By Todd Stankiewicz CMT, CFP, ChFC

1/ Is the Market Rotating?

2/ International May be the Hidden Opportunity

3/ S&P 500 is Overbought

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Is the Market Rotating?

Relative Rotation Graphs (RRG) are a great way to quickly gauge how different asset classes are performing relative to a benchmark, in this case, the Vanguard Balanced Index Fund. One key takeaway from this chart? Leadership relative to a balanced portfolio may be shifting away from stocks and Bitcoin and toward commodities.

Just like we talked about yesterday, commodities are breaking out. Could this be another sign that inflation is making a comeback? Or at the very least, does it suggest that some investors are starting to hedge against inflation with increased commodities exposure?

The takeaway for portfolios: it may be time to think about diversifying across multiple asset classes.

2/

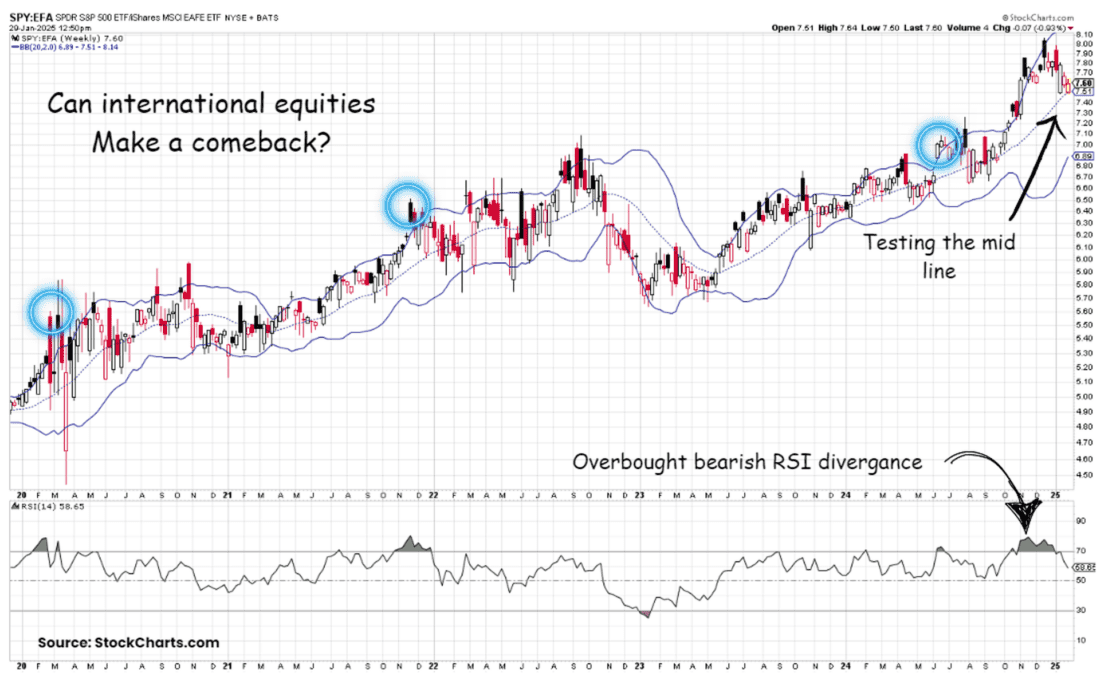

International May be the Hidden Opportunity

Just as most investors are writing off international equities, or really, anything that isn’t a U.S. equity index, it might be time to start paying attention. The relative performance of the S&P 500 versus the MSCI EAFE Index has pushed deep into RSI overbought territory, and there’s a bearish divergence showing up.

Now, the ratio has pulled back to the Bollinger Band midline. That suggests some short-term leadership for international equities relative to U.S. markets. If this ratio breaks below the midline, we could see a real shift in market leadership, with international equities taking the lead over domestic market-cap-weighted indices.

Once again, the theme remains the same: diversification matters.

3/

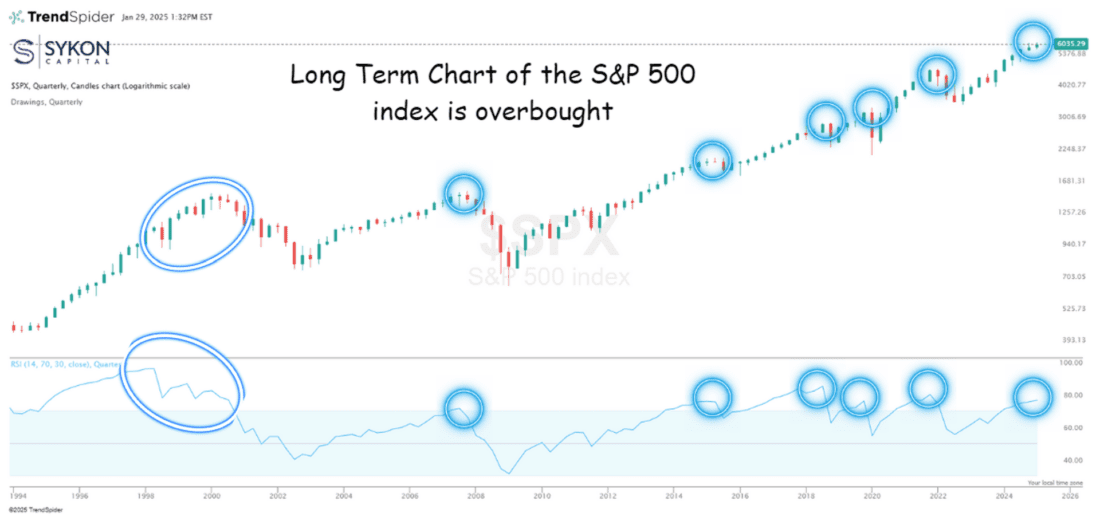

S&P 500 is Overbought

The S&P 500 is still in a strong uptrend, but it’s worth noting that the Relative Strength Index (RSI) on the quarterly chart has pushed into overbought territory. At the close of 2024, the RSI reading was 75.48, well above the 70 threshold.

Historically, similar readings have preceded market sell-offs. Some of these have led to prolonged drawdowns, like the dot-com bubble burst or the financial crisis, while others, like the pandemic selloff and the 2022 pullback, were shorter-lived.

While it’s tough to predict the magnitude of any potential decline, one thing seems likely: volatility may be set to pick up from here. Keep an eye on that middle Bollinger Band level I spoke about earlier this week.

Disclaimer: Advisory Services offered through Sykon Capital, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.

—

Originally posted 30th January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.