1/ Oracle Lift Off

2/ GOOGL Breaks out

3/ AI Component Stocks Lead market

4/ Google Bases Calmly

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

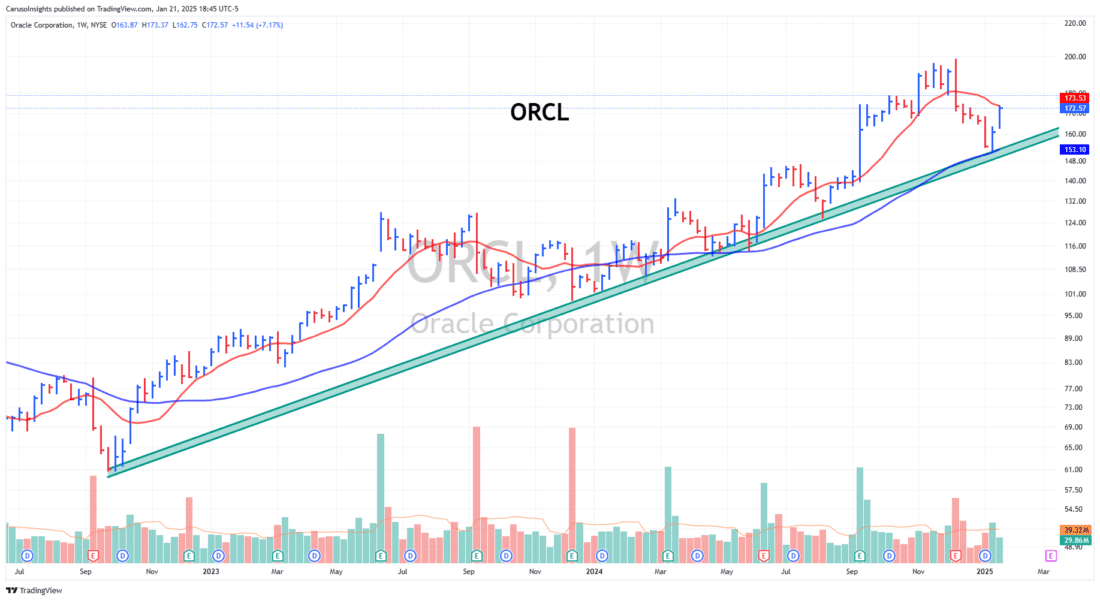

Oracle Lift Off

The AI revolution gained momentum with after-hours news that OpenAI, SoftBank, and Oracle ($ORCL) are planning a joint venture called “Stargate” to develop new AI infrastructure in the U.S., committing $500 billion over the next four years.

This groundbreaking announcement reinforces the importance of AI infrastructure stocks, including ORCL. After climbing in after-hours trading, ORCL is set to open back above its 50-day moving average. The recent market pullback has allowed ORCL to build a solid base and pull back to its long-term uptrend line. This positions the stock with substantial upside potential, supported by a strong news-driven catalyst.

AI infrastructure remains a critical focus area, with ORCL poised to benefit significantly in this developing bull market.

2/

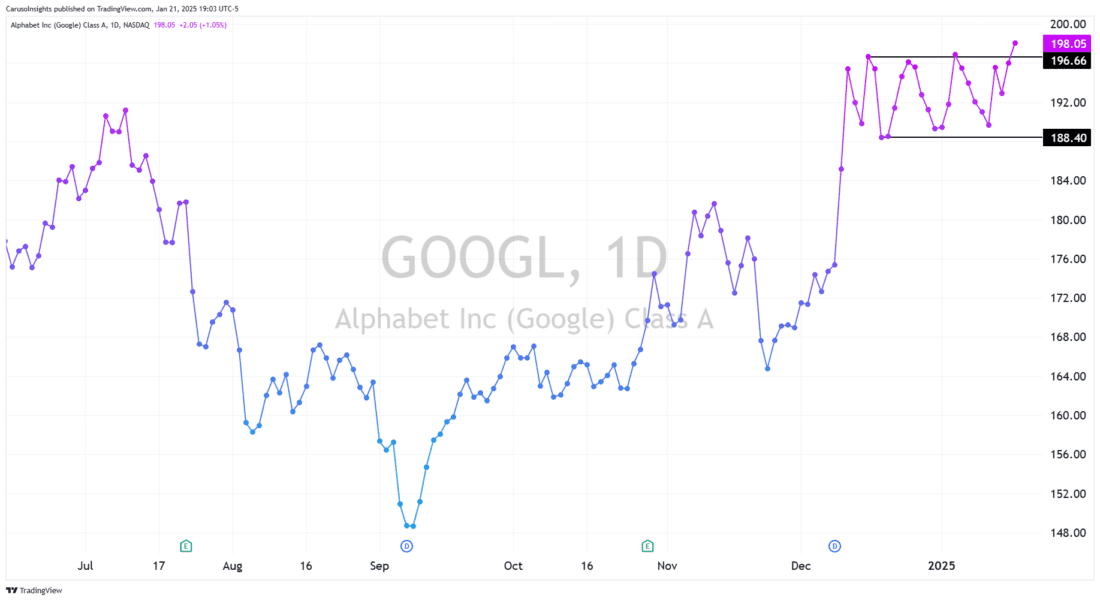

GOOGL Breaks out

As discussed yesterday, GOOGL has spent the past month oscillating sideways amidst a market-wide pullback. Today, GOOGL staged a breakout on a closing basis. Continued progress in the coming days and an ability to hold above its basing range will likely confirm that GOOGL is resuming its uptrend. It’s important to remember that GOOGL is uniquely positioned in three critical tech revolutions: General AI, Autonomous Vehicles, and Quantum Computing. Few companies have the breadth and depth of exposure to these transformative areas, making GOOGL a standout as these technologies shape the future.

