1/ Junk Bonds Indicate Investor Confidence

2/ Oversold Breadth to Support Broad Bull Market

3/ Energy Infrastructure is the “AI” Leader

4/ Google Bases Calmly

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

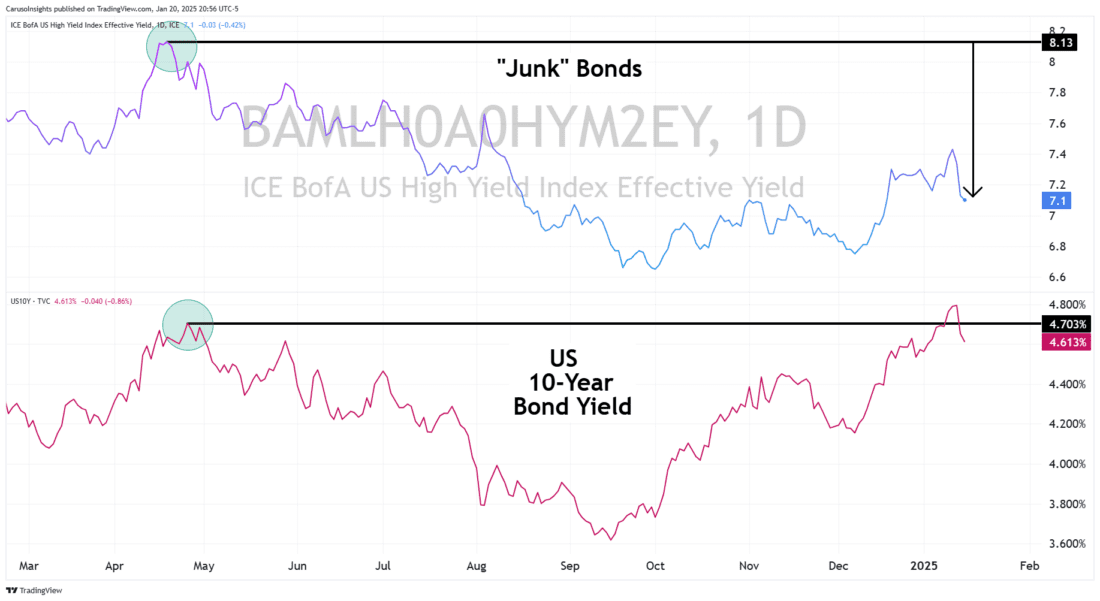

Junk Bonds Indicate Investor Confidence

Despite the volatility in equity indexes, the bond market reflects substantial investor confidence. Rapidly climbing U.S. 10-year yields have pressured broad equity indexes into correction territory. However, interest rates on high-yield or “junk” bonds have not risen nearly as sharply as government bond yields. While the U.S. 10-year yield has surpassed its 2024 peak, junk bond yields remain significantly lower. This suggests that the rise in yields is driven primarily by rate considerations, with risk concerns actually diminishing. Since bonds are typically the less emotionally driven market, this drop in risk concerns, as indicated by bond performance, provides a very bullish outlook for equities.

2/

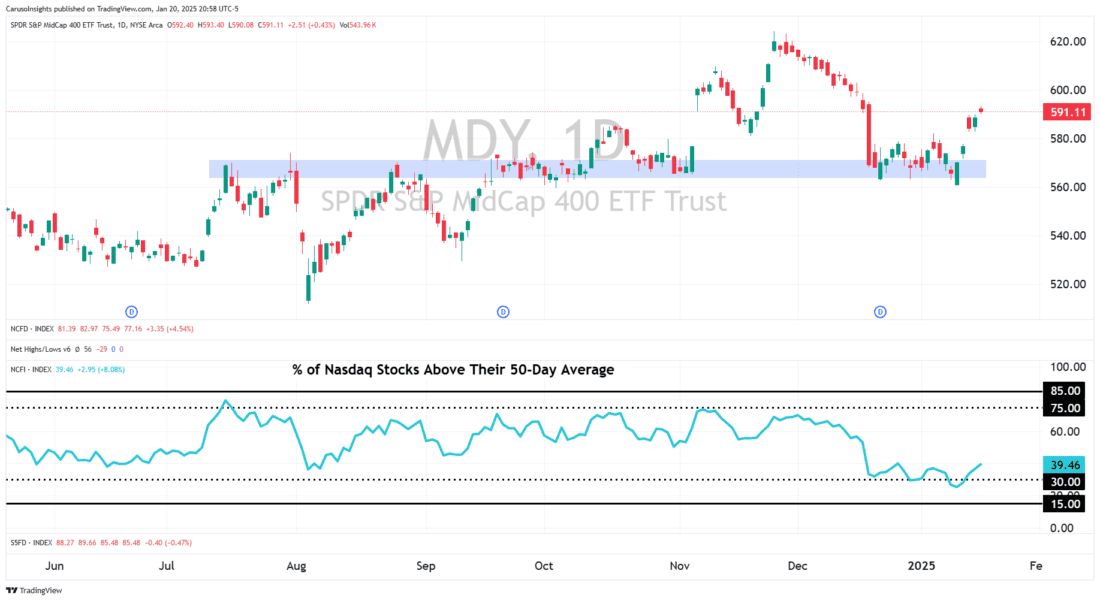

Oversold Breadth to Support Broad Bull Market

The sharp, interest rate-driven market correction was widespread, with the majority of Nasdaq-listed stocks falling below their respective 50-day moving averages (the blue indicator). Historically, when 30% or fewer stocks trade above their 50-day moving averages, the market often sets the stage for a multi-week, broad-based rally. Last week, we saw the initial signs of such a recovery, as stocks climbed nearly 5% over just a few trading sessions.

