By Brian Joyce, From Nasdaq

Nasdaq MID: Extreme Bifurcation Ahead of today’s FOMC +++ Charts and Tables

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Nasdaq MID: Extreme Bifurcation Ahead of today’s FOMC +++ Charts and Tables

Ahead of today’s FOMC, markets have 99% confidence the Fed will cut the FFR by 25bps. The uncertainty/risk to equities is whether or not the messaging and DOT plots will be interpreted as a “hawkish hike” due in part to the recent firming of inflation data. For 2025 markets are pricing between three and four 25bp rate cuts.

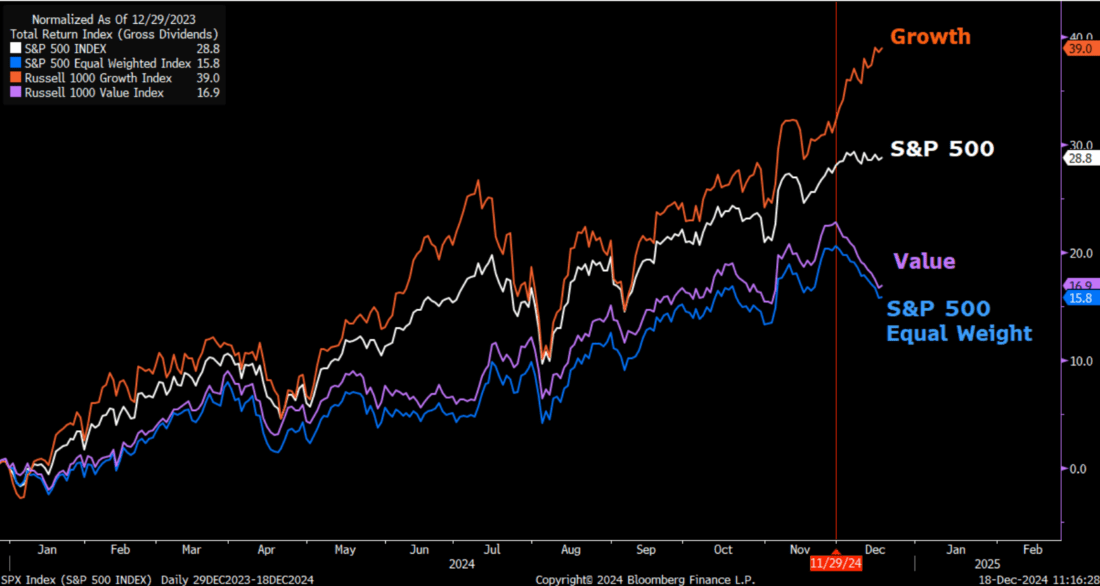

The stock market is near cementing a 2nd consecutive year of robust gains, the magnitude of which hasn’t been seen since the late 1990’s.

The S&P 500 gained +26.3% in 2023 and through the end of November rose another 28.1% in 2024.

The last time the flagship index had consecutive years of 20%+ gains was 1997 – 1999 (1997 +33.3%; 1998 +28.6%; 1999 +21%).

While the Nasdaq 100 and S&P 500 have reached new highs here in December, the breadth of the participation has been weak … which is not surprising. In my prior two updates (12/4 and 11/25) I noted the following:

12/4/24 “November Review & Outlook” email: “While new all-time highs were reached across a broad range of indices (Nasdaq 100; S&P 500; S&P MIDCAP 400; Russell 2000) reflecting healthy, broad participation, I suspect select industries, if not the broader averages, could be (over)due for a period of “healthy consolidation” following the steep uptrend over the prior two years.”

