The cannabis sector has seen its share of turbulence, highlighted by a 15.24% drop in the MSOS ETF MSOS following the DEA’s decision to delay the rescheduling of cannabis until December 2nd. This delay adds to the uncertainty in an already volatile market, particularly as the U.S. approaches a presidential election where candidates hold sharply opposing views on cannabis policy. Amidst the market backdrop, a few cannabis penny stocks, priced lower than one of McDonald’s MCD classic Big Macs, have shown resilience.

Sector-Wide Financial Health

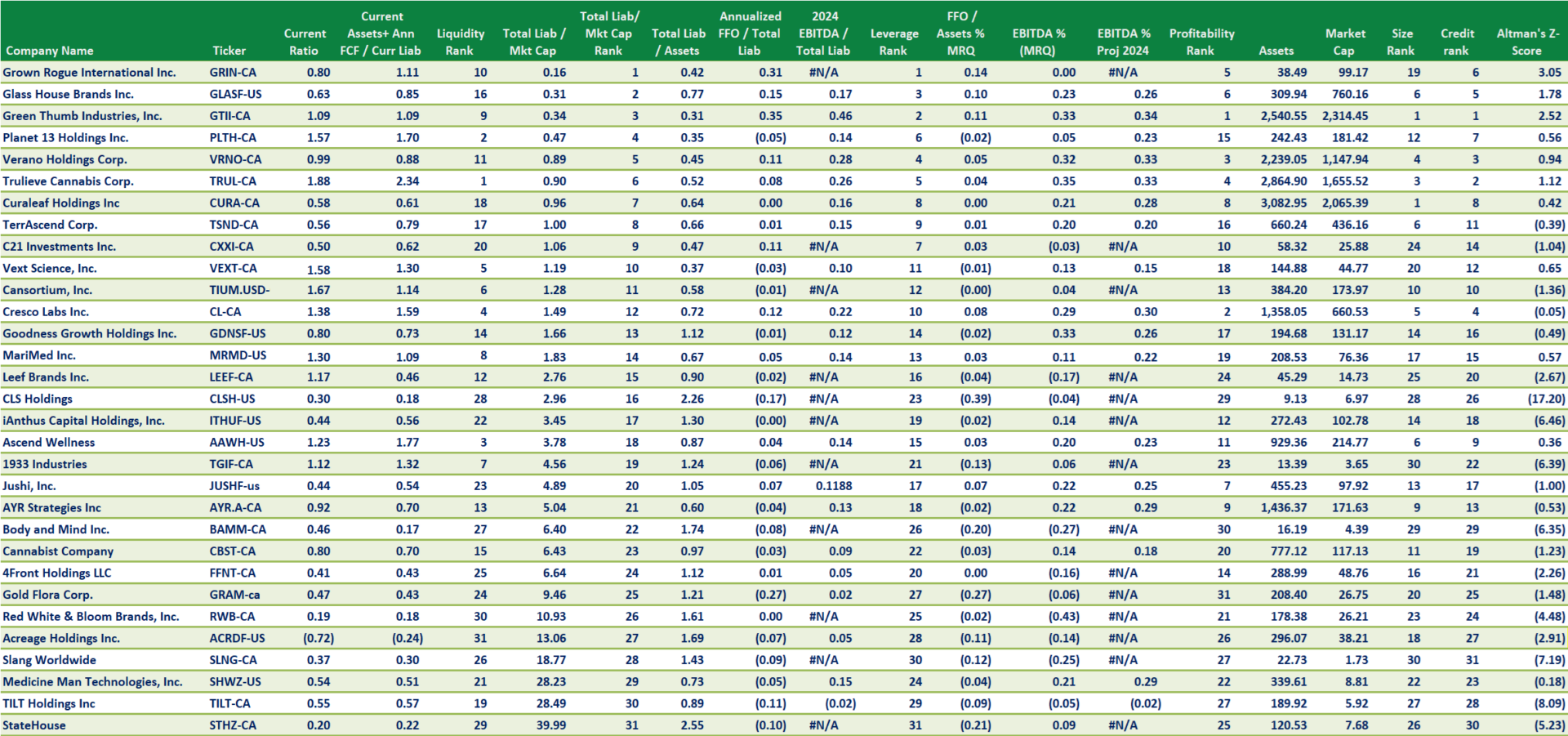

According to Viridian Capital Advisors, the broader cannabis sector shows a median debt-to-EBITDA ratio of 2.98 times across analyzed companies, aligning with thresholds for debt sustainability despite the ongoing challenges posed by regulatory frameworks like the 280e tax code.

However, the upper quartile of these companies exhibits leverage ratios considered unsustainable in the long term, pointing to a sector still in financial flux.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

The Resilient Few

Among the companies showing improvements are those with lower liquidity and trading volumes, demonstrating how strategic financial management can leverage market conditions:

- Vext Science VEXT experienced a slight decrease in stock price to $0.16, down 5.88%, despite demonstrating resilience against market volatility with stable trading volumes. The company reported an 8% decline in revenue year-over-year, facing significant market challenges. However, Vext’s strategic expansions in Ohio and operational efficiencies in Arizona are poised to drive future growth. The company achieved a positive adjusted EBITDA of $1.08 million in Q2 2024.

- C21 Investments CXXIF saw its stock price increase by 11.5295% to $0.2399, with a trading volume of 10,025 shares, reflecting strong market dynamics. The company reported a marginal revenue increase of 1% year-over-year to $6.6 million for the quarter ending June 30, 2023, amidst inflationary pressures. Despite a net loss of $1.4 million and a 1% sales decline in Nevada, C21 maintained robust transaction volumes. Crucially, the company reported a cash flow from operations of $600,000 and a positive free cash flow of $400,000, suggesting solid financial handling under challenging conditions.

- IAnthus Capital Holdings ITHUF reported a decrease of 8.7838% in its stock price to $0.0135, yet it continues to showcase financial resilience with improved credit metrics. The company enjoyed an 11.1% increase in revenue year-over-year to $43.0 million for the quarter ended June 30, 2024, alongside a gross profit rise to $20.7 million. Despite a substantial net loss of $9.8 million, iAnthus reported a reduction in losses compared to previous periods and an improvement in working capital. At the end of the reporting period, on June 30, the company had $16.55 million in cash, up from $13.10 million at the end of December. However, it still reported a working capital deficit of $67.0 million, improved from $79.9 million at the end of December, and an accumulated capital deficit of $1.35 billion.

Credit Concerns for Other Players

While some companies thrived, others like TerrAscend TSNDF, AYR Strategies AYRWF, and MariMed MRMD experienced downgrades in their credit scores. Additionally, firms like Red White & Bloom RWB, Acreage ACRDF and Slang Worldwide SLNG reported distressing total liabilities to market cap ratios exceeding 10, which typically signal financial distress.

Read Next: Does Size Matter? These Two Small-Cap Cannabis Stocks Are Masters Of Cash Flow And Credit Management

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.