By Todd Stankiewicz CMT, CFP, ChFC

1/ Will Rising Commodities Derail the FED?

2/ The Line is the Sand for the S&P 500

3/ Don’t Sleep on Duration

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

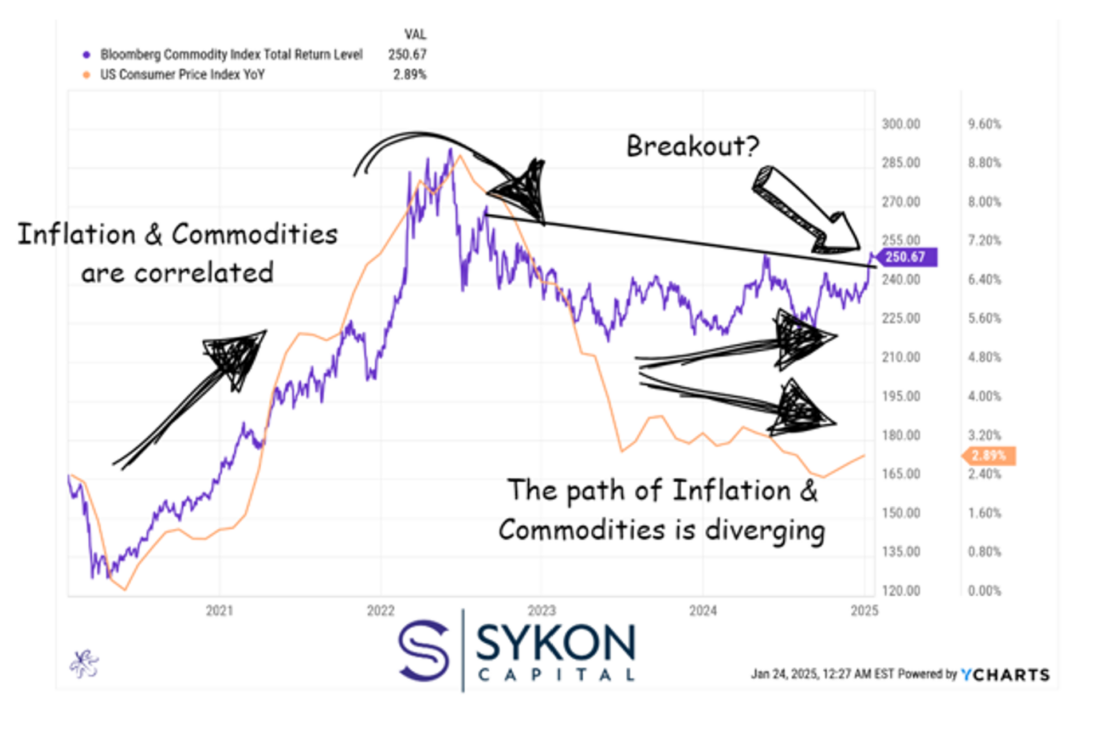

Will Rising Commodities Derail the FED?

Inflation remains the market’s primary focus, with investors clinging to hopes of continued rate cuts from the Federal Reserve. However, the Bloomberg Commodity Index is starting to tell a different story. While CPI has been increasing at a slower rate year-over-year, commodity prices appear to be breaking out of a two-year downtrend, a divergence that could signal renewed inflation risks. If this trend holds, it may dash hopes for rate cuts in 2025 and trigger heightened market volatility.

The market’s reliance on low rates highlights a broader behavioral issue: the addiction to easy monetary policy. As commodity prices inch higher, it’s a reminder that inflation isn’t just about the Fed’s moves, it’s also about supply and demand dynamics in key markets like energy and metals. Investors would be wise to monitor these trends closely and focus on building resilience in their portfolios, as any resurgence in inflation could upend the current narrative and challenge assumptions about what lies ahead.