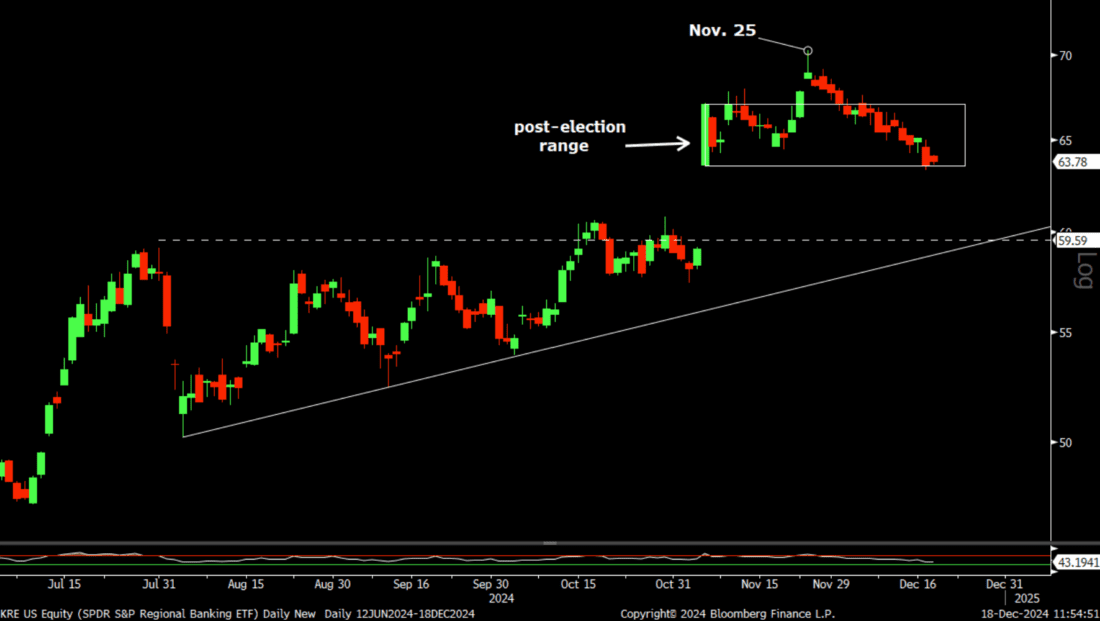

11/25/24 “Noteworthy Charts on Banks, Rates, Oil, & Transports” email: “At today’s intra-day high, the KRX Index came within 0.5% of its prior cycle highs previously set in January 2022. Momentum measures are already in overbought territory. From a technical perspective, when a security approaches an expected level of near term resistance with overbought momentum measures, it usually is a location where one can expect a period of near term consolidation (corrective price action either sideways over time or backwards in price) until momentum measures reset to more normalized levels.”

This day marked the YTD high for the KRX (+28.2%) after which it retraced 7.7% through yesterday’s close.

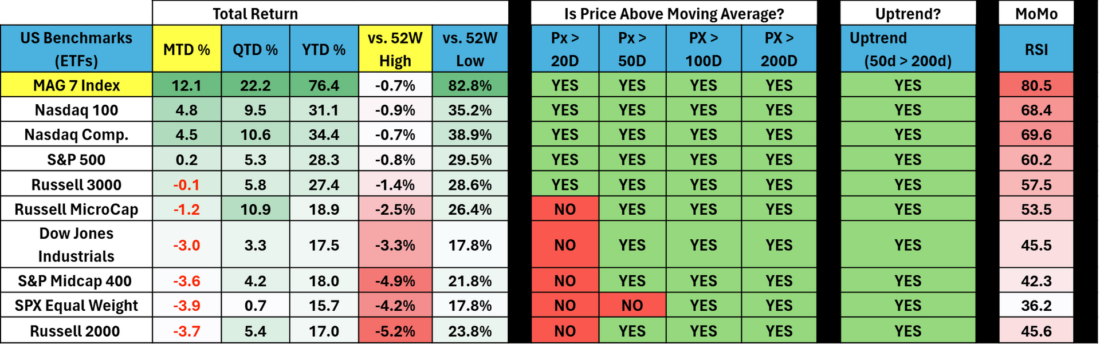

December Market Performance: the Nasdaq 100 (+4.8% MTD) and S&P 500 (+0.2% MTD) are higher this month due in large part to the mega-cap members of the Magnificent 7 Index (+12.1%MTD). The remaining major indices are in the red MTD. A few “factoids” which exemplify the extreme bifurcation in market performance so far in December:

The S&P 500 (+0.2%) is outperforming the S&P 500 equal weight index (-4%) by 4.2% MTD, which is the 5th largest monthly outperformance since the inception of the equal weight index in 1990 (sample 421).

The Russell 1000 Growth index (+4.7%) is outperforming the Russell 1000 Value Index (-5.2%) by 9.8% MTD, which is the 4th largest monthly outperformance since their inception in 1978 (sample 553).

The Dow Jones Industrials declined in each of the prior nine sessions which has not happened since January 1984.

The Russell 1000 Value Index has declined in 12 consecutive sessions which has never happened since its inception 1978.

The S&P 500 has had more decliners than advancers in 12 consecutive sessions for the first time since this data has been tracked starting 1990.

