1/ Time for Small Caps

2/ Keep an Eye on the Banks

3/ Bullish Divergence on KRE

4/ European Weakness

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Time for Small Caps

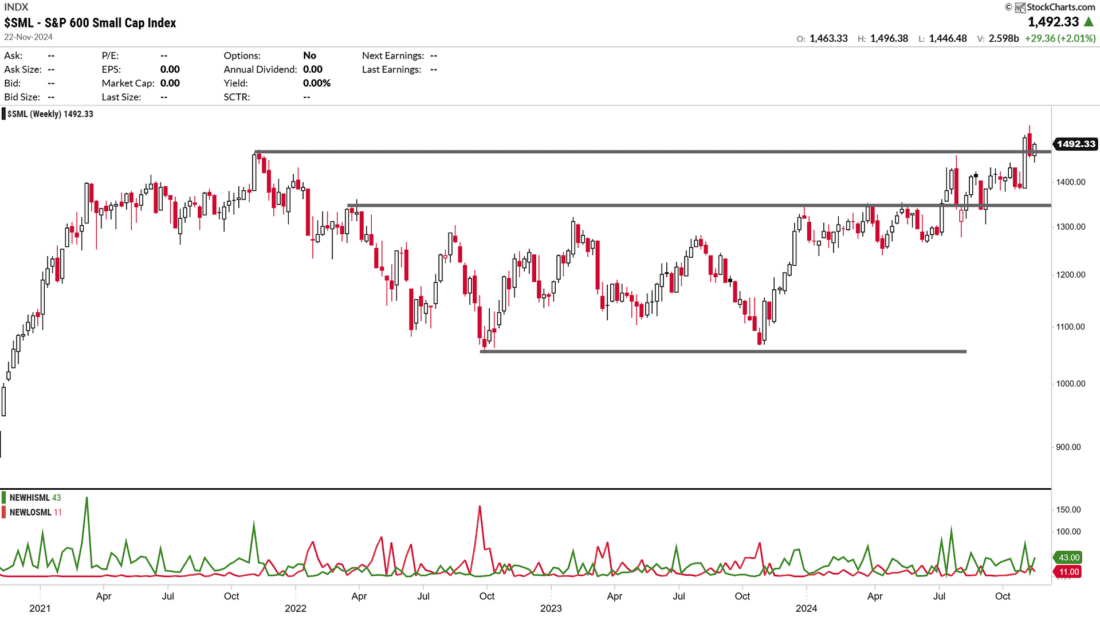

The $SML index, which represents the small caps of the S&P SmallCap 600, has shown mixed performance in 2024, combining bullish mini-rallies with periods of sideways movement. Influenced by several macroeconomic and market-specific factors, the index may be gaining traction with Trump’s arrival in the White House.

Recent comments from Fed Chairman Jerome Powell suggest a less hawkish stance toward rate cuts, which could benefit smaller companies that tend to be more sensitive to funding costs

Courtesy of StockCharts.com

The index accumulated +2% for the week and, with Friday’s session still to come, everything seems to indicate that we could finally be seeing the index hold the recent break of the 2021 high and target higher levels.

