From SIA Charts

1/ Tesla Inc. (TSLA)

2/ Candlestick Chart

3/ Point and Figure Chart

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

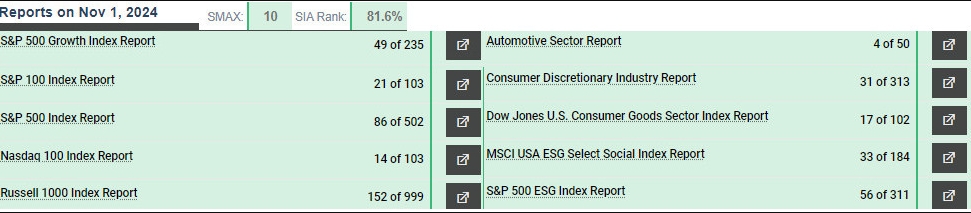

Tesla Inc. is an American multinational automotive and clean energy company. Headquartered in Austin, Texas, it designs, manufactures, and sells battery electric vehicles, stationary battery energy storage devices (from home to grid scale), solar panels, solar shingles, and related products and services. Shares of Tesla have been under selling pressure since 2022, when they peaked at over $400 per share, only to retreat to as low as $100 a year later in early 2023. The shares then spiked to almost $300 that summer in a stunning rally, which again faced selling pressure, pulling back to $140 per share and establishing a higher bottom in the latest phase of consolidation. Share prices have since settled into a period of price discovery and stability, currently at $250. Once again, Tesla has become a favored stock on the SIA platform, as millions of comparative calculations position the stock in the SIA Favored Zone across various reports. Notably, in the large SIA Russell 1000 Index Report, Tesla is positioned at #152. In other SIA reports, it is also in the Favored Zone: #21 in the SIA S&P 100 Index Report, #14 in the SIA Nasdaq 100 Report, and #4 in the SIA Automotive Report. The full list of reports is attached for your comprehensive review.

Tesla Inc. (TSLA)

Courtesy of SIA Charts

2/

Candlestick Chart

Next, let’s turn to the weekly candlestick chart. We have highlighted in yellow the bulk of the remaining overhead resistance, and we have also marked two boxes in the volume area that indicate a marked increase in volume as shares moved down in value, having previously had lower volume metrics when the shares were at much higher prices. Additionally, a grey line marks the intermediate down trend line that appears to have been broken in the last several months around the $200 level, with shorter-term resistance at the red line of approximately $300 per share.