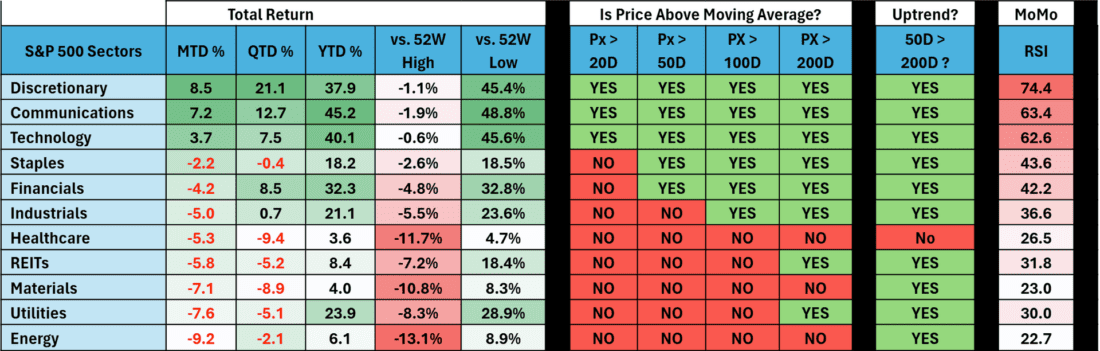

This month’s corrective price action is more pronounced when viewing the eleven sectors of the market. At the large cap sector level, 8 of 11 are in the red MTD, five are down 5% or more, and three are trading below their respective 200D simple moving average (sma).

Healthcare is the one sector in a downtrend as defined by its 50D sma below it s200D sma.

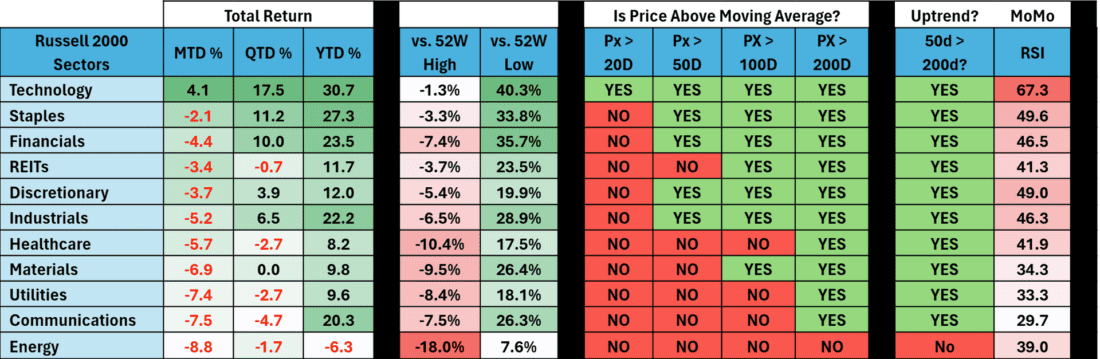

Small cap sectors are worse with 10 of 11 in the red MTD, including healthcare and energy which are down 10.4% and 18%, respectively, from their 52W highs.

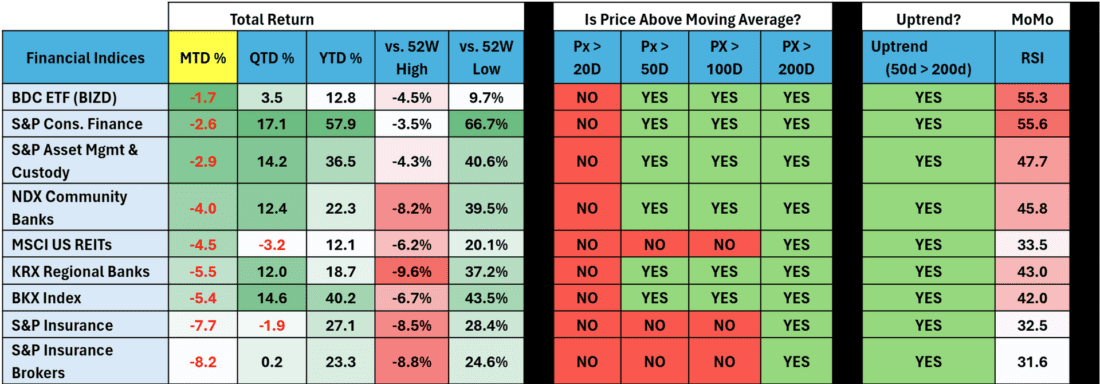

The sub industries within the Financial sector are lower across the board in December and in doing so have more than worked off the “overbought” momentum readings from late November.

