Stocks are slipping for the second-consecutive day on nervousness ahead of Nvidia’s earnings report tomorrow evening. Much of the year’s equity gains have been driven by the name and decelerating momentum may hurt the overall market during a seasonally weak period. Meanwhile, rates are jumping, led by the long end in bear-steepening fashion, the result of anxiety regarding incoming Treasury auctions as well as loftier activity expectations thanks to an upside beat on this morning’s consumer confidence figures. Research from McKinsey, released just last Friday, also pointed to improving household sentiment.

Confidence Advances Despite Labor Fears

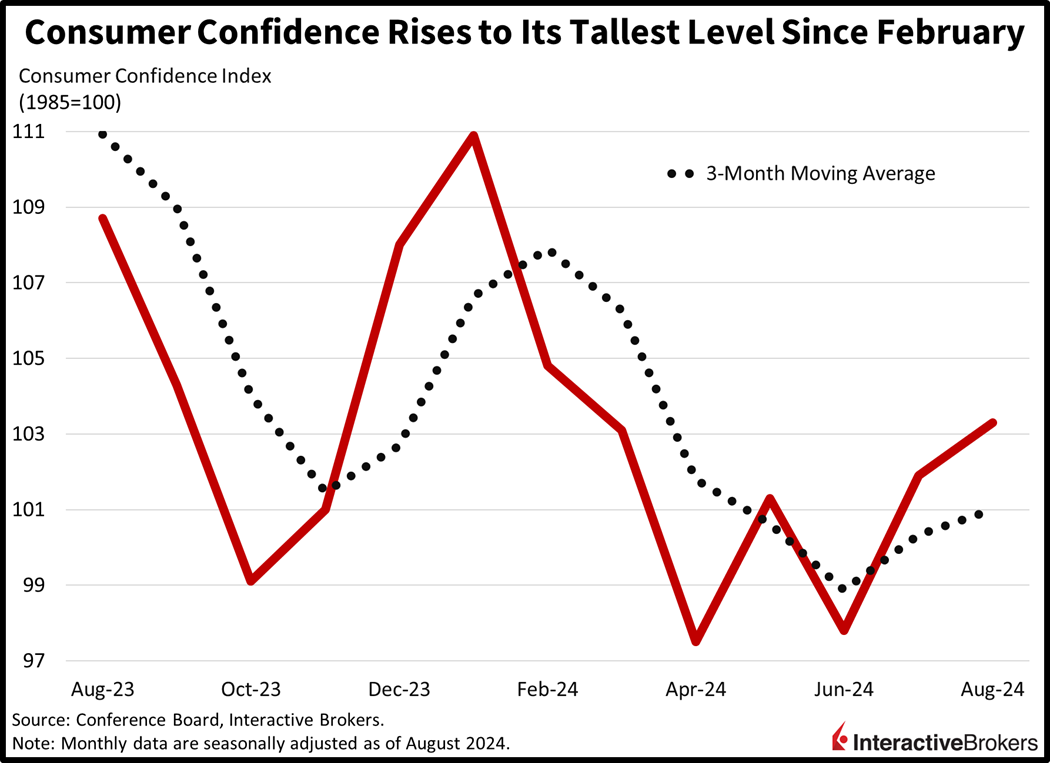

Consumer confidence rebounded this month despite households’ apprehension about stock market bumpiness, reduced employment opportunities and other headwinds. August’s 103.3 figure from the Conference Board reached its tallest level since February and exceeded the median estimate of 100.7 as well as July’s 101.9. The headline received broad support from its components, with the Present Situation and Expectations indices increasing from 81.1 and 133.1 to 82.5 and 134.4. Responses were bifurcated across the lower- and upper-income cohorts, however, with the former group more pessimistic on a relative basis. Equity market volatility and the ability to secure job opportunities were of particular concern this month on the back of the early August equity selloff and rising unemployment.

McKinsey: Consumer Sentiment Climbs to One-Year High

More consumers are ready to increase their spending even though dominant trends, such as inflation fears, are continuing, according to new research from McKinsey & Company. The survey, conducted earlier this month, found sentiment hit a one-year high. Various highlights include the following:

- Regarding inflation, 37% of consumers say stabilizing price pressures have made them feel more optimistic, up from 31% in the May survey. However, 51% maintain that bigger stickers are their largest concern.

- In the August survey, 41% of respondents said they were optimistic about the economy, up eight percentage points from the previous survey. In August, 42% said they had mixed opinions regarding the topic compared to 45% in May and 17% said they were pessimistic, down five-percentage points from the spring.