Courtesy of SIA Charts

3/

Point and Figure Chart

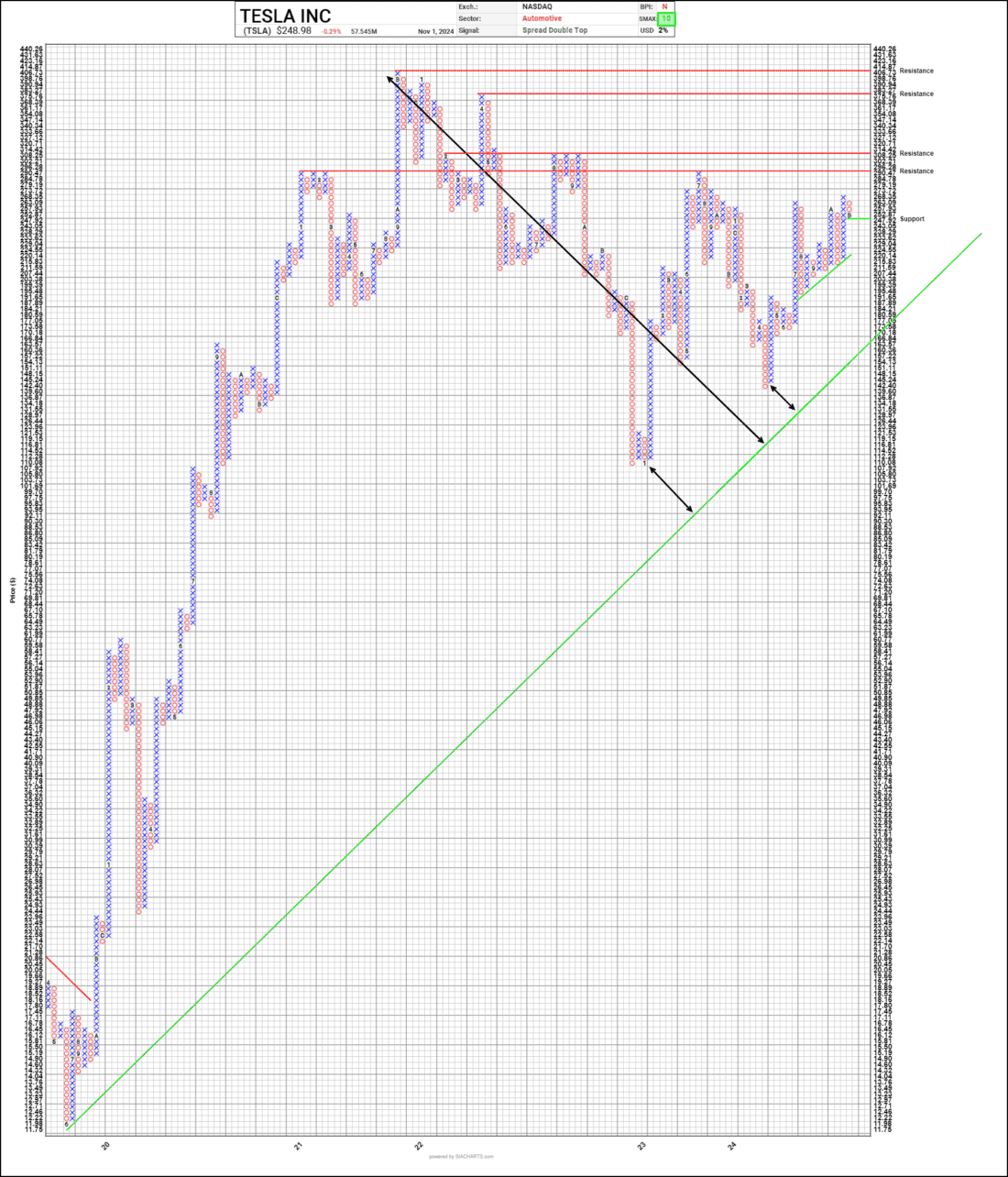

Also attached is the Point and Figure chart of TSLA, which allows readers to interpret support levels and the resistance levels that could materialize. Notable resistance levels include $296.28, followed by $314.42, $383.27, and the top line at $414.87. TSLA shares are currently at support on the 3-box reversal, with a small (short-term) trend line of support drawn around the psychological $200 whole number level. From an educational standpoint, Tesla shares provide an opportunity to discuss a powerful attribute of point and figure charting: the establishment of major trend lines. The major green trend line on the chart has been extended for effect. Note the double-sided arrows that illustrate the distance the share price moved from the trend line over time. It’s striking to see how far the price had moved away from the major trend line as shares exploded to the $400 level in 2022. A reversion to the mean is often observed in investing, and another hallmark of the SIA Ai platform is its ability to establish these differentials through millions of calculations. While the company continues to execute its strategic plans effectively and analysts report improving fundamentals, there are times when share prices simply get ahead of themselves and need a much-needed rest. Advanced SIA practitioners can observe this in the P&F charts and easily monitor those major trend lines, respecting the occasional reversion to them. The final piece of technical data we can glean from the chart is the SMAX, which is established using SIA’s Ai comparison calculations against other equities, bonds, commodities, currencies, and cash. In this case, it has produced a ranking of 10 out of 10.

Courtesy of SIA Charts

—

Originally posted 6th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.