3/

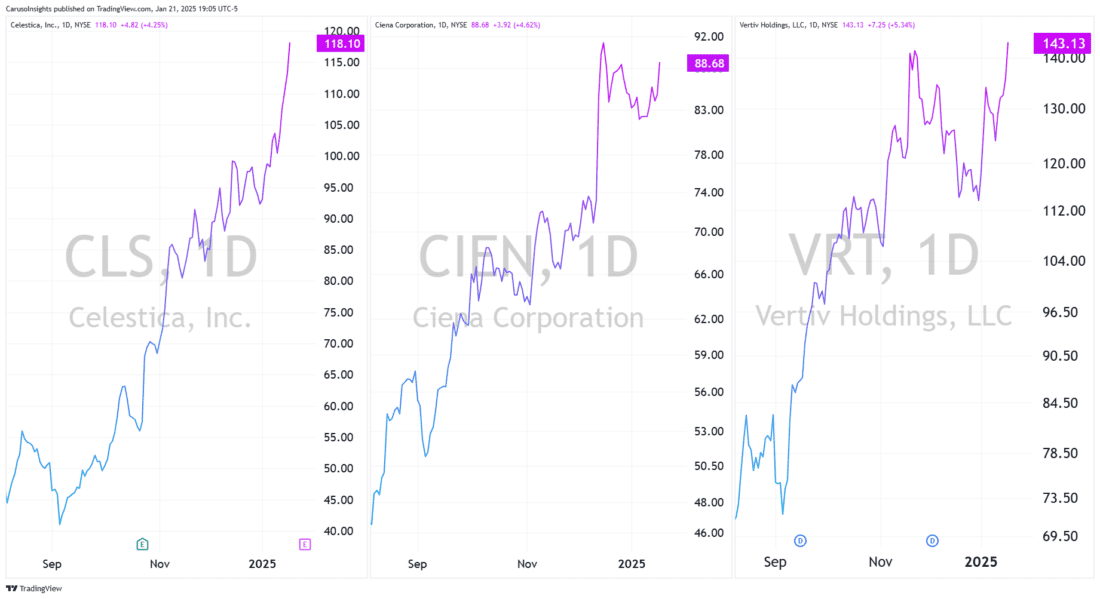

AI Component Stocks Lead market

While large-cap tech often grabs the spotlight, some of the most leveraged exposure to the AI boom lies with data center component companies. These include Celestica (CLS), Ciena (CIEN), and VRT Holdings (VRT)—all current market leaders, alongside the energy infrastructure group highlighted yesterday. Today’s “Stargate” news further boosted these stocks in after-hours trading.

Leading stocks share two key traits: 1) They outperform the market during upswings, and 2) they decline less than the market during pullbacks. These three names meet those criteria and continue to demonstrate significant upside potential as AI infrastructure development accelerates.

4/

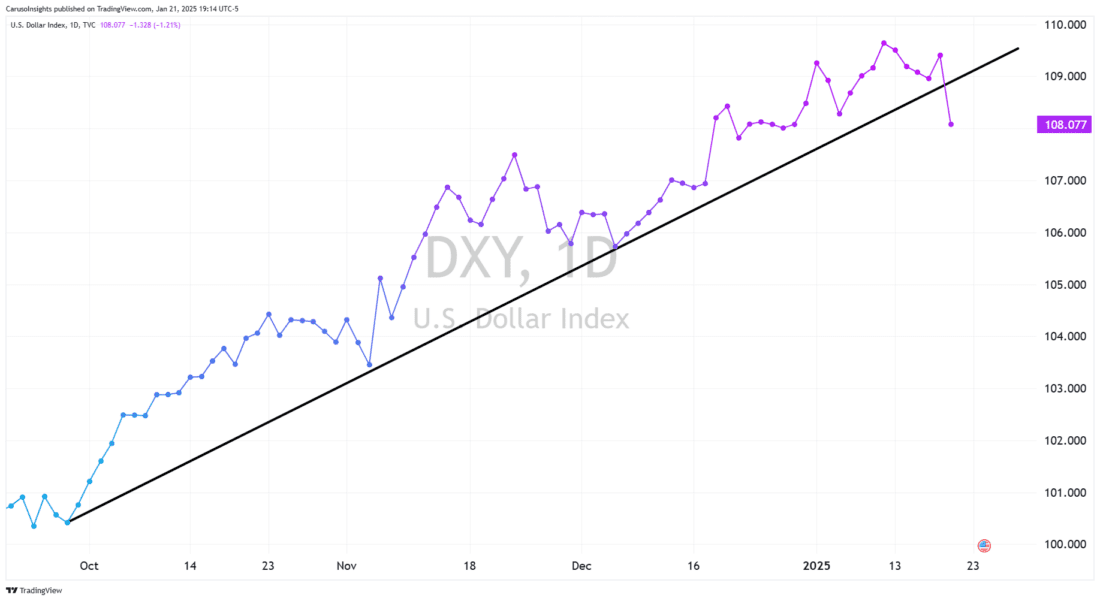

Dollar has “Unexpected” Downside Break

With much talk of tariffs swirling following President Trump’s re-election, the dollar has been in a multi-month uptrend. However, as he takes office, initial plans appear to focus more on growth, with a slightly more agreeable tone toward negotiating bilateral trade agreements. This softening stance has led to a breakdown in the dollar’s recent trend.

—

Originally posted 22nd January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.