before the week ends, this setup is very less likely to change.

2/ Multi-month Breakout in CI

The high of 340 that was first tested in December 2022 is being tested again. CI marked a classical double top resistance earlier this year. After a brief consolidation, the stock is staring at a potential breakout. While tracking the upper band, the prices are seen inching higher, it has closed a notch above the crucial resistance point on Thursday. The RS line against the broader S&P500 index is inching higher; it has crossed above the 50-period MA. If the breakout happens on the anticipated lines, the stock can go on and test 365-390 levels over the coming weeks.

3/ ORCL Staring At a Meaningful Upmove

The price action in ORCL over the past five months has led to the formation of a symmetrical triangle on the charts. Though symmetrical triangles are neutral formations, most of the time they end up acting as continuation patterns which generally resolve with a continuation of the prior trend. Though price confirmation is always required, a few signs appear that shows that the stock is likely to resume its upmove. The RRG has seen a quadrant crossover; the stock has rolled inside the improving quadrant of the RRG which is a sign of a potential beginning of a phase of its relative outperformance. While the stock stays in this formation, it has consistently taken support on its 50-period MA which is seen almost acting as its proxy trend line. OBV hovers near its high point.

4/ Promising Setup in ACGL

While some brief consolidation cannot be ruled out, ACGL too is staring at a fresh breakout. This stock has largely stayed in an uptrend; intermittent corrective retracements have found support at its 50-, and 100-week MA. Recently, the stock saw a strong rebound from its 50-week MA and is seen testing the prior highs. This stock has also rolled inside the improving quadrant of the RRG. This indicates the beginning of the relative performance of the stock against the broader markets. While the actual price breakout is yet to take place, OBV has already made a new high indicating strong accumulation and participation of volumes in the move. An expected resolution of the current setup has the potential to take the stock higher towards 93 and 96 levels over the coming weeks.

———

Originally posted on March 8th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.