2/

Keep an Eye on the Banks

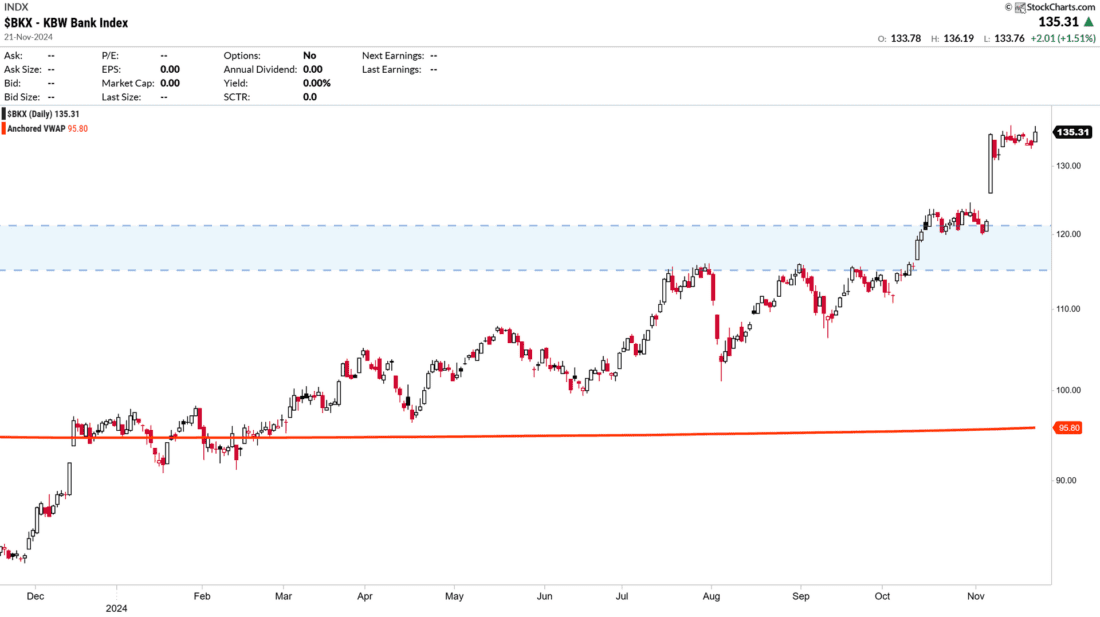

The financial sector has a significant weight within the S&P SmallCap 600 index, representing approximately 18.85% of the total index. This percentage places it as the largest weighted sector, followed by the industrials (17.65%) and consumer discretionary (14.50%) sectors. The index is designed to reflect the diversity of the U.S. economy at the small-cap level, which includes companies in the financial sector such as regional banks and insurers, among others.

The KBW Bank Index (BKX), which reflects the performance of major U.S. banks, has reached its highest level so far this year and is heading for 2022 highs. It has so far accumulated a gain of just over 90%, after bouncing off the VWAP traced from 2009 lows.

Courtesy of StockCharts.com

3/

Bullish Divergence on KRE

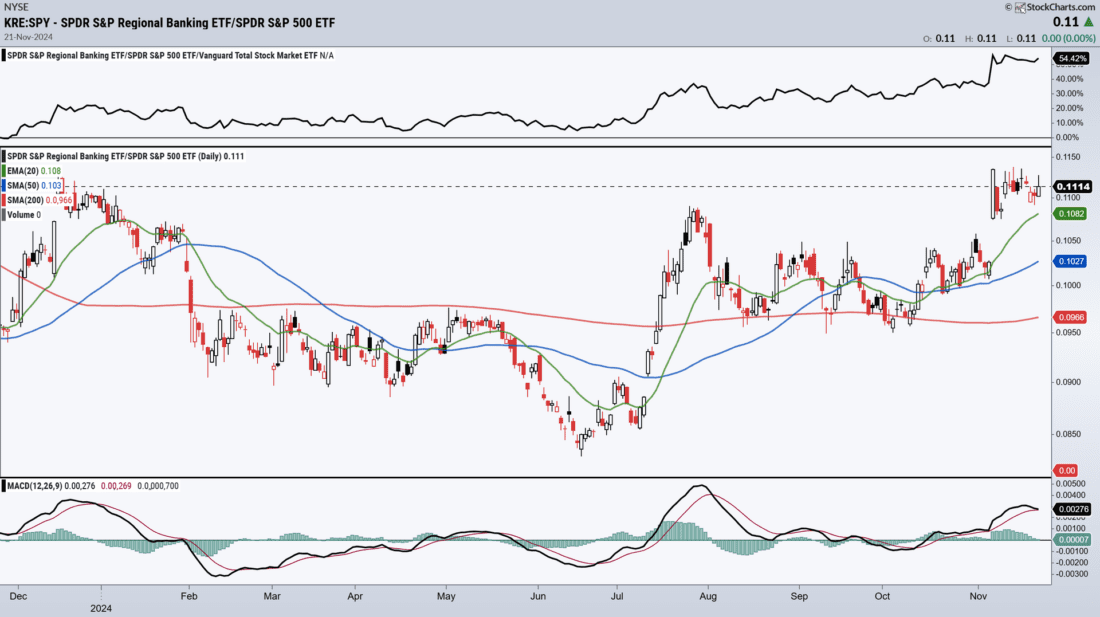

The SPDR S&P Regional Banking ETF (KRE), which focuses on U.S. regional banks, has recently experienced a significant rally, fueled by a favorable political environment following Donald Trump’s victory in the presidential election. This rally has been fueled by expectations of pro-business economic policies, such as financial deregulation, tax cuts, and increased lending activity.

