1/ Financial Friday

2/ Financial Follow Up

3/ Is the Paint Beginning to Peel?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Financial Friday

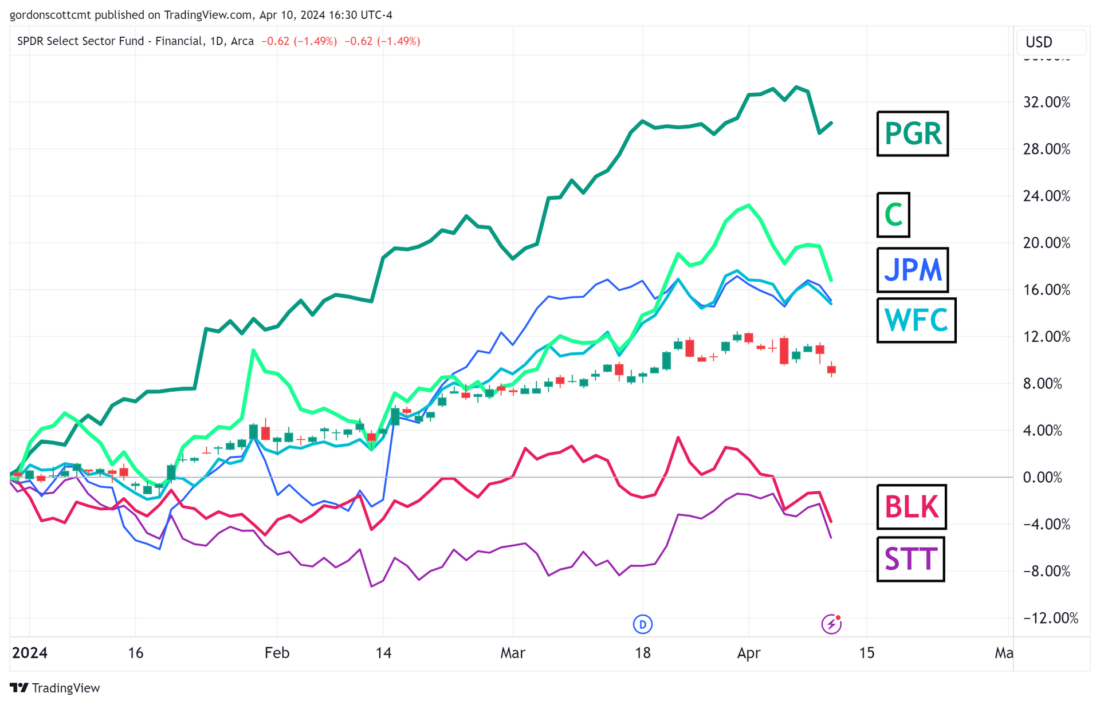

Friday kicks off the eagerly awaited first quarter earnings season. What’s not to look forward to? Companies surely had a great start to the year–at least share prices seemed to indicate that’s what investors expect. Four of the six largest companies in the financial sector that will report earnings this Friday would appear to be fairly well positioned to meet or exceed investor expectations. These are the companies whose share prices are running ahead of pace compared to the SPDR Financial Sector ETF (XLF).

Progressive (PGR), J.P. Morgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) are up 15 percent or better to start the year, compared to 9 percent for the overall sector fund. However Blackrock (BLK) and State Street show a remarkable gap in performance for the first quarter.

It’s worth noting that these two companies are classified as being in the Asset Management industry compared to the others which are classified elsewhere. The Consumer Price Index (CPI) number which came in this morning hotter than expected (and that’s saying something) is a likely indication of what is weighing on asset management companies right now. The headwinds they face include higher inflation, higher interest rates, and higher borrowing costs which add up to tougher times for asset management companies that hold heavy real estate portfolios.

2/

Financial Follow Up

Earnings season is often front-loaded with financial companies with the first two weeks delivering a one-two punch to investors and setting the stage for the subsequent four weeks when the majority of S&P 500 companies will report. The six largest companies in the finance industry that will report earnings next week don’t look nearly as favorably anticipated by investors as those reporting this week. The following chart shows that only one of them is tracking significantly above the XLF benchmark.

American Express (AXP) tops the list, but if this stock were on the first chart it would be comparable to WFC, the least of the top performers in that group. Other than Bank of America (BAC) which is closely tracking XLF, the other four are coming in at 4 percent or less for the quarter. Again it appears those companies with more exposure to real-estate investments of various sorts are facing the biggest headwinds.

3/

Is the Paint Beginning to Peel?

Based on the price action of these financial companies preparing to report earnings, it appears investors are showing a clear preference for shares not so heavily exposed to real-estate assets right now. This might not have been an obvious drag over the past quarter, but yesterday’s market action showed how this preference appeared in drastic fashion with matching exhaustion gaps on various related charts. Consider the comparison between Sherwin-Williams (SHW), the S&P Homebuilder ETF (XHB), and the S&P Real Estate Sector ETF (XLRE) in the chart below.

An exhaustion gap is defined as a gap in price after a visually obvious trend that preceded it. In this case, much of the real estate sector, along with the market in general, had a strong upward trend at the beginning of this year.

But yesterday following the CPI numbers, and the implication from analysts that Fed cuts were likely to have less impact than hoped, these stocks lost curb appeal like a house with peeling paint on its trim. It will be interesting to see if they gain back any ground based on the financial sectors earnings reports over the next two weeks.

—

Originally posted 11th April, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.