From SIA Charts

1/ Docusign Inc. (DOCU)

2/ Candlestick Chart

3/ Point and Figure Chart

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Docusign Inc. (DOCU)

Courtesy of SIA Charts

From the company that brought e-signatures, DocuSign Inc. is now at the forefront of another leading solution called Intelligent Agreement Management. This solution leverages the power of AI to extract value from the otherwise trapped information buried within corporate agreements, which Deloitte estimates costs US$2 trillion in global economic value each year. While every organization depends on agreements for many vital day-to-day activities, the processes that manage them are slow, manual, and error-prone, leaving critical business data trapped. DocuSign is addressing this global challenge. Given the massive pullback in the share price of DOCU over the past several years and the SIA’s detection of growing relative strength, SIA practitioners might wish to revisit the stock with fresh eyes. In 2021, DocuSign was a market favorite as the company experienced rapid growth due to the rise of remote work during the pandemic. However, in late 2021, after reporting its sixth straight period of revenue growth of over 40%, DocuSign warned that upcoming quarters might show only around 30%. After being bid up to lofty levels during the COVID work-from-home mandates, the shares were vulnerable to even slight disappointments. The shares then gapped down massively, with a one-day drop on December 1, 2021, of over 40%.

2/

Candlestick Chart

In the first attached daily candlestick chart, this gap down is visible on the far left of the chart, just below the red circle, which outlines the red candles that illustrate the position of DOCU shares within the SIA Russell 1000 Index Report prior to the massive selloff. According to SIA’s rules-based methodology, owning these shares would have been avoided, as only stocks in the upper zones of the SIA Reports are favored, while those in the Unfavored Red Zone, such as DOCU at the time, are avoided. The chart also shows the retracement of the share price into 2022, followed by a multi-year consolidation. However, last month, the shares appear to have perked up. The now-favored position of the shares within the SIA Russell 1000 Index Report is highlighted (see green circle), along with a full list of all reports where DOCU shares are a member. These reports show that DOCU shares are highly ranked and positioned in the Favored Green zones across all these reports.

The candlestick chart also features a rectangle red zone of resistance added to the lower level of the gap down, as this level may prompt sellers who were trapped during the selloff to exit their positions after being underwater for several years.

Courtesy of SIA Charts

3/

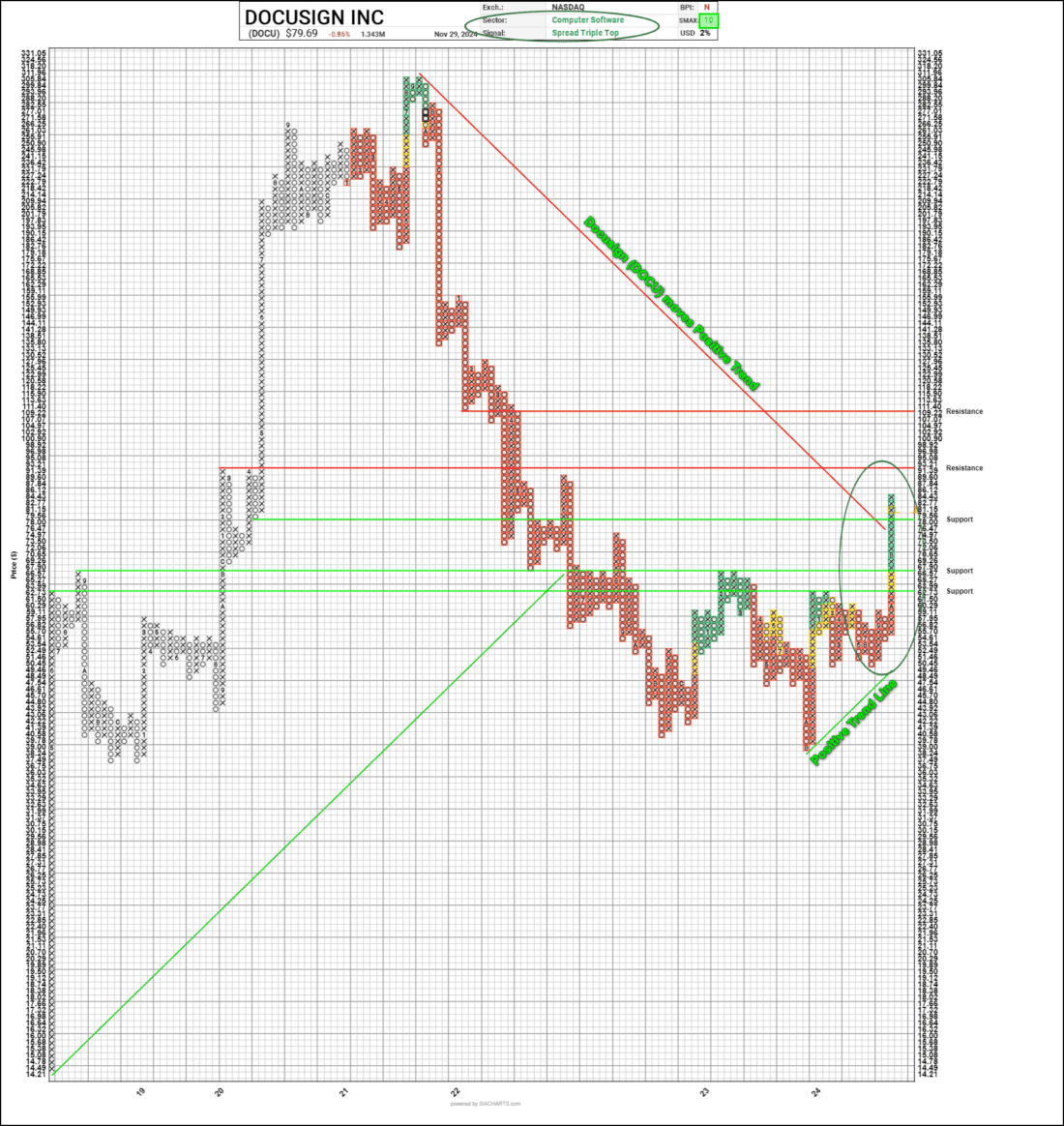

Point and Figure Chart

The final chart attached presents a point-and-figure chart of DOCU, highlighting several important data points, such as support and resistance levels and trend lines. Note the red negative trend line, which has recently been broken by the rally past $80. Support levels begin at $78.00 (3-box reversal level), followed by $66.57 and $62.73. Resistance now stands at $93.21, with upper resistance at $111.40. Engaged on the chart is DOCU’s matrix position within the SIA Russell 1000 Index Report, which has moved to the favored green zone this past month. Additionally, DocuSign is a member of the Favored Computer Software sector and has a perfect SMAX score of 10 out of 10, further underscoring its potential for near-term outperformance compared to other asset classes.

Courtesy of SIA Charts

—

Originally posted 3rd December 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.