YTD Performance (Total Return) – while the December performance bifurcation is extreme, to a lesser degree we last saw this weak breadth in Q2 2024 and 1H 2023.

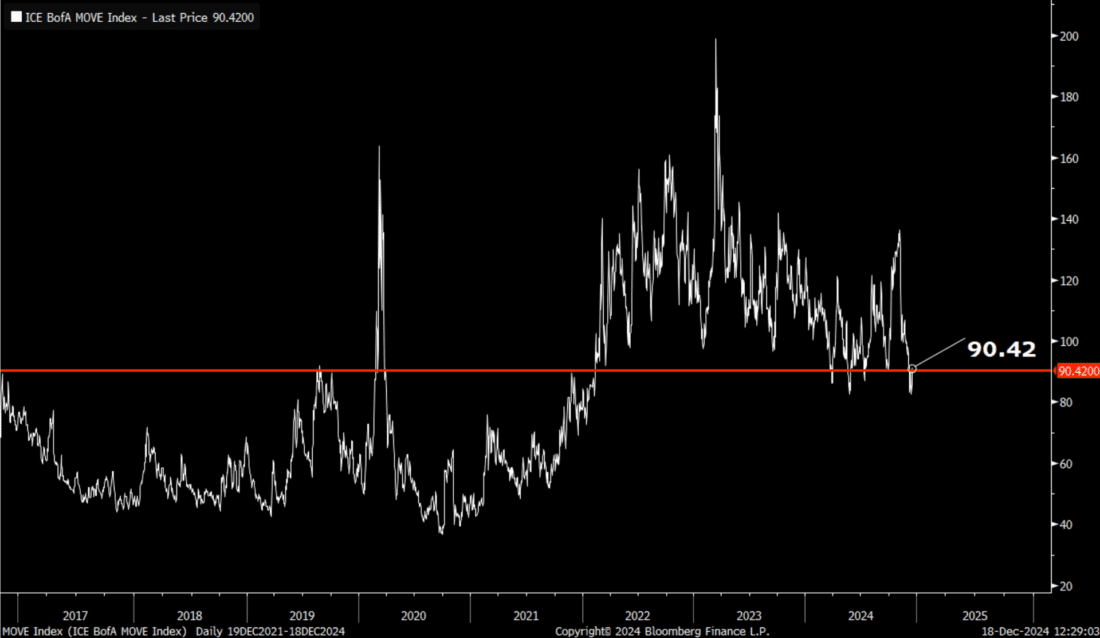

With historical seasonally trends strongly in favor of the bulls in December, my bias is to view the recent corrective price action as a “healthy correction” which may be near ending given the extreme bifurcation measures noted above. While the Fed could deliver a more hawkish outlook for 2025, I think markets will be more focused on the incoming administration’s policies on trade, spend, geopolitics, etc. Corporate credit spreads are not showing signs of stress, while the MOVE Index (fixed income volatility measure) is at 3-year lows.

