From SIA Charts

1/ TD.TO & CM.TO

2/ Toronto-Dominion Bank (TD.TO)

3/ Canadian Imperial Bank of Commerce (CM.TO)

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

TD.TO & CM.TO

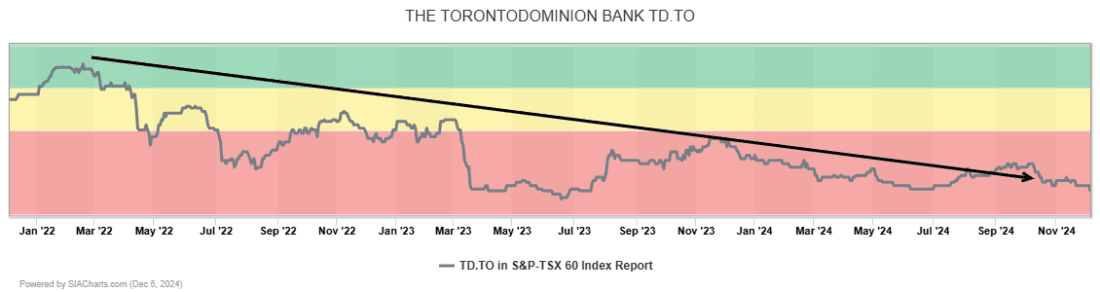

Courtesy of SIA Charts

A big question swirling around Bay Street is: “Should one buy TD stock while it’s below $75?” In today’s SIA Daily Stock Report, this question will be addressed from a technical perspective. While SIA is known for its powerful tools that identify strong relative strength positions, the SIA platform serves two key purposes for elite advisors. While many focus on improving rates of return for their clients, the platform does so primarily by reducing risk. A significant part of this process is determining what assets to consider, as the wrong choices can often undermine the hard work accumulated throughout the year. Let’s use TD Bank and CIBC Bank to illustrate this distinction and show how the SIA relative strength ranking can assist advisors in identifying situations before they become lingering issues. Earlier this year, nearly the entire financial industry began to rally together, from insurance companies and brokerage houses to both traditional and non-traditional fintech operations. This broad-based rally started with a few large US companies and spread globally, including Europe, Canada, Australia, and Asia. While TD Bank is well-regarded, the company’s shares continue to underperform the market. This is illustrated in the SIA matrix position chart above, which shows the stock moving down the relative strength ranks since January 2022, making it unfavorable to consider based on SIA’s rules-based methodology.

2/

Toronto-Dominion Bank (TD.TO)

Next, consider the point-and-figure chart for TD, where the SIA matrix position overlay tool has been applied. A red oval highlights the period of underperformance from a relative perspective. Additionally, two arrows indicate that TD shares have put in a lower high last month, while the rest of the sector is showing gains, with TD shares remaining stagnant. For those considering a potential recovery in TD, support and resistance lines have been added, initially at $81.51, $86.50, and $95.50. Support levels are at $70.96, $61.77, and, regrettably, all the way down at $50. Therefore, tighter stop-loss orders should be respected for those willing to take a risk, but it’s important to note that the risk-reward ratio is unfavorable. This is also reflected in the SMAX score of 3, a near-term indicator of relative strength, showing TD’s poor relative strength against its peer group on the various SIA Reports.

Courtesy of SIA Charts

3/

Canadian Imperial Bank of Commerce (CM.TO)

Turning now to CIBC Bank (CM.TO), the situation is quite the opposite. CIBC shares are highly ranked within the SIA platform, currently sitting in the #11 position within the SIA S&P/TSX 60 Index Report. In the attached point-and-figure chart, the upward movement in relative strength is visible, with color coding provided by the SIA Matrix Position overlay tool. The shares have moved from Unfavored (red) to Neutral (yellow) and finally to Favored (green) throughout 2024. In doing so, CIBC broke through resistance at $65 and $72, with current pricing at the $93 level. This has resulted in a YTD return of 52.23%, with 17.15% of that coming in the last quarter as the stock entered the SIA Favored zone.

By comparison the SIA S&P/TSX 60 Equal Weight Index benchmark is up 18.46% YTD and 6.33% for the past quarter. With the point-and-figure chart now showing strong upward momentum, the next resistance levels are at $107.87 and $116.87, with support initially at the 3-box reversal level of $85.84, followed by $71.24 and $64.52. The SMAX score of 10 out of a possible 10 further strengthens its position, indicating better risk-reward prospects overall. This, combined with its high rank across all SIA reports, suggests a more favorable investment profile. At SIA, the approach is clear: we prefer top-performing assets in favor of underperforming ones, especially on a relative basis. In fact, the preference is to buy more of the winners and sell the laggards. So while the initial question posed will not be directly answered, all the tools and analysis have been provided to make an informed decision, based on the probabilities revealed through this risk-reward analysis.

Courtesy of SIA Charts

—-

Originally posted 10th December 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.