KRE has performed positively in the last quarter, with an increase in value driven by stabilization in the regional banking sector following the deposit crisis of early 2023. Annual returns have been solid, reaching an increase of 29.17% YTD.

Courtesy of StockCharts.com

Technically speaking, the relative strength to market ratio has been showing us a positive divergence, signaling an increase in KRE’s momentum, which has been on the rise since 2023.

KRE offers an attractive option for investors seeking diversified exposure to regional banks, especially if economic stimulus and deregulation policies materialize.

4/

European Weakness

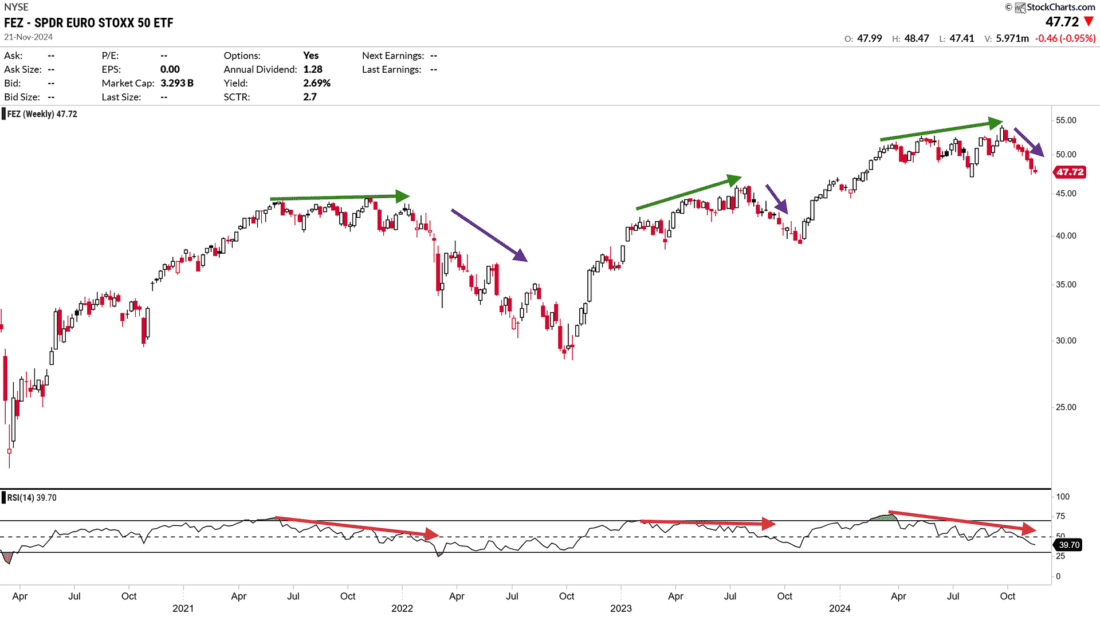

Shifting gears, we now turn our attention to the SPDR EURO STOXX 50 ETF (FEZ), which tracks the EURO STOXX 50 index and reflects the performance of major Eurozone companies.

During 2024, the price of FEZ had shown moderate positive performance. However, we are seeing how since the end of September, the situation has changed and the ETF has not stopped falling and is dangerously close to the $46-$45 area, which would erase the accumulated gains of 2024.

Courtesy of StockCharts.com

The economic weakness in Europe and a slowdown in growth in countries such as France and Germany continues to be a determining factor. Europe faces challenges such as the risk of stagflation and a slowdown in business confidence indices. However, more controlled inflation could be a catalyst for market stabilization.

Technically speaking, we see a negative divergence that marks a loss of momentum in the ETF.

—

Originally posted 22nd November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.