This renewed strength coincided with breadth reaching oversold levels and the MidCap index retesting a key multi-month support level—creating a strong foundation for a potential rally to gain momentum.

3/

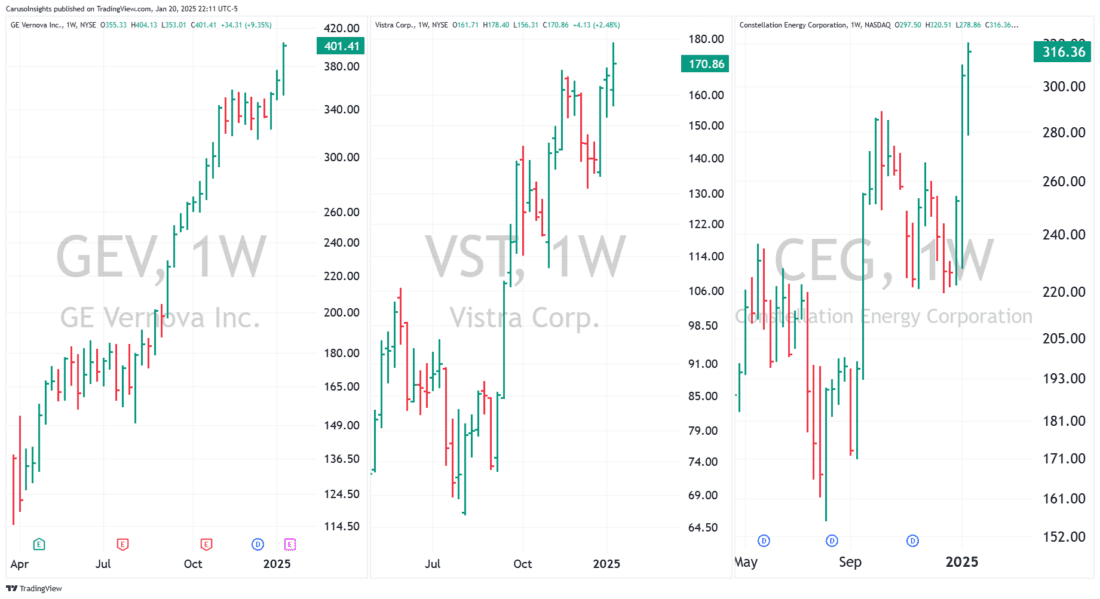

Energy Infrastructure is the “AI” Leader

Positioning in the leading stocks of any rally is critical to achieving significant outperformance—just look at NVDA since the start of the AI revolution. Currently, energy supply has become a critical bottleneck in future AI growth plans, with even former President Trump highlighting its importance as a vital area of focus.

GEV, VST, and CEG are three leaders in the AI infrastructure space, demonstrating tremendous relative strength. All three resisted the worst of the December correction and have already surged to new highs, signaling intense institutional accumulation. Note: GEV reports Wednesday before the bell.

4/

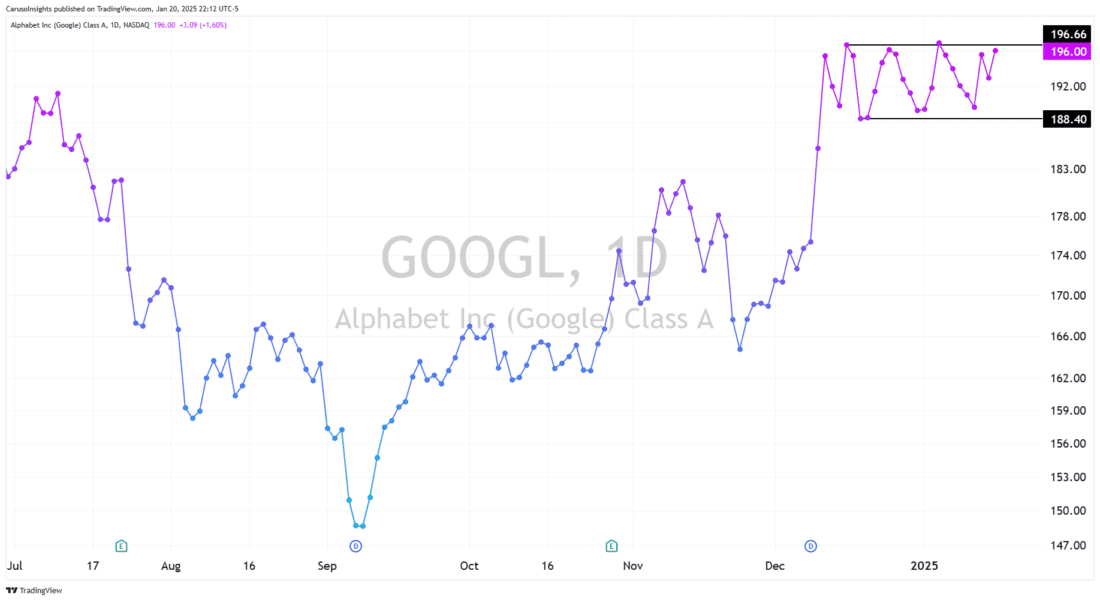

Google Bases Calmly

Of the “MAG 7,” only GOOGL has its hand in every major technological innovation currently unfolding. It leads in general AI with its Gemini platform, is a front-runner in autonomous driving with its Waymo division, and recently shocked the world with its Willow Quantum computer—a groundbreaking leap in computing power.

GOOGL also demonstrated remarkable resilience during the December selloff, maintaining its position near highs while forming a tightly constructed flat base, signaling strong institutional support.

—

Originally posted 21st January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.