2/

The Line is the Sand for the S&P 500

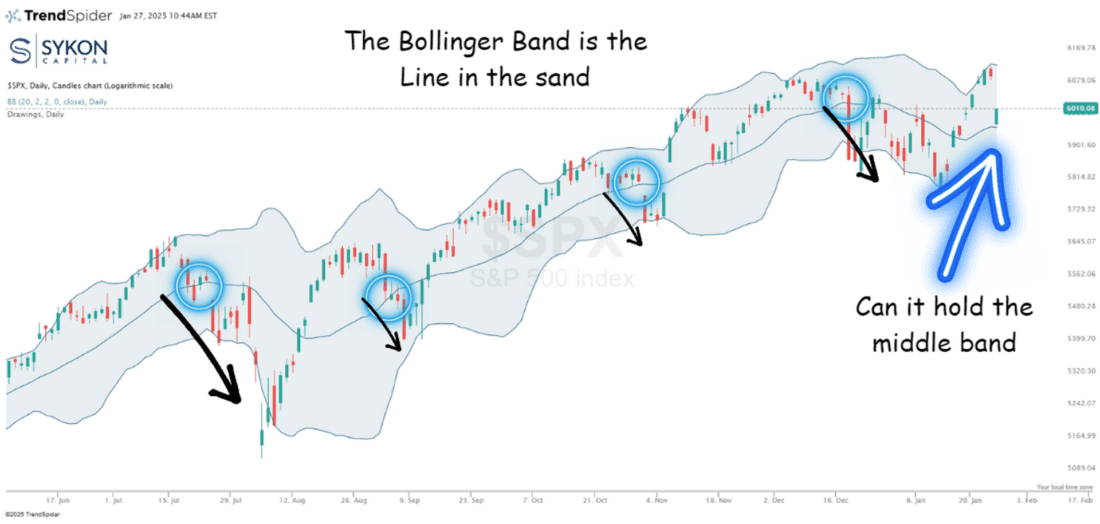

AI Shake-Up Sends Shockwaves Through Broader Indices

Big news in the AI space is rattling markets today, putting the S&P 500 at a critical juncture. The index is testing its middle Bollinger Band at 5958.45, a level it needs to hold to avoid more downside. If it doesn’t, we could see a move toward the lower band at 5785.94, a roughly 3.7% drop from Monday’s intraday high of 6011.

This kind of action isn’t unfamiliar. Over the past six months, similar pullbacks have played out. When the lower band was tested in September and October, it held, but in July and December, it gave way. What happens this time could offer important clues about where the market is headed next.

As always, staying focused on these levels will be key.

3/

Don’t Sleep on Duration

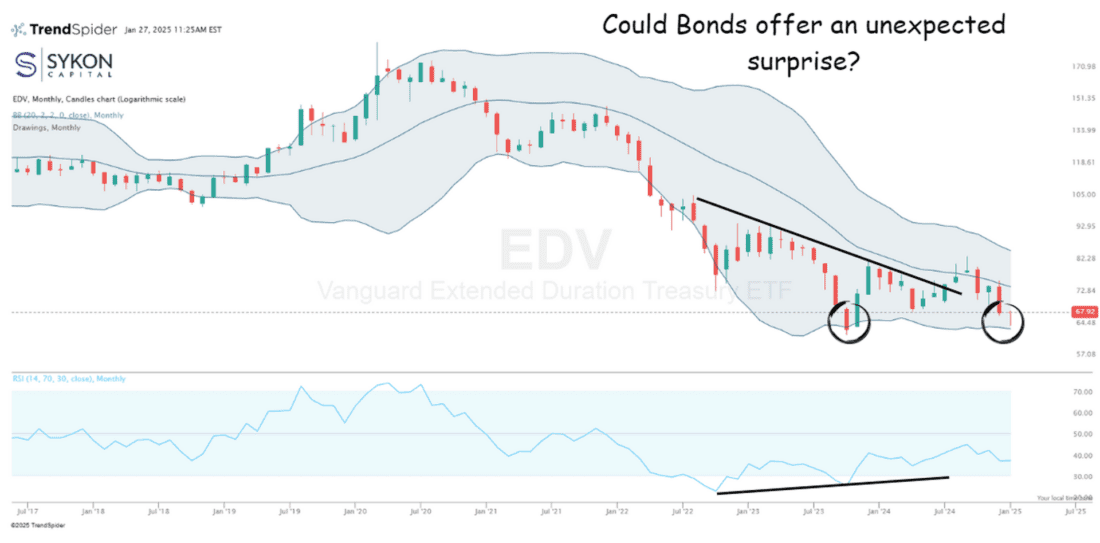

Treasuries Rally as AI Concerns Shift Market Dynamics

Treasuries are rallying today as concerns grow over a potential shake-up in AI growth projections. The Vanguard Extended Duration Treasury ETF (EDV), one of the longest-duration ETFs out there, has been quietly stabilizing after hitting its lows. Recently, it held the October 2023 lows and is now finding support near the lower Bollinger Band.

What really stands out here is the RSI, it’s making higher lows with each test of support. This bullish divergence suggests there could be an unexpected move higher in long-duration treasuries, potentially breaking a four-year downtrend.

The level to watch is the middle Bollinger Band at 74.85. If EDV can break above that, it opens the door for a push toward the upper band. It’s a good reminder not to write off any asset, even in markets as beaten down as treasuries.

Disclaimer: Advisory Services offered through Sykon Capital, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.

—

Originally published 28th January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.