Charts on the Radar

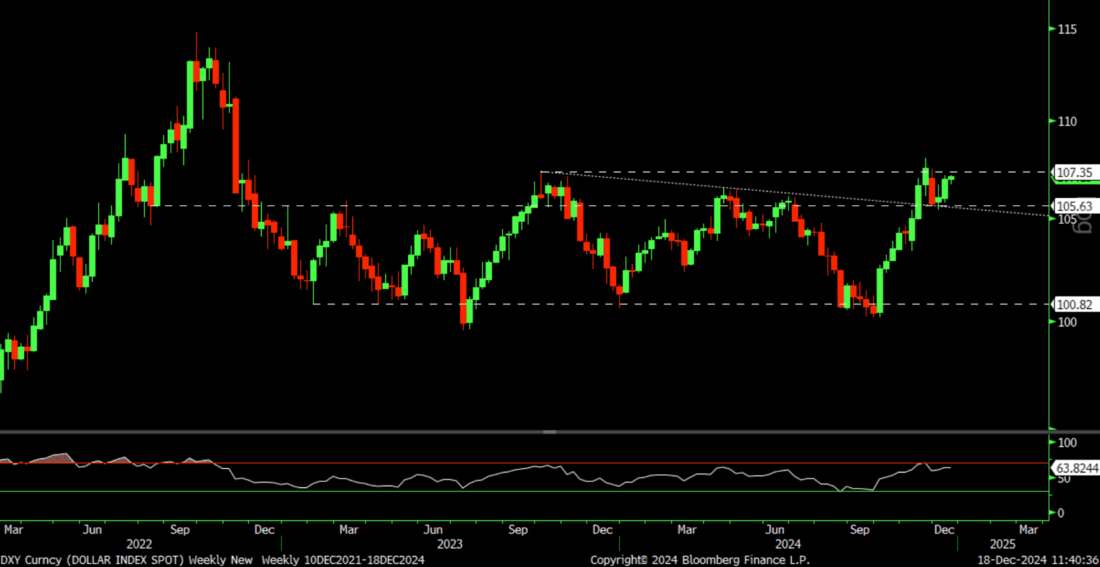

US Dollar Index (DXY): the greenback is near 2-year highs (i.e. expected resistance). A move above the 2023 high, 107.35, could be a headwind for global markets with spillover effects on US asset prices. A more hawkish Fed is one tailwind supporting higher prices in the greenback, however future price action will dictate how much of that is already baked in.

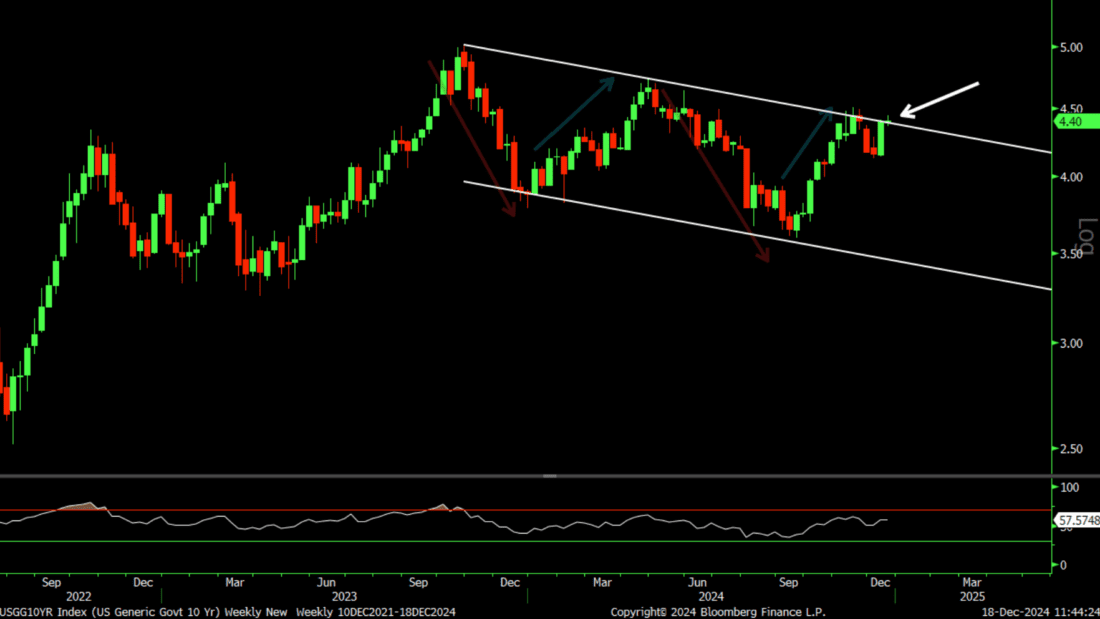

UST 10YR Yield: last week’s 24bps rise brought the long yield back to its declining resistance line connecting the two prior highs where it has stalled for the 4th consecutive session. Today’s FOMC could be the catalyst for a breakout higher or reversal lower.

Regional Bank ETF (KRE): the KRE is currently testing the bottom of its post-election (Nov. 6th) trading range ($63.49 – $67.12). As previously noted, Nov 6th was the 5th biggest daily percentage gain (13.4%) since inception on 6/6/2006 (4,627 days). Below the intra-day range is a wide price gap ($59.22 – 64.31). Gaps are notorious for acting as future support/resistance. Ideally, the top of this gap range will hold support and the KRE rallies from here. I suspect if Powell reaffirms the Fed’s support for jobs and the economy while emphasizing less concern over the very recent firmness in inflation, that may be the “dovish” signal that reverses rates and the greenback lower, and regionals/financials higher.

Move index

About the author:

Brian Joyce, CMT is a Managing Director on the Market Intelligence Desk (MID) at Nasdaq with more than two decades of capital markets experience. Before joining Nasdaq, Brian spent 16 years as an institutional trader executing equity and options orders on both the buy side and sell side. He is a Charted Market Technician and regularly writes technical analysis commentary. Brian focuses on helping Nasdaq’s Financial and SPAC companies, among others, understand the trading in their stock and the broader financial markets.

——

Originally posted on January 19th

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.