- Consumers plan to spend more during the next three months on many essential, semi-discretionary, and discretionary items.

- The post-Covid-19 trend of splurging on travel is continuing, with individuals planning to spend more on international flights and cruises climbing 11 and 10 percentage points, respectively. Plans to boost spending at hotels or resorts advanced five percentage points.

- Consumer wanderlust, however, doesn’t include US destinations, with the survey recording a one percentage point decline in individuals planning to dish out more Benjamin Franklins for domestic flights.

- Food delivered via orders from apps, however, showed one of the largest jumps, gaining 13 percentage points.

- Feathering the nest also appears popular. The number of respondents planning to elevate outlays for furniture climbed 10 percentage points, although those expecting to boost cash register activity for home improvement and gardening supplies dropped 12 percentage points, a result, in part, of the category’s seasonal nature.

Markets Tilt Bearishly

Markets are sporting a bearish tilt with stocks and commodities trading south for the most part while hotter economic data sends yields north. Still, equity benchmarks are varying, with the Russell 2000, Dow Jones Industrial and S&P 500 indices lower by 0.9%, 0.2% and 0.1% while the Nasdaq Composite is up 0.1%. Sectoral breadth is mixed, with 5 out of 11 losing on the session and being dragged lower by utilities, energy and consumer discretionary; they’re all losing around 0.4%. Leading to the upside are financials, technology and consumer staples, which are gaining 0.4%, 0.4% and 0.3%. In the rate complex, Treasurys are changing hands at 3.94% and 3.85% across the 2- and 10-year maturities. The former is unchanged while the latter’s yield is up 3 basis points (bps). The dollar is lower by 11 bps as it depreciates relative to most of its counterparts, including the euro, pound sterling, franc, yen and Aussie and Canadian dollars. It is appreciating versus the yuan though. Commodities are mostly lower with crude oil, lumber and gold down by 1.2%, 0.3% and 0.1%, while copper and silver gain 1.1% and 0.3%. WTI crude is trading at $76.99 per barrel on weak demand from Beijing and an improved supply outlook from Libyan barrels characterized by limitation rather than outright suspension.

Bull- or Bear-Steepener?

The last time yields on the 2- and 10-year Treasury maturities met was August 5, during the unwinding of the Japan carry trade, which punished global risk assets. Investors clamored for protection, rushing into the shorter end of the curve, propping up rate cut probabilities and bringing the spread between both instruments to zero in bull-steepening fashion. The next time, however, we may see a bear-steepener move, as the 10-year flies north to meet the 2-year. The development could be motivated by lackluster Treasury demand at auctions and/or an oil price shock. Momentum at the long end is more tantalizing for risk assets, as it’ll tighten financial conditions while the labor market is losing steam. Finally, auctions this year have gone well in aggregate, a result of the Treasury department allocating its issuance towards shorter-term bills instead of the duration commitments associated with notes and bonds. The measures have limited price discovery at the long end and suppressed the cost of capital over lengthy periods. IBKR Chief Strategist Steve Sosnick and I recently explored this topic, or the Treasury as an activist issuer, in a soon-to-be-released podcast featuring Nouriel Roubini and Stephen Miran of Hudson Bay Capital.

Look Ahead to September with ForecastEx!

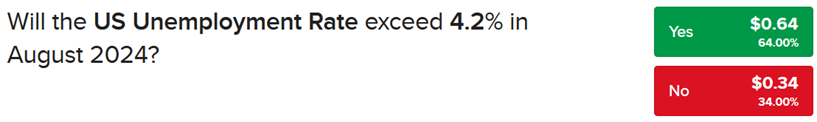

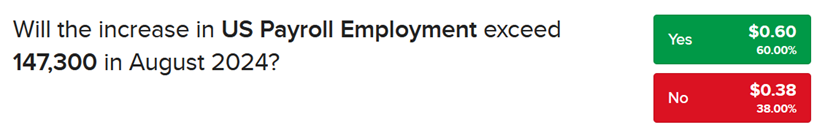

While this week’s main event is Nvidia earnings, the first Friday of September features the August Jobs Report, which may very well dictate the speed and depth of the Fed’s journey down the monetary policy stairs. Market bulls are looking for a controlled, vertical walk to the lower stories, while bears are seeking a speedy, dramatic and horizontal roll to lower levels. IBKR Forecast Traders are eyeing the unemployment rate and nonfarm payrolls in our market with the over, or yes, contract versions priced at $0.64 and $0.60 across the 4.2% and 147,300 thresholds.

To learn more about Forecast Contracts, please view our recent podcast with Wall Street Veteran and ForecastEx CEO David Downey here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.